Do I Need to Declare Pension Contributions on My Tax Return?

- By

- Murray Humphrey

It’s always worth checking whether you’re owed extra pension tax relief, especially if you pay tax above the basic rate. Many people miss out simply because they don’t realise they need to include pension contributions on their Self Assessment tax return.

In this guide, we’ll explain:

- when you need to declare pension contributions

- where to enter them on your tax return

- how to calculate the correct amount

- how to claim any extra tax relief you’re entitled to

Do I need to put pension contributions on my tax return?

Not everyone does. Just because you pay into a pension doesn’t automatically mean you need to include those contributions on your Self Assessment tax return.

The key rule is this: You usually only need to include pension contributions if you’re claiming more than basic rate (20%) tax relief. Let’s break this down.

If you’re employed

If you pay into a workplace pension arranged by your employer, in most cases you won’t need to enter your pension contributions on your tax return.

That’s because many workplace pensions either:

- Claim tax relief at source (after tax), where your pension provider automatically adds basic rate tax relief to your pot, or

- Use a net pay arrangement or salary sacrifice, where pension contributions are taken before tax – meaning you already receive full tax relief through payroll.

If you only pay basic rate income tax, there’s usually nothing extra to claim, so nothing to add to your return.

That said, it’s still worth double-checking how your scheme works. If you’re unsure, your pension provider or employer can confirm whether tax relief is being applied correctly.

If you’re self-employed

If you’re self-employed and pay into a personal or private pension, your pension provider will normally:

- claim 20% basic rate tax relief from HMRC, and

- add it directly to your pension pot.

If you only pay basic rate tax, you won’t usually need to include your pension contributions on your tax return.

What about higher and additional rate taxpayers?

If you pay higher-rate (40%) or additional-rate (45%) income tax, declaring your pension contributions on your Self Assessment can be essential.

Why? Because pension providers only ever claim basic rate (20%) tax relief automatically.

If part of your income is taxed above the basic rate, you may be entitled to extra tax relief – and the only way to get it is by declaring your pension contributions to HMRC.

This typically applies when:

- your contributions were taken after tax (known as relief at source), and

- you pay higher or additional rate income tax on some of your earnings.

HMRC then refunds the extra relief either by:

- reducing your tax bill,

- adjusting your tax code, or

- issuing a tax rebate.

👉 For a deeper dive, see our guide How to claim higher rate tax relief on pension contributions

Where do I put pension contributions on my tax return?

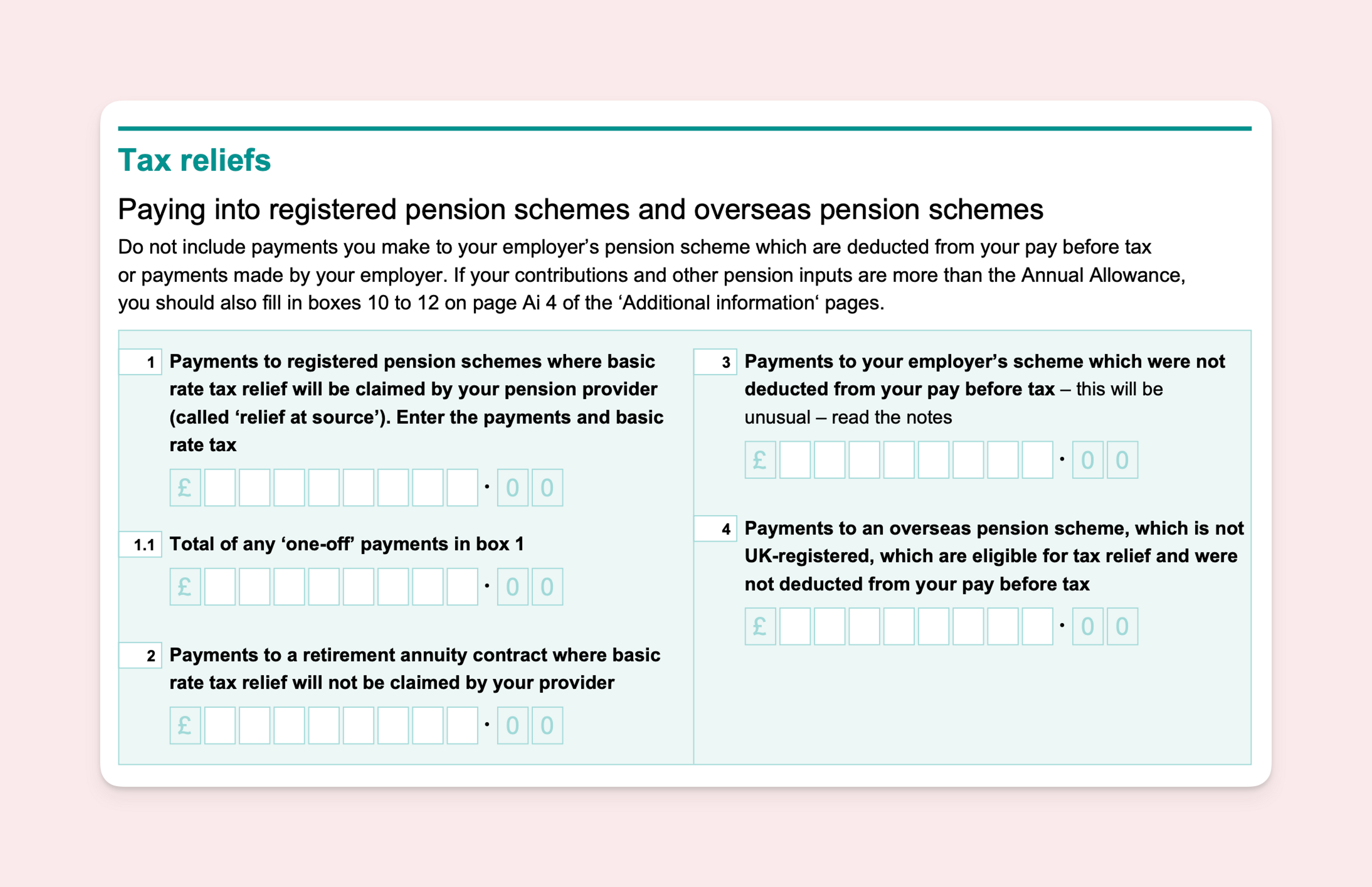

Your private pension contributions for the year are entered on the main Self Assessment form (SA100), in the section titled “Tax reliefs.” This section also covers things like:

- income from dividends

- charitable donations

- benefits such as the State pension and child benefits

Question 1: Relief at Source Pension Contributions

For personal pension contributions made under the ‘Relief at Source’ system, use Question 1 of the SA100 form. This box is specifically for contributions to registered pension schemes operating under relief at source. You should enter the total amount of your personal contributions for the tax year, plus the basic rate tax relief added by your pension provider.

For example, if you paid £800 into your pension, and your provider claimed £200 as basic rate tax relief (20%), you would report £1,000.

Question 1.1 Total of any ‘one-off payments’ refers to the sum of any lump-sum contributions made to your pension during the tax year. These one-off payments are distinct from your regular pension contributions and might include:

- Additional Voluntary Contributions (AVCs): Extra amounts you might choose to pay into your pension to boost your savings.

- Lump-Sum Investments: Single, substantial payments you make into your pension pot, perhaps from an inheritance, a bonus, or other windfalls.

Question 2 and 3: Other Pension Contributions

If you contribute to a retirement annuity contract or an employer’s scheme not deducted from pay before tax, these contributions are reported in Question 2 and 3, respectively. These boxes are used for pension contributions where tax relief is not claimed at source and needs to be reclaimed.

Question 4: Overseas Pension Schemes

For contributions to eligible overseas pension schemes, use Question 4. This is relevant if you're claiming tax relief for contributions to a pension scheme outside the UK that qualifies under HMRC guidelines.

Additional Information Section

If you have any one-off or unusual pension contributions, or if there are specific details you need to highlight, use the ‘Additional Information’ section on the SA100 form. This section can be helpful for providing context or clarity to your reported figures.

How to calculate pension contributions for a tax return

When declaring pension contributions, always use the gross amount for the tax year – including any basic rate tax relief. You can usually find this figure on:

- your annual pension statement, or

- your pension provider’s online dashboard

With Penfold, you can check your total contributions in your dashboard. The figure above “Saved this year” includes any tax relief already added. You can also download a full transaction history from the Activity tab.

Are tax return pension contributions gross or net?

It’s important to remember that any contributions you add to your tax return should be gross and include any basic rate tax relief. Essentially, you need to tell the government how much has been added to your pension in total for this tax year. Once you’ve entered this, it’s time to start thinking about claiming back any extra tax relief you’re owed.

How to claim higher rate pension tax relief on your self-assessment

To claim additional tax relief, you’ll need to enter your total gross pension contributions for the tax year - including the 20% basic rate tax bonus. Once you’ve calculated your annual pension contributions, submit your tax return and HMRC will process your additional tax relief. Remember, you can also claim tax relief for previous years if you missed out on the past.

Your tax refund will take the form of:

- Paying less tax this year

- An update in your tax code (so you pay less tax next year)

- A tax rebate

You don’t need to put your tax rebate into your pension. You’re free to use your rebate as you please - although adding to your pot is a great way to help it grow.

Pension tax relief deadlines

- Online Self Assessment deadline: 31st January

- To have tax collected through your PAYE code, you usually need to file by 30th December

Missed the deadline? You may still be able to write to HMRC to claim pension tax relief separately. For more details on this, head to the government’s dedicated page on claiming a tax refund.

What happens if I exceed the pension annual allowance?

For most people, the annual pension allowance is £60,000, or 100% of earnings (whichever is lower).

The only exception is the tapered annual allowance, which affects very high earners. If you earn more than £200,000 a year, we recommend visiting the government’s site on calculating tapered annual allowance to avoid any surprise tax charges.

Here’s the main takeaway: if you exceed this allowance, you may face a pension annual allowance tax charge, which must be reported on your tax return.

Do employer pension contributions count towards the annual allowance?

Yes, all contributions into your pension, whether they are from you, your employer or a third party count towards your annual allowance.

Maximise Pension Contributions with the Carry Forward Rule

The Carry Forward Rule allows you to use unused pension allowance from the previous three tax years, potentially increasing how much you can contribute while still receiving tax relief. This can be especially useful if your income has increased or you’ve received a bonus. To use carry forward:

- Eligibility: To use the Carry Forward Rule, you must have been a member of a registered pension scheme during the years from which you are carrying forward unused allowances.

- Calculation: Check how much of the Annual Allowance you have used in the last three tax years. Any unused portion can be added to your allowance for the current tax year.

- Limits: The maximum you can carry forward is the unused portion of the Annual Allowance from each of the previous three tax years.

The information provided in this article is intended for general informational purposes and should not be construed as professional financial or tax advice. Pension contributions, tax relief, and related regulations can be complex and vary based on individual circumstances.

Tax treatment depends on the individual circumstances of each individual and may be subject to change in the future.

Murray Humphrey

Penfold