Tax Year End Checklist for the Self-Employed (2026)

- By

- Murray Humphrey

How pension contributions can reduce your tax bill before 5 April

The end of the tax year is one of the most valuable financial planning moments for self-employed people.

Unlike employees, you don’t get automatic workplace pension contributions — and your tax bill can feel unpredictable from year to year. But there’s also a major advantage:

Before 5 April, you may still have time to take action that reduces the tax you owe – while boosting your long-term savings.

One of the most effective tools available is making a pension contribution before the tax year ends. This guide explains how it works and what to consider in 2026.

Why tax year end matters if you’re self-employed

Tax year end is a natural checkpoint to review:

- how much profit you’ve earned

- how much tax you may owe

- what allowances you’ve used

- whether you can reduce your bill legally and efficiently

For many self-employed people, pension contributions are one of the simplest ways to do exactly that.

Pension contributions: one of the biggest tax relief opportunities available

When you contribute to a personal pension or SIPP, the government effectively helps pay into it too.

This is because pensions come with tax relief, designed to encourage long-term retirement saving.

Basic-rate tax relief (20%)

Most pension contributions automatically receive basic-rate tax relief. For example:

- You pay £80 into your pension

- The government adds £20

- £80 becomes £100 in your pot

That’s why pension tax relief is often described as a 25% top-up.

Tax year end pension contributions: why they’re so powerful

Making a pension contribution before 5 April can help you:

- reduce your taxable income

- potentially lower your self-assessment bill

- make the most of unused pension allowance

- boost retirement savings with government support

It’s one of the few tax planning moves that benefits both your future and your finances today.

How much can you contribute? (Annual allowance explained)

The annual allowance is the maximum amount most people can contribute to pensions each tax year while still receiving tax relief. In 2026, this is usually:

- £60,000 per year, or

- 100% of your earnings (whichever is lower)

Higher earners may have a reduced allowance, and contributions above the limit may trigger a tax charge.

If your circumstances are complex, it’s worth speaking with an accountant or adviser.

Can you carry forward unused allowance?

In many cases, yes. If you haven’t used your full annual allowance in previous years, you may be able to carry forward unused allowance from up to the last three tax years. This can be especially useful if you’ve had a particularly profitable year and want to make a larger one-off pension contribution.

Carry forward rules can be complicated, so professional advice is recommended.

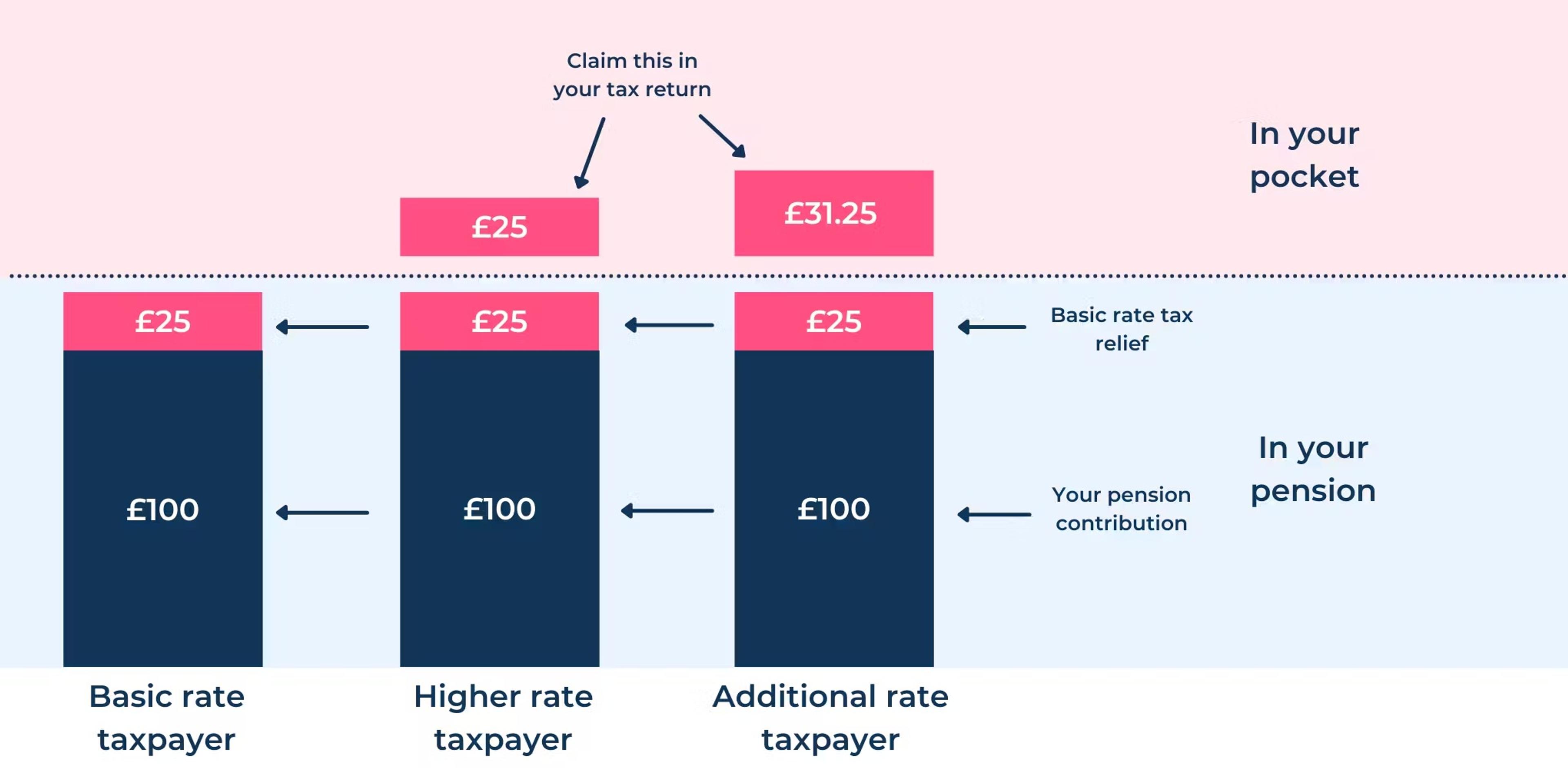

Higher-rate taxpayer? You may be able to claim extra tax relief

If you pay higher or additional rate tax, pension contributions can be even more valuable.

Everyone gets basic-rate relief automatically

Penfold (and most pension providers) will claim the basic-rate relief and add it to your pension pot.

Higher-rate taxpayers may be able to claim more

If you pay:

- 40% income tax, you may be able to claim an additional 20% relief

- 45% income tax, you may be able to claim an additional 25% relief

This extra relief is typically claimed through your self-assessment tax return. HMRC will either send this to you in a cheque in the post, or take it off your total tax bill. So pensions can be one of the most tax-efficient ways to save if you’re a higher earner.

You can see here how much tax relief you can get back in your pension and in your pocket, from a £100 pension contribution depending on your taxpayer bracket.

Tax relief depends on individual circumstances and may change in future.

Other ways pensions can help at key income thresholds

Pension contributions don’t just build retirement savings — they can also help you manage your taxable income. Here are two important examples.

Restore your personal allowance (income over £100,000)

If your income exceeds £100,000, your personal allowance begins to reduce. For every £2 earned above £100,000, you lose £1 of your allowance. This means the effective tax rate in this range can be very high.

Because pension contributions can reduce your taxable income, making a contribution may help you:

- regain some or all of your personal allowance

- reduce the amount of income taxed at higher rates

- boost your pension at the same time

This is a common planning strategy for self-employed professionals in high-income years.

Reduce the Child Benefit tax charge (income over £50,000)

If you (or your partner) receive Child Benefit, the High Income Child Benefit Charge applies when income exceeds £50,000.

- The charge increases gradually above £50,000

- Child Benefit is effectively cancelled out above £60,000

Because pension contributions can reduce your adjusted income, they may help you keep more of your entitlement.

You can check the latest rules using the official GOV.UK guidance.

A simple tax year end checklist for the self-employed

Before 5 April, consider:

- Have you reviewed your profits and likely tax bill?

- Have you used your pension annual allowance efficiently?

- Could a contribution reduce higher-rate tax or restore allowances?

- Have you checked whether carry forward applies?

- Have you spoken to your accountant if things are complex?

Even one well-timed contribution can make a significant difference.

Future-proof your finances beyond this tax year

Pensions are one of the most effective long-term tools available to the self-employed. They offer:

- government top-ups

- tax efficiency

- decades of potential investment growth

- flexibility in retirement

Tax year end is simply a reminder to take advantage of what’s available — and ensure your money is working as hard as you do.

Ready to make the most of tax relief before 5 April?

A pension contribution could help reduce your tax bill and build a stronger financial future.

👉 Learn more about the Penfold pension

👉 Or create an account in minutes and start saving today

With pensions, as with all investments, your capital is at risk and the value of your pension may go up or down. You may get back less than you put in. Tax rules depend on individual circumstances and may change. This article is for information only and does not constitute financial advice.

Murray Humphrey

Penfold