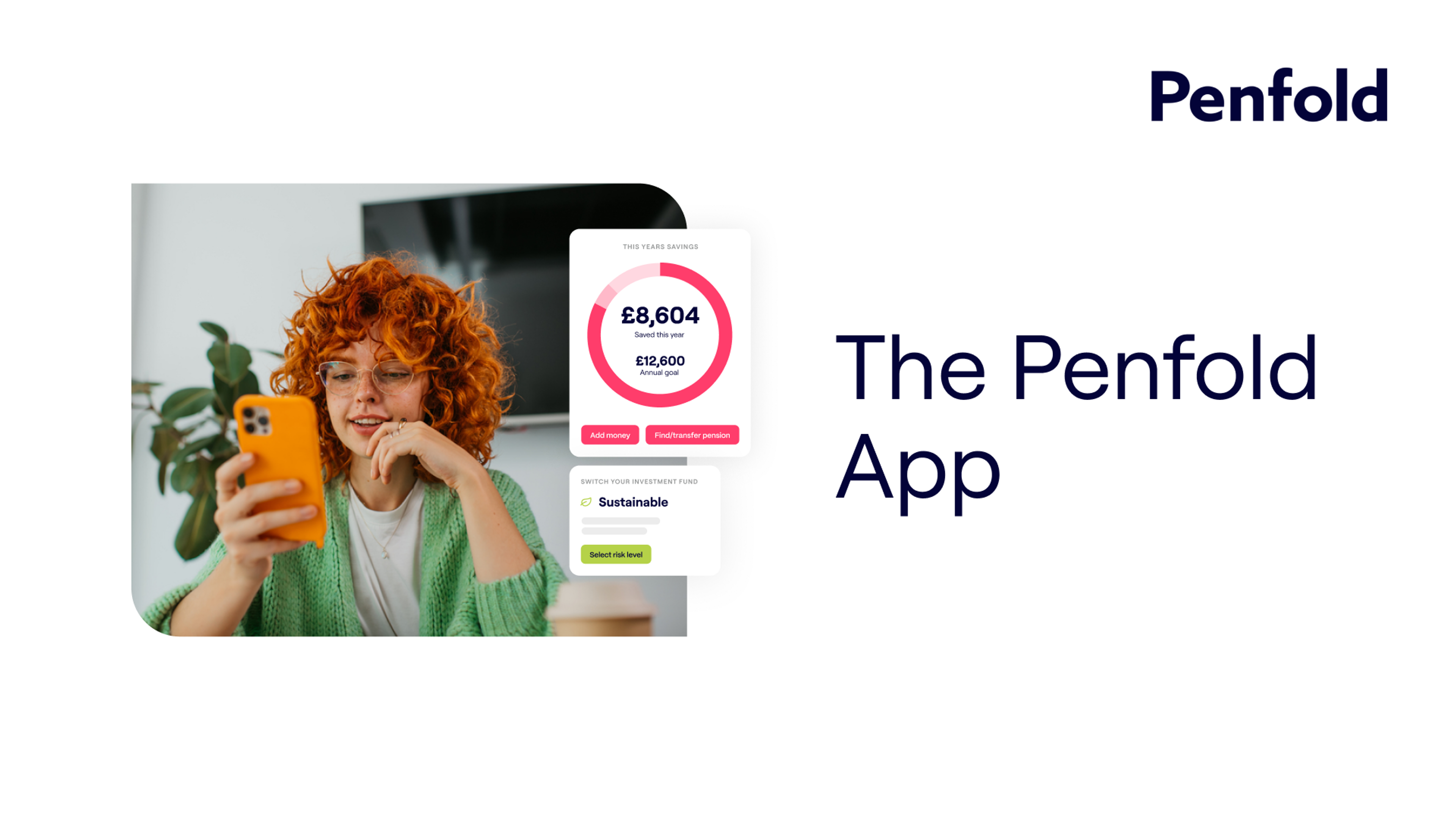

The pension that puts you in control

Track your savings. Combine old pensions. Plan your future. All in one app you’ll actually enjoy using.

With investments, your capital is at risk.

A better pension experience

Designed to make saving simple, the Penfold app gives you total visibility of your pension. Track your balance, combine pots, manage contributions and plan ahead – anytime, anywhere.

All your pensions, in one place

Most people have pensions scattered across old jobs. We help you find them, combine them, and so you can see everything in one place.

Find and combine pensions fast

Our Find My Pension tool has already recovered millions of pounds for our users. A few taps and you’re done.

We handle the legwork

We contact your previous providers and sort the paperwork. You’ll get updates along the way in your app dashboard.

Never lose a pension again

With everything in one place, you can keep track of your future – without the filing cabinet.

It’s important to compare providers’ fees and any guaranteed benefits when deciding on whether to transfer, and be sure that the investments available are suitable for you. If your employer is paying into your pension currently, transferring that pot may mean you lose out on their contribution.

Look into your future

Seeing how much is in your pension pot is handy, but seeing what your annual income will be when you stop working gives you a clearer view of your future.

Forecast your future lifestyle

It’s not just about what’s in your pot – it’s what it could mean for your retirement. Your Forecast shows your projected annual income and places you in a lifestyle category (like ‘comfortable’ or ‘luxury’), including your state pension and any personal pots.

Set goals – and smash them

Choose a target, track your progress, and get a nudge when you’re on course. You’ll see your savings habits over time and feel confident in where you’re headed.

Invest your way and stay flexible

Smart investments, simple choices

Pick a plan that fits your goals, values, and risk appetite. Choose from a range of options – including our exclusive Penfold Plan. See how it’s performing and where your money’s invested.

Flexible saving, made easy

Life is full of ups and downs. With Penfold, you can top up or pause your contributions whenever you like, directly in the app – no strings attached.

One pension, two ways to get it

Workplace pension

Get your own and employer contributions, cut tax with salary sacrifice, and keep Penfold for life – even if you change jobs.

Personal pension

Set up in minutes. Pause or boost payments when you like. Combine old pensions with a few taps.