For employees

The only pension you’ll need

Look after your financial wellbeing and retire more comfortably – with the pension that’s genuinely a benefit.

What they say

“Wow I can’t believe my pension was transferred over so quickly. Thank you for the great job your team performed.”

Eric

Penfold customer

“A really great way to save for your pension and withdraw if you need to. The staff are exceedingly friendly and highly professional.”

Gary

Penfold customer

“I've had experience with Penfold both from the employee and the employer side and have been impressed with both.”

Ceilidh

Penfold customer

“Penfold are a breath of fresh air. They do as they say and deliver. Good app, great service. Overall I'm delighted we are using Penfold. Thank you.”

Chris

Penfold customer

“Low fees and healthy growth of my pension together with a simple app that enables me to keep an eye on things. Whats not to like!”

Peter

Penfold customer

“I really do recommend using Penfold for their outstanding customer service, easy to use app and straightforward, no nonsense communication.”

Steve

Penfold customer

“They are always quick to respond and helpful. I also attended their webinars which were full of good quality information with a great presenter.”

Kerry

Penfold customer

“Excellent app, everything you need to keep your pension up to date, from transferring your old pensions to contributions, withdrawals, monthly payments, tax bonuses.”

David

Penfold customer

“Wow I can’t believe my pension was transferred over so quickly. Thank you for the great job your team performed.”

Eric

Penfold customer

“A really great way to save for your pension and withdraw if you need to. The staff are exceedingly friendly and highly professional.”

Gary

Penfold customer

“I've had experience with Penfold both from the employee and the employer side and have been impressed with both.”

Ceilidh

Penfold customer

“Penfold are a breath of fresh air. They do as they say and deliver. Good app, great service. Overall I'm delighted we are using Penfold. Thank you.”

Chris

Penfold customer

“Low fees and healthy growth of my pension together with a simple app that enables me to keep an eye on things. Whats not to like!”

Peter

Penfold customer

“I really do recommend using Penfold for their outstanding customer service, easy to use app and straightforward, no nonsense communication.”

Steve

Penfold customer

“They are always quick to respond and helpful. I also attended their webinars which were full of good quality information with a great presenter.”

Kerry

Penfold customer

“Excellent app, everything you need to keep your pension up to date, from transferring your old pensions to contributions, withdrawals, monthly payments, tax bonuses.”

David

Penfold customer

Your employer pays in too

Your company will top your pension up by at least 3% of your salary, every month you’re working with them.

Some of the easiest money you’ll ever make.

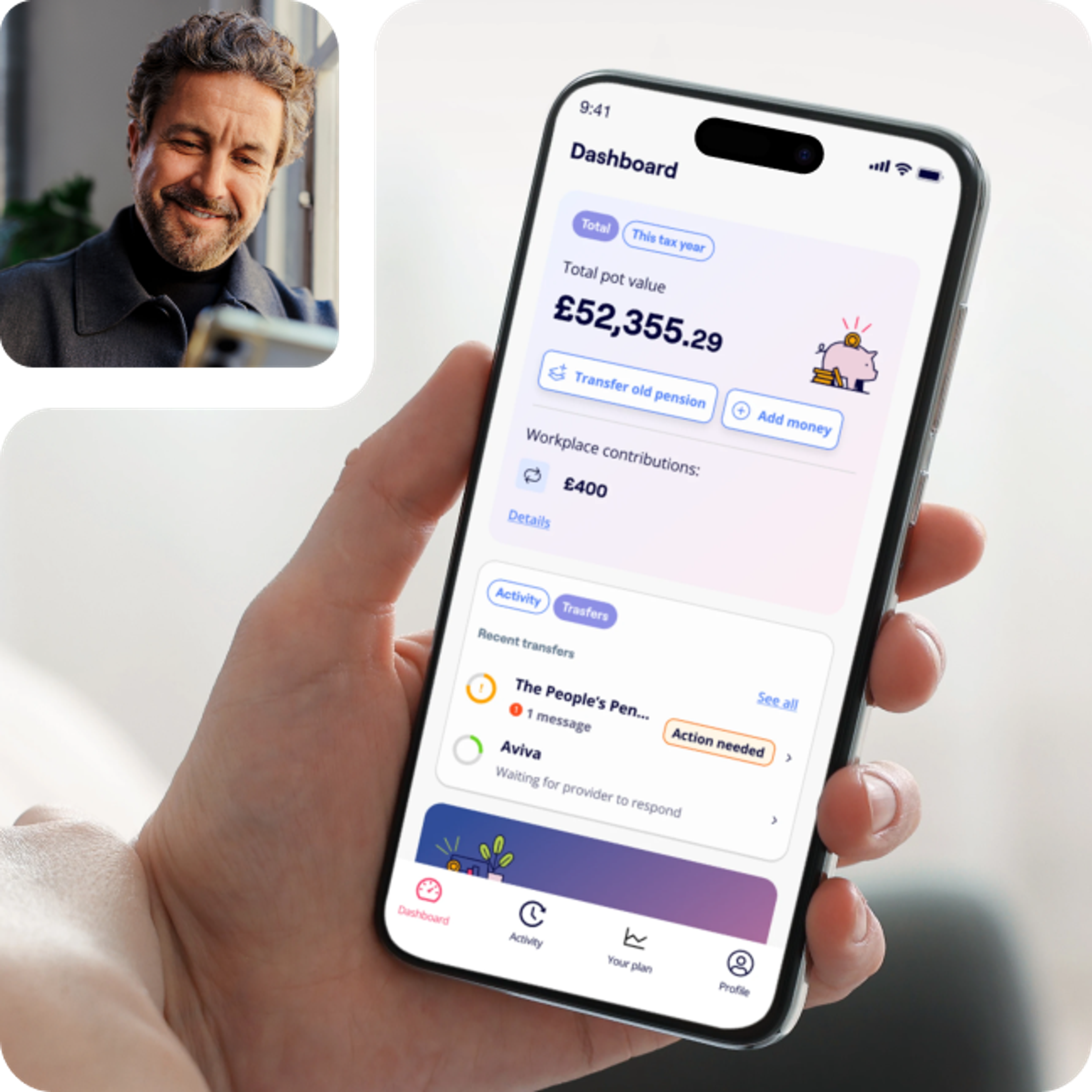

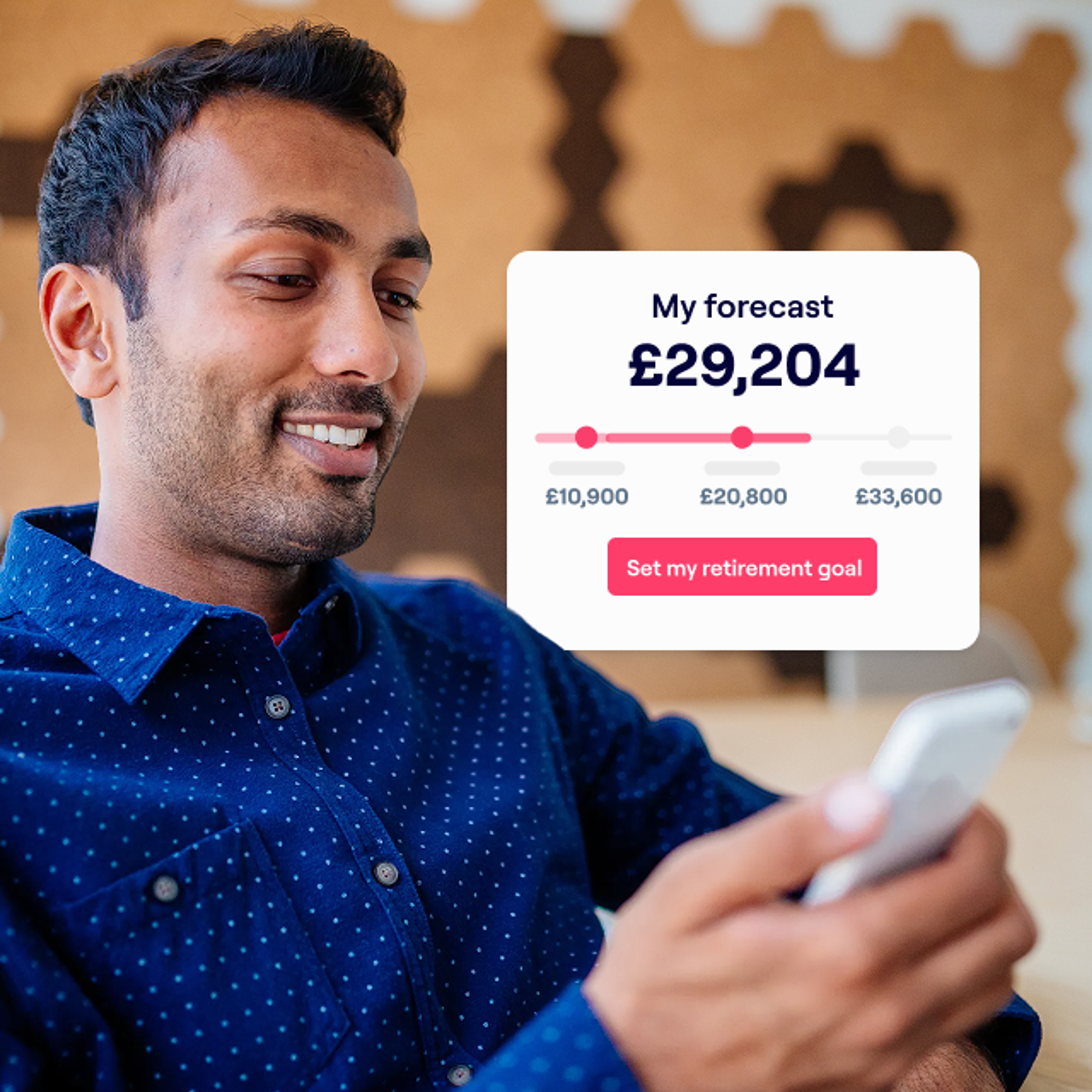

Get on top of your finances

See how much you’ve saved – and what it means for your retirement. Simple dashboards show you contributions, top-ups from your employer and savings growth.

Make life easier for yourself

Penfold tracks down pensions from previous employers – why keep going with several pensions, when you can handle everything through one?