Earn over £50K? You could be due a significant tax refund!

- By

- Murray Humphrey

The government is sitting on a pot of £830 million in unclaimed pension tax relief and Penfold want to help you track down and access those funds!

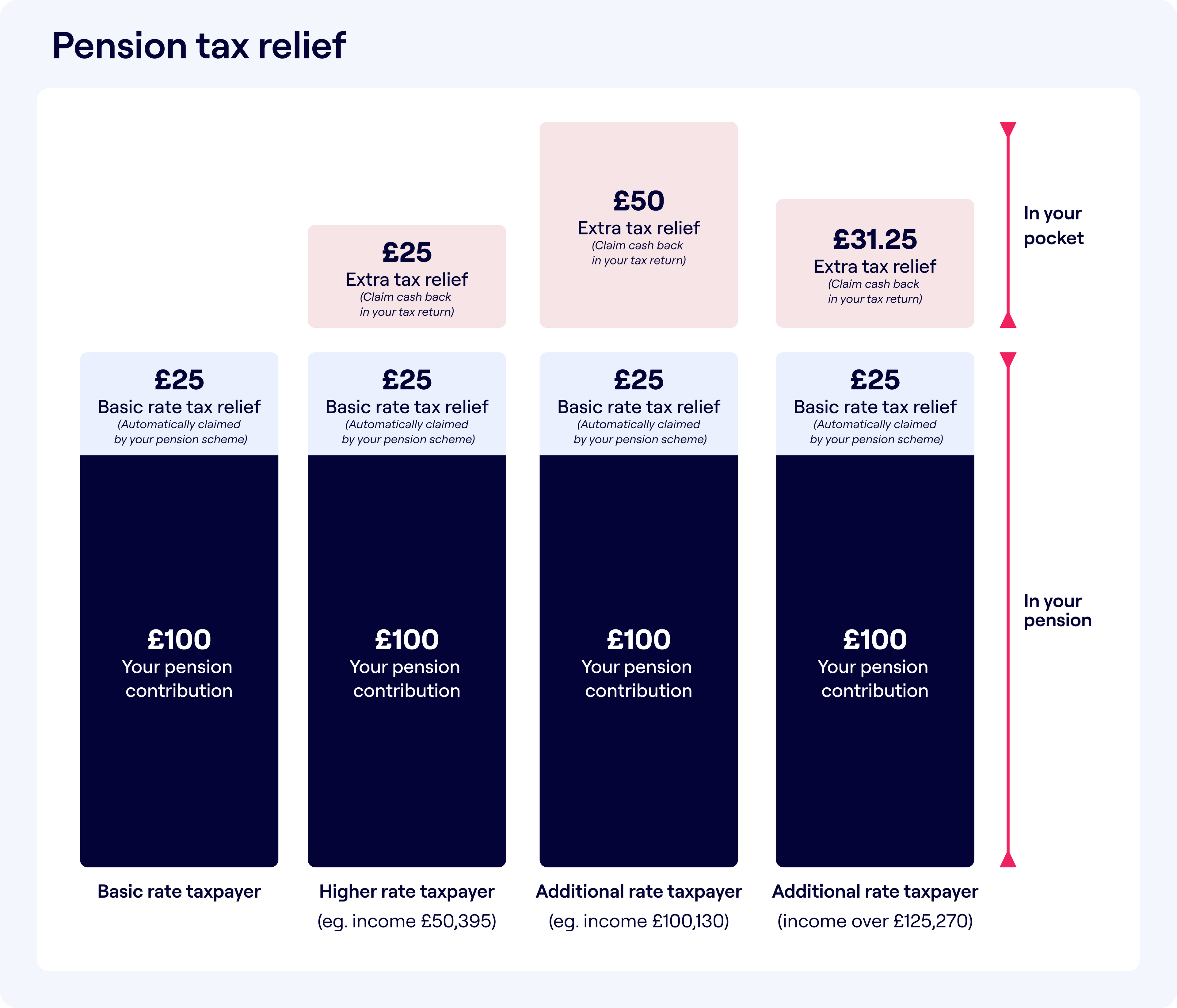

Certain pension schemes (see list below) offer a “relief at source” pension scheme. Relief at source means your contributions are taken from your salary after you have been taxed. Then your pension provider goes to HMRC to claim back the basic tax rate (20% of your pension contributions).

Earn over £50K? The rate of income tax is higher, typically 40-45%. This means that earners over £50K are due tax relief of 40-45% on their contributions to the pension scheme.

Here’s an example. Someone that earns £60,000 and pays into their company pension scheme on the standard UK minimum contributions (5% employee; 3% employer contributions) would be paying in £3000/year into their pension, and could be due £600/year in additional tax relief from HMRC.

The pension provider does not claim this from HMRC. You have to write to HMRC to receive it or alternatively if you do a self assessment tax claim include it there. The money arrives as a tax refund so you can decide whether to put it back into your pension or do something else with it.

The good news is that we can automatically generate a tax relief claim form for you! All you have to do is complete this letter and send it to HMRC, then in a few weeks you should receive your tax refund.

Bottom line: if you earn over £50K you should complete the letter to see if you’re due tax relief!

List of pension schemes that operate Relief at Source - note this is not exhaustive so please if you’re not sure complete and send off the letter anyway:

- NEST (National Employment Savings Trust)

- The People’s Pension

- True Potential Investments

- Standard Life Workplace Pension

- Aviva

More details can be found in the Government's website around pension tax relief here.

Penfold can help your entire team improve their understanding around pensions, find and combine previous pensions and learn more about the future of personal finance. If you're interested in us delivering a free session within your company let us know here.

Please note: tax benefits are dependent on personal circumstances. The examples used here are illustrative not guaranteed and may be subject to change. This article is not intended as financial advice.

Murray Humphrey

Penfold