Reading time: 6 minutes

Self Assessment Tax Returns Explained: A Practical Guide

- By

- Murray Humphrey

If you need to file a UK Self Assessment tax return, it’s important to understand what it’s for, whether it applies to you, and what you’ll need to complete it.

This guide explains how Self Assessment works, who needs to file, key deadlines, and what to watch out for – so you can stay compliant and avoid unnecessary stress or penalties.

What is Self Assessment?

Self Assessment is the system HM Revenue & Customs (HMRC) uses to collect Income Tax and National Insurance from people whose income isn’t fully taxed automatically.

While most employees pay tax through PAYE, Self Assessment is required when you have income HMRC doesn’t already know about – or where tax relief needs to be claimed manually.

Do I Need to File a Self Assessment tax return?

You may need to file a tax return if you:

- are self-employed or a business partner

- are a company director (unless your affairs are very simple)

- earn income from property, investments, dividends, or savings

- need to claim tax relief, such as higher-rate pension tax relief

- receive Child Benefit and have income over the threshold

- have foreign income

- have made capital gains

Even if you’re employed and taxed through PAYE, you may still need to file if your financial situation is more complex. If you’re unsure, HMRC provides an online checker – or you can speak to a tax professional.

How do I register for Self Assessment?

If you’ve never filed a Self Assessment before, you must register with HMRC.

- Registration deadline: 5 October following the end of the tax year

- HMRC will issue you a Unique Taxpayer Reference (UTR) once registered

If you’ve filed before, you don’t need to re-register unless HMRC has told you otherwise.

What are the Self Assessment deadlines?

There are three key deadlines to be aware of, missing these deadlines can result in penalties and interest:

- Paper tax returns must be submitted by midnight on 31 October.

- Online tax returns need to be filed by midnight on 31 January of the following year.

- The tax owed must also be paid by midnight on 31 January.

What penalties apply if I miss the deadline?

If you miss the deadline for submitting your tax return or paying your bill, you’ll incur a late filing penalty of £100 if your tax return is up to 3 months late. More significant penalties apply for longer delays. Interest is charged on late payments. However, you can appeal against a penalty if you have a reasonable excuse.

What do I need to complete a Self Assessment?

If this is your first Self Assessment, you would have needed to register with HMRC by the 5th of October telling them that you need to submit a Self Assessment tax return. HMRC would have sent you your Unique Taxpayer Reference (UTR) number which you’ll need for the return.

You’ll also need to gather a few documents about your income and relevant costs throughout the tax year. This includes:

- Information on all your untaxed income (this includes dividends, partnership income, interest from savings or investments, side gigs, rental income etc).

- Details of expenses for your self-employed company.

- Records of pension contributions and tax relief (get in touch with us to get a PDF of all your pension contributions this tax year).

- Proof of any income from employment (like your P60 or P45).

How do I complete my Self Assessment?

Most people file online via HMRC’s website, which allows you to:

- submit returns digitally

- view previous filings

- track payments and calculations

Alternatively, you can use an accountant. Penfold customers receive 10% discount with our partner, TaxScouts.

How much Income Tax will I pay?

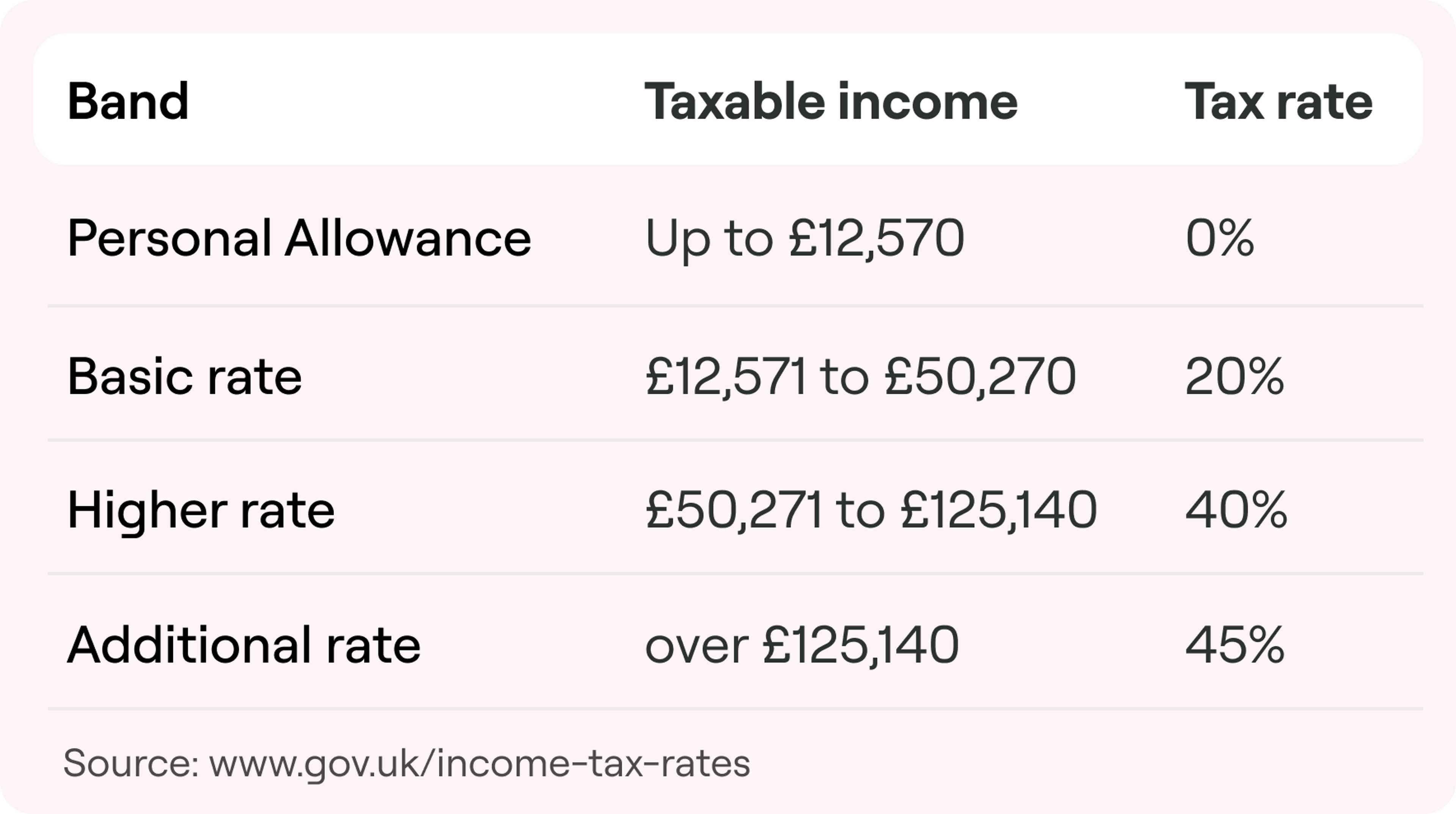

Everyone has a personal allowance, which is currently £12,570. Income above this is taxed at different rates depending on your earnings. Higher income may also reduce or remove your personal allowance entirely. Here’s a breakdown of income brands and their tax rates to help you figure out what you might owe.

National Insurance and Self Assessment

If you’re self-employed, National Insurance is handled through Self Assessment. Key points:

- Class 2 National Insurance is no longer paid but may still be credited

- Class 4 National Insurance is calculated as a percentage of profits

- NICs are usually paid as part of your Self Assessment bill, often via payments on account

Rates and thresholds can change, so it’s important to check the rules for the relevant tax year.

Capital Gains Tax and Self Assessment

You may need to report capital gains if you sell assets that have increased in value, such as:

- shares

- property (not your main home)

- business assets

The annual Capital Gains Tax allowance is £3,000 for individuals. Capital gains are reported using the SA108 supplementary pages alongside your main tax return.

More complex situations

Self Assessment can vary significantly depending on individual circumstances. Unique situations may require additional attention:

- Multiple Income Sources: If you have various income streams, each might have different tax rules. It’s important to understand how these interact and are reported.

- High Earners: Higher income levels can trigger complex tax considerations, like the High Income Child Benefit Charge or reduced personal allowances.

- Inheritance and Capital Gains: Handling inheritance tax and capital gains from estate sales can be intricate.

- Foreign Income: Income from overseas adds complexity due to potential double taxation and the need to understand international tax agreements.

In these cases, seeking specialised tax advice is often beneficial to ensure compliance and optimise tax liability. For detailed guidance, consider consulting a professional tax advisor or refer to specific HMRC resources.

HMRC queries and audits

If HMRC queries your Self Assessment tax return or decides to conduct an audit, it’s important to be prepared. HMRC may ask for clarification or evidence for certain figures on your return. This could be due to discrepancies or simply as part of their random checks. In an audit, HMRC thoroughly reviews your financial records and tax return. It’s essential to have all your documents organised and readily available, including income records, expense receipts, and bank statements. Cooperating fully and promptly with HMRC’s requests is crucial. If discrepancies are found, you may have to pay additional tax, interest, or penalties. Legal advice or assistance from a tax professional can be beneficial in these situations.

Getting help with Self Assessment

HMRC offers online guidance and tools, including digital assistants and videos. You can find more information on the GOV.UK Self Assessment pages.

If you need help understanding how pensions fit into your tax return, Penfold’s team is always happy to help via chat or email.

This article is for general guidance only and does not constitute tax or financial advice. Tax rules may change and depend on individual circumstances.

Murray Humphrey

Penfold