Paying tax when you’re self-employed

- By

- Murray Humphrey

Navigating your taxes as a freelancer or sole trader can be a challenge, especially when you first set out to go it alone. At Penfold, we’ve teamed up with GoSimpleTax to bring you a quick guide to paying tax when you work for yourself.

Do I need to register as self-employed?

All self-employed people first need to register with HMRC if you’ve never filed a Self Assessment tax return before. The deadline for registration is the 5th October in your second year of business, so be sure to register by this date in order to avoid paying a penalty. It’s recommended that you register as soon as possible so that you don’t forget the deadline.

To register, head online and complete the form CWF1. HMRC will send you a letter containing your Unique Taxpayer Reference (UTR) which you’ll use to file and pay your tax returns. Look out for a second letter from HMRC containing an activation code, so that you can log in to your online account.

How much can I earn before paying tax?

Each year, you’re entitled to receive an amount of tax-free income which is called the Personal Allowance. In 2020/21, the Personal Allowance is £12,500 (which is the same as 2019/20). The Personal Allowance can increase with inflation, so remember to check for any future changes on the HMRC website.

How much income tax will I pay?

If you earn more income than the Personal Allowance, you will need to pay income tax. The amount of income tax you pay each year depends on your total income, and how much of your income falls within each tax band. To pay your income tax, you’ll need to work out how much tax you owe. To find out more on how to calculate this, head to the GoSimpleTax How to calculate how much tax you owe blog.

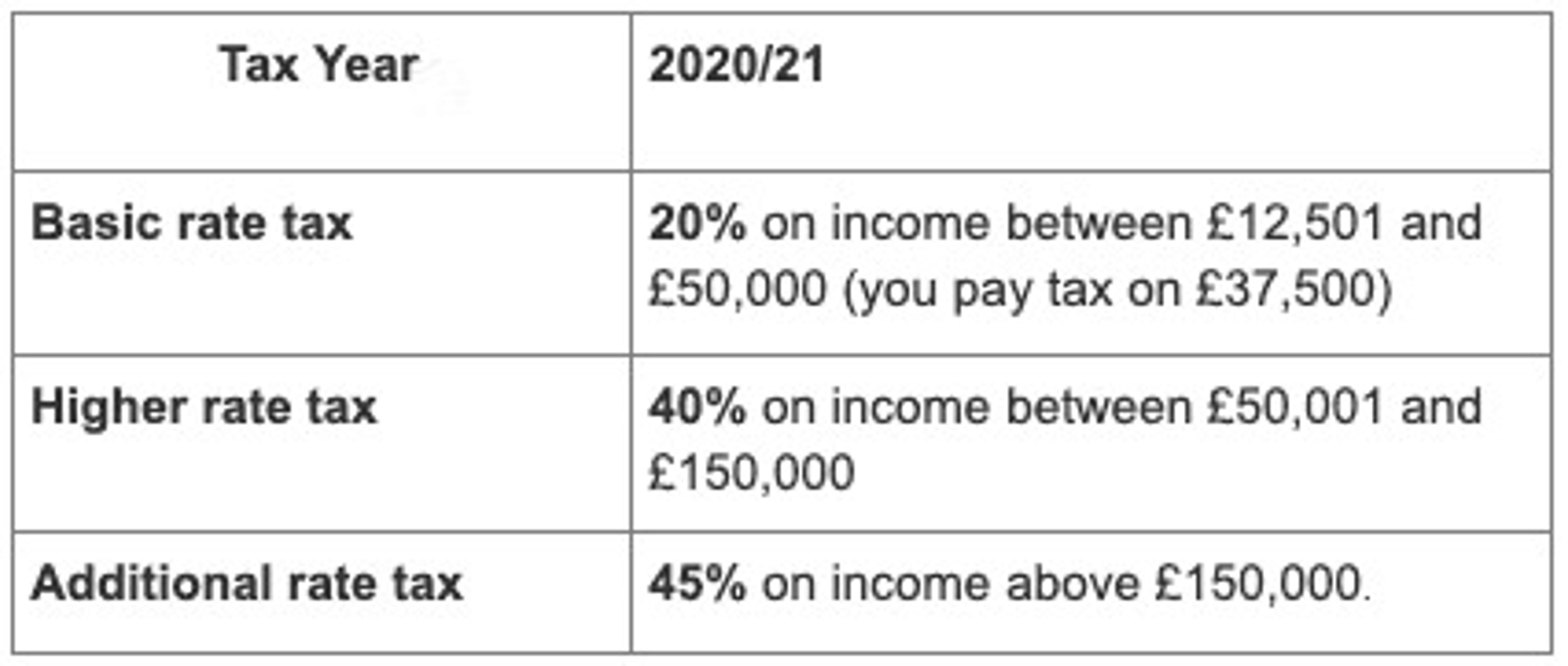

For the 2020/21 tax year, the income tax bands are:

In order to pay your income tax, you will need to complete a tax return. Once your return is submitted, HMRC will provide you with your tax bill and you can pay through a number of methods, including bank transfer or by post.

To find out more about how our partners, GoSimpleTax, can help you to manage your tax return as a sole trader or freelancer, head to their website now. And, they're giving all of our Penfold pension customers a huge 25% discount if you sign up through that link!

Murray Humphrey

Penfold