Workplace pensions explained

What workplace pensions are and how they work. Qualification, enrolment and opting out of a workplace pension. What happens to a workplace pension when leaving a company or after passing away.

Workplace pensions are one of the best benefits offered by today’s employers. In this article, we’ll explain everything you need to know, including what a company pension is, how they work, who gets them and more.

What is a workplace pension?

A workplace pension is a type of pension set up by your employer to help you prepare for life after work.

During your time working for your company, you’ll build up a savings pot which you can then access when you’re ready to retire - helping to provide an income in later life.

Most workplace pensions today require contributions from both you and your employer. Some older-style or public sector pensions will be completely covered by your employer, without you having to pay in.

You may also see workplace pensions referred to as an employer pension, company pension or an auto enrolment scheme. They all broadly refer to the same thing.

When did workplace pensions start?

Modern workplace pensions we use today began life after the 2008 Pensions Act. Following a thorough review of pensions in the UK, the government decided to take steps to address what was seen as a pension savings crisis. People simply weren’t putting enough money away for the future. This led to people working longer and becoming increasingly reliant on the State pension.

The key change to help fight this was switching to an opt-out scheme for employer pensions - meaning every employee should get some sort of pension automatically.

In 2012, the government made it obligatory for companies of a certain size to offer a pension to their employees. It was then made mandatory for all companies in the UK to automatically enrol all eligible employees into a pension scheme in 2018. More on what constitutes an ‘eligible employee’ a little later.

What is a Governance Advisory Arrangement?

From 6 April 2025, providers operating workplace personal pension plans have had to set up an Independent Governance Committee or appoint a Governance Advisory Arrangement whose principal functions are to:

- Act solely in the interests of the relevant policyholders of those pension plans; and

- Assess the “value for money” delivered by the pension plans to those relevant policyholders.

The Financial Conduct Authority requires the Chair of each Independent Governance Committee and Governance Advisory Arrangement to produce an annual report including how they have fulfilled their obligations in assessing value for money for policyholders.

Read Penfold's GAA terms of reference and most recent annual reports.

You can contact the GAA with any representations that you wish to make about Penfold’s workplace pension.

How do workplace pension schemes work?

There are two main types of employer pension scheme:

- Defined contribution

- Defined benefit

Most company pensions today are defined contribution. You and your employer pay into your workplace pension scheme every month for as long as you’re employed.

Both you and your employer pay into a workplace pension.

Your contributions will come straight from your pre-tax salary - with your employer automatically adding their share on top. Often, you’ll need to agree to contribute a certain amount to benefit from your employer contributions, usually 5% as a minimum. Everything added to your pension will then be invested into a pension fund.

The value of an auto enrolment pension comes from how much you and your employer have paid, as well as how well your chosen pension plan has performed.

Some companies (particularly in the public sector) offer defined benefit pensions - also called a ‘final salary scheme’. Here, how much you receive in retirement is defined by your salary and how long you’ve worked for your company, among other things. Today, defined benefit pensions are becoming less and less common.

If you’re paying into your pension yourself, you’ll also benefit from tax relief on your contributions from the government. Tax relief for workplace pensions works in three different ways:

- Before you pay tax (known as ‘Net Pay’)

- After you’re taxed (known as ‘Relief At Source’)

- Salary sacrifice

Your employer will decide which method your company pension uses.

Net Pay

With Net Pay, your employer takes your pension contribution from your monthly wage before you pay any tax. When you get paid, you’ll receive your monthly salary minus your pension contribution. Your employer adds it to your pension for you, meaning you won’t pay any income tax or National Insurance on this part of your earnings.

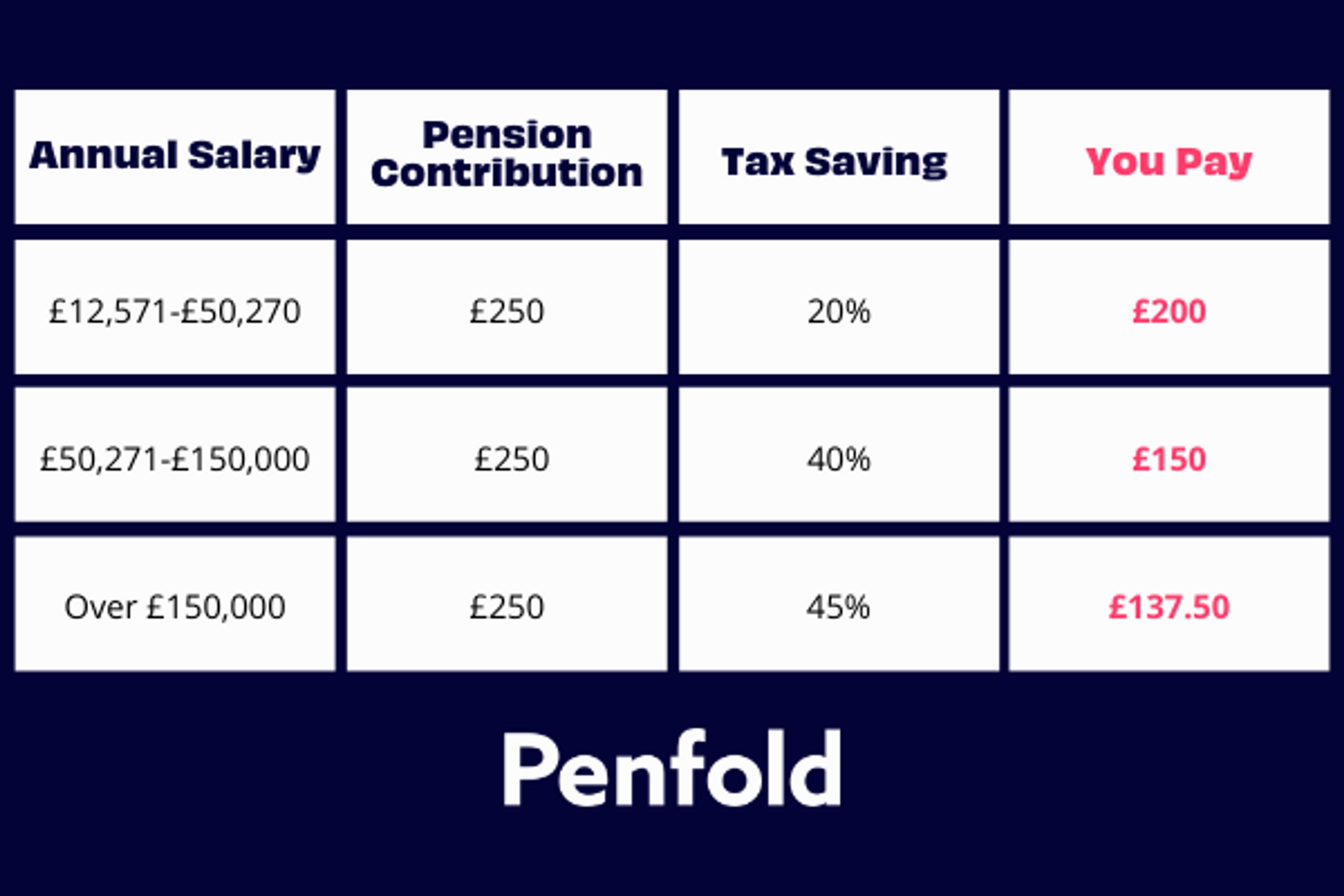

It happens automatically and you won’t have to claim any tax relief yourself. Whether you’re a basic, higher or additional taxpayer, you save tax at your marginal rate. Here’s what that looks like for a £250 contribution.

The Net Pay approach reduces your overall take-home pay, reducing the amount you owe in tax. Essentially, you get to keep more of the money you’ve earned.

Relief at Source

Relief at Source means your pension contributions are taken out of your salary after you’ve paid tax on your earnings. Here’s how it works.

First, you’ll pay income tax and National Insurance on your earnings as normal. Your employer will then take your pension contributions from your pay before it arrives in your bank account

Your contribution will be sent to your workplace pension provider who claims tax relief back from the government at the basic rate.

For anyone earning under £50,270, that means you’ll save 20% tax on everything you pay in. It’s worth noting that you won’t receive any tax relief on contributions from your employer.

This applies even to those who don’t pay any income tax - making it a fantastic way to boost your pension savings.

Let’s say you want to add £100 into your pot. £80 will come from your salary, with the remaining £20 coming from the government as a tax top-up.

Higher earners can earn even more back, but you’ll need to do this yourself via your self-assessment tax return - check out our guide on tax relief for high earners.

Salary Sacrifice

One final type of arrangement offered by employers is a salary sacrifice pension. This is a government-backed scheme where employees can swap part of their salary for regular pension contributions.

Instead of paying into your pension from your monthly earnings, you voluntarily give up a small part of your income - your employer then pays this (plus their contribution) into your pension on your behalf. By reducing your salary ‘on paper’, you also reduce your income tax and national insurance, helping you keep more of what you earn.

Do I qualify for a workplace pension?

To qualify for an auto enrolment pension scheme, you’ll need to be an ‘eligible employee’. That means:

- you’re legally classed as a ‘worker’ (see government guidelines)

- you’re aged between 22 and State Pension age

- you earn at least £10,000 per year (roughly £520 a month, £120 a week or £480 over 4 weeks)

- you work in the UK

There are also a few other things that may disqualify you from receiving a pension from your employer, including:

- you’ve given (or received) notice that you’re leaving your job

- you’ve already taken a pension that meets the automatic enrolment rules

- you opted out of a pension scheme offered by your employer within the last 12 months

- you’re in a limited liability partnership

- you’re a company director without an employment contract employing at least one other person

Again, the government’s guide to workplace pensions is your best resource for the full list of eligibility criteria.

Do I have to enrol in a workplace pension?

As long as you’re eligible, your employer will automatically enrol you into the company pension. If you haven’t been enrolled (and think you qualify), talk to your HR team or people manager.

If you don’t want to take part in your company pension scheme, you’ll need to opt out manually. More on that below.

Does every company have to provide a pension?

By law, every UK company must offer some form of workplace pension scheme. They will also need to pay into your pension and set up some form of tax relief with your pension provider.

Your company will need contribute a minimum of 3% of your total earnings - to get this, you’ll also need to add 5% of your earnings yourself. For example, if you earn £50,000 a year, you’ll need to pay at least £208.33 into your pension each month. Your employer will then add a minimum of £125 on top.

Many employers offer more than the minimum pension contribution as an added benefit of working there. If your employer pays in 8% of your monthly earnings, you won't have to contribute anything yourself (unless you want to). Not sure how much to contribute? Head to our guide on workplace pension contributions.

Can I opt out of a workplace pension?

While a workplace pension is generally a great way to save for the future, you may not want to take part for a number of reasons. Is it possible for you to opt out once you’ve been enrolled?

The answer is yes! You can opt out of your company pension at any time. All you need to do is let your employer know you no longer wish to take part.

Remember, by doing this you’ll also stop receiving any pension contributions from your employer.

You’ll still keep any pension contributions you’ve made to date. All contributions will wait in your pension pot until you reach retirement age or decide to transfer to another provider.

If you have decided to opt out, your employer legally must offer you the chance to rejoin the scheme at least once a year.

Also, it’s worth knowing that your employer will automatically enrol you back into the company pension scheme after 3 years (if you’re still eligible). If you still don’t want to take part, you’ll need to manually opt out again.

What happens to my workplace pension when I leave my company?

If you leave your current job, you have a couple of options for your old company pension.

You can:

- Leave it where it is

- Transfer it to a new provider

Leaving it where it is

When you get a new job (or start working for yourself) you can simply leave your pension where it is. You and your employer won’t continue paying in, but your pot will remain invested and may continue to grow over time. Just remember to make a note of your pension provider and policy number for future reference. Then, when you’re ready to retire you can start to withdraw your savings.

Many workplace pension schemes even allow you to continue contributing even after you’ve left. Just remember you’ll no longer receive any extra contributions from your old employer.

Lost track of an old workplace pension? Here’s our straightforward guide to finding old pensions.

Transferring a workplace pension

You can also move your pension to a new pension provider. Many people like to combine their pots so they only need to manage one pension. Again, you’ll need your policy number and pension provider details to get started, as well as the name of your old employer. There may also be a fee associated with transferring your pension. For more on this, check out the Penfold guide to transferring pensions.

What happens to my workplace pension when I die?

An important part of long-term saving is being prepared should the worst happen. If you pass away before you retire, your workplace pension can be claimed by your nominated beneficiary. This is a loved one you’d like to receive your pension should anything happen. They will usually receive the entire value of your pot as a tax-free lump sum