Pension performance update: June 2022

- By

- Murray Humphrey

Since our last update, the news for UK investors has been dominated by one major, continuing trend: inflation.

Across much of the world, the rising cost of living continues to bite, with fuel prices, energy bills and more climbing as inflation in the UK reached 9.1%.

But what does this means for your savings?

Let’s take a look at how the investments in your pension fared in June.

A look at the markets

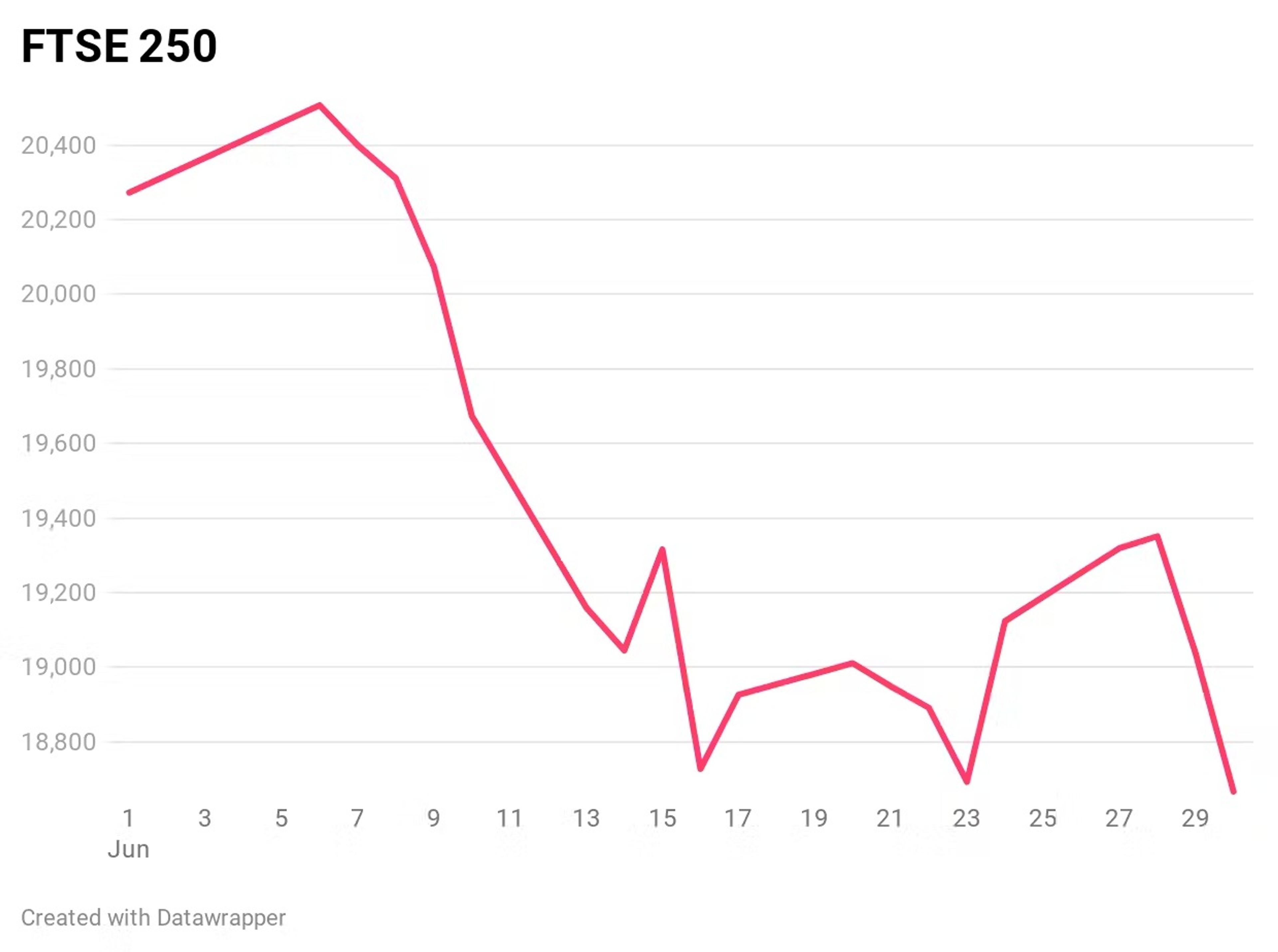

Last month, the FTSE 250, an index combining the value of the top 250 valuable companies in the UK dropped by 7.9%.

Source: Google

Since the start of the year, the FTSE 250 is down more than 21% - highlighting the significant impact of current financial trends on our investment markets.

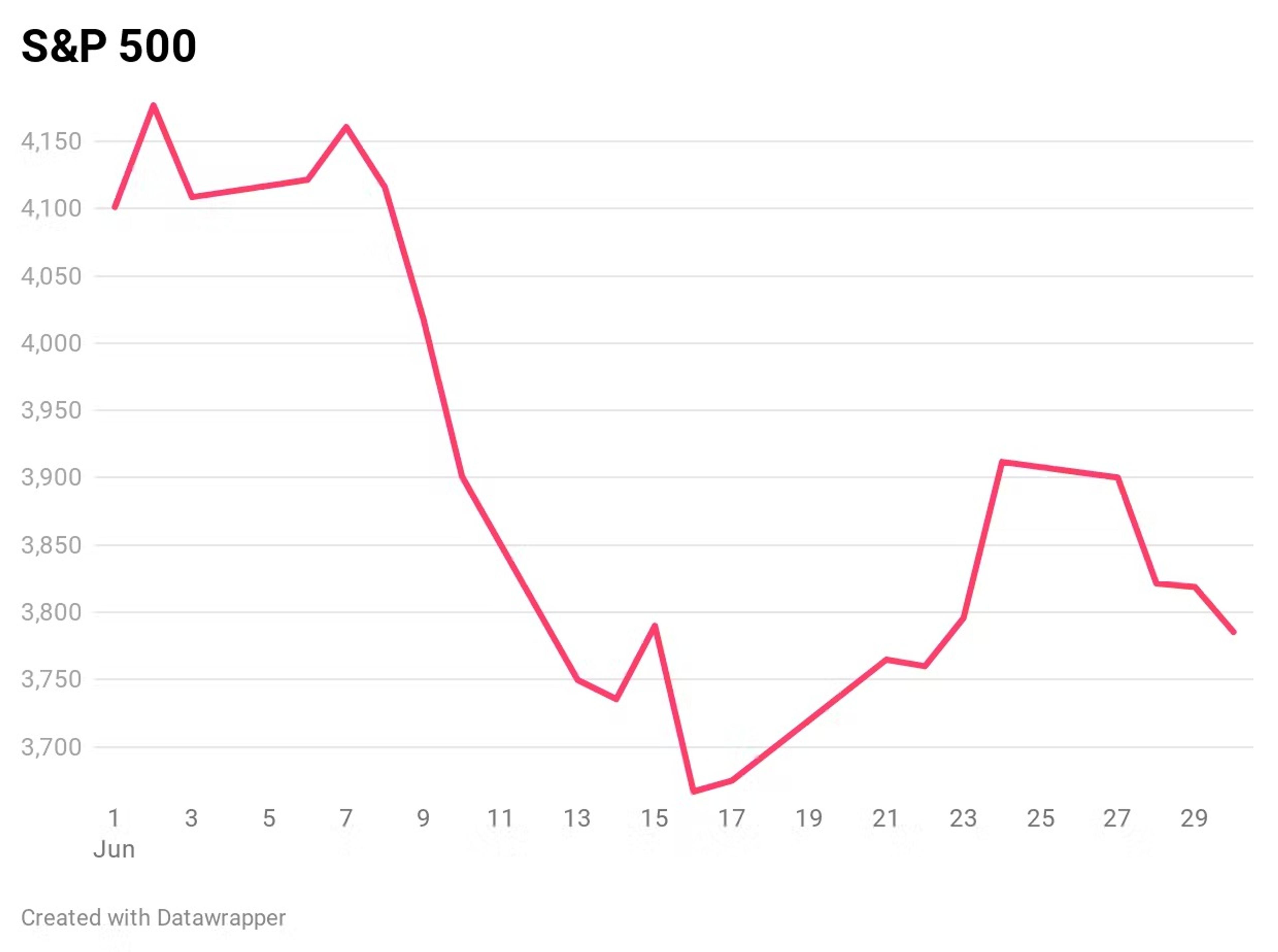

In the US, the biggest market index, the S&P 500, tells a similar story.

Source: Google

June saw a 7.7% decrease over the pond, down 21% since January.

These long-term downward trends mean that we are now in a bear market. Here’s what that means.

What is a bear market?

When we talk about medium to long-term trends in investments, we tend to classify the overall outlook in one of two ways.

A bull market or a bear market.

Traditionally, a bear market is when a group of stocks (or any financial assets) drop by more than 20% in value.

Bear markets aren’t particularly rare, and are an expected part of investing - normally lasting around 12 months (although this can vary significantly, from a few weeks to several years).

Since 1948, there have been a total of 12 bear markets in the US.

The opposite of a bear market is a bull market, a general upward trend in the value of stocks and shares.

As you may have guessed, a bull market is officially declared when a significant portion of large stocks has grown by 20% or more.

Bull markets tend to last longer than bear markets and are also more frequent - we’ve been in a bull market for 78% of the last 91 years.

Why is this happening?

So, what has caused the current bear market?

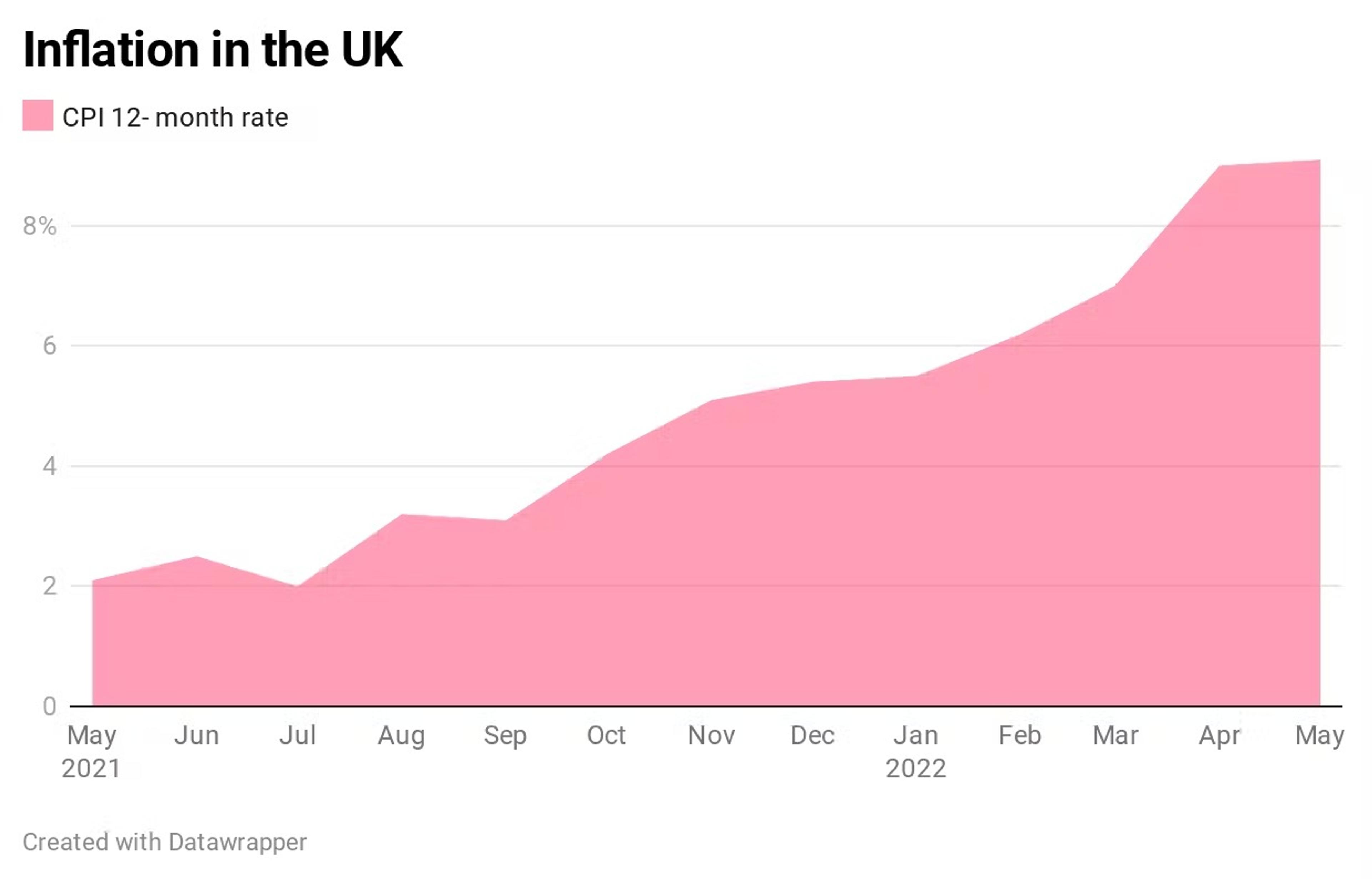

As we called out at the start of this article, the main driving force causing the value of many pensions to fall is inflation.

Source: Office for National Statistics

Inflation refers to the decrease of the value of our money over time, where £5 today can buy less than it could 10 years ago.

The amount of money is the same, but its purchasing power has diminished.

To help combat this phenomenon, the Bank of England has been raising interest rates.

They do this by increasing how much it costs money lenders like banks to borrow money. As of June 2022, the current interest rate is 1.25%.

Theoretically, this should reduce the amount of money available in the financial system, resulting in less purchasing and helping to slow rising prices as demand falls.

However, when combined with slowing economic growth, this can lead to something called “stagflation” where high prices and low sales reduce business profits.

The result? Selling off in the financial markets as investors grow concerned for the medium-term future.

What this means for your pension

Unsurprisingly, the impact of this financial downturn is also being felt across pensions.

Your pension is invested across a mix of assets, including:

- Stocks and shares

- Company bonds

- Government bonds

- Commodities

As the value of all financial markets across the globe is impacted, seeing an effect on your pension savings is unfortunately unavoidable.

Remember, even keeping your money as cash will have seen the real value of your savings drop by 9.1% in the past month thanks to inflation.

The good news is that, again, bear markets don’t last forever.

Your pension is designed to weather market downturns in the short-term, to help grow your savings in the long term.

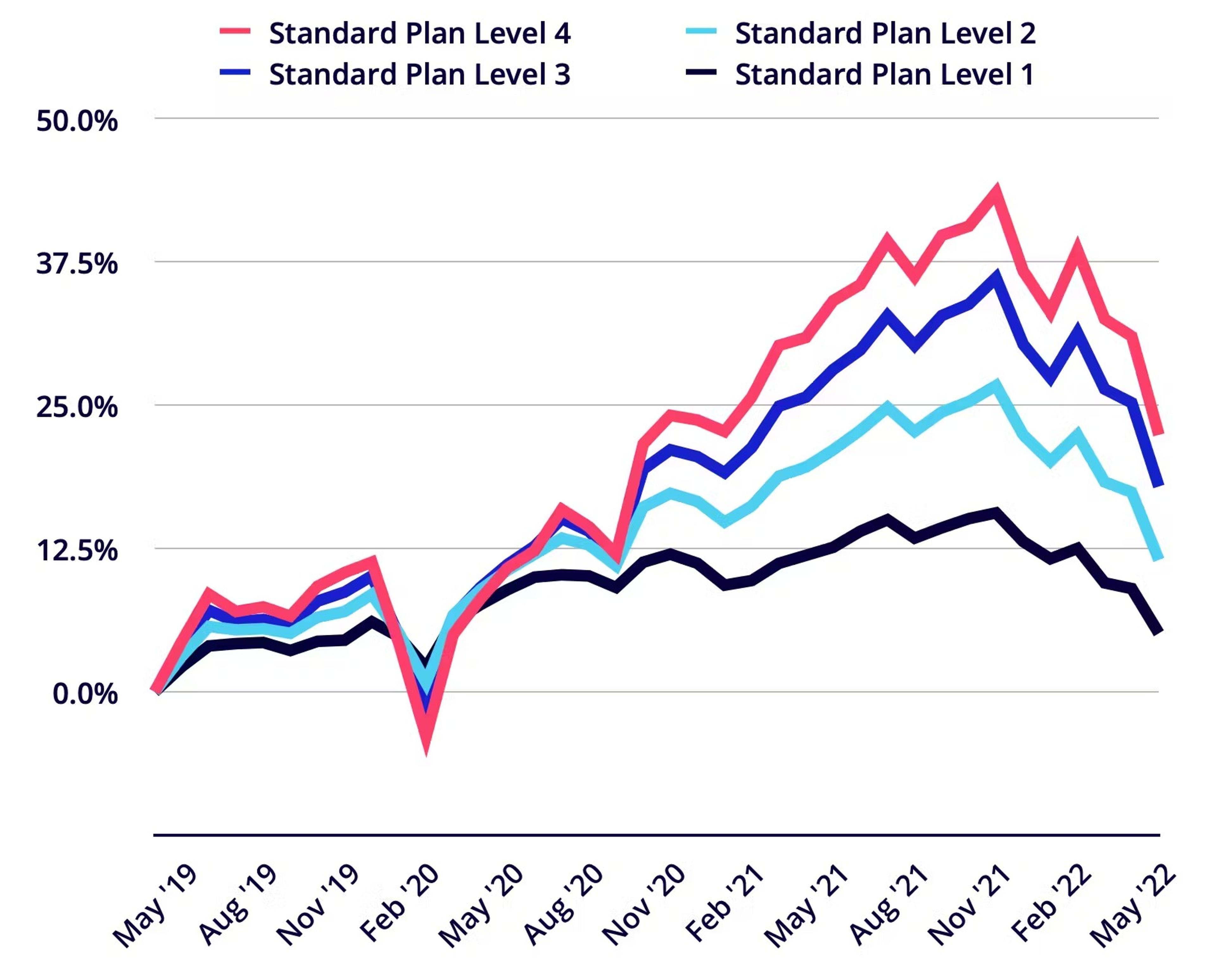

As you can see from the chart below, our pension plans have seen many rises and falls over the past few years - some lasting a few months, some rebounding almost straight away.

Source: Penfold

With your pension, it's vital to always keep an eye on the long-term, even if you are close to retirement.

Conclusions

While it is of course scary to see the value of your pension dip, remember that bear markets don’t last forever.

By transferring or withdrawing your pension while the wider market is down, you’ll likely see a loss in the value of your savings - especially when all pensions, no matter the provider, will have been impacted by this latest financial crisis.

Here’s the main thing to keep in mind.

Over the long term, keeping your money invested remains the best way to protect the value of your savings and fight off inflation in the long run.

For more help, check out our article on what to do if your pension drops.

With investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.

Murray Humphrey

Penfold