Pension Transfer Rules Explained

Find out how to transfer a pension, what the process is, how long it takes and what to think about before transferring.

If you aren't happy with your pension provider, or you just want to bring all your pensions into one pot, you'll need a pension transfer. In this article, we'll explain exactly what that means, how you can transfer a pension, and what you need to check before you do.

What is a pension transfer?

A pension transfer, or pension fund transfer, is when you move your pension from one provider to another. These days, it's a relatively simple process, although there are a few pension transfer rules you'll need to know.

A pension transfer is when you move your pension from one provider to another.

As your pension savings are invested, you'll need to sell the investments in your pension fund and turn your pot into cash. This money is then transferred to your new pension provider before being invested into your new plan. Most pension providers will take care of this part for you.

If your pension provider offers different pension plans, you can also switch between plans to change how your savings are invested. Because you aren't actually changing pension provider, this isn't classed as a pension transfer.

How to transfer my pension

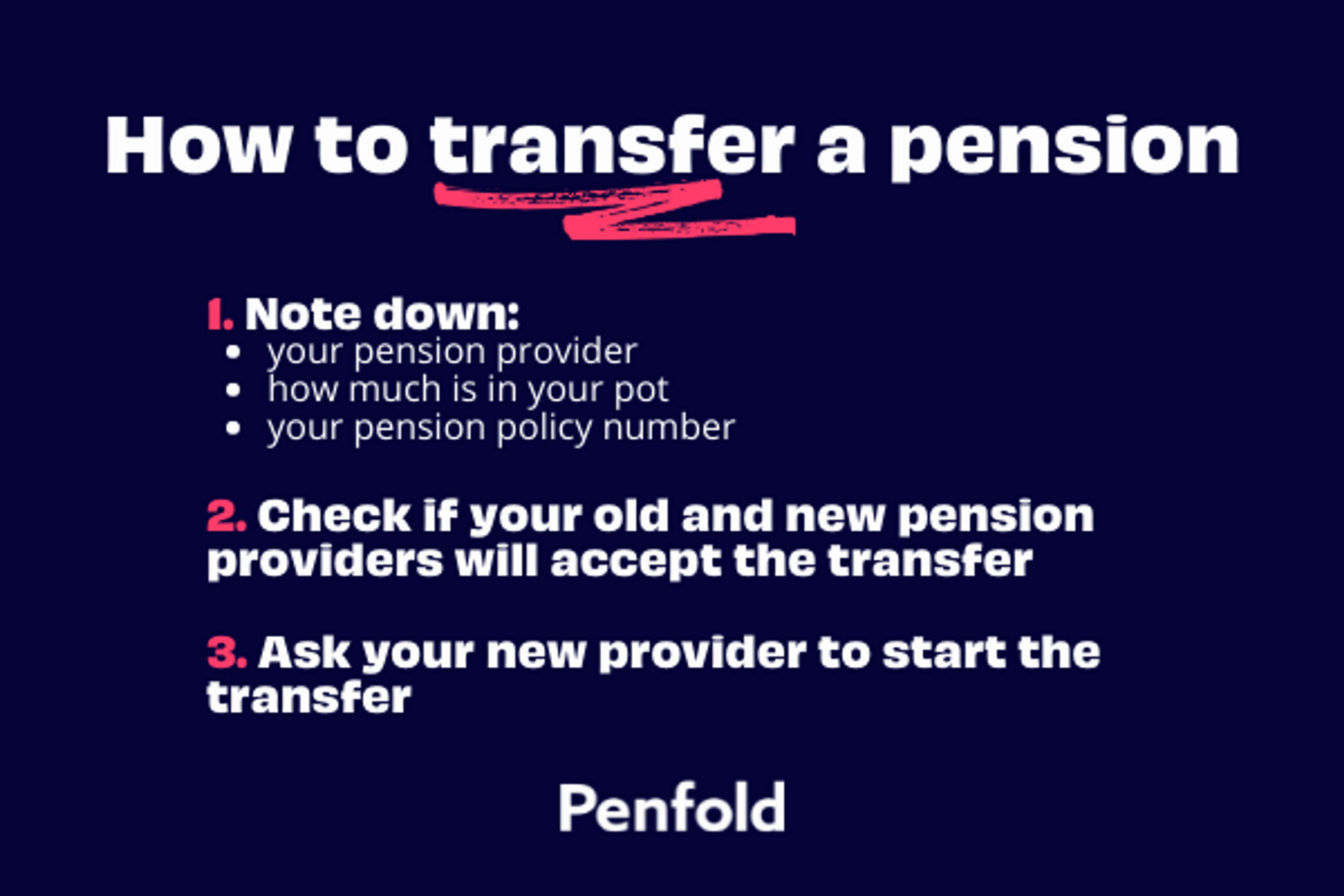

Before you start your pension transfer, you'll need to make sure you have all your information ready. Here's what you'll need to check:

- where is your pension going?

- where is your pension right now?

- does each pension provider allow pension transfers?

- is there a fee to transfer my pension?

Not sure of your pension details? Don't worry, we've put together a handy guide on how to find old pensions.

Pension transfer process

Once you have all your details, the process of transferring your pension is fairly straightforward. Simply send your pension details to your new provider and ask them to start the transfer. Remember, if you're moving to a completely new provider, you’ll need to make sure that your new pension is set up first before starting the transfer.

Can I change my mind?

You normally have 30 days to change your mind and cancel a pension transfer. However, your previous pension provider may refuse to take back your previous pension, including any guarantees or benefits you had before. Also, if you decide to cancel and the value of your pension has dropped, you may receive less back than you originally transferred in.

Pension transfer value

When you transfer a pension, you'll first need to sell all the investments within your pension fund. Once that's done, your old provider will work out your pension transfer value - the amount of money that will be sent to your new pension.

If you're looking to transfer a pension from a previous employer, you'll also want to check what kind of pension you have. Defined benefit pensions can be very valuable and transferring into cash can be a little more complicated. Here, the value of your pot will be calculated by looking at factors like how many years you've been a member of the scheme, before being converted into a cash amount - known as a cash-equivalent transfer value (CETV). Want to transfer a defined benefit pension worth more than £30,000? You'll need to chat with a financial advisor first.

Finally, some providers will also charge you for transferring your pension into another pension scheme. With Penfold, you can transfer as many pensions as you like for free.

Can I transfer my pension myself?

Right now, it isn't possible to transfer your pensions on your own. You will need the help of your provider's pension transfer specialist. Many pension providers offer a transfer service and will happily organise everything for you. Some may charge a fee for doing so. Remember, your new pension provider should be able to organise the transfer for you as long as you know:

- the name of your old pension provider

- your pension policy reference number

- an estimate of your total pot value

How long does it take to transfer my pension?

There is no set time for how long it takes to transfer a pension. This usually depends on whether your request can be processed electronically, or manually - relying on paperwork.

Transferring a pension digitally is normally significantly faster and should only take a few weeks. However, some older pension providers still use a paper-based system. This means documents will need to be signed and verified manually, before being posted to you and your new provider. This can take several months.

Penfold processes things electronically and it takes around 4-8 weeks on average to complete a pension transfer, assuming that there are no complications. We'll provide updates from your old provider and let you know if there is something that needs your attention. Of course, you can also get in touch at any time to ask for an update.

What to think about before transferring

Before your transfer, you should look at your current pension and carefully compare it to your new plan. In particular, make a note of:

- fees and charges (including exit or transfer fees)

- your pension fund options

- your retirement options

Some pensions also offer special benefits or guarantees. Defined benefit pensions like these are a little more complicated to transfer, as outlined above. Again, you'll want to chat with an independent financial advisor before making a decision. Penfold cannot currently accept defined benefit pension transfers.

For more on what you should consider before transferring a pension, check out our article 'Should I combine my pensions?'

How to transfer into Penfold

At Penfold, we do all the hard work for you. We can transfer all your pensions completely free - no matter how many you have, how small they are, or what provider you’re with. We streamline the entire process to make transferring a doddle. It's entirely online, requires no paperwork, and should only take 5 minutes.

If you want to transfer existing pensions to Penfold, simply create an account and request a transfer today. We aren't currently able to accept defined benefit pension transfers.

It's important to compare providers’ fees & any guaranteed benefits when deciding on whether to transfer, and be sure that the investments available are suitable for you. We cannot accept defined benefit pension transfers.

If you decide to close your Penfold account and the value of your pot has gone down, the amount returned to the provider may be less than what you originally transferred.

Please know that if your employer is paying into your pension currently, transferring that pot may mean you lose out on their contribution.

With pensions your capital is at risk. It's important to compare providers’ fees & any guaranteed benefits when deciding on whether to transfer, and be sure that the investments available are suitable for you. We cannot accept defined benefit pension transfers.