Pension performance update: July 2022

- By

- Murray Humphrey

In July, investors finally started to see some green shoots of recovery in their pensions.

While inflation still continues to bite, particularly across energy and fuel prices - both UK and US investments have seen growth since our last update - the first time we’ve seen this in many months.

Let’s take a look at how the investments in your pension fared in July.

A look at the markets

Last month, the FTSE 250, an index combining the value of the top 250 valuable companies in the UK grew by 8.19% - up 10.09% from the month's low.

FTSE 250

Source: Google

The FTSE 250 is still down 15% since

the start of the year - highlighting once again how markets have struggled in 2022.

In the US, the S&P 500 (their broad market index) has also had a better month.

S&P 500

Source: Google

US markets are up 7.9% in July - although similarly still 13.9% down over 2022.

The road to recovery?

After months of decline and volatility, the investment markets have finally steaded and showed the first tentative signs of growth.

But is this the first step to recovery, or a brief respite in further declines?

Much of the recent economic news has been ‘priced in’ to the value of assets.

This means that the current value of shares and commodities already reflects events like the war in Ukraine and high inflation - as well future events like the widely-predicted energy price rises.

Many still consider the UK on the edge of a bear market - still fearing we could face a recession in the coming months.

It’s important to remember that high inflation has already led to the Bank of England raising interest rates (how much it costs to borrow money) with further hikes potentially on the horizon.

Generally speaking, one side-effect of rising interest rates is that growth-focussed businesses struggle to raise money to fund their activities - affecting the performance of the stock markets.

Bonds and gilts (loans to businesses and the government) also tend to perform worse in a high-interest environment.

What this means for your pension

In July, chances are you have seen a slight jump in the value of your pension.

This comes from your pension being invested across a mix of assets, including:

- Stocks and shares

- Company bonds

- Government bonds

- Commodities

Despite economic difficulties in the UK and across the globe, stock markets have seen a rally in the past few weeks, helping to increase the value of pension plans with a heavy stock and share makeup.

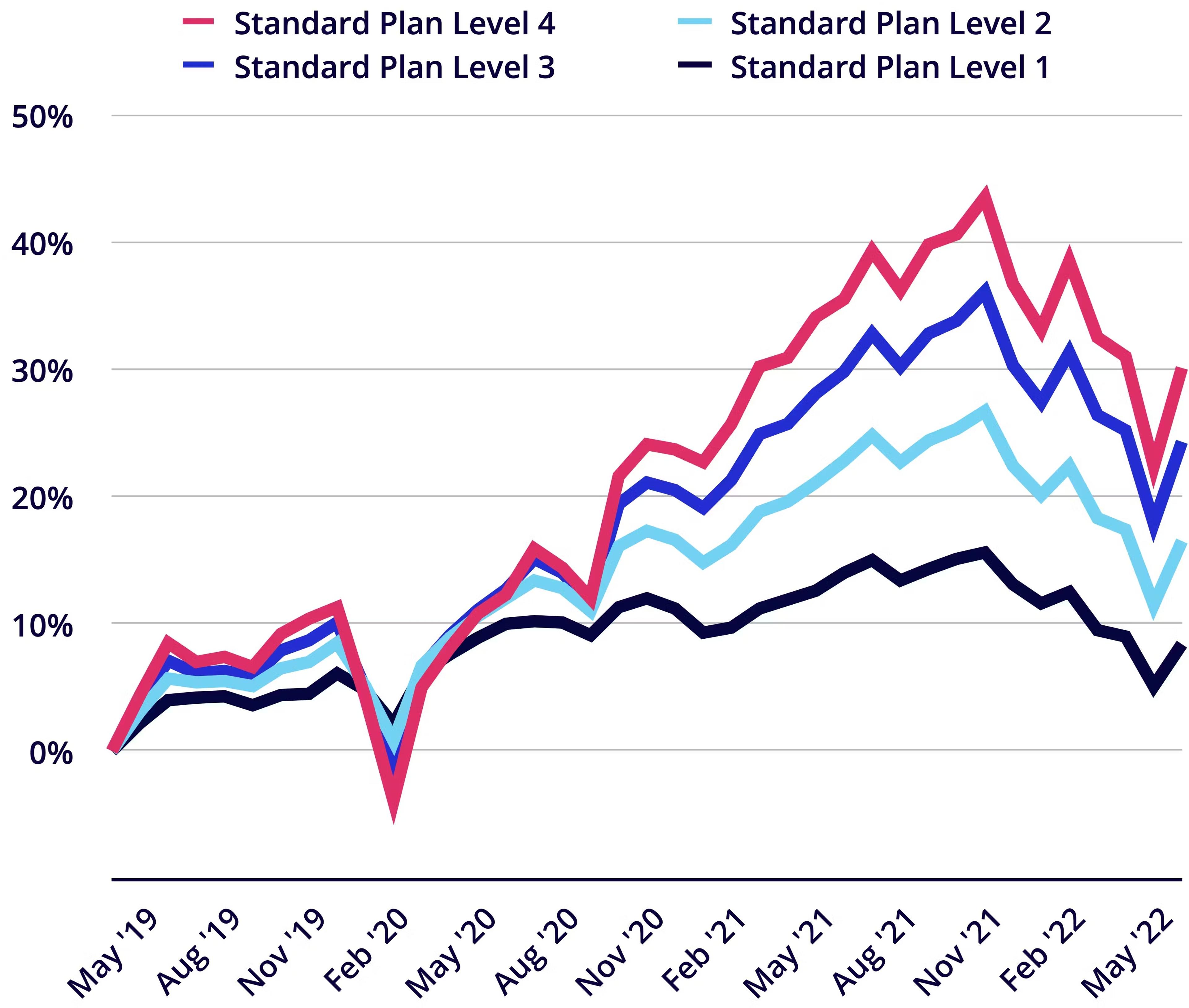

Here’s an overview of the value of our plans over the past few years.

Source: BlackRock

As you can see on the right side of the graph, all our plans bounced back in July from recent lows. Our Standard Level 4 plan saw the biggest rise, up 6.3% due to its larger allocation of stock and shares.

Conclusions

July finally saw some tentative growth for investors, with Penfold's pension plans up an average of 5% month on month.

However, with inflation still at record levels and the Bank of England predicting a recession - it's important to stay grounded with our outlook for the near future.

If you're worried about the value of your pension, check out our article on what to do if your pension value drops.

With investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.

Murray Humphrey

Penfold