The pension for the 21st century

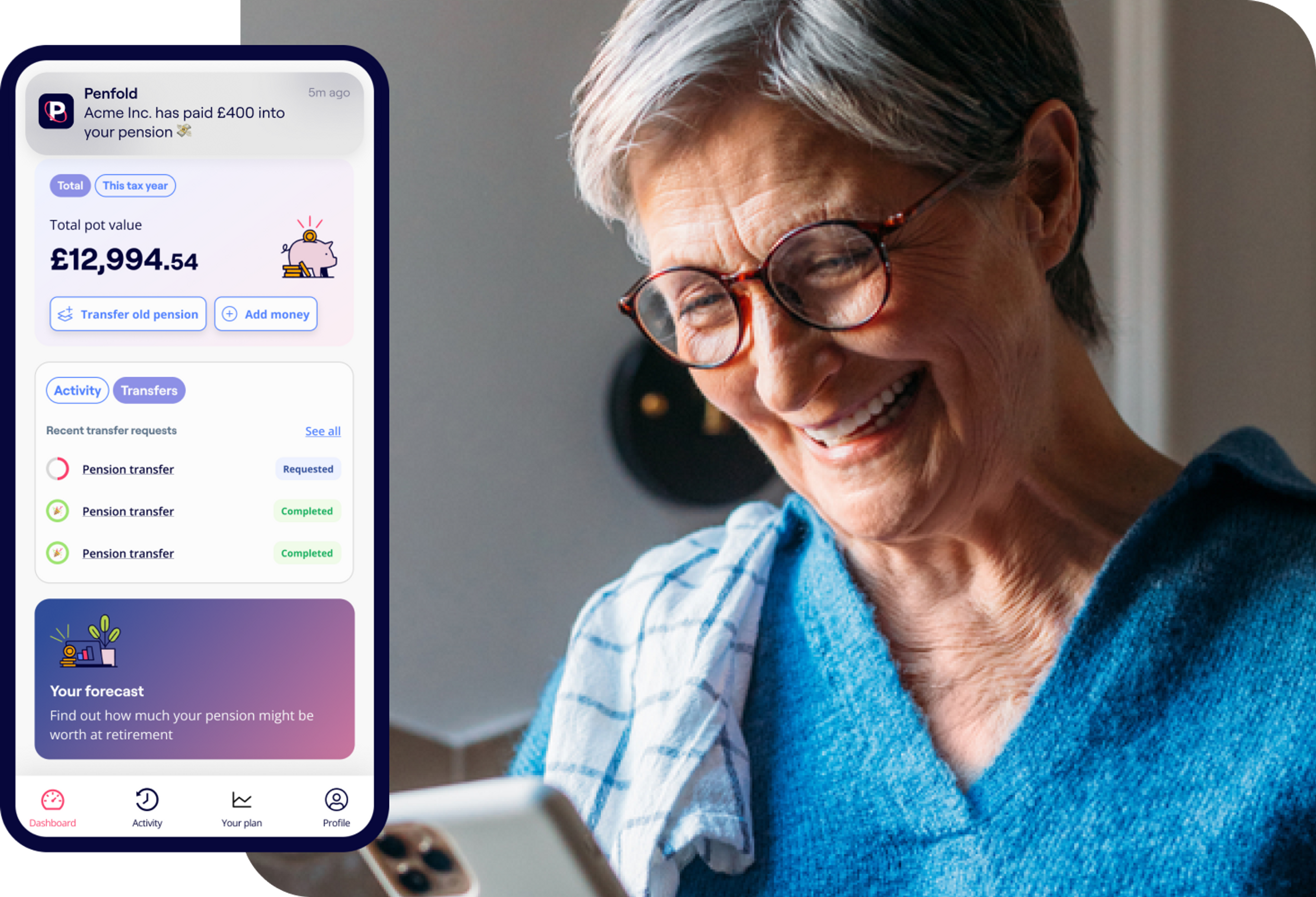

Welcome to a new kind of private pension. Set it up in minutes, top up or pause payments, and combine old pensions with a few quick taps. It's that simple. Leave the future to us, so you can get back to living today.

As with all investments, your capital is at risk.

Join thousands of happy pension savers

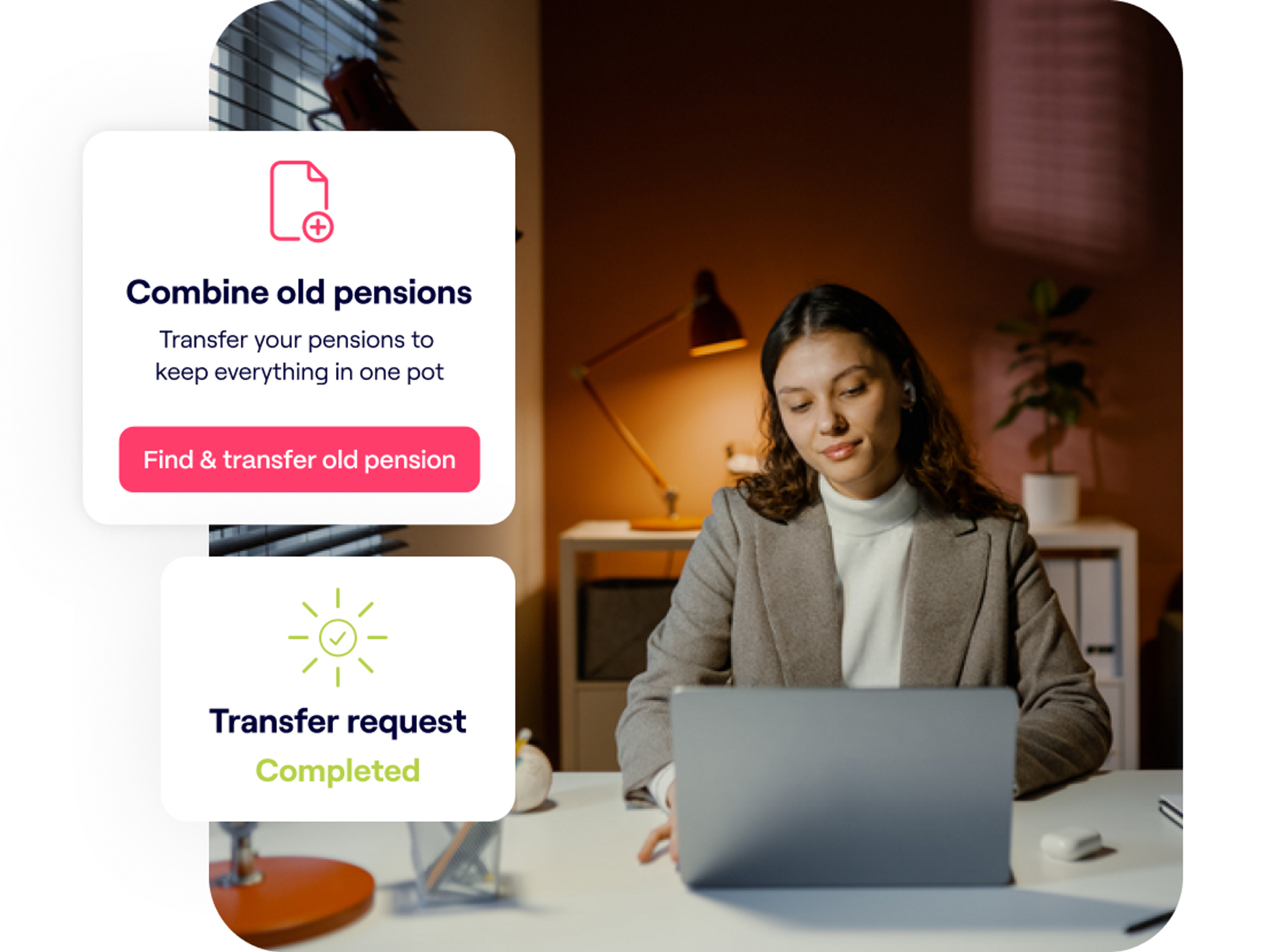

All your pensions in one place

Combining your pensions with Penfold is easy, free of charge, and our expert pension transfer team will take care of the process.

If you already have details of an old pension, you can start a Penfold pension with a transfer.

Alternatively, use our Find My Pension tool to track down the details of existing workplace pension pots. Simply enter the name of your old employer and we'll do the rest.

It’s important to compare providers’ fees and any guaranteed benefits when deciding on whether to transfer, and be sure that the investments available are suitable for you. If your employer is paying into your pension currently, transferring that pot may mean you lose out on their contribution.

Save your way

Life is full of twists and turns. Penfold's private pension adjusts to all of them.

Adjust, top-up, or pause your contributions any time – instantly online or with our app.

Private pension savers receive a 25% government tax bonus on pension contributions. We'll automatically claim this and add it to your account.*

*Subject to annual allowance. Tax treatment depends on individual circumstances and may change in the future.

Reach your retirement goals

Not sure how much you’ll need when you stop working? Forecast your future income and get on track with your retirement goals in three simple steps:

- See your future income: Real time reporting on what your pension will be worth when you retire.

- Set goals: Use in-app tools to see how you can achieve the lifestyle and spending power you’d like

- Get on track: Use our calculator and set yearly targets to reach your retirement goal

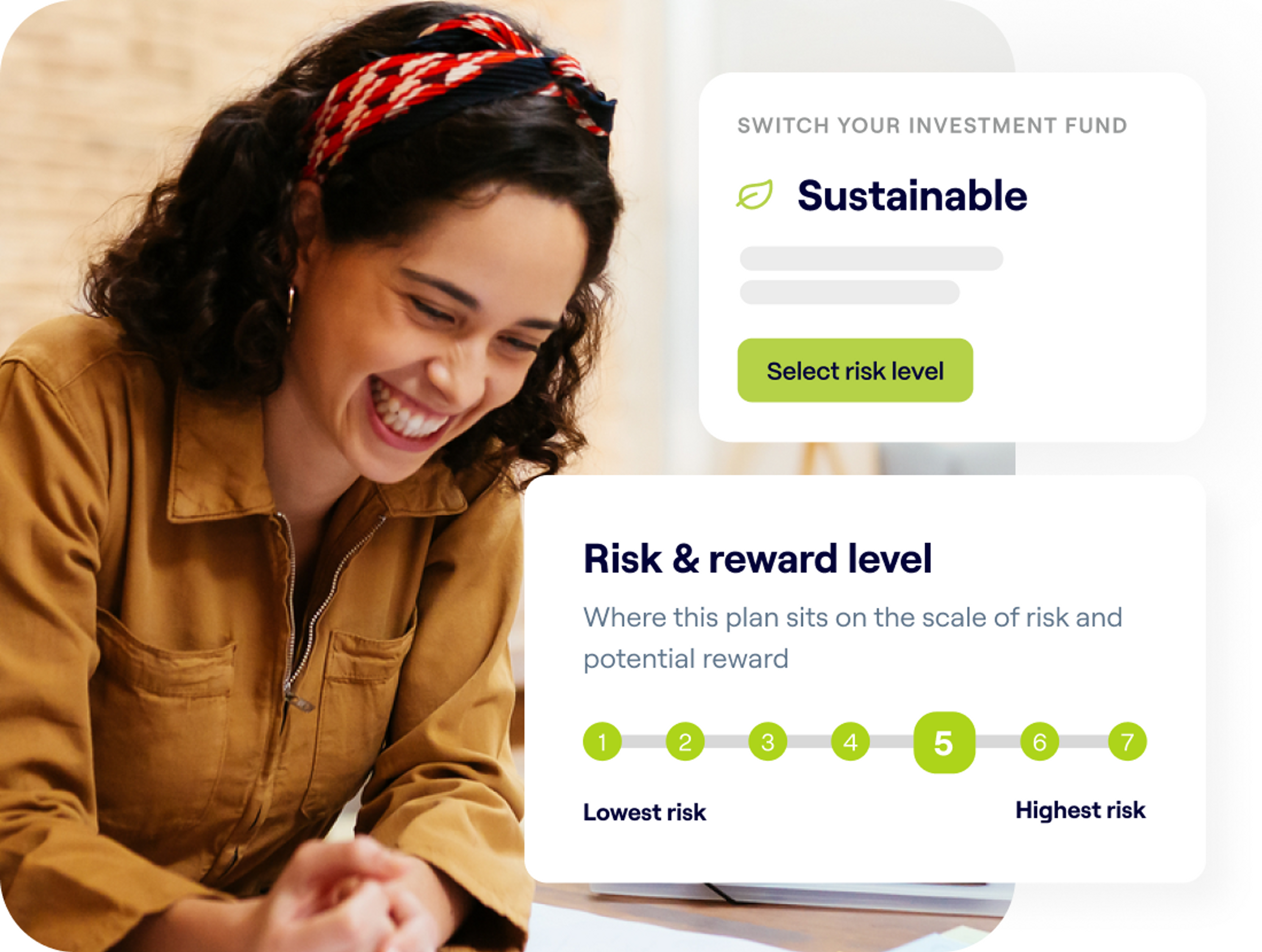

Hand-picked fund selection

Penfold is here to make things simple. We offer a selection of carefully selected plans, managed by leading money managers, that take the stress out of investing and make your pension as straightforward as possible.

Penfold Plan

Exclusive to Penfold, our default plan is 100% FSCS protected and custom built for high returns potential.

Sustainable

Make a positive impact on the world without sacrificing growth. Invests your money into companies with a high ESG rating.

Sharia

Invest your money only into Sharia-compliant companies. All investments are approved by an independent Sharia committee.

Standard

Complete control of your pension. Choose between four different risk levels - tailoring investments to fit your preferences and outlook.

With investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice and past performance is not a reliable indicator of future performance.

Grow your wealth

Enjoy an automatic 25% tax relief top-up every time you contribute to your private pension with Penfold.*

If you’re self-employed or a director of a limited company you can make tax-efficient contributions through your business bank account.

Our plans aim to balance risk control with good returns, at a cost-effective price. We also give full visibility into your pension with a live view of how your pension is performing.

*Subject to annual allowance. Tax treatment depends on individual circumstances and may change in the future.

Start your retirement the right way

Penfold makes withdrawing your pension simple. Access your money however you like – choose drawdown, an annuity or even taking a lump sum in one go.

Our service is completely flexible to your needs – tweak your monthly withdrawals as often as you like, for free. There are no minimum withdrawals or restrictions on how you spend your hard-earned savings.

Our expert team are on-hand to support and help you make the right decisions for retirement. We'll guide you through the entire process, step by step.

Personal savers

Combine old pensions or start saving in a few quick taps with our easy to use app and website. Leave the future to us, so you can get back to living today.

Self-employed savers

Built for anyone who works for themselves. Flexible contributions, automatic tax relief, a transfer service that does the paperwork for you and much more.

Directors and limited companies

Quick to set up and simple to use. Make tax-efficient contributions in line with company cash flow anytime, anywhere.

Sandeep's story

Private pension FAQs

This is the killer question! If you sign up for Penfold, we’ll help you figure this out by applying some helpful rules of thumb and making some assumptions about what sort of life you want to live when you’re a bit older.

Penfold is designed for maximum flexibility, so you can pause or stop your contributions at anytime, make one-off top-ups, or set up regular payments – whatever you like. There is no minimum deposit when you set up your pension, and you can pay nothing each month if you like. If you do make a contribution, the minimum amount we can process is £10.

Yes. We can help you track down and consolidate all your old pension pots. Just click the 'Find and transfer old pensions' card on your dashboard when your account is set up, provide what information you can, and we'll get started. We'll keep you informed every step of the way.

We hate hidden fees and you probably do too. We'll only charge you one fair, transparent annual fee for managing your pension that covers absolutely everything within Penfold’s pension service.

You'll pay an annual fee between 0.75% and 0.88%, depending on the plan you choose. We'll automatically deduct a portion of your annual fee from your pension in 12 monthly instalments.

If your pension pot size is larger than £100,000 the fee is reduced to either 0.4% or 0.53%, depending on the plan you choose, on the portion of your savings over this amount.

Our platform is based on giving you pension peace of mind. We believe you should know your savings are being looked after, no matter what the future holds.

At Penfold we don’t hold or manage your money. Anything you pay into your pension with us first goes into a secure account held by a custodian bank. It’s held here for usually just one business day before being used to buy into your investment plan, managed by some of the world’s largest money managers.

Here’s an important thing to remember: Your savings are your savings. All of your pension is kept separate from us and belongs entirely to you. This means if anything were to happen to Penfold, your money can’t be touched by us or any of our partners. Your pot will be transferred to another pension provider, ready for your retirement.

With Penfold, the money you pay into your pension is invested. Your savings are used to buy a mixture of shares (part ownership in a company) and bonds (a loan with a guaranteed fixed interest rate) that will hopefully help your pot grow over time.

As with any investment, this involves risk. The value of your pension can go up as well as down, and you could get back less than you put in. However, greater risk can lead to greater returns. If you have a long time before retirement, investing over the long-term can help ease any short-term losses.

We have appointed BlackRock and HSBC as your money managers, two of the biggest names in investment management.

The day-to-day management of your investments is done by these money managers who, although appointed by us, act independently of us, to try and ensure that your investments perform well.

Penfold is a registered pension administrator, authorised and regulated by the Financial Conduct Authority (FCA), number 826097.

Penfold is also a part of the Financial Services Compensation Scheme (FSCS). In the very unlikely event that something were to happen to Penfold or our partners (BlackRock and Lloyds bank), the value of your pension is protected up to a maximum of £85,000 per individual.

As a digital pension provider, we understand that many people want to know how their personal information is kept safe. To safeguard your data, we use the latest security technology and maintain strict internal practices every step of the way.

We also comply with General Data Protection Regulation (GDPR) guidelines. We'll never share your information with anyone else without asking you first.