5 minutes

Pension and Financial Markets Performance Update: Q1 2025

Your update on the global stock market and a look into how Penfold funds have performed in the first quarter of 2025.

After a strong finish to 2024, global markets began 2025 on rockier footing. Equities dipped, bonds rebounded, and geopolitical tensions took centre stage. But through the noise, Penfold customers can stay confident: your pension plan is built for resilience.

In this update, we’ll break down what happened in Q1, how it affected Penfold’s investment plans, and why staying focused on the long term remains the smartest move.

First, What’s Happening Right Now?

Before we look back at the first quarter of the year, it’s worth acknowledging the big story that’s been driving headlines, and investor nerves, throughout April.

In a swift escalation of trade tensions, the U.S. government announced sweeping new tariffs on imports from over 60 countries. Markets didn’t take it well. The S&P 500 dropped 10% in just two days, one of the sharpest declines since the pandemic. Although many of the tariffs were paused just days later (with China being the notable exception), trade tensions are still high - and average U.S. tariff levels remain at multi-decade highs.

This isn’t just political drama – it’s affecting inflation, economic growth forecasts, and financial markets around the world. In response, BlackRock (who manage the MyMap funds behind the Penfold, Standard and Sustainable plans) have made some cautious but important changes:

- They’ve shifted investment focus to a slightly longer timeframe.

- They’ve increased investments in U.S. and Japanese equities, where they see long-term opportunities.

- They’ve maintained their investment in gold, which continues to offer protection against volatility during periods of uncertainty.

- And they remain cautious on long-term U.S. government bonds, which are more sensitive to rising debt and inflation.

The key message? Markets might stay unpredictable for a while. But by adjusting how and where your pension is invested, the BlackRock team is actively managing those risks without losing sight of the bigger picture.

Q1 2025 Market Recap: A Quarter of Contrasts

After a strong finish to 2024, markets started 2025 on shakier ground. Shares (equities) fell across most regions, driven by concerns about inflation, slowing growth, and rising trade tensions – especially between the U.S. and China.

Here’s what stood out:

- U.S. tech stocks saw sharp losses after the unexpected launch of DeepSeek’s new AI model.

- European markets held up better, helped by Germany’s €1 trillion infrastructure and defence package.

- Emerging markets were mixed – Latin America and Eastern Europe fared well, but Asia lagged.

- Bonds rallied as expectations grew for further interest rate cuts.

- Higher-yielding debt performed strongly, helped by resilient emerging market currencies.

- Gold surged nearly 19%, providing a safe haven during uncertainty.

- Property investments outperformed global equities, softening the blow for many portfolios.

While markets dropped, Penfold plans didn’t fall as sharply as broader equity markets. For example, the S&P 500 saw a drop of 4.6% during the quarter, while the Penfold Standard Plan Risk Level 4 saw a smaller drop of 3.9%. It’s a strong example of how diversification can help cushion against short-term shocks.

How Penfold’s Fund Managers Responded

To help protect and grow your pension during a volatile quarter BlackRock, the investment managers of our Penfold, Standard and Sustainable plans, took action:

- Broadened U.S. share exposure, so performance didn’t hinge too heavily on a few big tech names.

- Added more UK shares, which looked better value and more stable.

- Increased bond holdings in lower-risk plans, swapping out cash to take advantage of possible interest rate cuts.

- Kept investments in gold and listed property – both of which helped returns.

- Took steps to protect against currency swings, so changes in the value of the U.S. dollar had less impact on returns.

This active, hands-on approach helped limit losses – and in some cases, even delivered modest gains in our least risky plans.

Spotlight on the Sharia Plan

The Sharia Plan invests in a fund managed by HSBC that follows Islamic principles. It avoids companies involved in industries like alcohol, gambling, or conventional finance, and is made up entirely of shares (equities).

Because it’s 100% invested in shares, this plan is more exposed to short-term market swings. Like other equity funds, it was affected by falling tech stocks in early 2025 – but it also benefited from strong performers in other regions and sectors, such as Europe and China, and companies like NVIDIA and Alibaba.

In April, markets were shaken by new U.S. tariffs. The Sharia Plan felt some of that impact too, but its global diversification helped limit the effect. HSBC continues to look for opportunities that match both performance goals and Sharia values.

Penfold Plan Performance: Q1 2025

Here’s a look at how Penfold’s plans performed over the first three months of the year. These long-term, globally diversified plans are designed to handle bumps like these.

Penfold Plan

- Growth: +0.9%

- Balance: +2.2%

- Protect: +3.4%

Standard Plan

- Risk Level 1: +0.4%

- Risk Level 2: -1.5%

- Risk Level 3: -2.7%

- Risk Level 4: -3.9%

Sustainable Plan

- Risk Level 1: -0.1%

- Risk Level 3: -3.6%

- Risk Level 5: -5.2%

Sharia Plan (Managed by HSBC):

- Risk Level 5: -10.0%

Past performance isn’t a guarantee of future returns. But it’s a reminder of why staying invested, and staying diversified, can help weather short-term storms.

Penfold fund performance vs. benchmarks

When evaluating how well a fund is performing, it can be useful to compare it against a benchmark – an industry standard or reference point. For instance, if your fund achieves a return of 8% and the benchmark return is 6%, it’s outperforming by 2%.

The following chart shows how Penfold’s fund performance compares to a benchmark of CPI inflation + performance percentage in the period 1 January 2025 to 31 March 2025:

Why Long-Term Investing Works

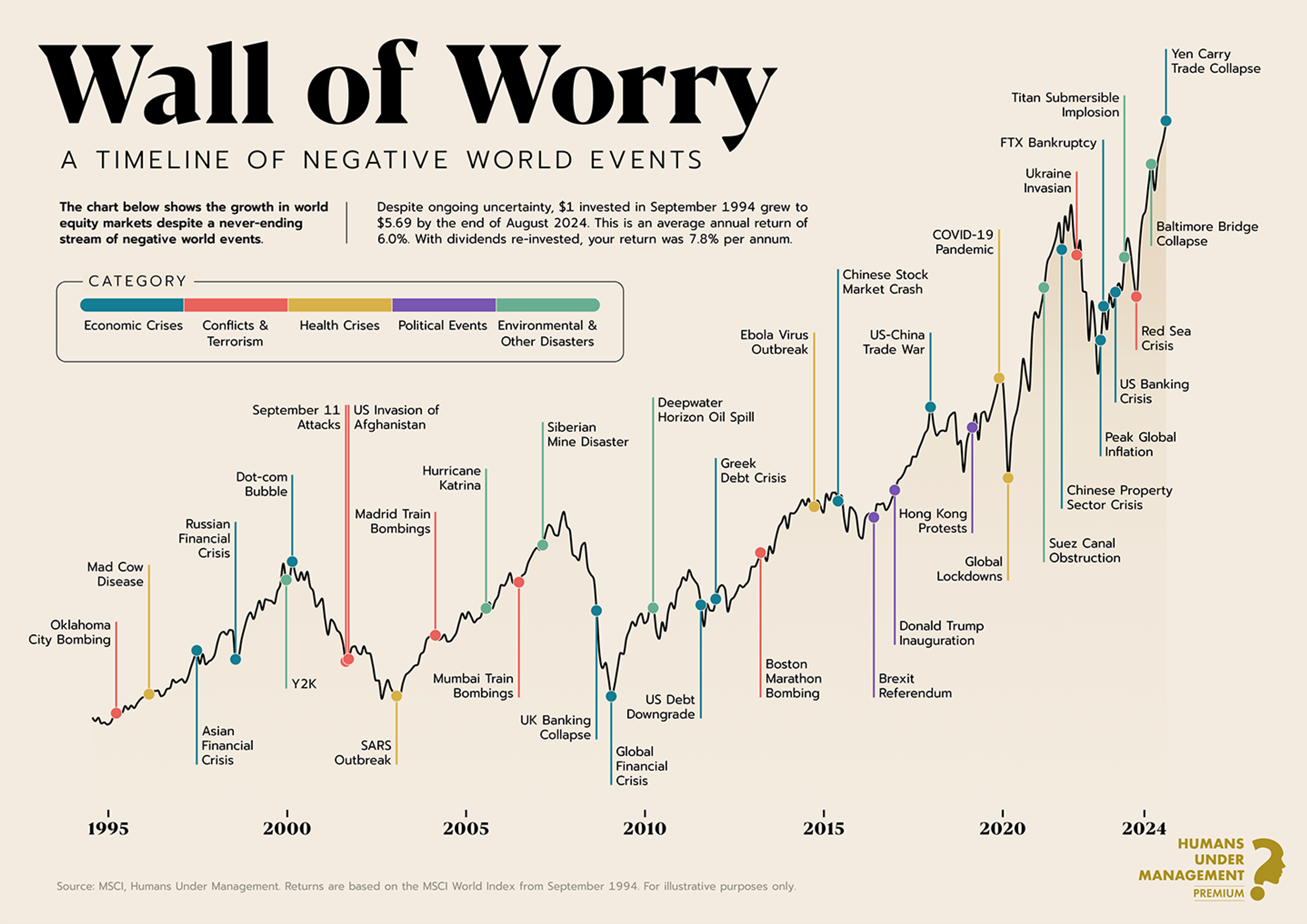

With all the headlines and market moves, it’s easy to focus on the short term. But history tells a more hopeful story.

Markets have been through recessions, pandemics, wars, and more. Each time, it felt like everything was changing forever. And each time, markets recovered.

- After the 2008 financial crash? Recovered.

- After COVID shut down the global economy? Recovered.

- After the dot-com bubble, 9/11, Brexit? Recovered.

One of our favourite charts (you’ll see it just below) shows this in action. It tracks the global stock market through decades of uncertainty – from oil shocks and inflation to geopolitical crises. Despite the drama, the long-term trend is clear: growth.

If you’d invested $1 in world equity markets in September 1994 and stayed the course, it would’ve grown to nearly $6 by August 2024 – even with all the ups and downs. This is an average annual return of 6.0%, with dividends re-invested, your return was 7.8% per annum.

The lesson? It’s not about picking the perfect time to invest. It’s about staying invested. Long-term investors who stay calm through the noise are often the ones who come out ahead.

What You Should Do

Markets rise and fall. That’s the nature of investing. But pensions are built for the long haul. Here’s what we recommend:

- Stay calm. Short-term drops are part of the journey.

- Stay invested. Timing the market rarely works. Sticking with it usually does.

- Stay informed. The Penfold app puts everything you need at your fingertips.

Final Thought: The Value of Resilience

The first quarter of 2025 was a reminder that financial markets aren’t always smooth sailing - but Penfold’s pension plans are designed with resilience in mind. With world-class fund managers making smart decisions in the background, your pension is in experienced hands – focused on steady, long-term growth, not short-term noise.