5 minutes

Pension and Financial Markets Performance Update: Q4 2024

Your update on the global stock market and a look into how Penfold funds have performed in the last quarter of 2024.

As we say goodbye to 2024, it’s a great time to reflect on how the financial markets performed over the past year and what that means for pensions and investments. From headline-grabbing gains to unexpected challenges, this year has shown us the importance of staying focused on the bigger picture when it comes to saving for the future.

Remember: while tracking global stock market trends can be fascinating, staying aligned with your long-term goals is what truly matters. Short-term fluctuations are part and parcel of investing, and reacting impulsively to market movements can often do more harm than good. If you’d like to explore this further, check out our Understanding the Ups and Downs of Your Pension Pot article.

That being said, let’s dive into how stock markets in the US, Europe, and the UK performed in the final quarter of 2024—and take a closer look at how Penfold’s funds fared during this period.

The US: A Year of Growth Amid a Softer Finish

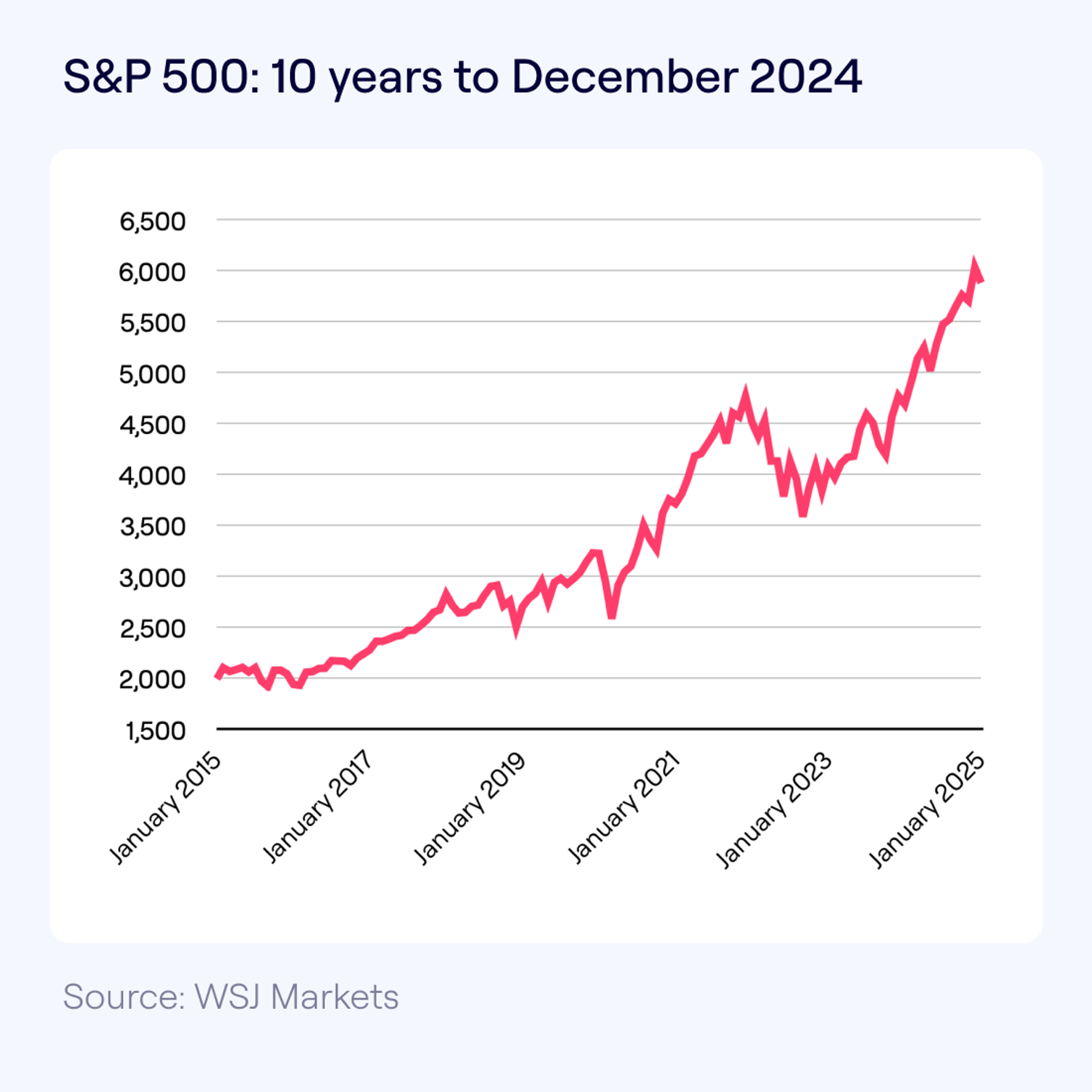

After an impressive 5.24% return in Q3 2024, the S&P 500 posted a more modest 1.9% gain in the final quarter of the year. This small dip didn’t stop the US index from delivering a stellar 23% annual return—its second consecutive year of 20%-plus growth. The last time this happened? 1997!

Key drivers of US market performance:

- AI Boom: Companies like Palantir (+340%) and Nvidia (+130%) benefited from surging interest in artificial intelligence.

- Lower Interest Rates: The Federal Reserve cut rates twice during Q4, reducing borrowing costs and boosting investor confidence.

- Tesla’s Resurgence: A late-year rally saw Tesla’s share price jump 70%, buoyed by optimism around Elon Musk’s ties to the incoming US administration.

Investors are entering 2025 with high hopes, eager to see if the momentum continues.

Why do lower interest rates matter?

Lower interest rates allow companies to borrow money at cheaper rates, which they can then use to potentially expand their operations, increase profits and boost their share price.

As well as making borrowing cheaper, savings accounts also become less attractive and so many investors move their money into higher returning assets, such as stocks, which pushes up share prices.

The UK: Modest Gains but Big Individual Wins

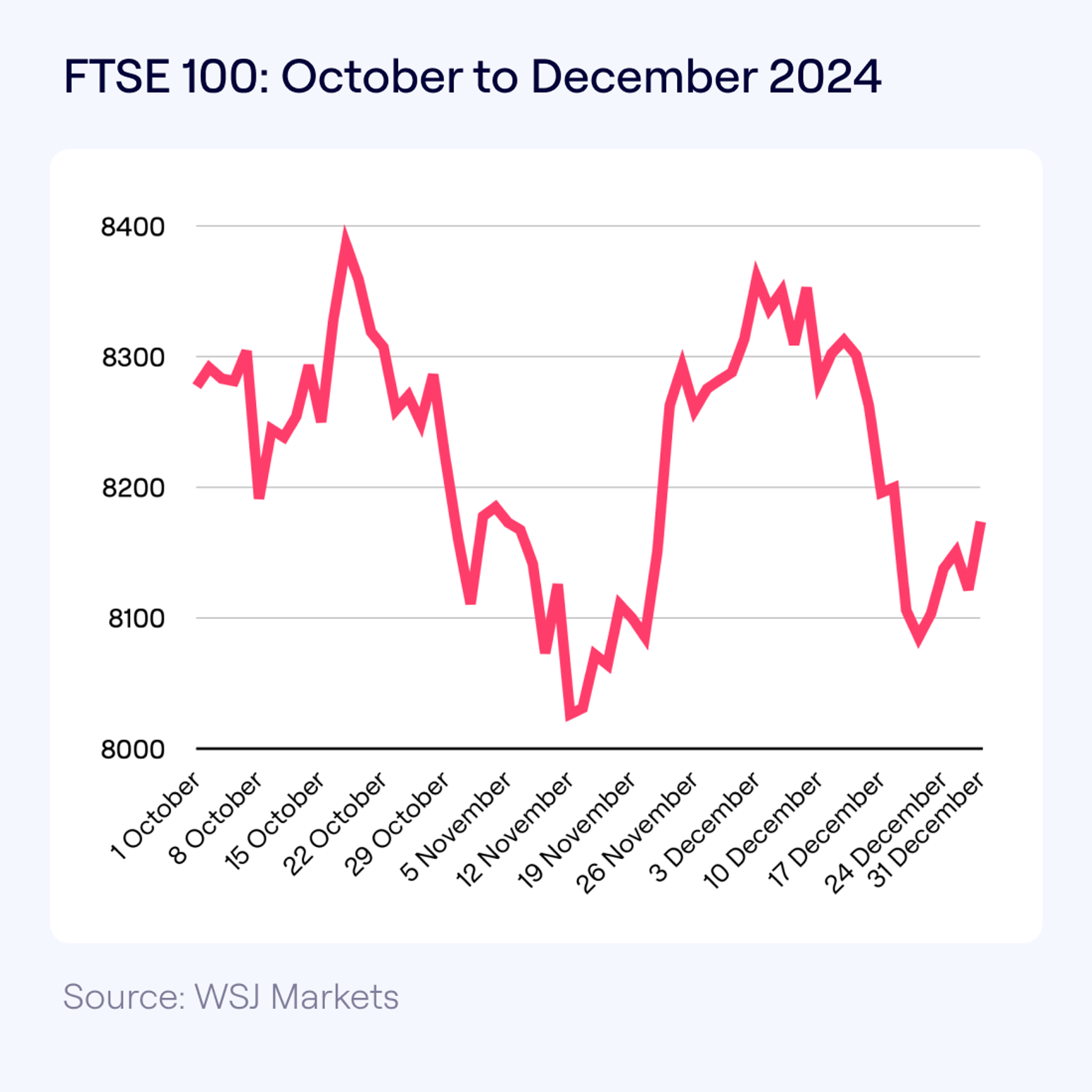

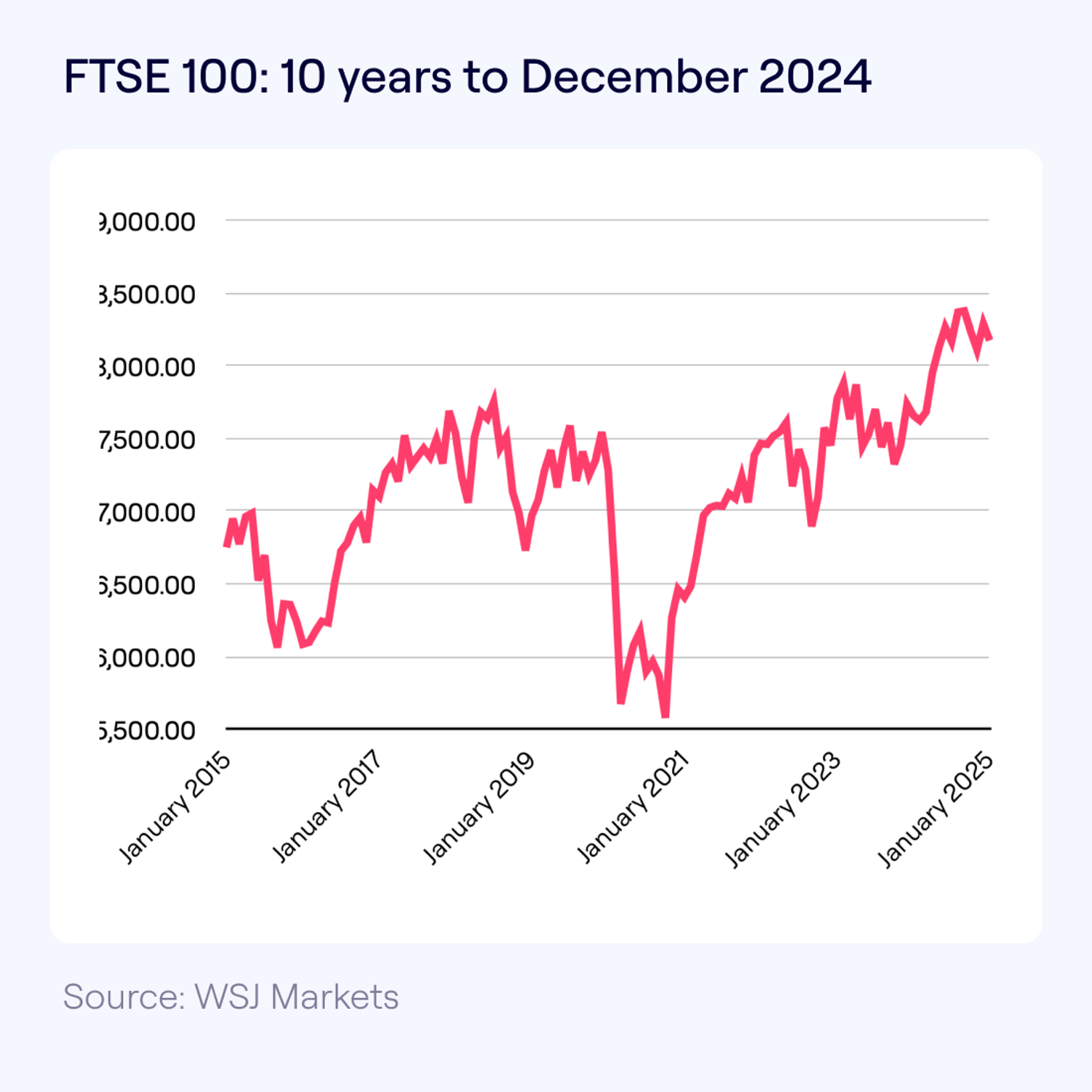

Closer to home, the UK’s FTSE 100, which tracks the performance of the UK’s top 100 companies, rose 5.8% in 2024 – modest compared to the US but bolstered by some standout performers.

Notable stock performances in 2024:

- Rolls Royce (+93%): Increased global tensions drove up defense spending, benefiting this aerospace giant, on top of a 222% increase in 2023.

- IAG (+93%): Parent company of British Airways, IAG, soared as international travel demand continues to surge post-pandemic.

Not to be left out, the Bank of England also cut interest rates to 4.75% in the final quarter of last year, which should help lift stock prices, boosting stock prices and setting the stage for further cuts in 2025.

Europe: Some Bright Spots

The pan-European Stoxx 600 gained 5.9% in 2024, with a few standouts that stole the limelight:

- Siemens Energy (+320%): Rebounded after a €15b German government-backed rescue in November 2023.

- UCB (+140%): Driven by a promising drug pipeline.

- Kongsberg Gruppen (+180%): Benefiting from defense and maritime sector growth.

However, not every story was a success. Novo Nordisk, known for its obesity drug Wegovy, faced a plummet of 20% on one day in December after a late-stage trial for its experimental CagriSema weight loss drug missed expectations.

How Did Penfold Plans Perform in Q4 2024?

At Penfold, we have five types of plan, including Standard, Sustainable and Sharia. Our funds are built on strategically diversified portfolios designed to decrease risk exposure, limit potential losses and improve overall investment performance – and they all made gains during the fourth quarter.

As with any investment, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice and past performance is not a reliable indicator of future performance.

Let’s take a look at how our plans performed over this quarter.

- Standard, risk level 1: -0.2%

- Standard, risk level 2: +1.3%

- Standard, risk level 3: +2.1%

- Standard, risk level 4: +3.4%

Our Sustainable plans, which prioritise green and ethical options:

- Sustainable, risk level 1: -0.2%

- Sustainable, risk level 3: +2.2%

- Sustainable, risk level 5: +3.4%

Our Sharia plan, which invests in companies that comply with Islamic finance principles:

- Sharia: +8.4%

Penfold fund performance vs. benchmarks

When evaluating how well a fund is performing, it can be useful to compare it against a benchmark – an industry standard or reference point. For instance, if your fund achieves a return of 8% and the benchmark return is 6%, it’s outperforming by 2%.

The following chart shows how Penfold’s fund performance compares to a benchmark of CPI inflation + performance percentage in the period 1 October 2024 to 31 December 2024:

Stay Calm. Stay Invested. Stay Informed.

Investing in a pension is a marathon, not a sprint. Markets fluctuate, but your long-term goals remain constant. If you’re feeling unsure or curious about your pension’s performance, here are some steps you can take:

- Stay Calm: Market fluctuations are normal. Avoid making rash decisions.

- Stick to Your Plan: Short-term distractions shouldn’t derail your long-term goals.

- Track Your Progress: Use the Penfold app to keep an eye on your pension’s performance whenever you like.

Want to learn more about managing market volatility? Visit Moneyhelper, the government’s free financial advice service.

Looking Ahead

As we enter 2025, the financial landscape will undoubtedly continue to evolve. Whether interest rates rise, markets shift, or global events unfold, the key is to stay focused on the destination as much as the journey. At Penfold, we’re here to help you save for a brighter, more secure future.

Stay tuned for the latest updates on pensions, investments, and financial markets.