4 minutes

2025 National Insurance Increase: How Salary Sacrifice Helps

Employer NI is going up. Your costs don’t have to. Discover how a government-backed strategy could help your business save thousands.

💡 Looking to cut National Insurance costs?

Penfold offers free salary sacrifice setup and support to help you save money and support your team.

Talk to our team or Get started free

Announced during the 2024 Autumn Budget, big changes are coming to employer National Insurance (NI) from April 2025 that will mean significantly higher payroll costs for many businesses.

But there’s good news: salary sacrifice pensions can help businesses soften the blow while helping employees grow their pension savings. Here’s why now is the time to consider salary sacrifice – and how Penfold can help.

What’s Changing in 2025?

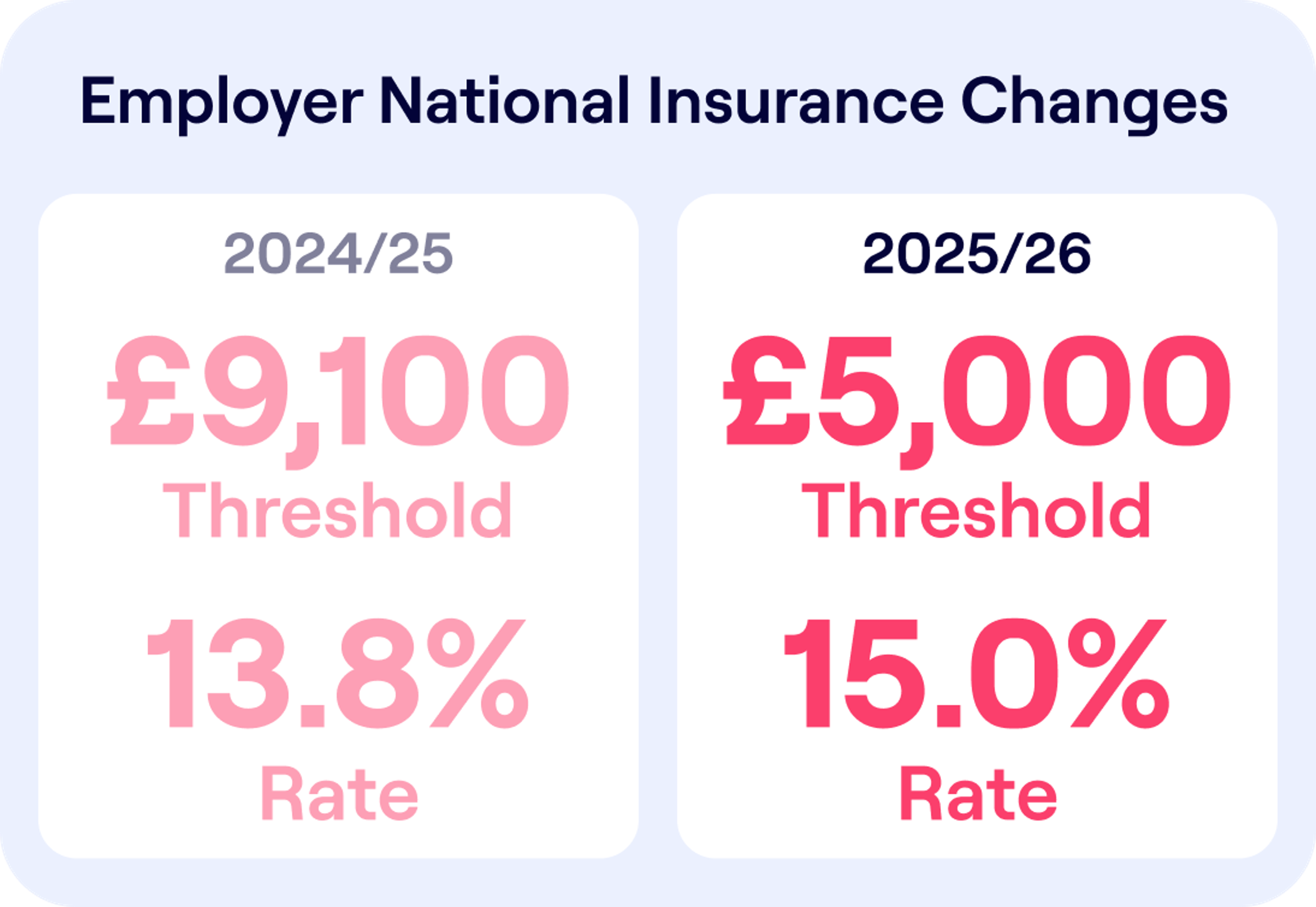

Let’s start with the facts – straight from HM Treasury. From 6 April 2025, businesses across the UK will face two major changes to employer National Insurance contributions, as outlined in the 2024 Autumn Statement:

- The Secondary Threshold – the earnings level at which you start paying employer NI – will drop from £9,100 to £5,000.

- The employer NI rate will increase from 13.8% to 15%.

These reforms are part of the government’s effort to raise an additional £25 billion a year to support public services and reduce debt. But for employers, they mean a steep rise in payroll costs – especially for businesses with larger teams.

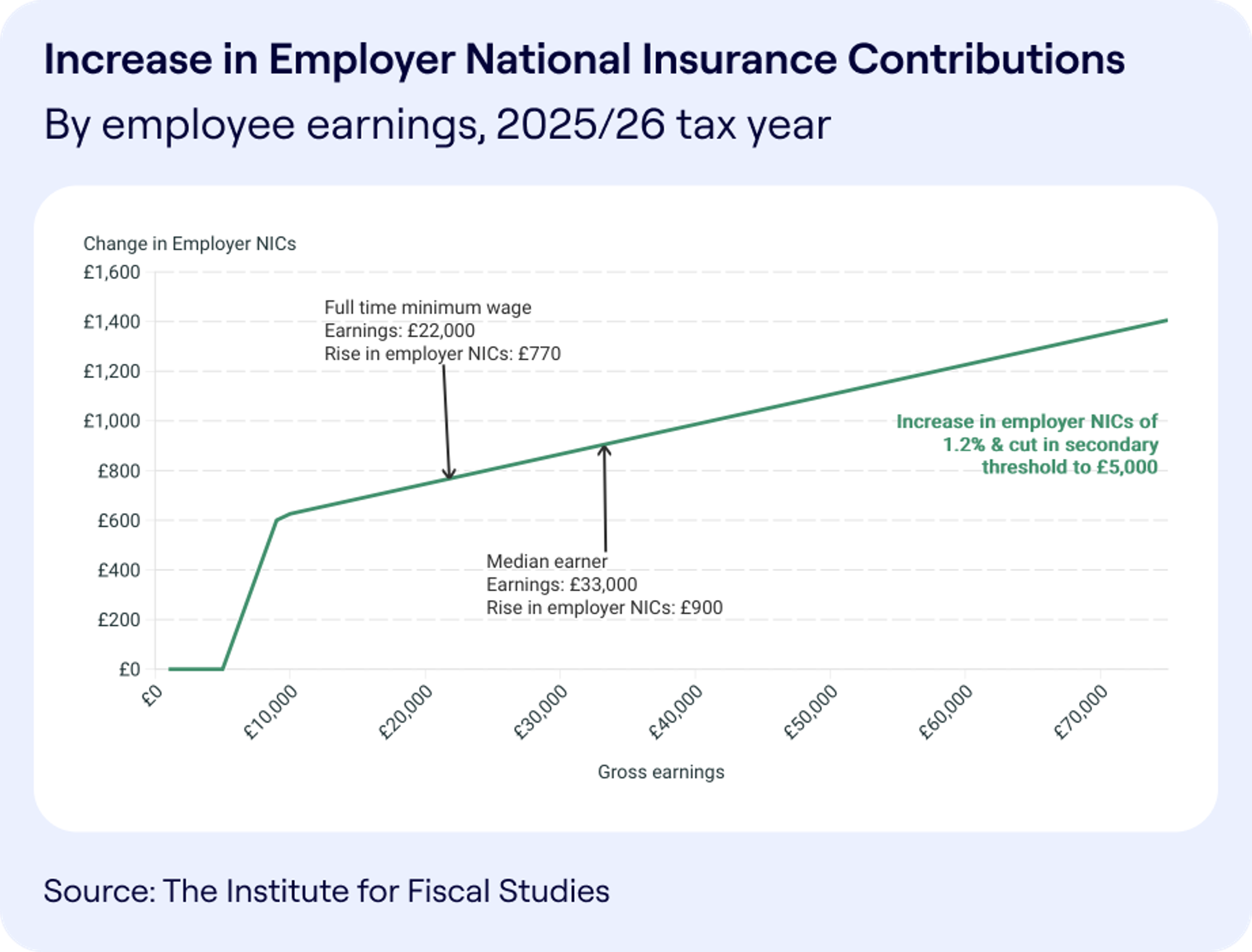

Estimated Impact per Employee

For many businesses, these new NI requirements represent a big increase in costs:

- £770 extra per year for a full-time minimum wage worker

- £900 extra per year for someone on median UK earnings (~£33,000)

What It Means for Your Bottom Line

In short: you’ll be paying more NI on more of each employee’s salary – and at a higher rate. The cost impact could be thousands of pounds a year.

To help cushion this, the Employment Allowance will increase from £5,000 to £10,500 in April 2025, which will benefit some small businesses. But if your total Class 1 NI liabilities exceed £100,000 annually, this allowance doesn’t apply – so larger employers will still feel the full force of the hike.

This is where salary sacrifice comes in.

Salary Sacrifice: A Simple, Powerful Way to Save

Salary sacrifice (also called salary exchange) allows employees to give up part of their gross salary in exchange for a non-cash benefit – like pension contributions.

Here’s why it’s a game-changer under the new rules:

- Sacrificed salary is exempt from employer and employee NI

- You pay less NI as an employer

- Employees save on tax and NI, while their pension grows

It’s a rare win-win that’s both financially efficient and HMRC-approved.

With the upcoming NI increase, salary sacrifice provides a timely solution for businesses to manage increased NI costs while offering employees a tax-efficient way to grow their pensions.

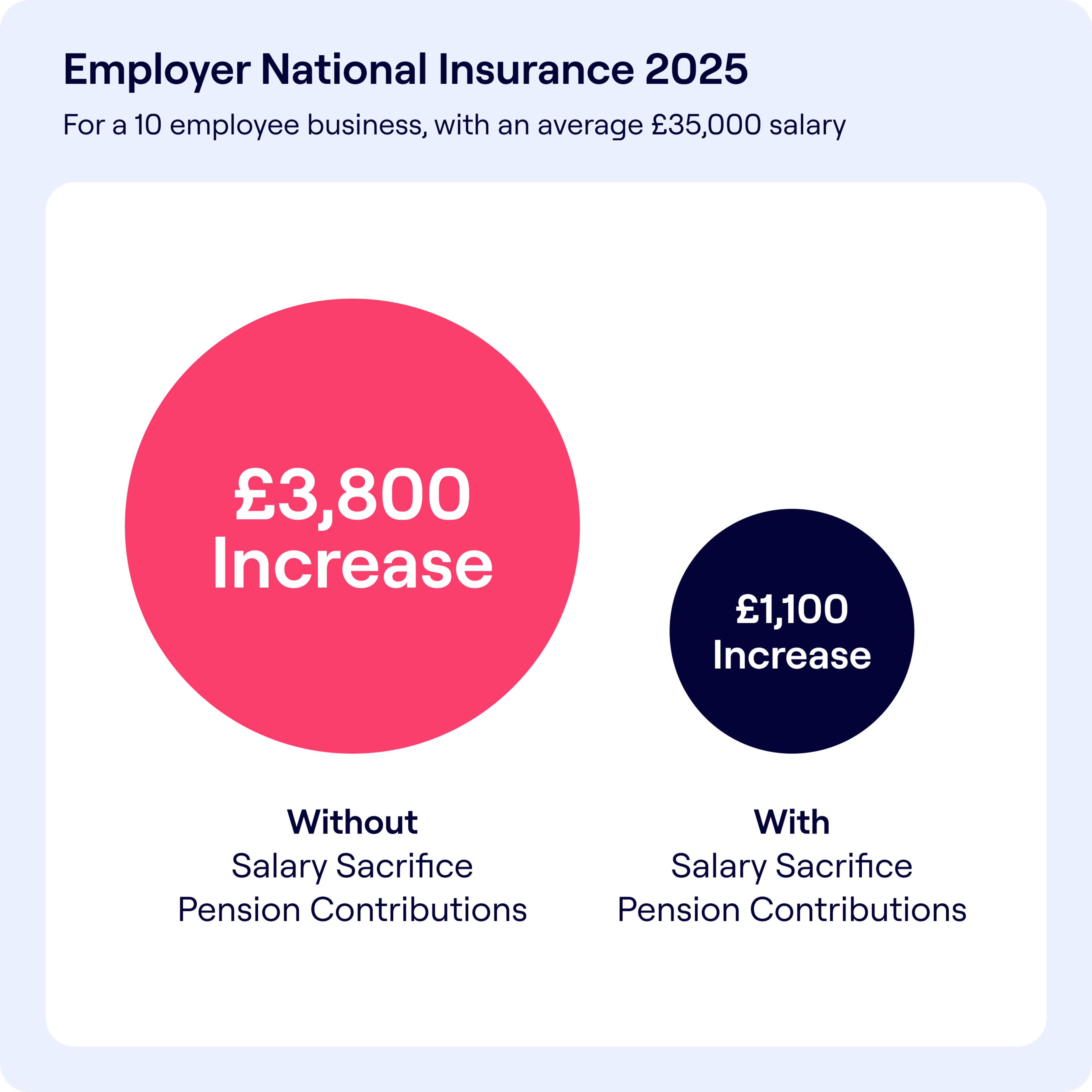

The Numbers Speak for Themselves

Let’s say you’ve got 10 employees, each earning £35,000.

- Without Salary Sacrifice: £3,800 extra NI to pay

- With Salary Sacrifice: £1,100 extra NI to pay

That’s £2,700 saved. Every year. And that’s just one example. These savings scale with your workforce – and they only grow more valuable as NI rates rise.

Real Results

Don’t just take our word for it. One of our customers, Capital on Tap, implemented salary sacrifice with Penfold and saved over £135,000 a year in employer National Insurance contributions.

“With the rise in employer National Insurance contributions, salary sacrifice has been a game-changer for us. By implementing it early with Penfold, we’ve been able to significantly reduce our payroll costs while continuing to invest in our people with their pension.”

— Fay Sumner, Head of People, Capital on Tap

Your Employees Benefit Too

Salary sacrifice doesn’t just help your business. It also helps your team:

- Reduces their taxable salary = less income tax and NI

- Helps them stay under tax thresholds

- Boosts pension contributions with no extra cost to them

It’s a tangible financial wellbeing perk, at zero cost to your employees – and minimal admin for you.

Why Acting Now Makes Sense

With the changes coming into force in April 2025, the best time to act is now. Switching to a salary sacrifice scheme means:

- Your business can start saving money

- You’ve got time to communicate clearly with your team

- You’re ready when the new rules kick in – no last-minute stress

Penfold Makes It Easy

At Penfold, we help modern businesses turn pension saving into a strategic advantage. Our modern platform makes switching to salary sacrifice effortless:

- Fully HMRC-compliant setup

- Integrated with your payroll software

- Simple onboarding and employee education

- Ongoing support and reporting

We’re already helping hundreds of employers cut costs and boost pension engagement. Yours could be next.

Beat the 2025 NI Hike

Whether you’re switching from a traditional provider or just starting out, Penfold makes setting up a salary sacrifice workplace pension painless and powerful.