Success story

Capital on Tap: Saving £135,248 on National Insurance

By implementing salary sacrifice pension contributions early, Capital on Tap has achieved an estimated annual saving of £135,248 in employer National Insurance contributions.

“With the rise in employer National Insurance contributions, salary sacrifice has been a game-changer for us. By implementing it early with Penfold, we’ve been able to significantly reduce our payroll costs while continuing to invest in our people with their pension.”

- Fay Sumner, Head of People at Capital on Tap

Inspired by Capital on Tap’s journey with Penfold? Request more information now!

Championing Financial Wellbeing with Salary Sacrifice

Capital on Tap is dedicated to making life easier for small business owners by providing flexible and affordable funding solutions. With a mission to simplify financial management, they offer business credit cards with generous limits and seamless access to funding. But their commitment to financial wellbeing doesn’t stop at their customers – it extends to their employees too.

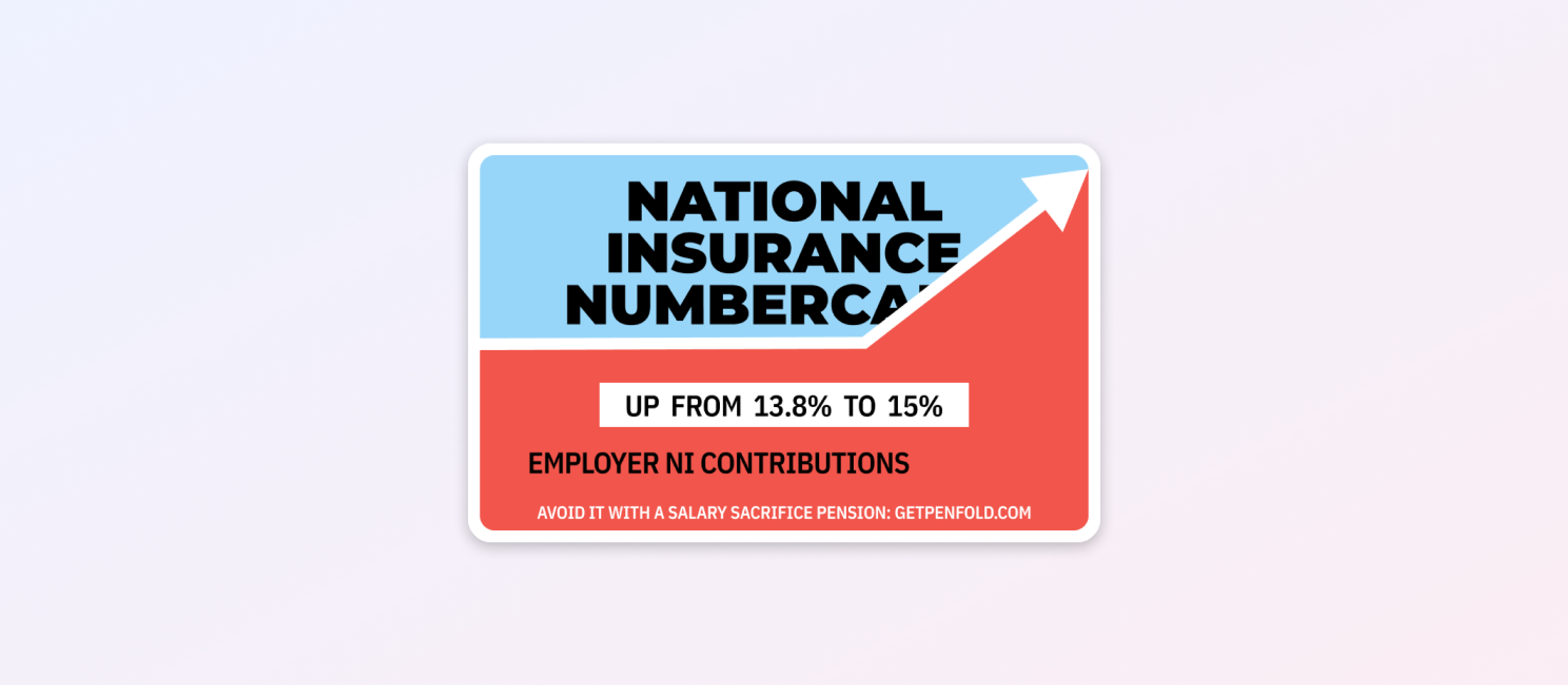

Recognising the long-term benefits of salary sacrifice early on, Capital on Tap proactively implemented this approach well before the April 2025 changes to employer National Insurance (NI) were announced. By doing so, they positioned themselves ahead of the curve, ensuring their business and employees could reap the rewards of tax-efficient pension contributions. Now, with the 2025 NI increase set to impact businesses across the UK, their proactive decision means they are well-prepared to absorb the changes with minimal disruption.

The Challenge

Before the 2025 NI increase was announced, Capital on Tap recognised the opportunity to enhance their employee benefits while also reducing payroll costs. Their existing pension provider wasn’t effectively engaging their workforce, and employees found the process confusing and impersonal.

By implementing salary sacrifice early, Capital on Tap was able to streamline their pension contributions, improving both employee participation and payroll efficiency. When the 2024 Autumn Budget later introduced a rise in employer NI contributions, raising the NI rate from 13.8% to 15% and lowering the earnings threshold to £5,000, Capital on Tap’s proactive approach meant they were already ahead of the curve, mitigating the financial impact of these changes.

The Solution

Penfold stepped in to help Capital on Tap seamlessly implement salary sacrifice pension contributions, ensuring both cost efficiency and enhanced employee benefits. By allowing employees to contribute a portion of their pre-tax salary into their pension, Capital on Tap reduced their NI liability while offering employees a more tax-efficient way to save for retirement.

Our dedicated support team provided hands-on assistance, ensuring a smooth transition and answering any questions from employees. We worked closely with Capital on Tap’s People and Compliance teams to guarantee everything was set up efficiently and in line with regulations.

The Results

The impact of switching to Penfold has been significant:

- Proactive Cost Management: By implementing salary sacrifice before the 2025 NI changes, Capital on Tap positioned itself ahead of rising employment costs.

- Reduced NI Impact: Their early adoption of salary sacrifice means the 2025 employer NI increases will have less effect on their overall payroll expenses.

- Annual NI Savings: Capital on Tap is projected to save an estimated £135,248 annually in employer National Insurance contributions.

- Enhanced Employee Engagement: More staff are actively engaged in their pension savings, recognising the benefits of salary sacrifice.

- Higher Take-Home Pay for Employees: Employees benefit from reduced National Insurance deductions, increasing their overall take-home pay while growing their pensions.

- Seamless Payroll Integration: The payroll team now enjoys an easier, hassle-free process thanks to our intuitive platform.

- Cost Savings for Everyone: Employees benefit from higher take-home pay, while Capital on Tap reduces National Insurance liabilities.

- Outstanding Customer Support: The People team now has access to responsive, expert support whenever needed.

With a strong emphasis on financial wellbeing, Capital on Tap has reinforced its commitment to supporting its workforce. Their early adoption of salary sacrifice has not only optimised their financial strategy but also ensured they remain resilient in the face of rising employer costs.

“For any business facing the challenges of rising National Insurance contributions, salary sacrifice is a no-brainer. It’s been a huge win for us—reducing our tax burden while reinforcing our commitment to employee financial wellbeing.”

- Fay Sumner, Head of People at Capital on Tap

Looking Ahead

Capital on Tap continues to champion financial wellbeing, setting a precedent for businesses looking to optimise their benefits packages while making smart financial decisions. With Penfold as their trusted pension partner, they’re ensuring their employees feel valued, supported, and empowered to plan for the future.

“We found Penfold and instantly loved their approach to supporting our team’s financial wellbeing, whilst also giving Capital on Tap’s People team access to incredible customer service. The best thing about Penfold for me is the responsiveness of their team to any queries or questions that come from me or our employees. We just didn’t have that with our previous provider.”

- Fay Sumner, Head of People at Capital on Tap

Penfold remains committed to supporting businesses through tax changes, helping them optimise payroll costs while providing employees with greater financial security.

About Capital on Tap

Capital on Tap makes it easy for small businesses to manage their business spending, access funding, and earn cash back, travel, and gift card rewards. Over 200,000 small businesses have spent more than £10 billion on Capital on Tap Business Credit Cards across the US and UK. They were recently recognised by The Sunday Times and the Financial Times as one of Britain and Europe’s fastest-growing businesses, respectively.

About Penfold

Penfold is the modern workplace pension provider that helps businesses attract and retain top talent. With a seamless digital experience and hands-on support, we make pension saving easy, accessible, and engaging for employees and employers alike.

See how much your business could save: Request more information now!

This information is provided for informational purposes only and does not constitute financial advice. This article discusses National Insurance, which is a form of taxation in the United Kingdom. Tax laws and regulations can be complex and readers are advised to consult with qualified professionals for specific guidance tailored to their circumstances.