Autumn Statement: What it means for you

- By

- Murray Humphrey

Last week, UK chancellor Jeremy Hunt outlined some important economic changes via his Autumn Statement. Responding to rampant inflation and widespread fears the UK is heading into a recession, the government outlined a suite of tax rises and spending cuts. The changes outlined in the statement will have a big impact on UK workers from April 2023 and in the years to come.

In this article, we’ll look at what’s changing, what it means and how you can stay tax efficient to keep more of what you earn.

Autumn Statement: What’s changed?

First, a quick reminder of what’s changing (and what isn’t). Here’s a quick summary of the main changes affecting UK workers and the self-employed.

Additional rate income tax threshold

The Additional rate income tax threshold (the point at which you start paying 45% Additional rate income tax) has been lowered. You will now start paying 45% tax on any earnings over £125,140 - down from £150,000 previously.

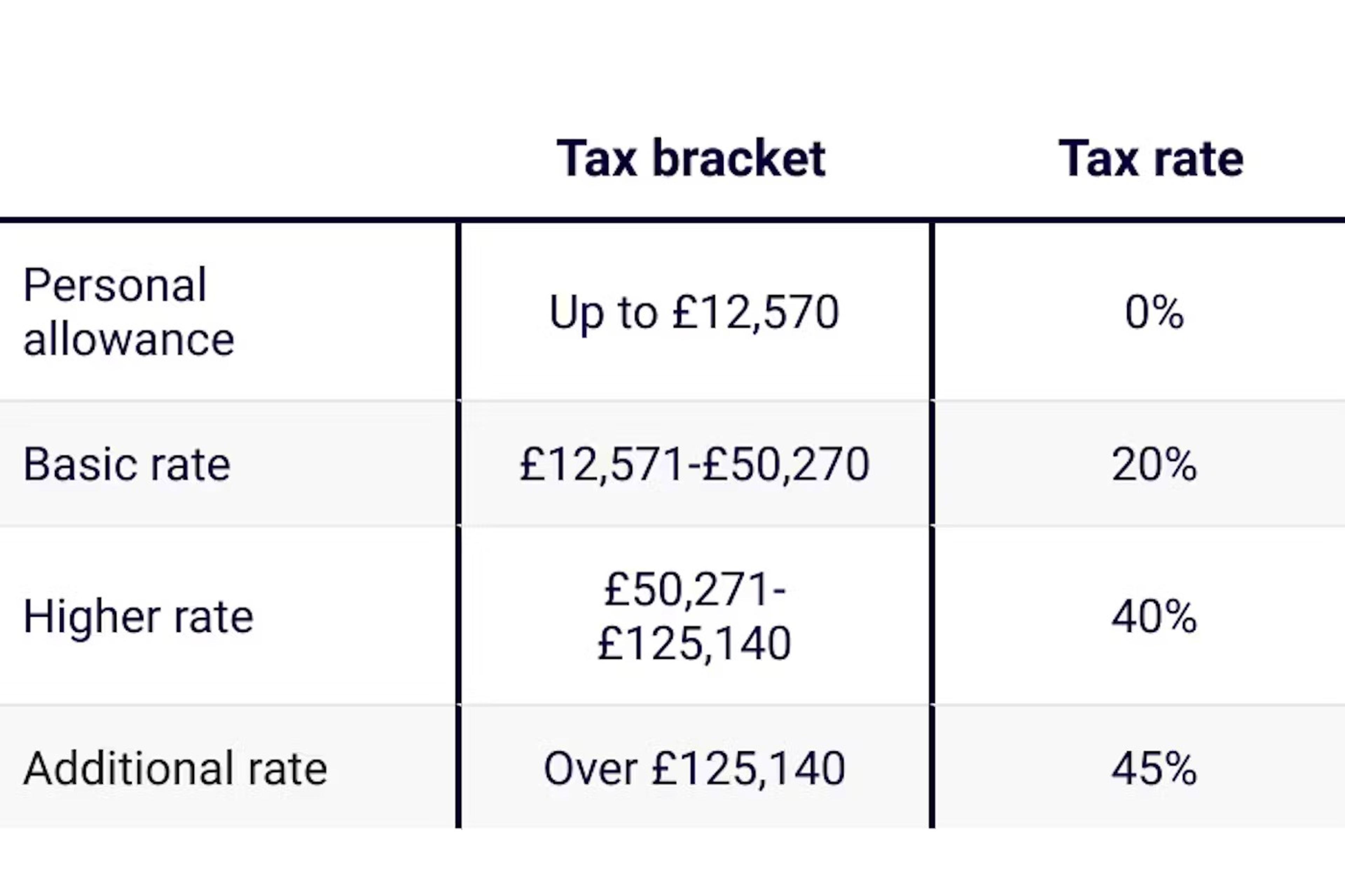

Income tax rates (from April 6th 2023)

*Personal Allowance is reduced by £1 for every £2 over £100,000 taxable income.

Today, someone earning £150,000/year will owe £52,460 in annual income tax. From April 2023, income tax owed will increase to £53,703. They’ll need to pay £1,243 more.

Personal Allowance and Income tax thresholds frozen until 2028

Your Personal Allowance (how much you can earn without paying tax) and income tax thresholds (including the amended Additional rate threshold) have been frozen until at least April 2028. The rates laid out in the table above won’t change before then.

With inflation currently at 10.1%, this will likely mean millions more people will creep into the higher and additional rate tax brackets in the coming years.

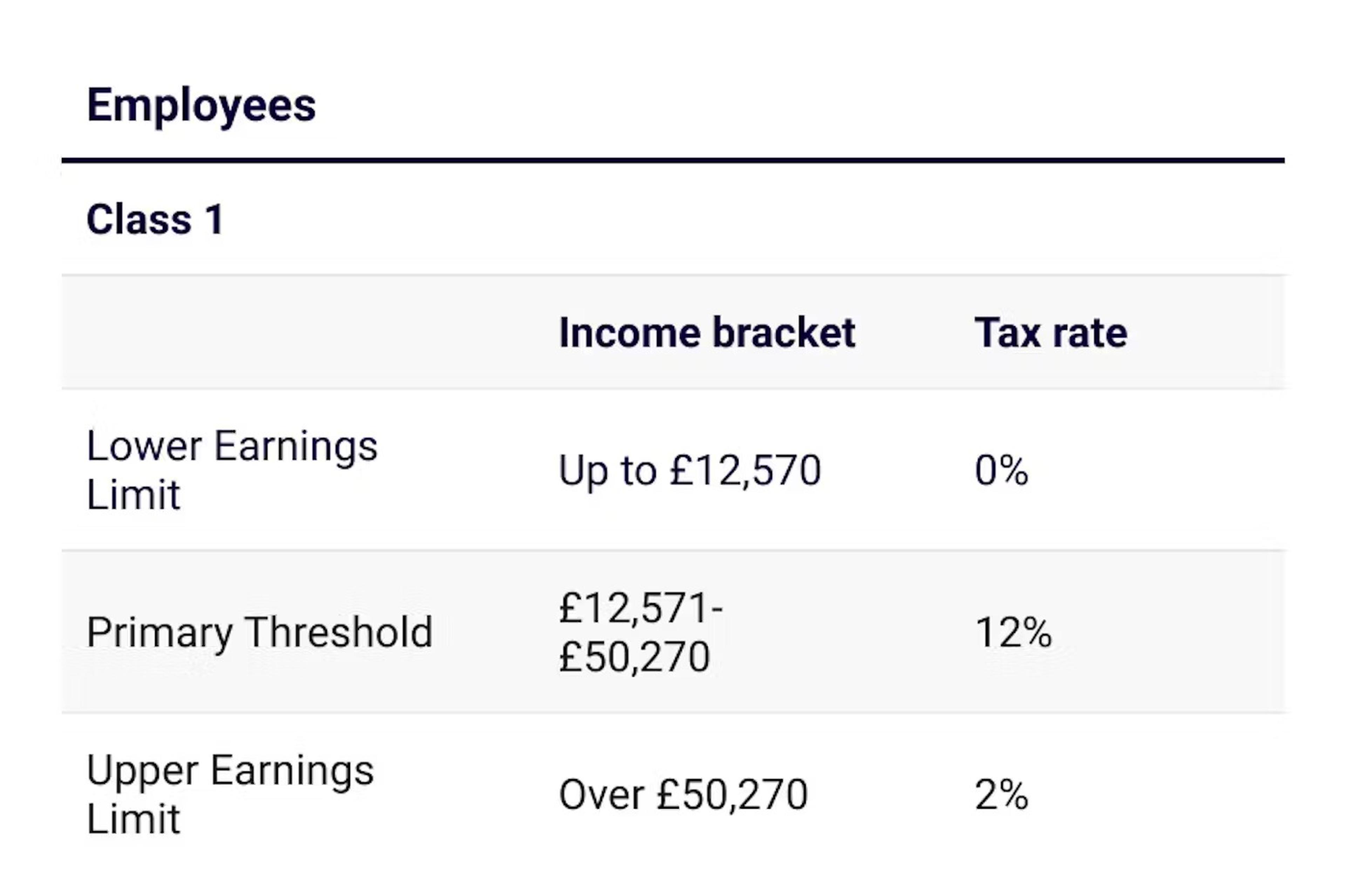

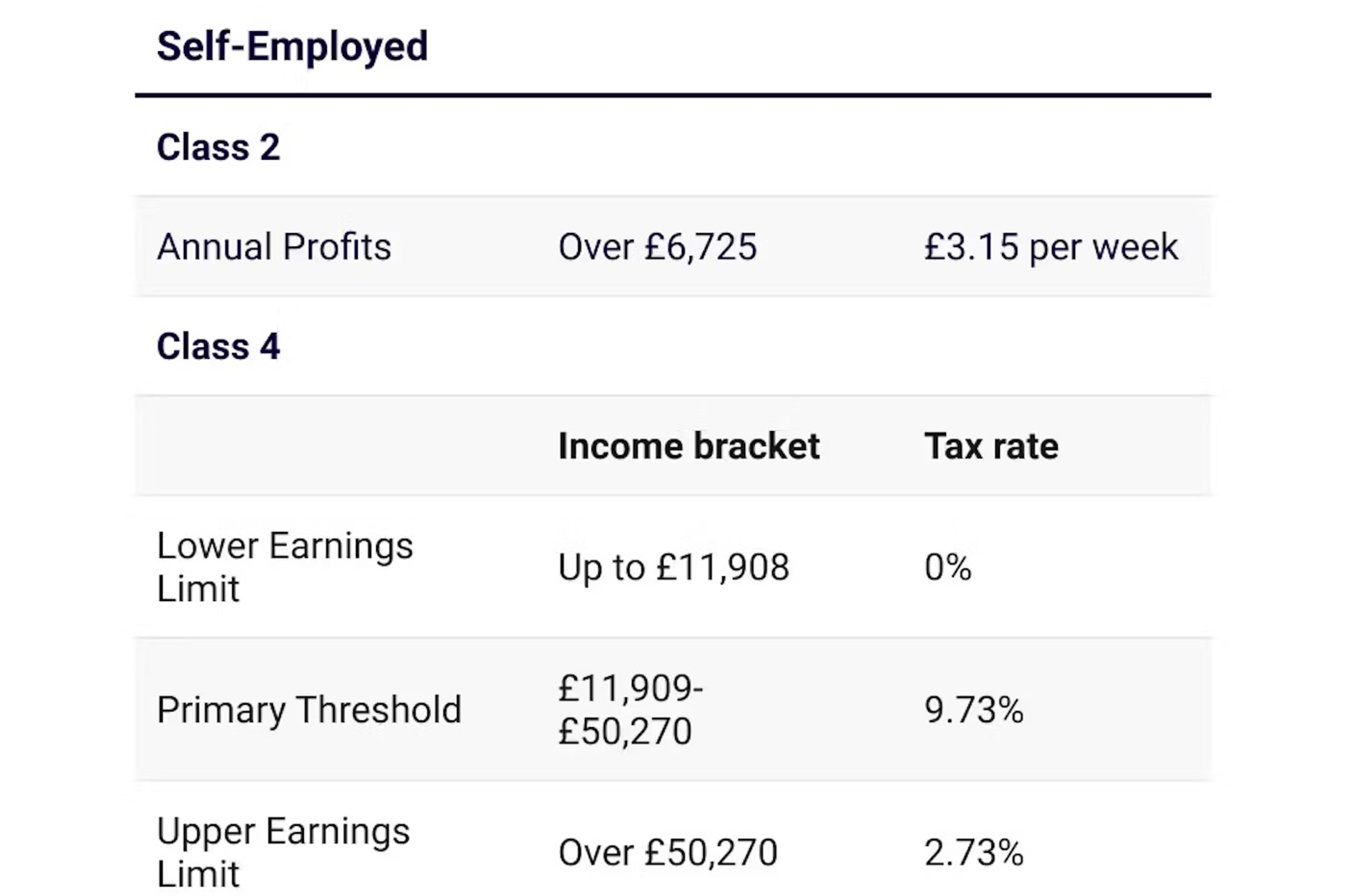

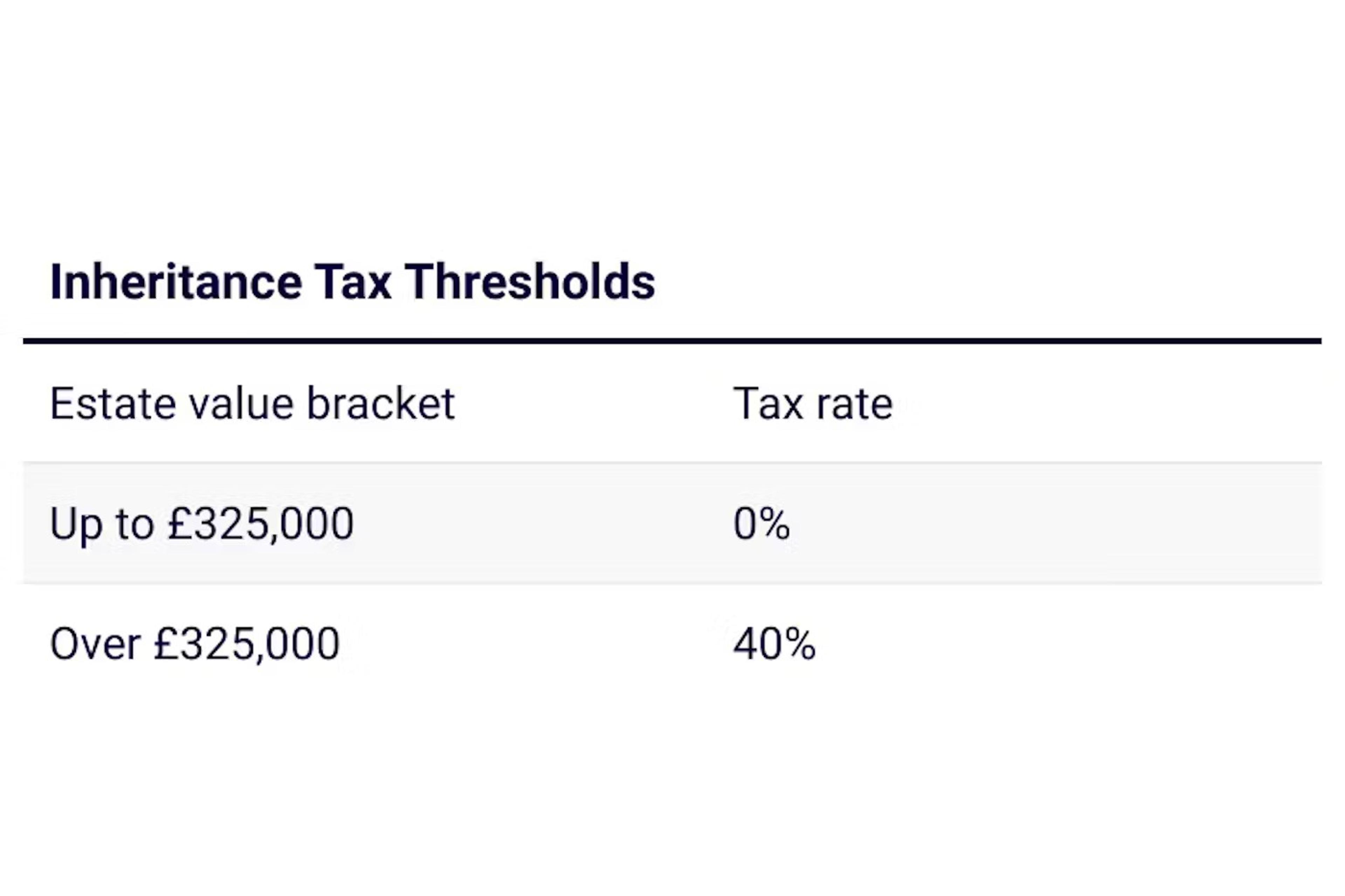

National Insurance and Inheritance tax thresholds frozen until 2028

National Insurance and Inheritance tax thresholds have also been frozen for the same period.

National Insurance thresholds

State pension to rise 10.1%

The government also announced that the State pension will rise in line with inflation - a 10.1% increase. From April 6th of next year, the full State pension will pay £203.85/week or £10,600.20/year. You will need a full 35-year National Insurance record to qualify for the full payments.

This means the government keeps its manifesto promise on the so-called Triple Lock - guaranteeing the State pension rises each year equal to the highest of:

- Inflation

- Average earnings

- 2.5%

Dividend and Capital Gains Tax Allowances Cut

Tax-free allowances for Dividends (payments for owning shares in a company) and Capital Gains (profit on selling ‘assets’ like investments or buy-to-let property) are also due to be cut next year - with further cuts coming in 2024.

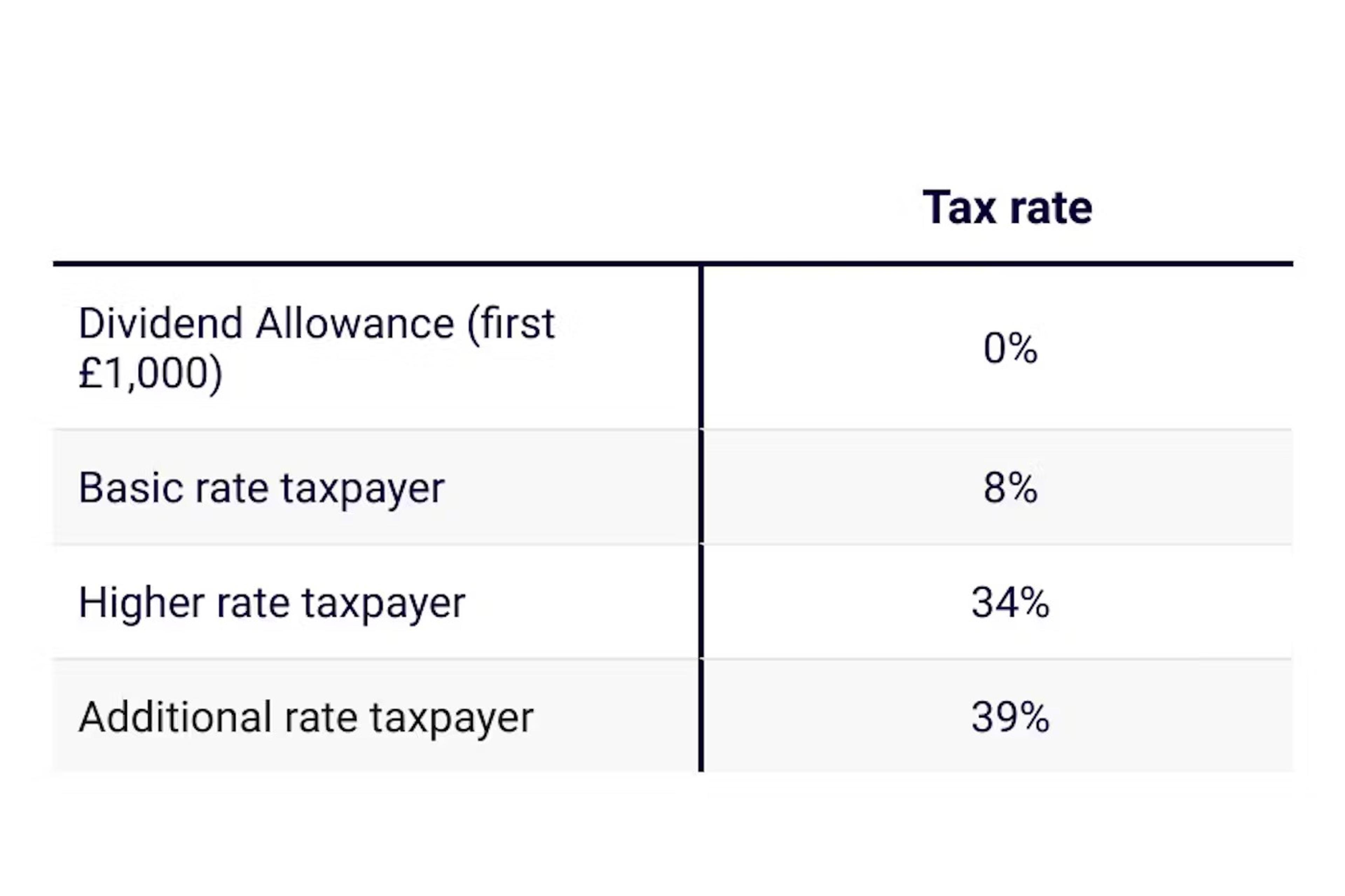

The Dividend allowance is how much in Dividends you can receive before you need to pay Dividend tax. This allowance is being halved from £2,000 to £1,000 in April 2023, with a further cut to just £500 in April 2024.

Here’s a quick example. For a higher rate taxpayer receiving £5,000 in Dividends, today you would owe £1,012.50 in Dividend tax. From next April, you’ll owe £1,350. From April 2024, that jumps to £1,518.75 - effectively 50% more in tax than today.

Dividend tax (from April 2023)

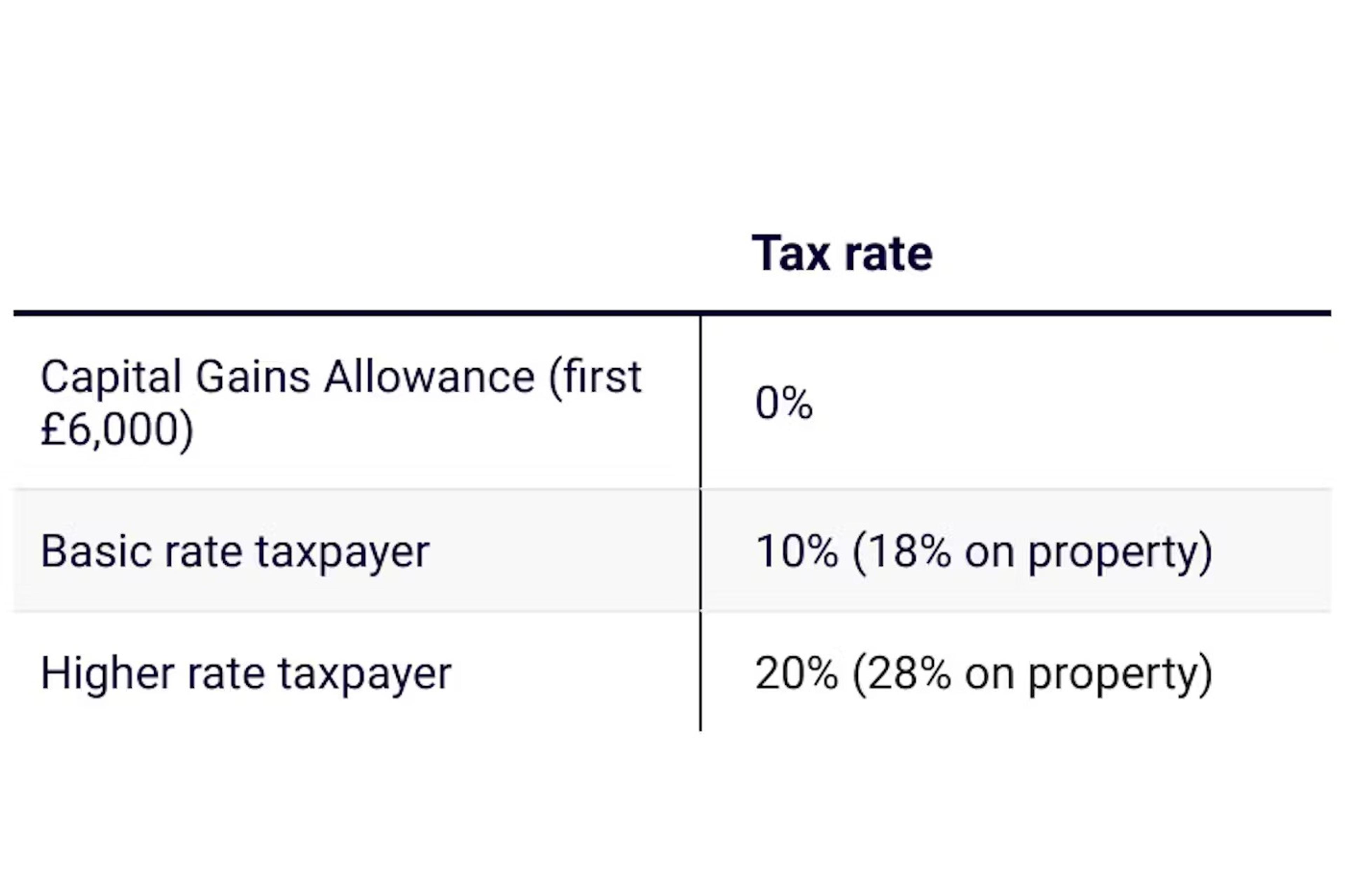

It’s the same story for the Capital Gains Allowance. You pay Capital Gains when you ‘dispose of’ (sell) an asset you own - think shares, 2nd homes and personal possessions valued over £6,000 (excluding your car).

Today, the amount you can earn from selling these assets without being taxed is £12,300. From next April, that drops to £6,000 before dropping again to just £3,000. That means for Capital Gains of £20,000, higher rate taxpayers will be paying £2,400 more tax from April 2024.

Capital Gains tax (from April 2023)

What it all means

For the majority of UK workers, the most significant announcement concerns the frozen income tax thresholds. In an economy with high inflation, the cost of everyday expenses like food and energy are rising at a rapid pace. To keep up, employees demand a pay rise to ensure they can afford to live.

However, the government have confirmed that tax thresholds won’t change to reflect this. This causes a phenomenon called ‘fiscal drag’ where tax thresholds don’t increase alongside rising wages.

The outcome? Far more people will start paying higher and additional rate taxes than before. In the next few years, it will become more important than ever for savers to be aware of ways of reducing their taxable income and keeping more of what they earn. One of the very best ways to do this is your pension.

Contributing to your pension is one of the best ways to reduce your net income - trimming how much tax you owe.

How your pension can fight fiscal drag (AKA trim your tax bill!)

If you’re concerned about paying more tax in the next couple of years, don’t worry. There are a number of completely legal ways you can trim the tax you owe. Your pension helps you keep more of what you earn by reducing your net income - the portion of your earnings you pay tax on.

Higher rate taxpayers

All higher-rate taxpayers contributing to a pension get to keep hold of an extra £2,201.50/year minimum (assuming 5% contribution from qualifying earnings). Of course, the more you pay into your pension, the more you’ll save in tax. You save even more by using a salary sacrifice pension to trim your National Insurance.

A quick example: if you earn £55,270 a year, you’re being taxed 40% on £5,000 of your earnings. That’s the amount you earn over the higher rate threshold of £50,270. £5,000 of your income becomes £3,000 in your pocket.

However, if you instead choose to put that £5,000 in your pension, you get to keep the lot AND benefit from a 25% tax relief bonus. £5,000 of your income becomes £6,250 in your pension. A £3,250 bonus.

And that’s not all. It isn’t widely known that higher-rate taxpayers are owed extra tax relief on their pension contributions in addition to the 25% we just mentioned. That £5,000 contribution gets you another £1,250 back via your tax return. Check out our guide to higher-rate pension tax relief for all the details.

Higher-rate taxpayers can get 25% extra tax relief on their pension contributions via their tax return.

Claim back your Child Benefit

If you’re a parent, your pension can also help you get your Child Benefit back. Your Child Benefit allowance starts to be reduced if you earn £50,000/year. If you earn over £60,000/year, you’ll lose it entirely. Contributing to your pension can take your taxable income below those £50/60,000 marks so you can keep hold of your Child Benefit.

Recover your Personal Allowance

Earn over £100,000 a year? You can use your pension to claim back your Personal Allowance.

Every UK resident is entitled to £12,570 income tax-free. However, for every £2 you earn over £100,000, your Personal Allowance is cut by £1. Once you earn more than £125,140, your allowance is lost completely. The end result is that more of your earnings become liable to income tax - you may end up paying more tax than you expect. This is known as the ‘60% tax trap’.

For every £1,000 you earn over £100,000, you only actually receive £400. Adding £1,000 into your pension instead and you’ll get £1,250 in your pot, plus another £250 back as cash (or a tax reduction) via your tax return as we outlined above.

Conclusions

The recent Autumn Statement from the government means millions of UK workers will need to pay more tax over the next few years. As the country enters a recession, it becomes vital that savers can keep hold of as much of their money as possible.

A fantastic way to do this is through your pension - one of the few tax-efficient financial products unaffected by Jeremy Hunt’s update. For more on how pensions can protect your income, check out our guide to pension tax relief.

Murray Humphrey

Penfold