4 minutes

How to Avoid the 60% Tax Trap

- By

- Murray Humphrey

Earning over £100,000? Here’s why your tax rate can jump to 60% and how to avoid it.

Earning £100,000+ is a huge milestone and one that should feel rewarding. But for many people, crossing into six figures comes with an unpleasant surprise: part of your income can effectively be taxed at 60%. This isn’t a special tax band. It’s the result of how the UK tax system claws back your Personal Allowance once your income exceeds £100,000.

The good news? With the right pension strategy, this “60% tax trap” is largely avoidable.

What is the 60% tax trap?

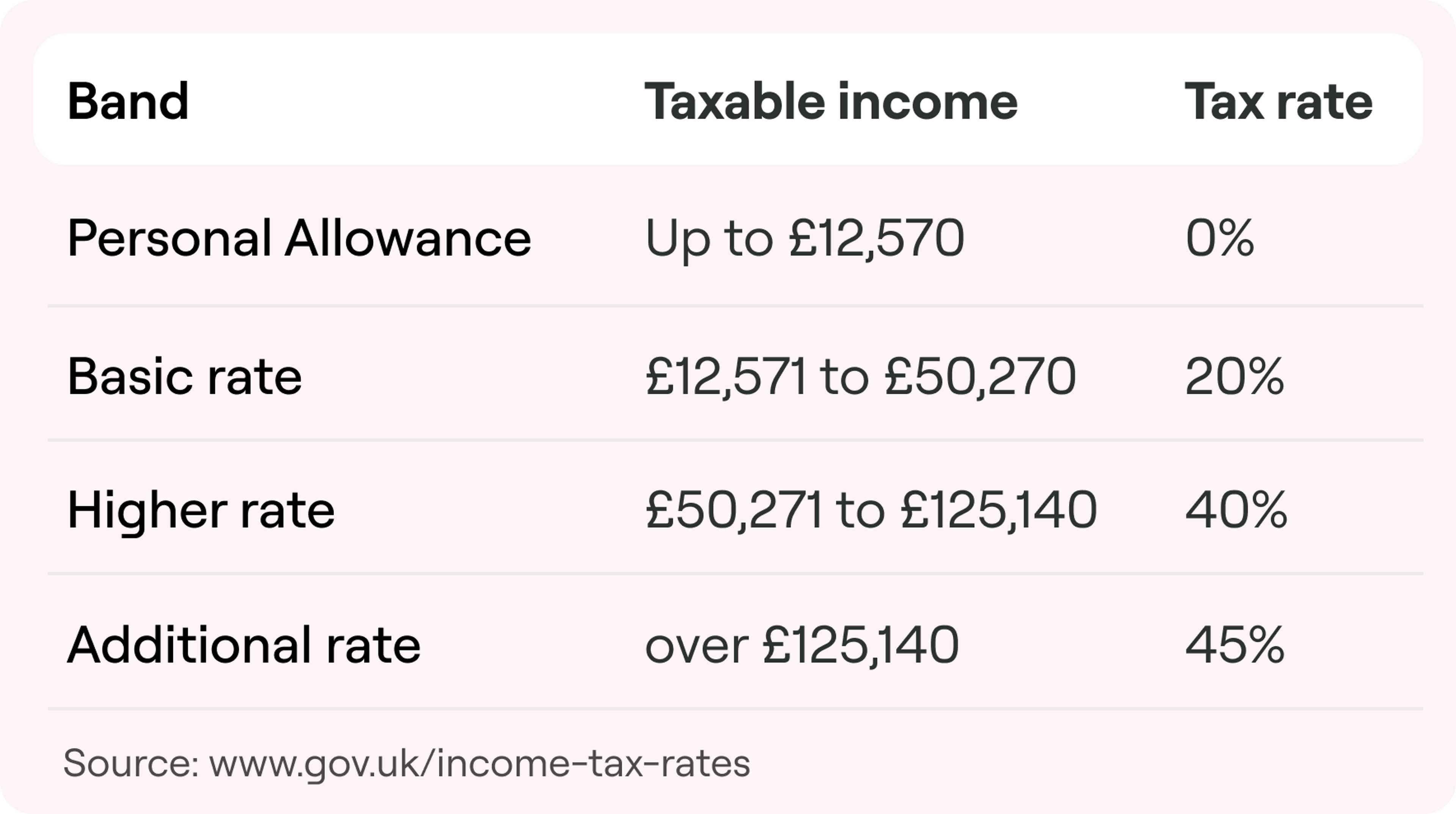

Everyone in the UK can earn a certain amount tax-free each year – known as the Personal Allowance, currently £12,570. Here are the current tax bands.

Once your income exceeds £100,000, that allowance is gradually withdrawn:

- For every £2 you earn over £100,000

- Your Personal Allowance is reduced by £1

By the time your income reaches £125,140, your Personal Allowance is reduced to zero. See GOV.UK Income Tax rates and Personal Allowances

Why that creates a 60% tax rate

Between £100,000 and £125,140, two things happen at once:

- You pay 40% income tax on that slice of income

- You also lose tax-free allowance, meaning more income becomes taxable

Combined, this creates an effective marginal tax rate of 60% on income in that range (before National Insurance). In simple terms: For every £1 you earn in this band, you may only keep around 40p.

Why pensions are the most effective solution

The key to avoiding the 60% tax trap is reducing your adjusted net income back below £100,000. Pension contributions do exactly that. Money paid into a pension:

- Reduces your taxable income

- Preserves your Personal Allowance

- Receives tax relief instead of being taxed

This means money that would have gone to HMRC can instead be working for your future.

The most powerful tool: salary sacrifice

The most effective way to avoid the 60% tax trap is through salary sacrifice.

Instead of:

- Earning £110,000 as salary

- Paying tax and NI

- Then making a pension contribution

You agree with your employer to:

- Reduce your salary (e.g. to £100,000)

- Have the difference paid directly into your pension

Why salary sacrifice is so effective:

- Income Tax is avoided

- Employee National Insurance is avoided

- Employer National Insurance is often saved (and sometimes shared with you)

- Your Personal Allowance remains intact

Example: Earning £110,000

Let’s look at the principle. If you earn £110,000 and do nothing:

- £10,000 sits in the 60% tax zone

- Your Personal Allowance is partially withdrawn

- You lose a large chunk of that income to tax and NI

If instead you salary sacrifice £10,000 into your pension:

- Your taxable income falls back to £100,000

- Your Personal Allowance is fully restored

- You avoid the 60% tax trap entirely

- The full £10,000 goes into your pension (often more if employer NI savings are added)

The result is:

- More money invested

- Less tax paid

- Higher effective take-home value

This is why pensions are often described as the cleanest escape route from the 60% band.

What about pension limits?

Annual Allowance

You can usually contribute up to £60,000 per tax year into your pension without triggering a tax charge. This includes:

- Personal contributions

- Employer contributions

- Salary sacrifice contributions

Many people also have access to carry forward, allowing unused allowances from previous years to be used.

Lifetime Allowance

The Lifetime Allowance charge was removed from April 2023. This means:

- You are no longer taxed simply for building a pension above a fixed lifetime cap

- The main constraint is now the annual allowance, not a lifetime limit

(There are still limits on the tax-free lump sum, but these are separate and don’t undermine the core strategy.)

For high earners regularly contributing large amounts, this change has made pensions significantly more attractive.

Is avoiding the 60% tax trap worth it?

For most people earning between £100,000 and £125,140, yes absolutely. Using a pension (and especially salary sacrifice) can:

- Turn a punitive tax band into a tax-efficient saving opportunity

- Protect your take-home pay

- Accelerate your retirement savings

Instead of losing money to the least generous part of the tax system, you’re redirecting it to your future.

Final thought

The 60% tax trap isn’t obvious, and many people fall into it accidentally after a pay rise or bonus. But with the right setup, it’s also one of the easiest tax inefficiencies to fix.

If you’re earning over £100,000 and not using your pension strategically, there’s a strong chance you’re paying more tax than you need to.

The goal isn’t just to earn more – it’s to keep more of what you earn.

This article is for information only and isn’t personal financial advice. Tax and pension rules depend on individual circumstances, so consider seeking advice before acting.

Murray Humphrey

Penfold