Three easy ways to become an investor

- By

- Murray Humphrey

You don't need a pinstripe suit or a trust fund to get started.

If you’re one of those people for whom the word ‘investment’ conjures up images of serious people in sober suits and waffley, long winded articles that are too difficult to understand, we’ve got good news: you’re not going to find any of that here.

Instead we’re going to take three common ways to invest, demystify them and show you how easy it is to get involved, whatever your budget. Making money isn't going to happen overnight – these are all long term investments.

Why are we doing this? Because for too long the financial services industry has prevented people from being better off by doing a bad job of explaining how their products work.

And we want people to feel better off! One way of doing that is to stash some money away in places where it should grow. Here’s how:

The tax free one

A Stocks and Shares ISA (Individual Savings Account) does what it says on the tin, allowing anyone to invest in a range of stocks, shares, and other investments without paying income tax or capital gains tax (tax paid on profits from selling an asset) on any returns they make.

They’re managed by banks, building societies, fund management companies, and other financial institutions. You can choose individual stocks yourself if you feel confident or you can invest in a fund that your provider manages for you.

Stocks and Shares ISAs are exempt from tax in order to encourage individuals to save and invest for the future. The caveat is that the government limits the amount that can be invested in them annually, which is £20,000.

Stocks and Shares ISAs are exempt from tax in order to encourage individuals to save and invest for the future

You can take your money out of an Individual Savings Account (ISA) at any time, without losing any of the tax benefits, but you’ll need to check the T&Cs to see if there are any rules or charges for making withdrawals.

The company managing your ISA will charge you a fee to do so, but check if it’s an annual service charge, a percentage of your ISA value or another metric.

So how do you choose one? There’s no way around this – you will have to set some time aside to do your research. We’d recommend checking out this page by Money Saving Expert Martin Lewis, who also lists other sites where you can research.

The one which the government chips into

Boy do we wish someone had convinced us to start a pension when we were 22 (and maybe given us a few quid to start it off).

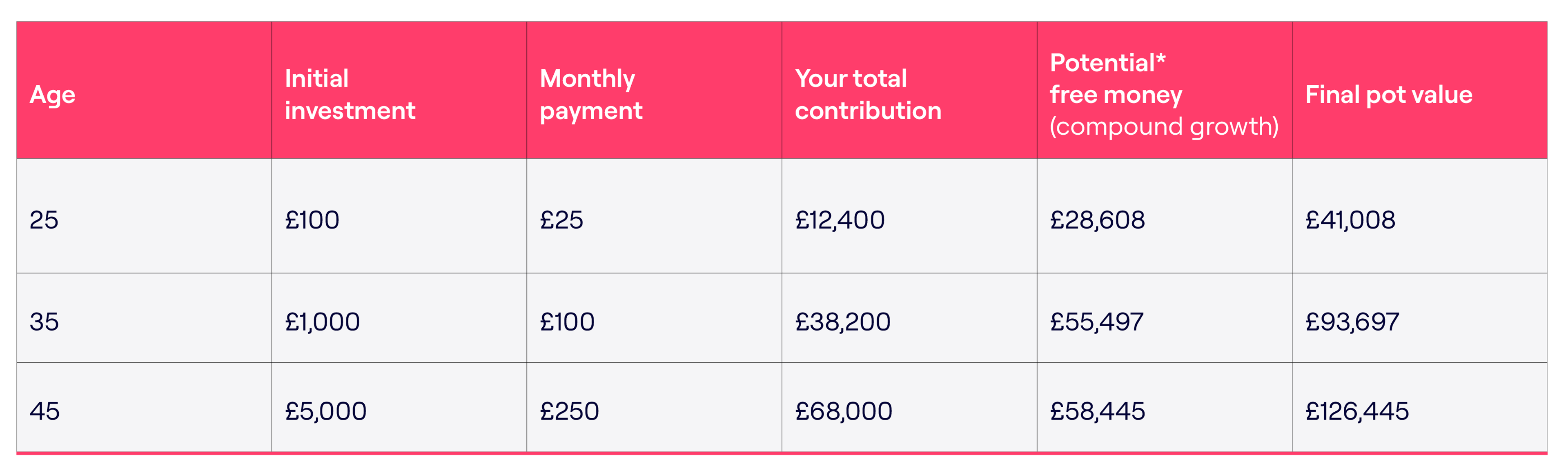

The reason for this is the really rather dull sounding ‘compound growth’. Let’s put it another way – it’s potentially a lot of free money that your pension provider makes for you by investing your pension contributions in the stock market. Here’s an example of that free money, assuming an annual growth rate of 5% and retirement aged 66:

*Investments can go down as well as up. Your capital is at risk.

We’ve got even better news for you - there’s more free money to be had when you invest in a pension and this time it’s from the government in the form of 25% tax relief.

For example, for every £100 you invest in a pension, the government gives you £25 in the form of tax relief. That means if you put £1000 in your pension, the government adds £250. We think that’s worth repeating: the government will give you £250 for every £1000 you put in your pension.

There’s no paperwork required for you to get that money from the state. Your pension company takes care of it for most people; for company directors it can be a bit more complicated (more on that here).

The one that’s more exciting than it sounds

Once upon a time the only people who understood how to invest in shares were City traders and people who read the Financial Times. The internet and smartphones changed all that. It’s a lot easier for anyone to take a punt on the stock market now.

One way to do it is through a General Investment Account. The GIA may well be a product genre whose name makes it hard to get excited about but stick with us!

The stock market goes up and down in the short term, but in the long term, there has historically been an upward trend. How you invest in it through a GIA depends on your risk appetite and your acumen. If you’d invested in Apple back in the 1970s for example, you’d be feeling pretty good about it right now.

How you invest through a GIA depends on your risk appetite and your acumen.

GIAs offer the opportunity to pick certain stocks and shares yourself or choose a managed fund and let some financially savvy people (and some algorithms) make the necessary adjustments for you.

Unlike pensions or ISAs, there are no tax advantages to GIAs and the companies that operate them will charge you a fee – typically less than 1% of your investment.

As pension providers ourselves, it won’t be a total shock to you to read that we think pensions are a good idea. The problem with pensions is that they’re sometimes hard to engage with.

Stopping working might seem too far off to care about or the subject might just be too complicated and boring for you that you keep bumping it down your to-do list. Well, no more.

We want everyone to feel good about retirement so our pension is easy to use, simple and clear. How much you’ve got, how much you need and how you can save for the lifestyle you want – it’s all there on our app. Here’s how it looks.

With investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice or as a recommendation to invest with any mentioned firm. Past performance is not a reliable indicator of future performance.

Murray Humphrey

Penfold