Goal Setting

Not sure how much you need to save for retirement? Forecast your future pot value and get on track with your retirement goals with Goal Setting.

What is Goal Setting?

1. Forecast your pension

Calculate how much your pension will be worth as a retirement income.

2. Build a goal

Set your retirement goal based on your income at the moment, or an ideal lifestyle.

3. Get on track

Set yearly targets to reach your retirement goal.

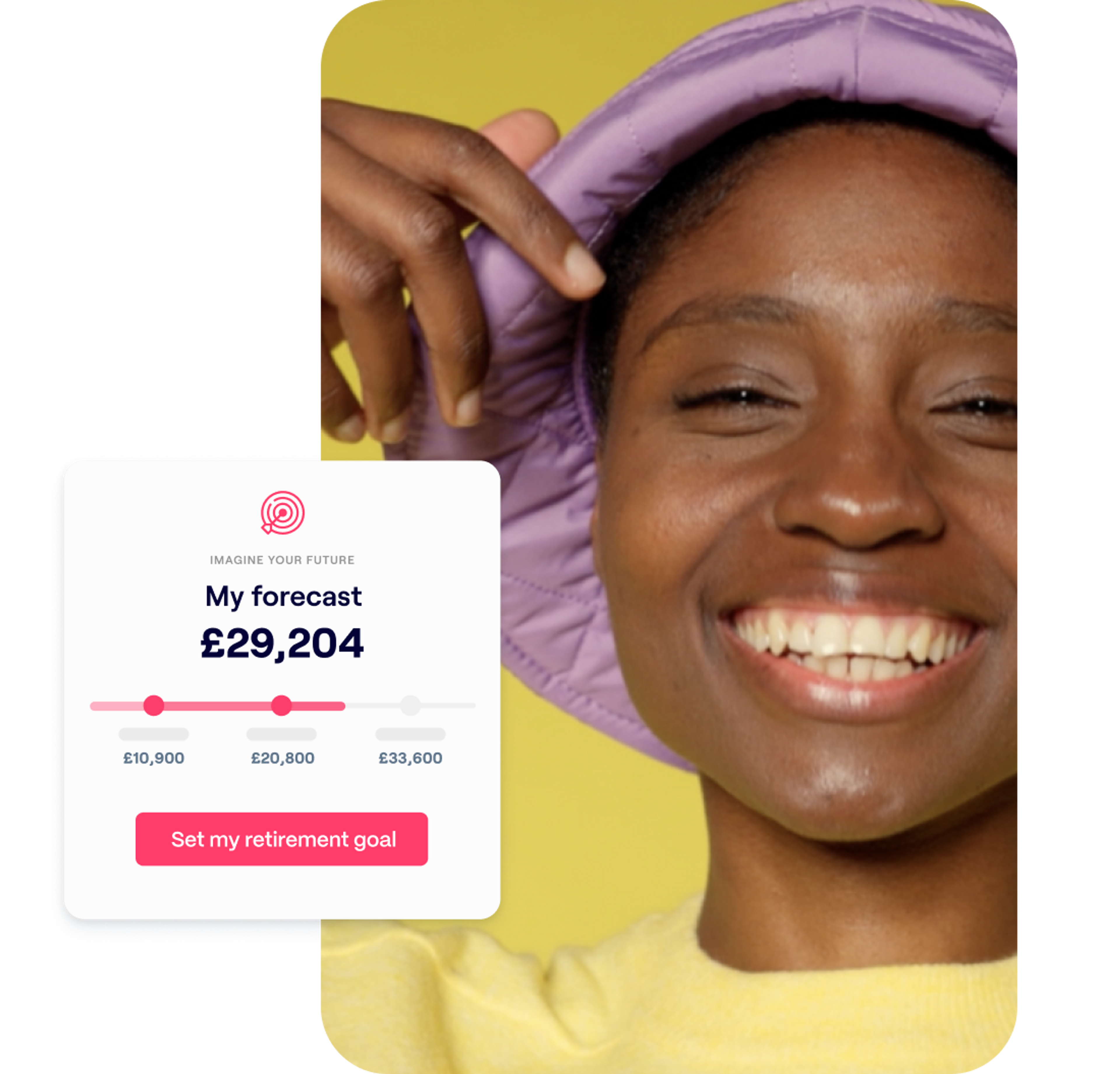

Your forecast

Goal Setting starts by helping you understand your current situation.

Your forecast calculates how much your pension will be worth as a yearly income when you retire.

You can adjust your contributions and desired retirement date, add in the State pension and even factor in pension pots elsewhere to get the full picture.

Not sure what your forecast means in real terms? Use our Lifestyle categories to understand what quality of life you’re on track for.

Set a goal

Next, Goal Setting helps you build the ideal retirement goal for you. Simply:

- Choose what age you’d like to retire

- Decide how much you’d like to withdraw each year in retirement - using a lifestyle category or your annual income as a guide

- See how your current forecast compares with your goal

You’ll be given two numbers, your current forecast and your goal.

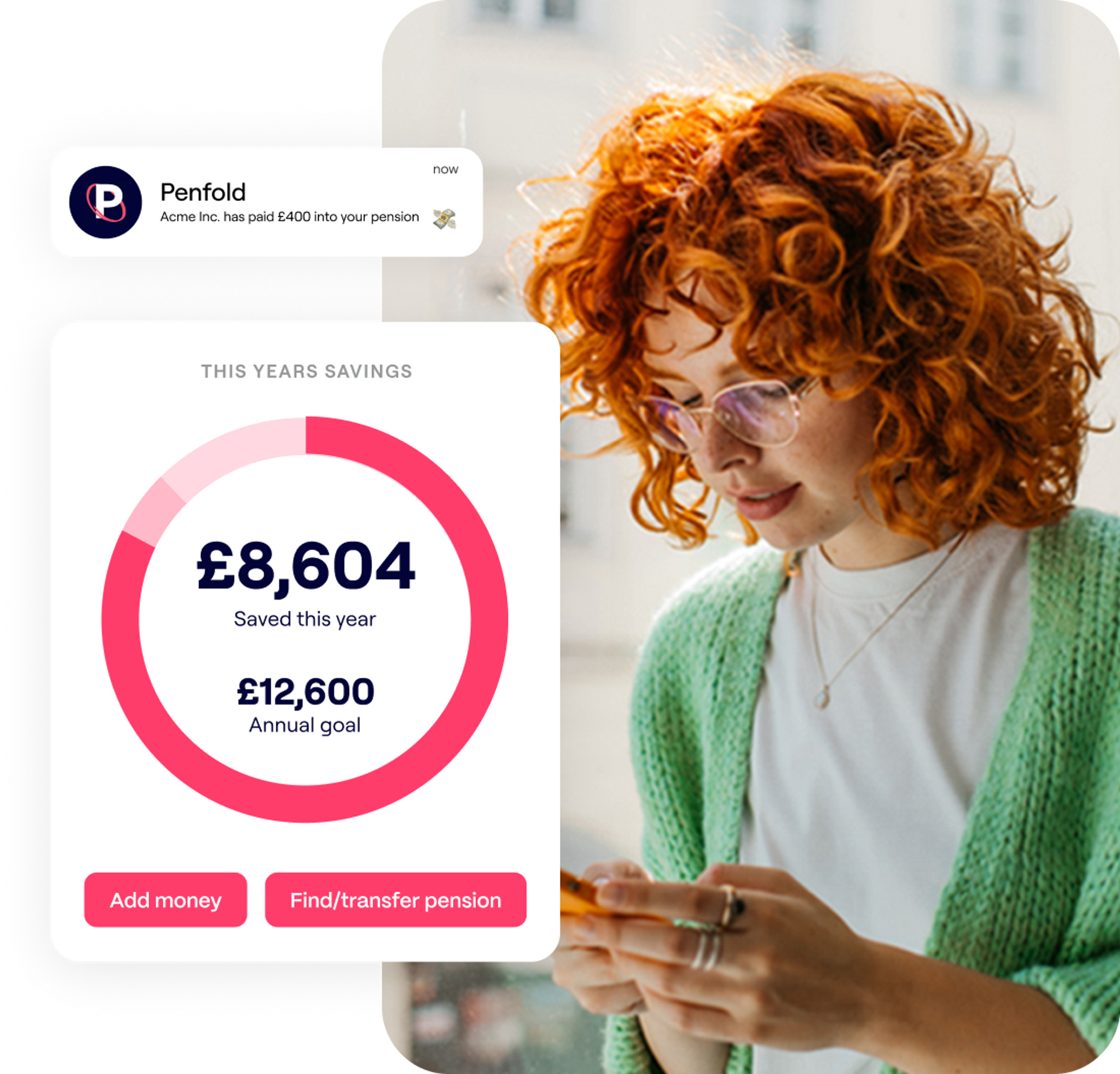

Get on track

Finally, Goal Setting helps you get on track with yearly targets

Have a gap between where you are and where you want to be? Don’t worry, that’s what this tool is all about.

Goal setting breaks down your goal down into realistic yearly targets.

Start off with however much you can afford today and Goal setting will spread your contributions year on year to help you achieve your goal.

Get notifications when you've achieved your targets and a breakdown of your growth and saving habits to stay on track with your goal.