2 minutes

Breaking News: We're Releasing a Movie

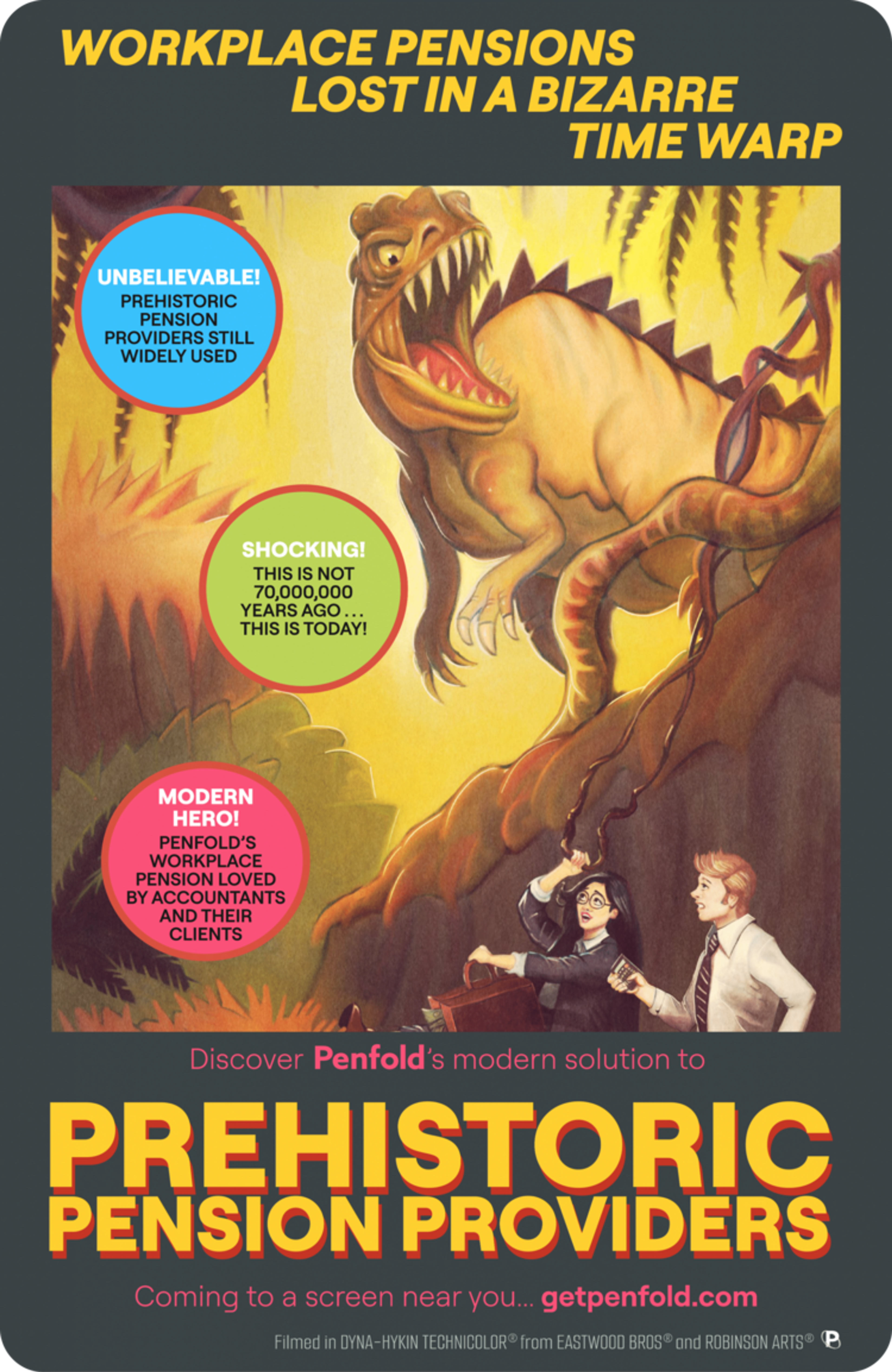

Okay, not really. But we did go through the trouble of designing a pretty legit poster. Find out why...

What’s all this about a movie, then?

Dinosaurs haven’t roamed the land for nearly 70 million years, but sometimes it still feels like they’re here – in the form of outdated workplace pension schemes.

To raise awareness about prehistoric providers, we thought we’d mock-up a movie poster and fake press release, and send them to some lucky recipients across the UK. Check out the poster!

In our imaginations, Prehistoric Pension Providers, tells the story of traditional providers on an adventure into the past. The protagonists journey from 2012, during the introduction of auto enrolment, into the land of dinosaurs – only to get stuck in the prehistoric era and unable to get back.

The idea was to get accountants thinking about just how outdated traditional providers are and how valuable pensions can be for employers and savers when you’ve got the right partner. (Is it working so far?)

How outdated are workplace pension providers?

Sometimes we think workplace pension providers haven’t updated their offering since auto enrolment came into effect in 2012. It can even feel closer to 70 million years when we hear about some especially bad experiences.

Most prehistoric pension providers don’t offer an easy-to-access mobile app, making it difficult for savers to log in, track their funds, or stay engaged with their pension.

And the rest either have poor service you can never get through to anyway, outdated processing platforms which make uploading contribution files a nightmare, confusing and hidden fees including for accountants and employers – or a mix of it all.

Often accountants are unaware of any alternative so these traditional providers are still widely used. Enter the hero of our movie: Penfold.

How is Penfold changing the game?

With Penfold, pensions don’t just have to be a compliance task. They can be a powerful tool to strengthen your relationships, help your clients retain employees and deliver financial freedom for savers.

Picture this:

- You pick up your phone and open the Penfold app. Want to make contributions, combine old pensions, set savings goals, and forecast their retirement income? Go ahead. It’s your pension in your pocket.

- You log into our platform and see all your client’s schemes. You upload your files without errors, thanks to our advanced error autocorrect.

- You have a question and call your account manager. They greet you by name and help to resolve your query. You know you can call or email them whenever you need to.

What’s more, Penfold's completely free for accountants and employers with just one all-in fee for savers.

We might have dreamed up our own blockbuster movie, but Penfold is no figment of your imagination.

The workplace pension you and your clients will love

We sent a fake movie poster around the country, with the aim of getting accountants thinking about just how outdated traditional providers are and how valuable pensions can be when you’ve got the right partner.

Did it work?