3 minutes

Unveiling the Hidden Costs of Workplace Pensions

- By

- Murray Humphrey

Understanding the hidden charges associated with workplace pensions is crucial for accountants and advisers striving to make informed decisions for their clients. This guide highlights common extra fees imposed by pension providers and showcases why Penfold offers a transparent, cost-effective alternative.

When it comes to workplace pensions, transparency is key. Yet, many auto-enrolment providers cloak their fees in a shroud of complexity, leaving accountants and advisers struggling to understand and convey the true costs to their clients.

At Penfold, we believe in clarity and simplicity. This guide will help you navigate the often murky waters of pension fees and highlight why Penfold is the straightforward, cost-effective choice for you and your clients.

Why Extra Charges Matter

In the UK, there are 5.5 million businesses classified as SMEs, accounting for 99% of all businesses according to the British government.

Most of these have fewer than 50 employees. Since the introduction of auto-enrolment in 2012, all small businesses are required to provide a workplace pension for their employees, contributing a minimum of 3% of their salaries. This often makes workplace pensions the most significant benefit cost for employers.

However, the financial burden doesn’t stop at contributions alone.

Fees for Employers

Some pension providers impose additional charges which can add up quickly.

- NOW Pensions: £36 per month

- People’s Pension: £500 set up fee

These costs can be avoided with some other workplace pension providers.

Smart Pension Fee Increases

Did you know that Smart Pension have introduced a monthly employer charge?

- £15 per month, from 1st December 2022

- £22 per month, current Smart Pension charges

Smart Pension stated that this fee would help improve their service and allow for platform enhancements.

Fees for Employees

Additional charges also affect employees.

Nest charges a 1.8% contribution fee. If an employee contributes £200 a month, they lose £3.60 each time, amounting to £43.20 annually or £432 over a decade, this doesn’t count the lost potential compound growth.

Some providers charge users a monthly ‘member administration charge’ on top of the annual management charge (AMC).

- NOW Pensions: £1.25 per month

- Smart Pension: £1.75 per month

For low earners, this can be significant. For instance, someone saving £300 annually would see 7% of their savings go to these fees.

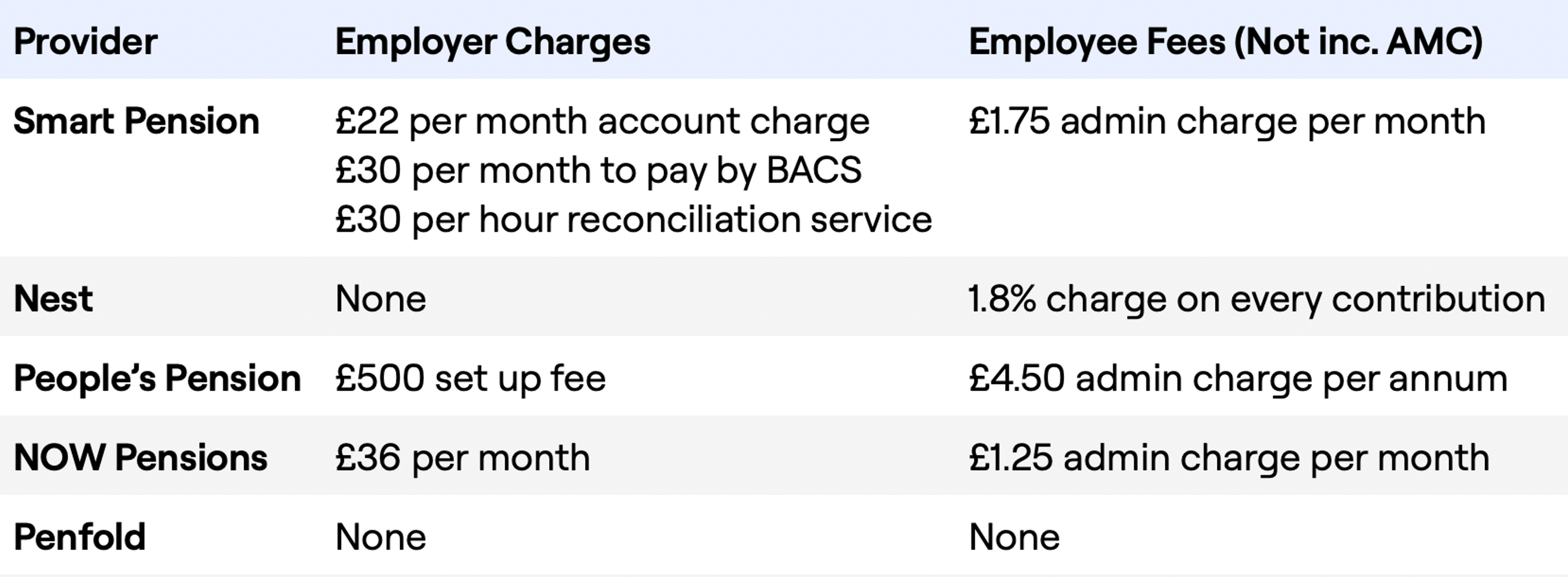

Hidden Fees Comparison

Pension providers charge an annual management charge (AMC) but some add extra fees, making it difficult to understand the total cost. Here’s a comparison of common workplace pension providers additional fees:

For a detailed comparison, check out our guide to different workplace pension providers.

Simplicity and Transparency

At Penfold, we value transparency and hate extra charges – so we’ve created a fair, straightforward fee structure:

- Our annual management fee on employees’ pension pots covers everything.

- There are no fixed fees, extra fund management fees, account fees, or adviser fees for employers.

- There are no extra admin charges, contribution fees, or switching fees for employees.

We understand the financial duty accountants have towards their clients, with Penfold you can offer a cost-effective solution.

When evaluating a new provider, consider not just the fees but also fund choices, performance, and customer service quality. We’ve put together a list of the things you should consider in our How to choose a workplace pension provider article.

Penfold’s Workplace Pension

Our modern workplace pension prioritises simplicity and transparency.

Our simple fee structure eliminates hidden charges, making it easy for both you and your clients to understand the true cost of their workplace pension. For more information about Penfold's one simple fee (the AMC) read our pension charges page.

Switching providers is simpler than many think; read our guide on how to change workplace pension provider to find out more.

Give your clients the peace of mind that comes with clear, predictable fees and the potential for significant savings.

Murray Humphrey

Penfold