Benefits of Paying Into Your Pension Before Tax Year End

- By

- Murray Humphrey

If the end of the tax year is approaching and you’re wondering whether it’s worth paying into your pension now, here’s the short answer: For most people, yes – and waiting could cost you real money. A pension contribution before the tax year ends can:

- Instantly boost what you save

- Reduce the tax you pay this year

- Lock in benefits you can’t get back once the deadline passes

This won’t take long to read, but it could make a meaningful difference to both your take-home position today and your future finances.

Why paying into a pension before tax year end is so powerful

The government wants people to save for retirement so it actively rewards you for doing it. That reward comes in the form of pension tax relief, which effectively means: Some of the money you would have paid in tax goes into your pension instead.

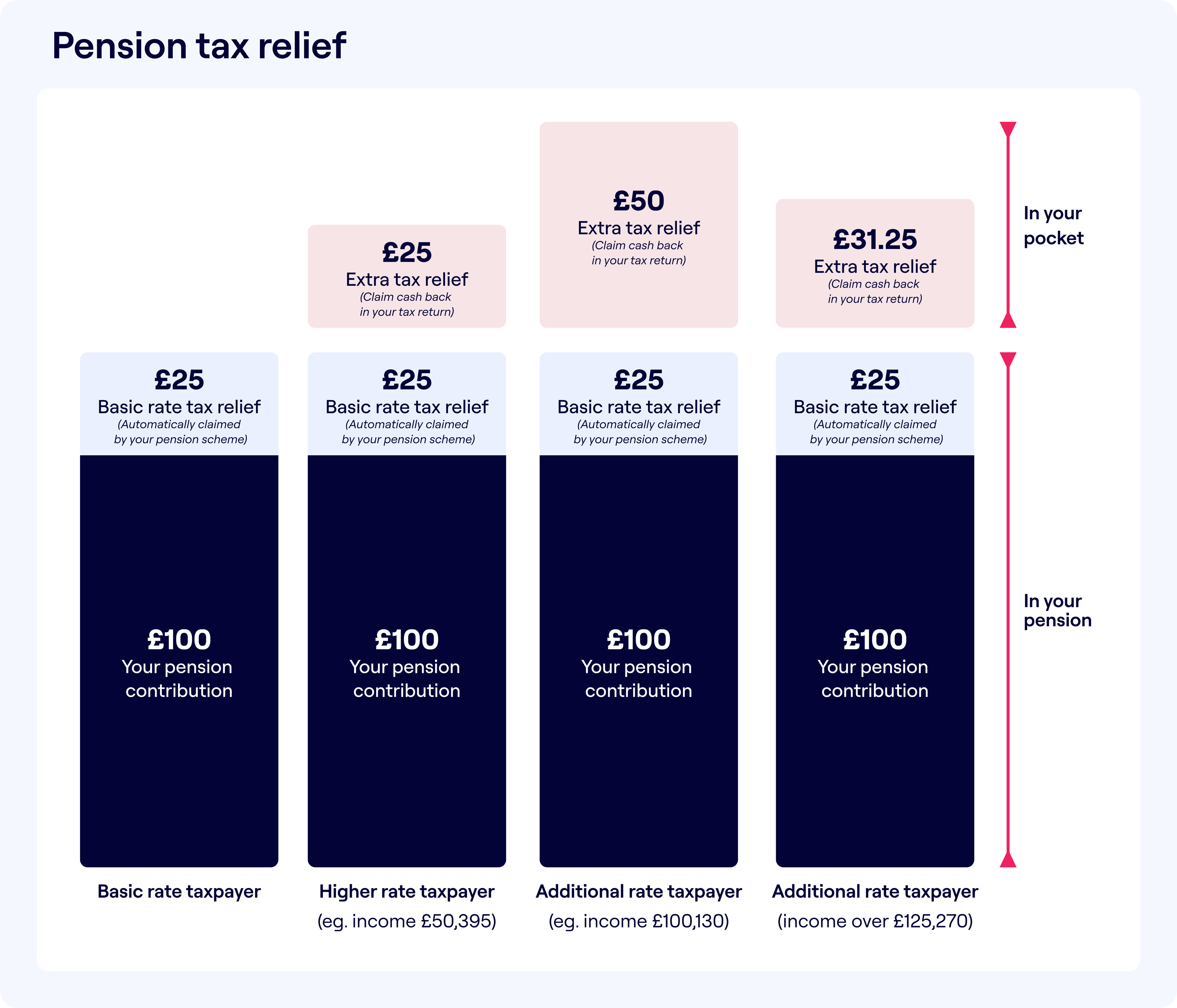

How pension tax relief Works

Tax year end pensions planning is all about maximising the tax relief available:

Basic rate taxpayers: Every £1,000 you contribute gets a £250 government top-up and you don’t need to claim anything back yourself.

Higher or additional rate taxpayers: You can claim even more tax back via your Self Assessment as long as the contribution hits your pension before the pension tax year ends.

If you’re a basic rate taxpayer

- You pay £1,000 into your pension

- The government adds £250

- Your pension receives £1,250 total

You don’t need to claim anything – we do it automatically for you.

If you’re a higher or additional rate taxpayer

- You get the same 25% pension top-up

- Plus the option to claim more tax back in cash via HMRC

This extra relief can be worth thousands, but it’s only available if the contribution is made before the tax year ends.

👉 If you want to understand exactly how this works, we explain it clearly in our Pension tax relief explained guide.

Self-employed? This is one of the most efficient moves you can make

If you’re self-employed, a pension contribution before tax year end can be one of the simplest ways to cut your tax bill. You can contribute:

- Up to £60,000, or

- 100% of your annual income (whichever is lower)

And you’ll still benefit from the 25% government top-up. That means money that would otherwise be lost to tax is instead:

- Working for you

- Invested for your future

- Fully under your control

The key thing to remember is that the £60,000 limit applies across all your pensions combined, not per account.

👉 Full details here: How much can self-employed people pay into a pension?

Limited company directors: A smarter way to use profits

If you run a limited company, paying into a pension before tax year end is often more tax-efficient than taking money as salary or dividends. Here’s why directors often choose pensions:

- Contributions are treated as a business expense

- They reduce your taxable profit

- Corporation tax is currently 19-25%, depending on profits

- Pension contributions are not subject to National Insurance or dividend tax

In simple terms: Putting company profits into a pension can save you up to 25p in tax for every £1 contributed. That’s why many directors use pensions deliberately as part of their year-end planning.

👉 Learn more here: How much can a company contribute to a director’s pension?

Why acting before tax year end matters

This is the part many people underestimate. Once the tax year ends:

- Unused allowances can’t always be recovered

- Tax relief opportunities expire

- You may end up paying tax you didn’t need to

Acting now means:

- Private savers lock in a 25% government boost that we arrange for you.

- Higher earners can claim even more back in your tax return - but you need to make that payment before the end of the tax year!

- Business owners using pension contributions to reduce your profit, and therefore, your corporation tax.

If you’re already planning to save for the future, doing it before the deadline is usually the smarter move.

Pension contribution cut-off dates – don’t leave it too late

The official tax year ends on 5th April, but pension contributions don’t always work right up to that deadline.

Most pension providers set their own processing cut-off dates to make sure payments have time to clear and be allocated correctly. That means if you wait until the last minute, your contribution could end up counting towards the next tax year instead.

Before the tax year ends, it’s worth checking:

- Your pension provider’s contribution cut-off date

- Whether contributions need to be received as cleared funds, not just paid

- Extra time needed for bank transfers, weekends, or one-off lump sums

Missing a provider’s cut-off, even by a day, can mean losing valuable tax relief for this year, with no way to claim it back later.

If you’re planning a top-up, acting a little earlier gives you peace of mind that your contribution will count for the current tax year.

A simple step that can make a big difference

You don’t need to overhaul your finances or make a long-term commitment today. For many people, tax year end is simply about:

- Reviewing what they’ve already saved

- Deciding whether a one-off top-up makes sense

- Making sure they’re not missing an obvious win

Contributing to your pension now isn’t just about retirement – it’s about keeping more of your money working for you.

Take a moment to review your pension before the tax year ends.

It’s a small action today that your future self will genuinely thank you for.

Act Now to Make the Most of Tax Year End Pensions

Here’s what to prioritise before the tax year ends:

- Review your total pension contributions, ensure they are sufficient to take full advantage of your annual allowance.

- Check the pension contribution cut off date with your provider, many require cleared funds before the scheme’s processing deadline to count for this tax year.

- Consider carrying forward unused allowances from previous tax years if you want to make larger contributions.

Missing the official pension tax year end cut-off could mean losing valuable tax relief that you can’t reclaim once the year closes.

Finally:

Tax year end pensions planning isn’t just about saving for retirement, it’s about keeping more of your money working for you today. The earlier you review your pension position and confirm the pension contribution cut off date, the better your chances of claiming every bit of tax relief you’re entitled to before the pension tax year ends.

A Penfold pension helps you keep more of what you earn and secure your financial future. Learn more about our award-winning pension today.

Murray Humphrey

Penfold