How a better pension can tackle the cost of living crisis

- By

- Murray Humphrey

At a time of rising prices, it’s more important than ever to ensure you’re not blind to money leaking out of your business unnecessarily.

But that’s exactly what could be happening to companies that don’t have a decent pension offering. Don’t believe us? Read on and reap the reward of saving thousands of pounds.

Keep your best people – and save a big chunk of change

Rare are the people that stay with one company forever. As lifestyles change, people will move for more money that pays for a bigger house for a growing family, or better conditions, or because they want to move out of one area of work and into another.

Although certain aspects of staff leaving are uncontrollable, there are definitely some things companies can do to limit the average cost of losing an employee, which is around £30,000, according to Oxford Economics and Unum.

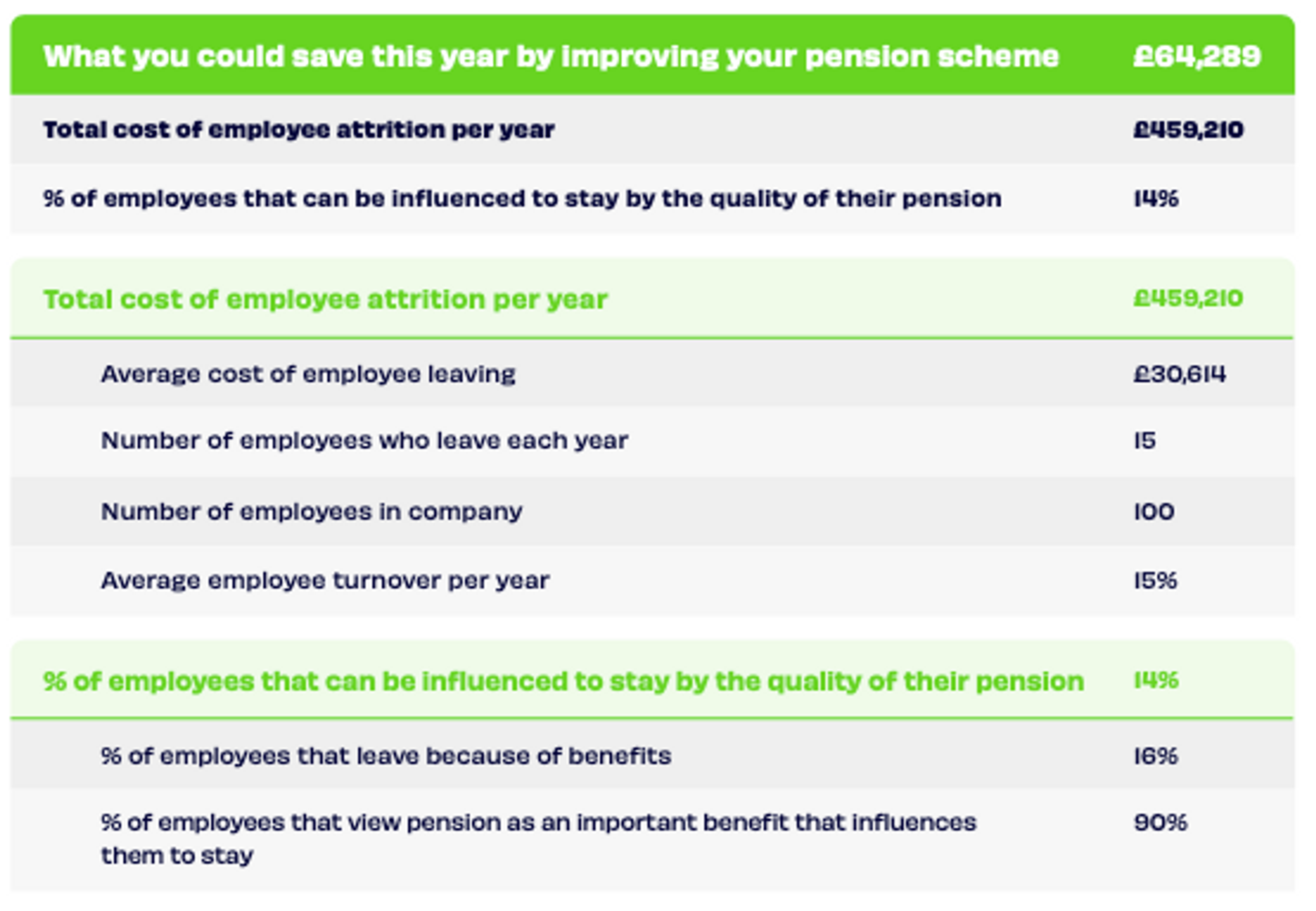

In fact a company with 100 employees could save up to £65,000 per year with the right pension scheme. And here’s why: in a 2022 survey of 200 HR leaders and 2,000 employees in the UK conducted last year by the tech company Lattice, 14% of them said they left their employer for better benefits. You can find more information about this in our employee retention guide.

Offering a better pension plan can increase employee loyalty as it shows that the company cares about its employees' long-term financial wellbeing. And If they can be tempted to stay, a lot of money can be saved. The table below shows our workings on this, based on a company with 100 employees.

Pick a pension making finances user friendly

Giving everyone a pay rise isn't the only solution to helping your employees with the cost of living crisis.

Companies have to provide employees with a pension, so why not choose one that offers financial wellbeing workshops, education programmes and a tool that gives a clearer picture of retirement income?

People have been put off engaging with their pension by impenetrable jargon and outdated products and Penfold is on a mission to change this. Our app makes it easy to forecast retirement income, combine pensions and top up when there’s some spare cash.

We also love to offer workshops and programmes to help employees better understand their finances, along with tips on how they can save more for their future.

Time is money: don’t lose either!

You know how precious your own time is. At work there’s a lot to do and only so many hours to do it in. The same goes for your employees.

They’re just like you, trying to do their job whilst juggling life admin – getting calls from school when their child is unwell, checking in with ageing parents and taking calls from partners delayed by the traffic.

The last thing they – or you – need is to be listening to call waiting music for half an hour when something goes wrong with their pension before being passed around departments when someone eventually picks up.

That’s not us. Our workplace pension clients get a dedicated account manager that you’ll know the name of and can contact whenever you need to.

Your employees will already be saving time managing their pension because our phone app gives them all the tools they need to manage their pension.

But if they ever do need to talk to us, we provide friendly human beings and not bots. All of which means you – and they – can get on with your job, with no productivity time lost to bad customer service.

Leverage salary sacrifice: the tax hack that gives back

With the cost of living meaning budgets are presently squeezed, taking advantage of a government approved tax hack can help both you and your employees save money. With salary sacrifice, employees can choose to lower their annual salary and pay the difference directly into their pension pot.

If they’re earning less it means they owe less National Insurance (NI), one of the two taxes that everyone sees taken from their salary. And if they are paying less tax, their take home pay will be more.

Every company also pays NI proportionate to their staff salary bill. If salaries are reduced, then the NI bill is also reduced. Based on an average salary of £50,000, a company with 100 employees could save £34,500 in annual NI savings. Read more about how Penfold can help you save money with salary sacrifice.

With investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice and past performance is not a reliable indicator of future performance.

Murray Humphrey

Penfold