How to turn your pension scheme into an employee retention tool

Boosting employee retention with a better workplace pension.

A Note from our Founders

Pete, Stuart & Chris - Penfold Co-Founders:

"As founders of a fast-growing company, we know how important it is to make sure employees stick around. Scale-ups like Penfold rely disproportionately on individual talent, so losing a key employee can mean that we take a few steps back from hitting our company goals.

But can pensions really improve retention? We know they do. Employees leave their role for a number of reasons: some reasons you can’t control, but most you can. Pensions are the benefit that most influences employees to stay in their roles, but their value has been long overlooked by People departments.

With this guide, we’ll clarify the link between your workplace pension scheme and your ability to retain employees, and show you how to introduce a pension scheme that your employees will love."

Join businesses providing great pension experiences for thousands of employees. Book a demo today.

Is your pension scheme an employee retention tool?

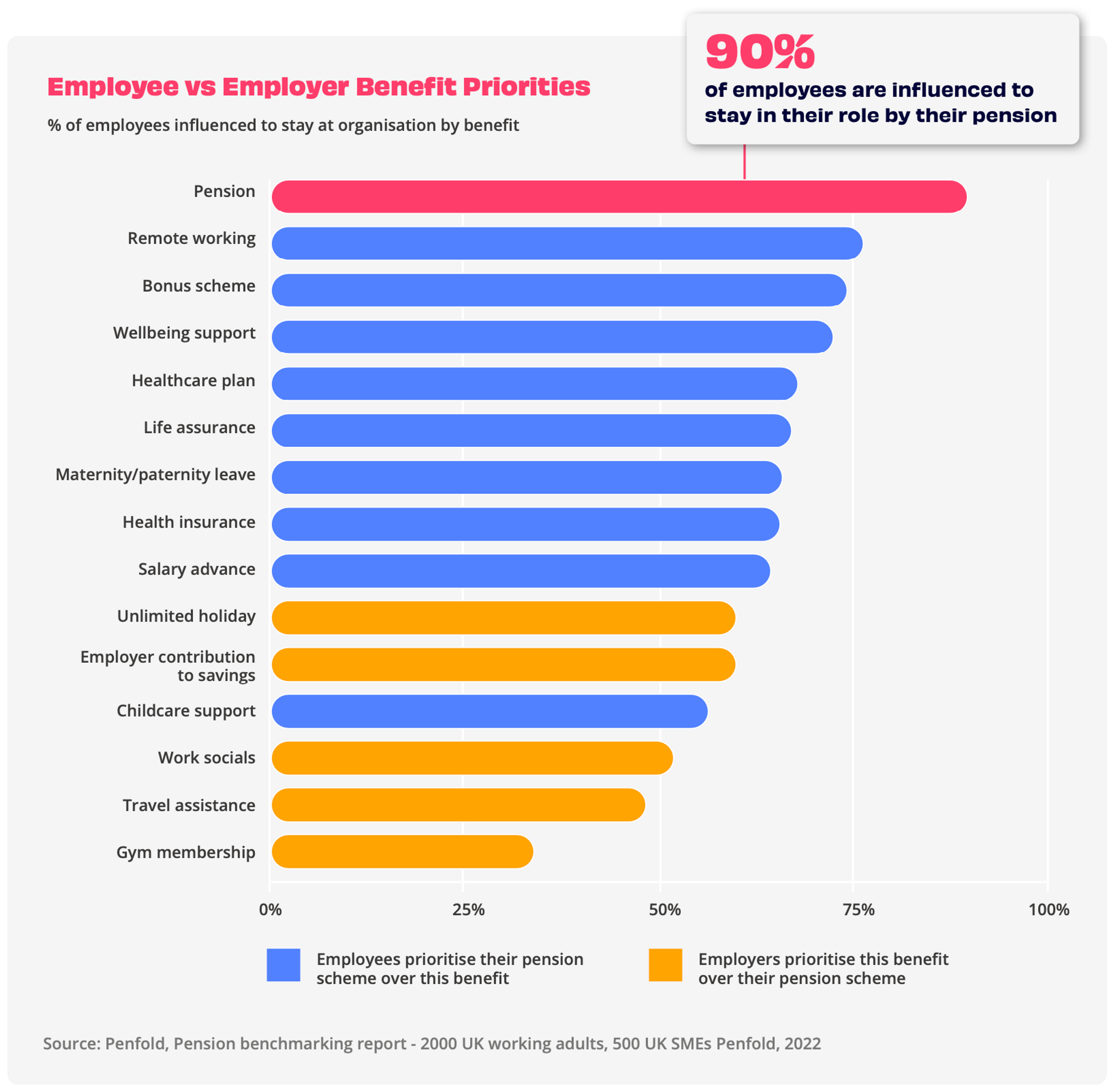

Over the past ten years, we’ve seen employers overlook high-quality pension schemes in favour of literally every other benefit, from work socials to travel assistance.

However, recent data shows they may have been misguided: pensions are the benefit employees most frequently report as an important influence on their decision to stay in their role (90%). That’s far ahead of the suite of benefits employers typically prioritise ahead of pensions, including travel assistance (59% ranked this above pensions), work socials (56% ranked this above pensions) and salary advance (50% ranked this above pensions).

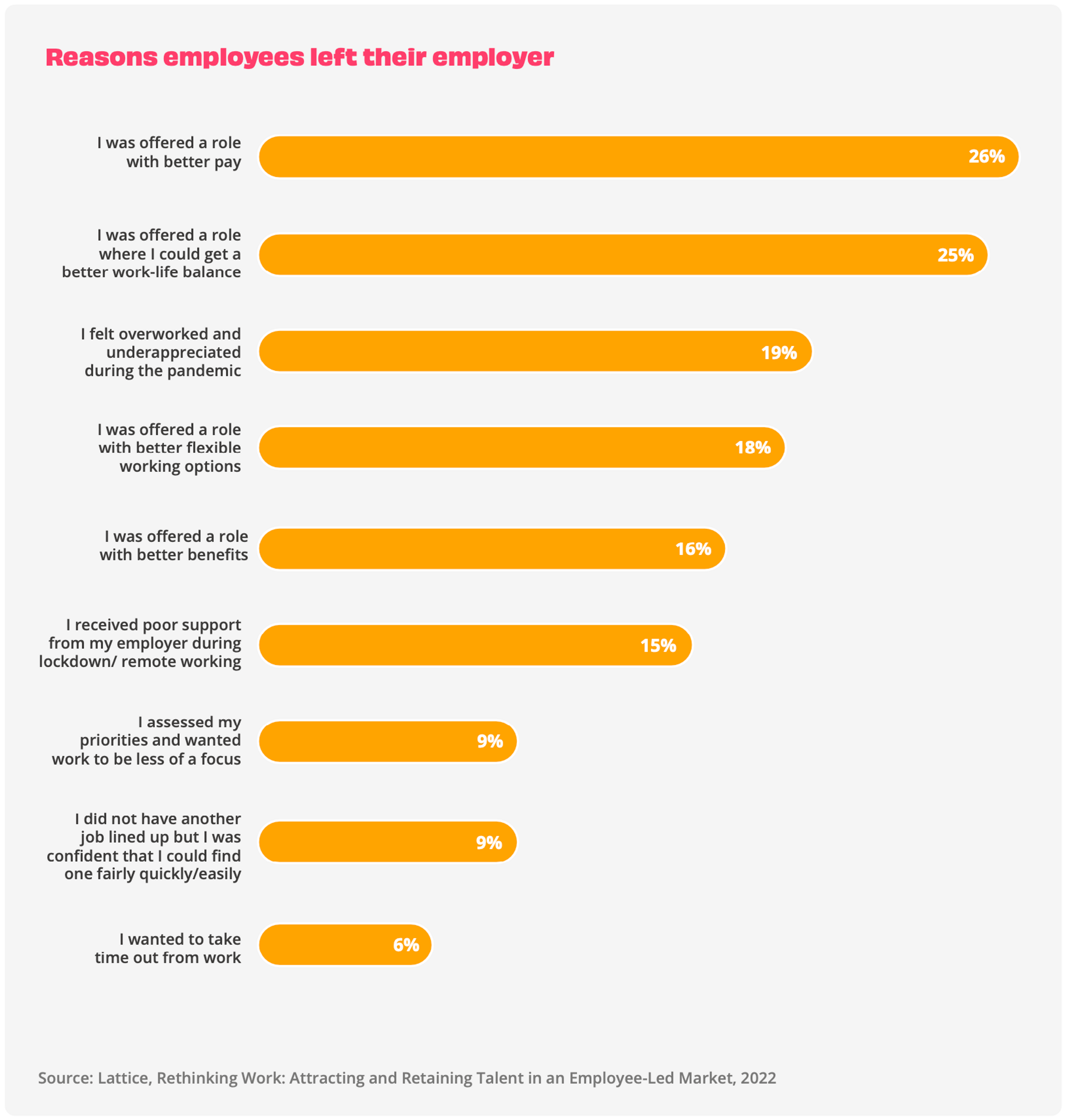

Now consider that demand for better benefits ranks #5 among all reasons employees leave their workplace, affecting 16% of employees. Only pay, work-life balance, under appreciation at work, and flexible working options were more powerful motivators to leave a company.

More than ever, employees are thinking about securing a healthy, long- term financial future

As the UK’s cost of living crisis continues, the importance of pension plans to retaining employees will only rise. More than ever, employees are thinking about securing a healthy, long-term financial future, and are less likely to be wooed by softer benefits.

That presents a big opportunity for forward-thinking employers. With existing employee expectations of pensions so low, and its influence on retention high, just how many more employees could you retain if your pension was as good as it could be?

Pensions and Employee Retention: What’s the opportunity?

What the stats say

Let’s start with a stat that you’re probably already painfully aware of: the average cost of losing an employee is around £30,000, according to Oxford Economics and Unum. That includes the lost productivity from their departure, and the cost of hiring and getting their replacement up to speed. In today’s economic climate, avoiding those costs has made it to the top of your agenda (if they weren’t there already).

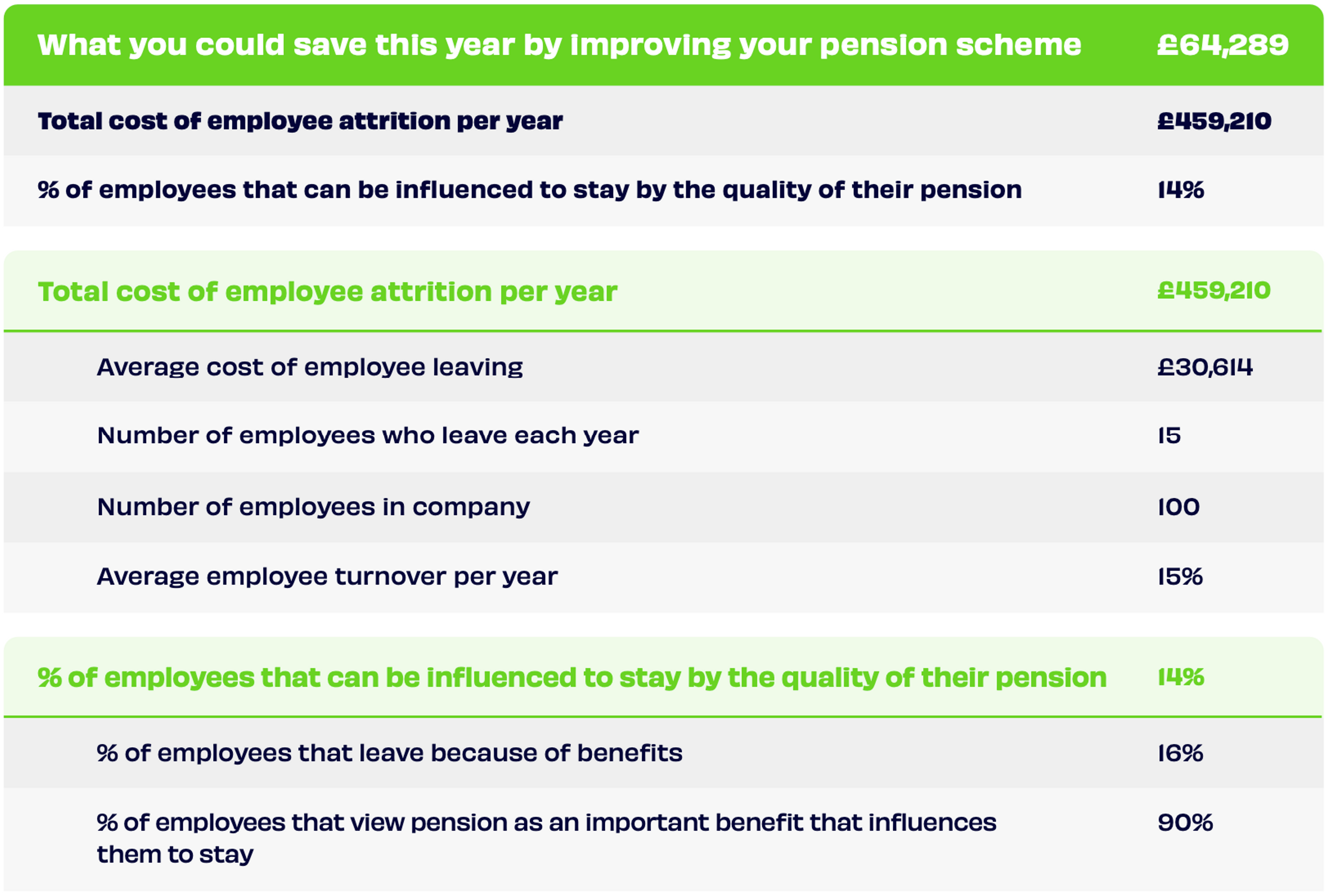

Now let’s apply what we know about pensions’ influence on retention to discover the opportunity cost of underinvesting in your pension scheme.

By making your pension scheme a good experience for all employees, a business of 100 people stands to save up to £65,000. A larger business could save much more.

But for growing businesses, the hidden cost of losing a key, revenue-contributing employee is far greater. Despite everyone’s best efforts to organise a smooth handover, some elements often leave with the employee (such as crucial skills, processes, and drive) — and sometimes they never come back. That puts the brakes on company growth, and occasionally the consequences are worse... How much revenue could your business forfeit by losing a key employee?

What your employees think

Very few pension providers do a good job of giving employees what they need from their pension: flexibility and transparency. Why? Perhaps we’ve all come to expect bog-standard plans, so providers have had little incentive to deliver anything else.

If you’re a proactive people leader, this is good news! Here’s a straightforward opportunity to offer your employees what they want: a pension scheme that’s a huge improvement on what’s come before.

You’ll communicate a clear message to employees: “we’re thinking about your long- term future because we see you as a long-term partner”. In the same way engagement surveys say “we’re listening” and health insurance says “we’ll support your family’s physical and mental health”, pension schemes demonstrate that you’re prepared to support their longer-term financial wellbeing.

This is a key part of a halo effect whereby employees feel well looked after, and become less motivated to seek job opportunities elsewhere. That counts more than ever right as the cost of living rises. In 2022, our survey found that 43% of UK employees felt very worried about money, and 53% believed their employer isn’t doing enough to support their financial wellbeing.*

As many employers (who face economic challenges of their own) struggle to offer employees pay increases, other financial benefits become more important. Flexible pension plans, salary sacrifice options, and improved financial education all support employees’ financial wellbeing and encourage them to stay at your organisation.

Step 1: Identify the benefits to your business

When was the last time you looked at your pensions package? As a legally obligated benefit, by providing any old pension, your organisation might feel as though they’ve already ticked that box. Pension scheme, done!

Instead, you may have worked on building out new employee wellbeing initiatives, and that’s great!

That means you’re probably already well aware of the wave of employee-friendly HR tools that make sharing feedback, booking time off, or accessing perks a total pleasure.

With those tools in place - and the bar well and truly raised - let’s take a look at the benefits that come with revamping your pension scheme:

- Communication: Despite being employees’ most important benefit, 58% of UK workers do not know the value of their pension pot*, whilst many don’t understand how their salary sacrifice options, or how their pensions work. There has to be a better way!

- Changing priorities: Many organisations have recently shifted focus from hiring to retaining employees. If you’re in the same boat, it’s time to put all of those attractive-on- the-job-description benefits to the test. What do your employees think of them? How many employees actively use them? You’ll probably discover employees now prefer practical benefits, like flexible working and salary sacrifice options.

- Attracting senior hires: If you’re responsible for attracting new hires to a scaling business, you’ll need to land some crucial senior hires. Unlike your first employees, who may be hard- workers at an early stage in their career, senior hires are more likely to scrutinise your pension scheme in more detail.

- ROI: A good pension is not just cost-neutral, it could deliver tangible tax savings to your business. A business of 100 employees could save as much as £34,500 every year in National Insurance contributions with a salary sacrifice scheme. Now we’ve explored what an improved pension scheme has to offer, let’s evaluate your pension provider’s ability to deliver.

Step 2: Assess your current pension provider’s ability to deliver

We’ll help you understand how your pension scheme matches up to the alternatives by looking at these four criteria.

- Contributions: What level of contribution does your organisation offer? Do you match employee contributions? Is there a cap?

- Features & Flexibility: How does your pension work for each employee’s needs? Is it suitable for every stage of life? Does it offer ethical investing?

- Management & Engagement: Is your pension easy to understand and use? How do you help your employees get the most from their pension and plan for their future?

- Fund performance: As fund performance dips in line with market trends, you should look for a provider that comes out strong compared to others within this context.

Step 3: Onboard your employees to the new scheme

Your employees may currently have low expectations of their pension plan or a poor understanding of their options. Onboarding them to a new scheme is your opportunity to wow them with everything their pension can do for them now.

We’ve seen employees of our clients go from having a poor understanding of their pension, to more than 70% of employees making requests to customise or combine their pensions!

Here’s the checklist we use when helping clients onboard employees to their new pension scheme:

- Give your team notice that you’ll be switching provider and the opportunity to ask questions

- Announce the switchover via all relevant comms channels

- The launch announcement should cover the basics, along with the magic of compound interest

- Share logins to the new scheme before the welcome session so your team can prepare questions

- Run more than one welcome session so all team members can attend

- Offer quarterly refresher sessions

And here are some tips from Penfold clients on preparing for a successful pension scheme launch:

“When we need information to land with employees, we always communicate it in three ways. To launch our new pensions scheme, we presented it at our weekly all-hands meeting, we included it in our company newsletter, and we used a dedicated Slack channel to encourage uptake and field questions.“

Sophia Guy-White Co-founder, Generation Home.

“You have to support employees at every stage of awareness. At first we ran a kick-off session that covered the pension basics, then 3 months later we ran a session to introduce salary sacrifice and help people understand the tax benefits.“

Amanda Fernandez Finance Director, Sensat.

Step 4: Build on the scheme’s long-term impact

Now everyone’s on board with their new pension scheme... How do you avoid ‘set and forget’ happening all over again, and ensure employees see the full value of the new options available to them?

This can be a challenge. Pensions are unlikely to be top of mind for all employees, however, all employees still want to feel supported for their longer-term financial future.

There are a number of ways you can encourage employees to stay engaged with their pension, learn more about how their pension works, and develop healthy saving habits.

You may look at the above and think “How on earth am I supposed to get all of that together?” The answer is that you don’t - not by yourself, anyway. Instead, a good pension provider will organise all these comms themselves.

These features help employees get the most from their pension scheme:

- Goal setting encourages employees to think longer-term and put away enough for the future

- Internal comms remind employees they can change contribution levels, funds, or opt for salary sacrifice

- Regular newsletters that show fund performance keep employees up-to-date

- Up-skilling on financial topics via guides, webinars and Q&As go a long way to improve how employees approach their longer-term financial future

Conclusion

Of all the reasons businesses fail, two of the biggest fall on the shoulders of the people department: not being able to hire the right people, and not being able to keep the right people.

So why, then, have people departments ignored employees’ self-reported ‘most important benefit’ - the pension scheme - for so long?

We think it’s because everyone has been asleep at the wheel. Employees, who became used to poor pensions, didn’t know they had options. Meanwhile, employers looked to pad out job descriptions in the race for talent, and overlooked the influence of their pension scheme.

However, in the current climate, employers’ focus has moved from acquisition to retention, and the potential of pensions to retain the best people is finally being realised by forward- thinking people leaders.

If your organisation invests in your employees’ long-term future, then your employees will be more likely to invest back in your organisation for the long-term.

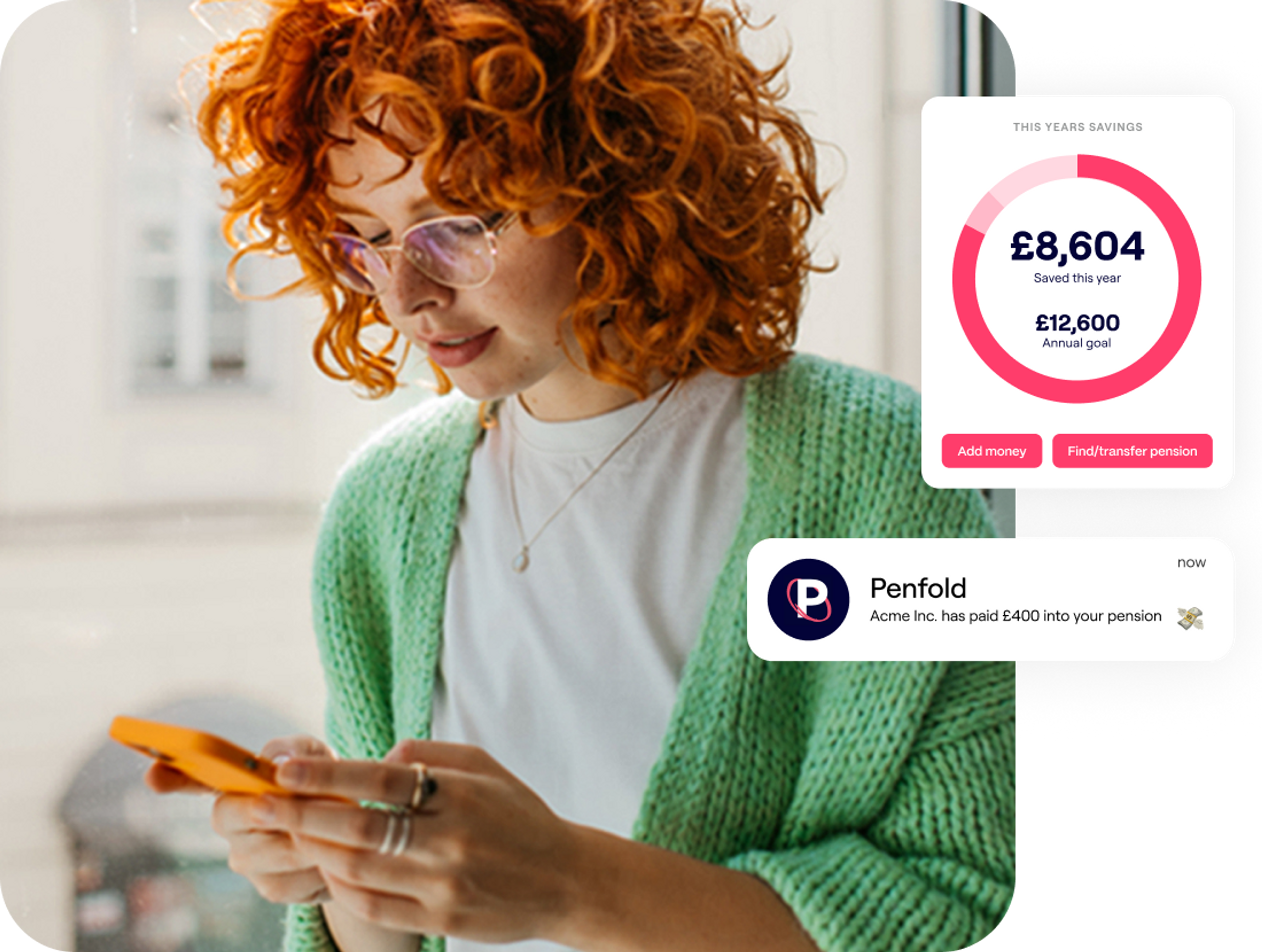

About Penfold

Penfold is the award-winning workplace pension provider for forward-thinking businesses who want an unbeatable employee experience. We’ve rebuilt the workplace pension experience from scratch - creating an easy, accessible and engaging pension scheme that will help make your business a great place to work.

Want more from your pension scheme? Get in touch today for a free consultation with our pension experts.