Pensions over perks: What employers think vs. what employees want

Discover the unexpected divide between what employers offer and what employees truly value in workplace benefits.

A letter from our founders

"As any high-growth company will attest, the key to scaling your business lies in the strength of your team. Finding the right people and keeping them engaged.

One of the key levers for achieving this is your employee benefits strategy. But just how well do we know what employees want from their employer when it comes to benefits?

Our survey of 2,000 UK working adults and 500 UK small and medium sized enterprises (SMEs) revealed significant discrepancies between how companies and their teams think about the most expensive employee benefit in their package: their workplace pension.

- 90% of employees say their workplace pension influences their decision to change or remain in their job

- Despite this, 50% of employers prioritise other benefits like work socials and gym membership over their pension

The mismatch between how employers and employees think about their pension can be attributed to multiple factors: the introduction of auto-enrolment, the shift away from Final Salary schemes, but also the broad reputation of pensions as a ’boring’ financial asset.

Whatever the underlying causes, the survey results reveal that given how valued pensions are by your employees and how undervalued they are by many SME employers, your workplace pension could be your most under- utilised tool for attracting the best talent and keeping them.

The time has come to bring pensions to the top of the agenda and this report is designed to give you everything you need to transform your scheme into one your employees will value and stick around for.

“The time has come to bring pensions to the top of the agenda.”

Our report ends with an innovative workplace pension ranking system – a simple framework that allows SMEs to easily compare and contrast their schemes against benchmarked industry standards and understand what needs to change to stand out in the market.

For a more granular view of the survey results by industry, location or company size and what you need to stand out from the crowd, please get in touch directly via autoenrolment@getpenfold.com."

Thank you, Pete, Stuart and Chris

A changing workplace

The world of work is changing. It’s about time workplace benefits change too.

Today employers and employees face unprecedented challenges: the introduction of hybrid working, skills shortages and a cost of living crisis eroding real-term salaries.

Employees are more keenly focused on their finances than ever and smes are under pressure to respond.

Employees are facing massive economic uncertainty, with inflation soaring to a 40-year high and interest rates at their highest in over a decade. This, coupled with a revolution in working practices brought about by Covid, means employee benefit strategies need a considerable rethink.

For employers, meanwhile, employee benefits are more vital than ever. The Great Resignation, foreign workers returning home, career changes and increased demand have seen UK vacancies rise to record levels: 1,294,000 in June, according to the Office of National Statistics.

The role of benefits in attracting and retaining staff is now crucial to growth. It’s a particular challenge for the country’s SMEs, which account for about 60% of private sector employment.

Employees are more keenly focused on their finances than ever and SMEs are under pressure to respond.

Pensions in pole position

Whatever the answer to these challenges, pensions will be at its heart. Our research unambiguously shows that workplace pension schemes are the most valued employee benefit – the most important for employees deciding on their future.

Yet our survey also shows widespread uncertainty and confusion surrounding pensions – on all sides. Individuals may appreciate them but, in many cases, don’t understand basic details about their schemes.

Many businesses, meanwhile, fundamentally underestimate their importance. Neither side knows what ‘good’ looks like. Even without the financial difficulties on the horizon, the survey shows the need for more education and better discussions about pensions.

We hope this research will spark and inform conversations that urgently need to happen and help SMEs review and develop their pension schemes so that they deliver for both the business and their employees.

What employees want

Despite competing factors like company culture and work-life balance, salaries and benefits remain critical for recruitment and retention. Little is more likely to prompt employees to switch jobs than an underwhelming set of benefits.

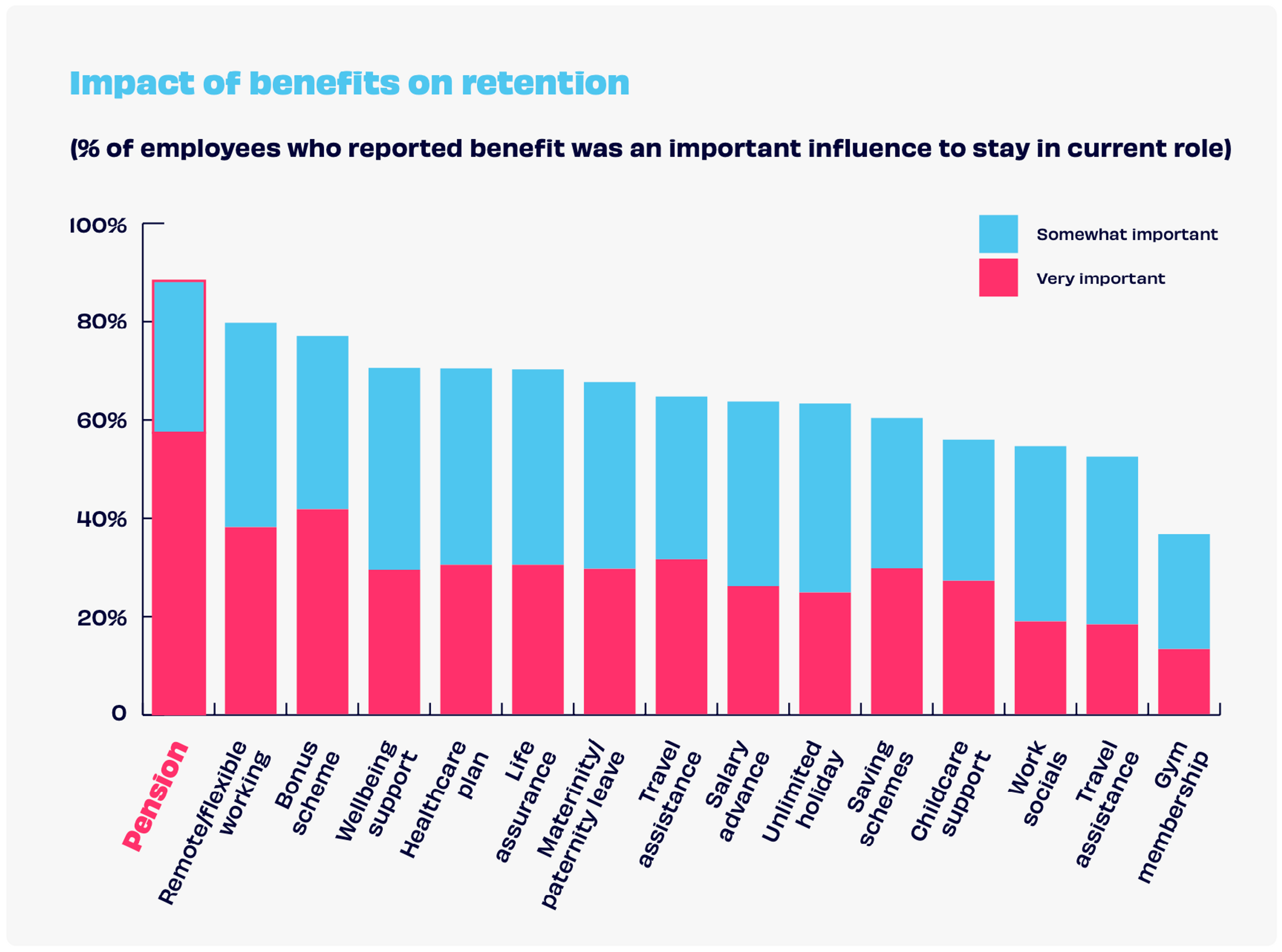

But what benefits are best to attract and keep staff? Our survey of employees is unequivocal: pensions are by far the most valued benefit employers provide. Asked to what extent specific benefits were significant in their decision to remain at their organisation, 90% said their pension was important. Almost six in ten (59%) said it was very important.

No other benefit comes close:

- Two thirds (66%) said generous maternity/paternity leave was important

- The same proportion (66%) said health insurance or life insurance (67%)

- 60% said unlimited holiday

- 56% said childcare support

- Just 34% said gym membership and 52% work socials – victims perhaps of increased working from home, with three quarters (76%) naming remote or flexible working as key.

Our survey of employees is unequivocal: pensions are by far the most valued benefit employers provide.

Even financial benefits like salary advances (65%) and bonus schemes (74%) don’t approach pensions’ appeal. And that’s equally true for those working for businesses with 15 employees as it is for those with 500.

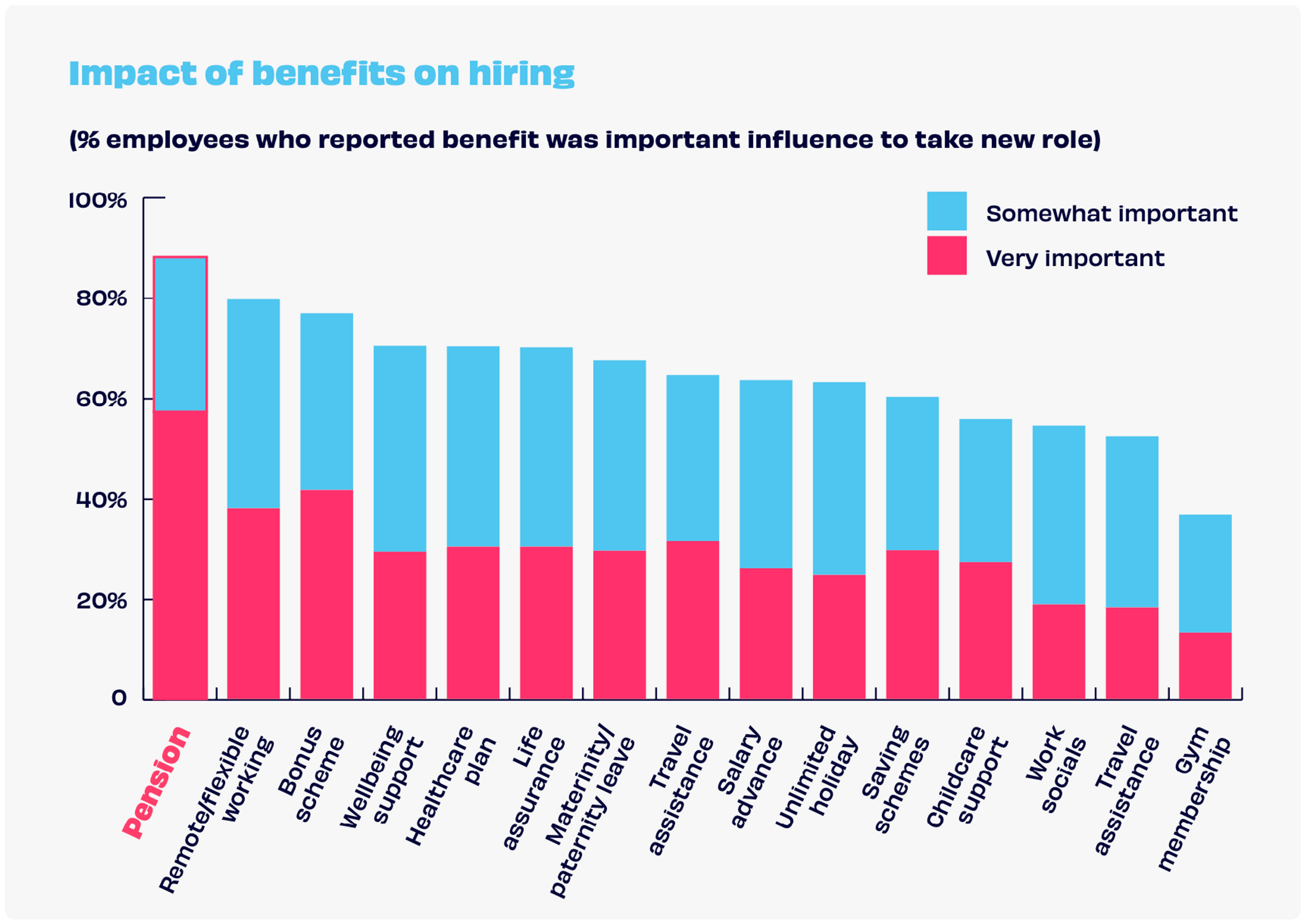

It’s a similar story when it comes to recruitment. Again, among all employees, a combined nine in ten say the pension is either very (57%) or somewhat (31%) important when deciding to join a new company. That puts it well ahead of other benefits.

Even allowing for their greater prevalence – being the only benefit (except maternity/ paternity pay) universally provided – the importance of pensions is difficult to overstate. Among employers, though, they are fundamentally under-appreciated.

Misplaced priorities

The survey of SMEs shows a significant mismatch between employees’ and employers’ views on the importance of different benefits.

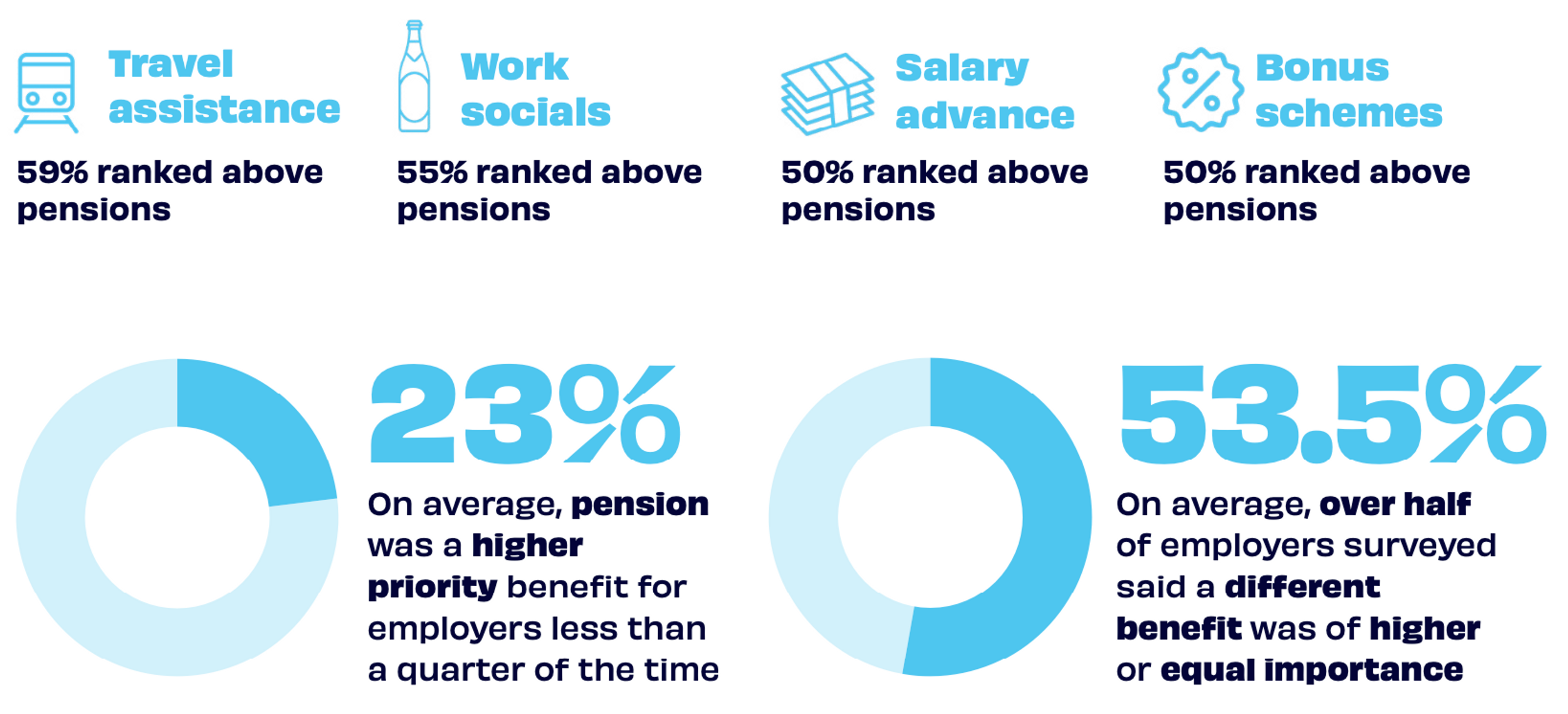

While staff are focused on pensions, half or more of SMEs say they give as much or more priority to a range of other benefits:

- Travel assistance, like season tickets or company cars (59%)

- Work socials (55%)

- Salary advance (50%)

- Bonus schemes (50%)

- ‘Wellbeing support’, such as workshops and therapy (50%)

It was a close run for other benefits too, including gym membership (44%). In fact, more employers ranked gym memberships above pensions (22%) than vice-versa (19%). Unlimited holiday and work socials were more likely to be given a higher priority by employers.

Many employers do value the importance of their pension scheme. 89% said their role in helping employees save for the future was somewhat (46.4%) or very (42.8%) important.

This makes it even more surprising how many ‘soft’ benefits are given a higher priority.

This misalignment is even starker when we consider the relative cost per employee of different benefits. Pensions, by and large, are the most expensive benefit in an average package.

While staff are focused on pensions, half or more of smes say they give as much or more priority to a range of other benefits.

Defining ‘good’

This failure to prioritise pensions has big consequences for the size of employees’ saving pots. Almost half of employees (47%) said their pension contributions were in line with the statutory minimum: just 8% of qualifying earnings (5% from the employee and 3% from the employer). Another one in five (18%) said monthly contributions were 9-10%.

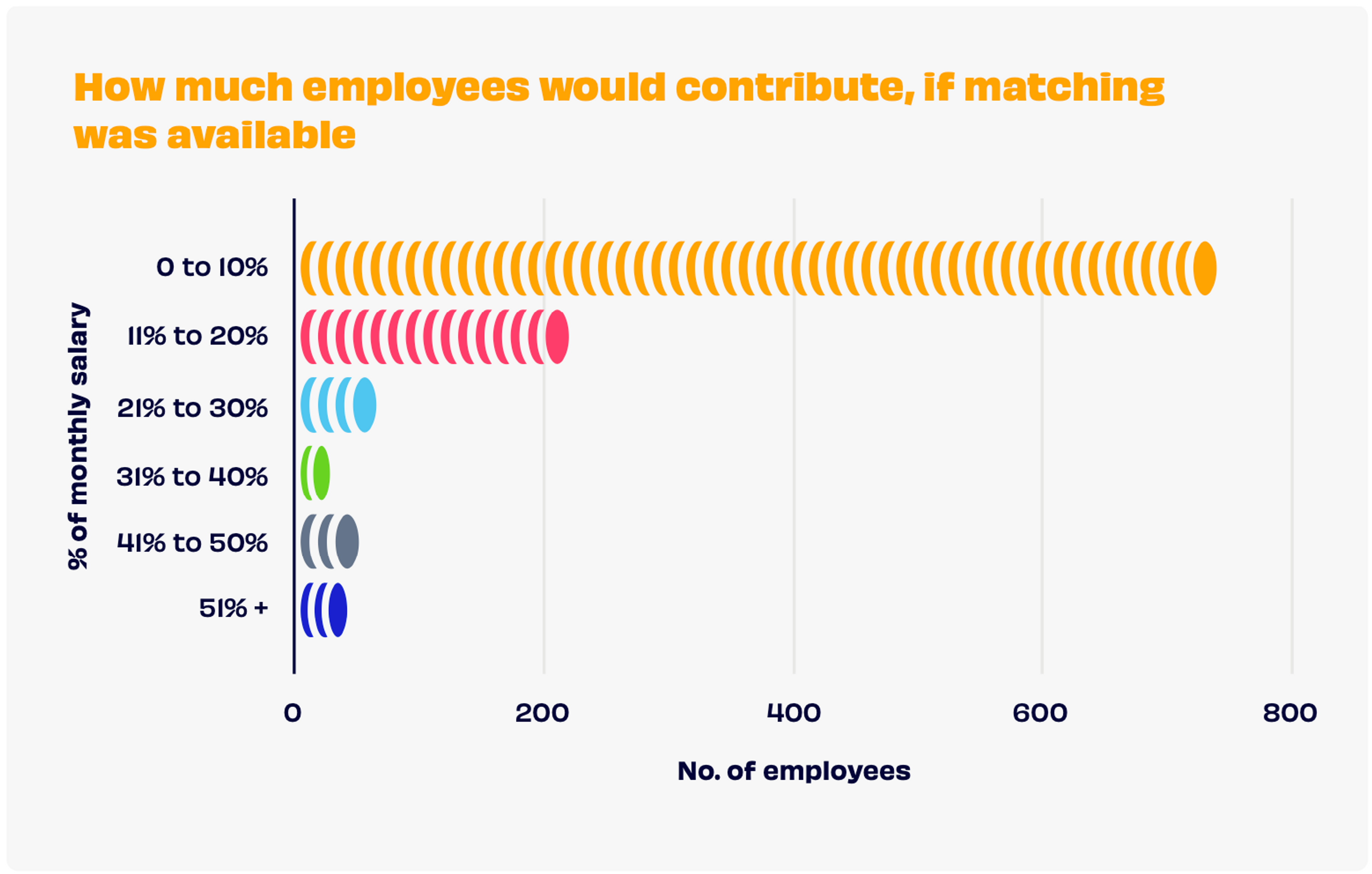

Most would like to put more in though: 53% said that, if their employer matched them, they would increase contributions. Only a quarter (25%) said they wouldn’t.

Some employees want to boost contributions substantially. On average, employees would be willing to contribute 12% of their monthly salary to their pension if their company offered matching.

The majority (71%) said they would add between 0-10%, while one in five (20%) said they would increase their contributions to between 11-20%.

Among those aged 18-24, the average contribution amount employees would commit to if matched by their business was 17%. That fell to 10% for those aged 55-64.

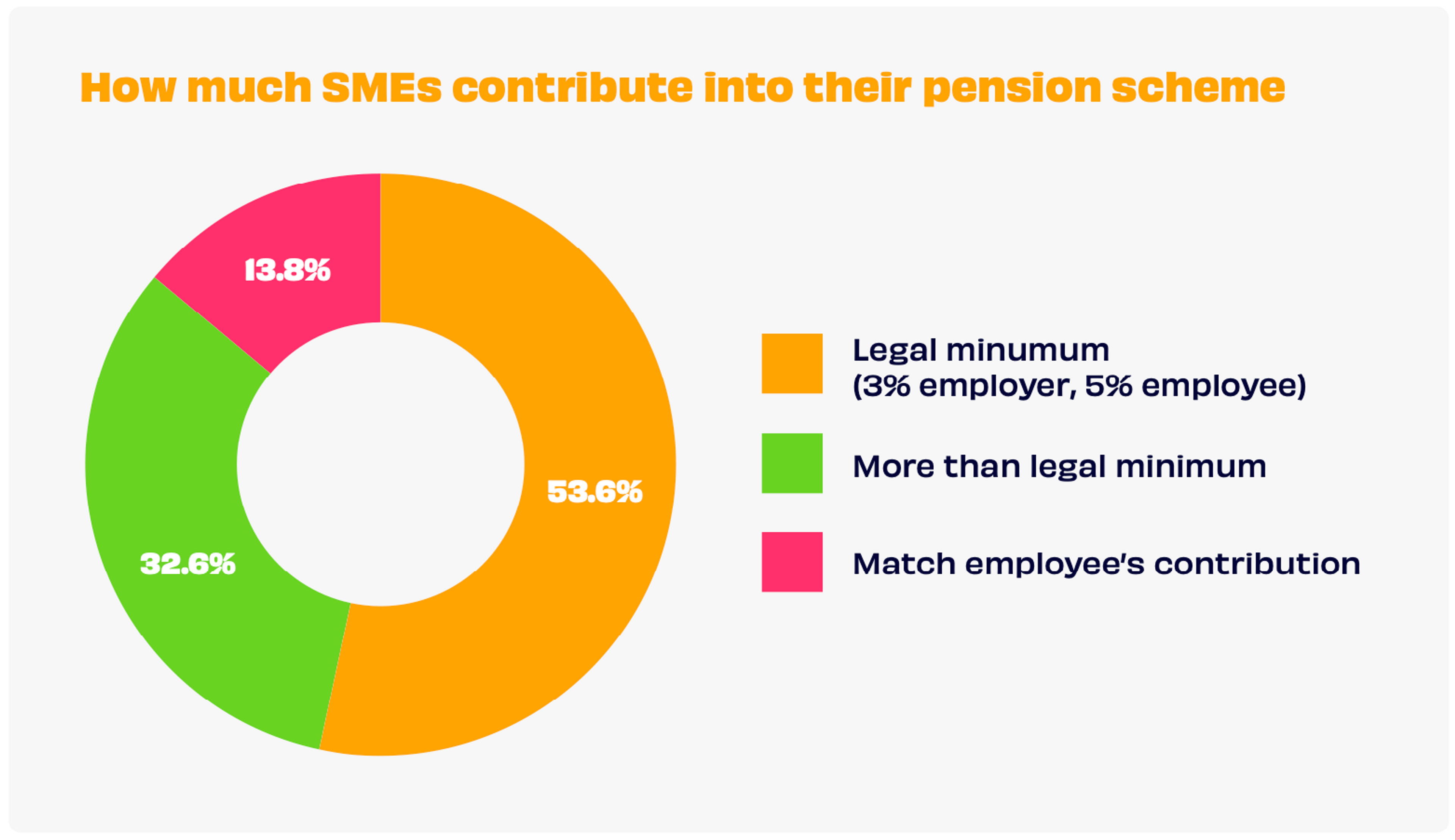

While most employees would welcome matched contributions, few SMEs offer it – just 14%, according to our survey. The majority contribute just the minimum statutory requirement, and 59% do the same for all staff, regardless of seniority.

The employee survey suggests this is likely to be having a detrimental impact on retention. Asked what level of contribution from their employer would positively impact their decision to stay with the business, the average answer from employees was 9.5%. The most common response, given by almost a third (31%), was 8-10%. Only one in twenty (5%) said a pension payment of 3-4% – the most popular SME contribution – would be enough to increase their likelihood of staying put with an employer.

That more employers are not using this lever to boost retention is in part, no doubt, due to cost. Yet only 4% said they could not afford to contribute more than the minimum. More significantly, it reflects that relatively few employers are thinking strategically about how their pension scheme can ladder up to attrition KPIs.

On average, employees want at least 9.5% contributions from their employer in order to positively impact their decision to stay in a job

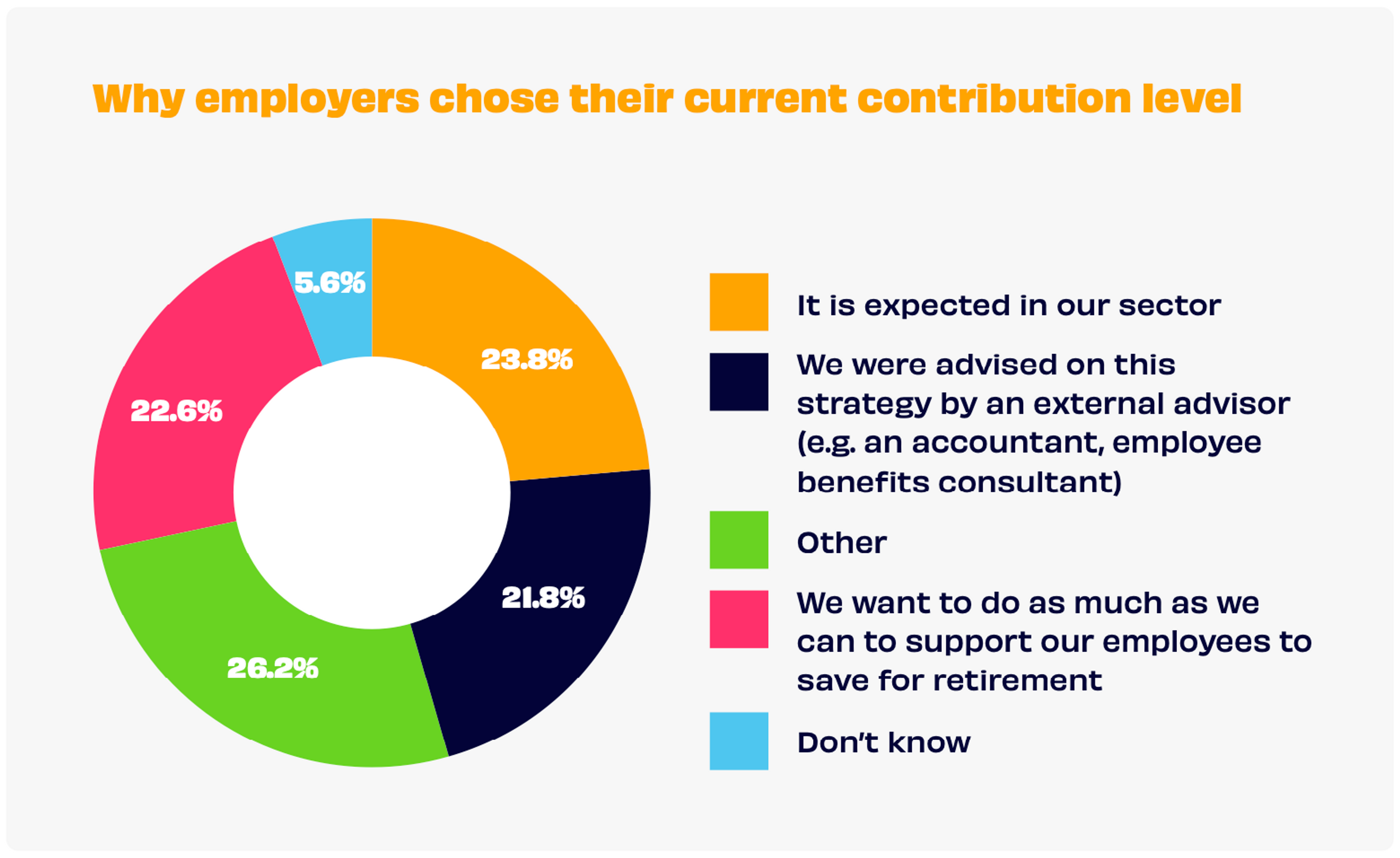

Asked about the reasons behind their organisation’s contribution level, a quarter (24%) of SMEs said it was because it was expected in their sector. A similar proportion (22%) said it reflected the guidance of an adviser, such as an accountant or employee benefits consultant. Just 17% said it was because senior leadership had decided on the level based on their experience.

If many still haven’t found an answer to what makes a good pension, in some cases, it’s because they’ve never even asked the question.

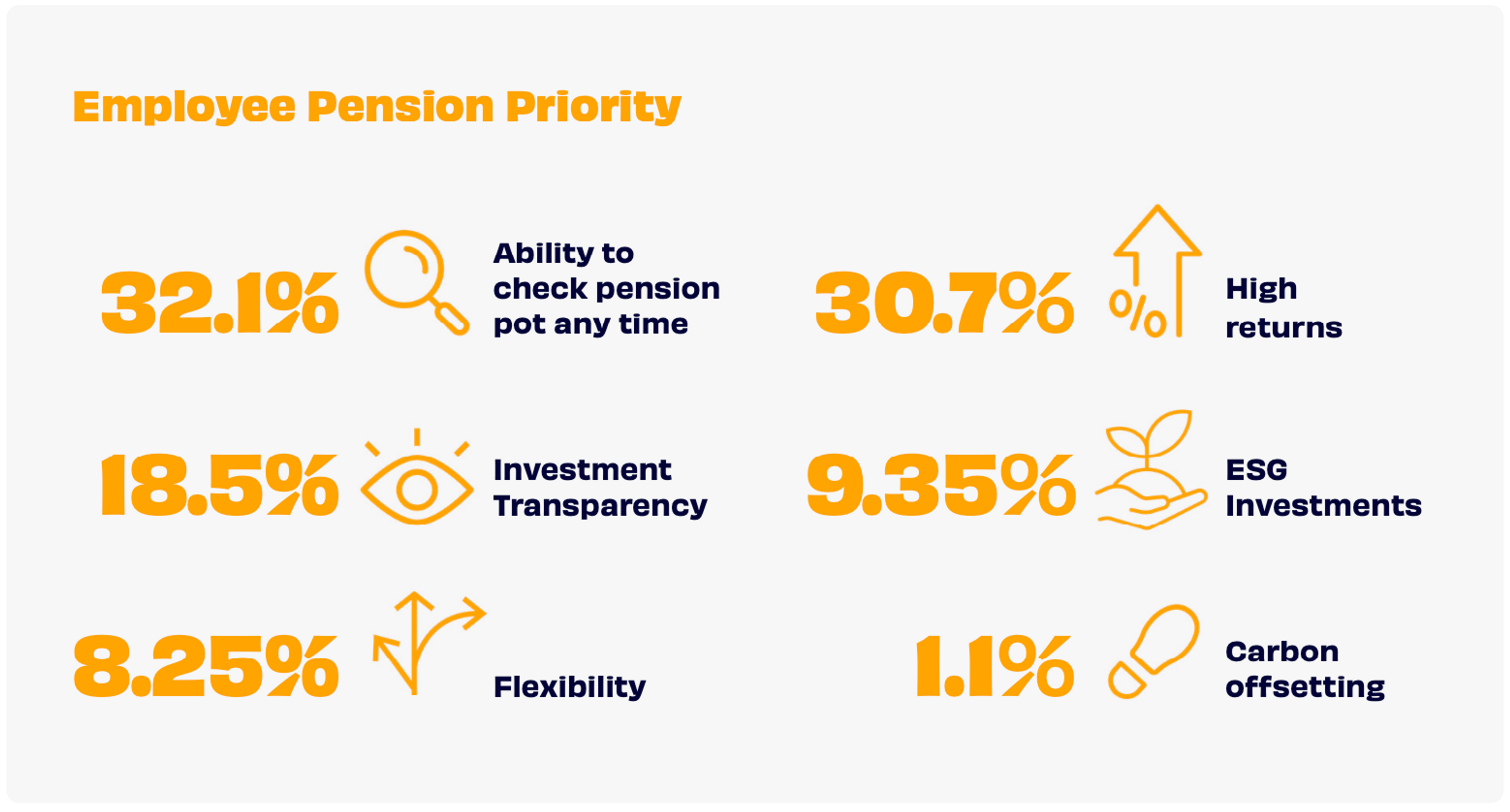

Almost a third (32%) of working- age people say that being able to check their pension pot whenever they want is what they care most about.

Quality and quantity

Finally, while contributions will play a central role in determining a workplace scheme’s attractiveness, there are other ways to set a pension apart. Convenience and visibility are big issues: Almost a third (32%) of working- age people say that being able to check their pension pot whenever they want is what they care most about.

That’s even more than those naming high returns (31%) and, despite much discussion, significantly higher than those who say they care most about their funds being in investments that reflect social, environmental or ethical values (9%). Transparency as to how funds are invested is a critical issue for almost one in five (19%), however.

Overall, the results make it clear that while pensions are a priority for most workers, not all pensions are made equal. There are significant opportunities for employers to differentiate their pensions provision to attract and retain staff.

A learning opportunity

Building a best-in-class pension scheme requires your team to know about it. Unfortunately, another consequence of employers’ decision not to prioritise pensions ahead of other benefits is a widespread lack of knowledge about schemes’ basic details.

- Almost half of employees don’t know where their pension is invested (49%)

- More than a fifth (21%) don’t know how much they and their employer contribute, including 32% of those aged 55-64

- More than half (58%) of people don’t know the current value of their pension pot, including again a larger proportion of those who will soon need it. Just 35% of those aged 55-64 knew the value

- 36% don’t know who their pension provider is

- A quarter (26%) don’t even know what type of pension they have – defined benefit or defined contribution

Partly this is a societal failure. Despite the UK government’s introduction of mandatory workplace pensions and auto-enrolment, state-sponsored publicity and education have proved insufficient at rehabilitating the image of pensions in the nation’s psyche.

Since the introduction of auto-enrolment, employers too, while certainly not to blame, have often overlooked the value of their pension scheme for their team, overlooking the importance of offering supplementary education and support to maximise ROI from their single most expensive benefit.

Many employees will only discover the consequences when they come to retire. More than a third (37%) in the survey said they didn’t know how much they needed to save to retire comfortably. Perhaps more worryingly, almost a quarter (23%) think they only need up to £150,000. At 65, that is likely to generate an income of under £10,000. By contrast, the Pensions and Lifetime Savings Association (PLSA) estimates that a single person to reach a minimum standard of living requires an annual income of £14,400, and for a ‘moderate’ lifestyle, more than double that, at £31,300. Many of today’s employees will face tough economic challenges at the end of their working lives if nothing is done to improve saving habits.

Many employees will only discover the consequences when they come to retire.

Fortunately, our survey revealed that employees are looking for ways to improve these saving habits, and this presents a significant opportunity for employers to step in and add meaningfully to the well- being of their teams. Asked what broader financial tools and resources they would most want from their employers, a majority, unsurprisingly, said more frequent salary reviews or increases (56%). But close to half (44%) said they wanted financial education, such as retirement planning.

It’s good to talk

There is a huge opportunity for employers to better educate and inform workers about pensions. The value employees put on pensions means that, even for employers making the minimum contribution, there is potential for better communication to boost retention and recruitment.

SMEs already communicate with workers about their pensions using a range of methods, including emails, provider portals, websites, letters, and in-person events.

While a wide arsenal of communication should certainly be encouraged, our research clearly highlights that 3 in 4 workers (74%) prefer regular updates via email.

A third of SMEs engage with employees annually, and 31% do so quarterly. Only a minority offer monthly (28%) or weekly (9%) communications.

The scale of confusion regarding pensions generally and employers’ schemes specifically, however, suggests many should revisit the methods, content and frequency of communications. If businesses can better communicate the pension to staff, it is likely both will get more value from it.

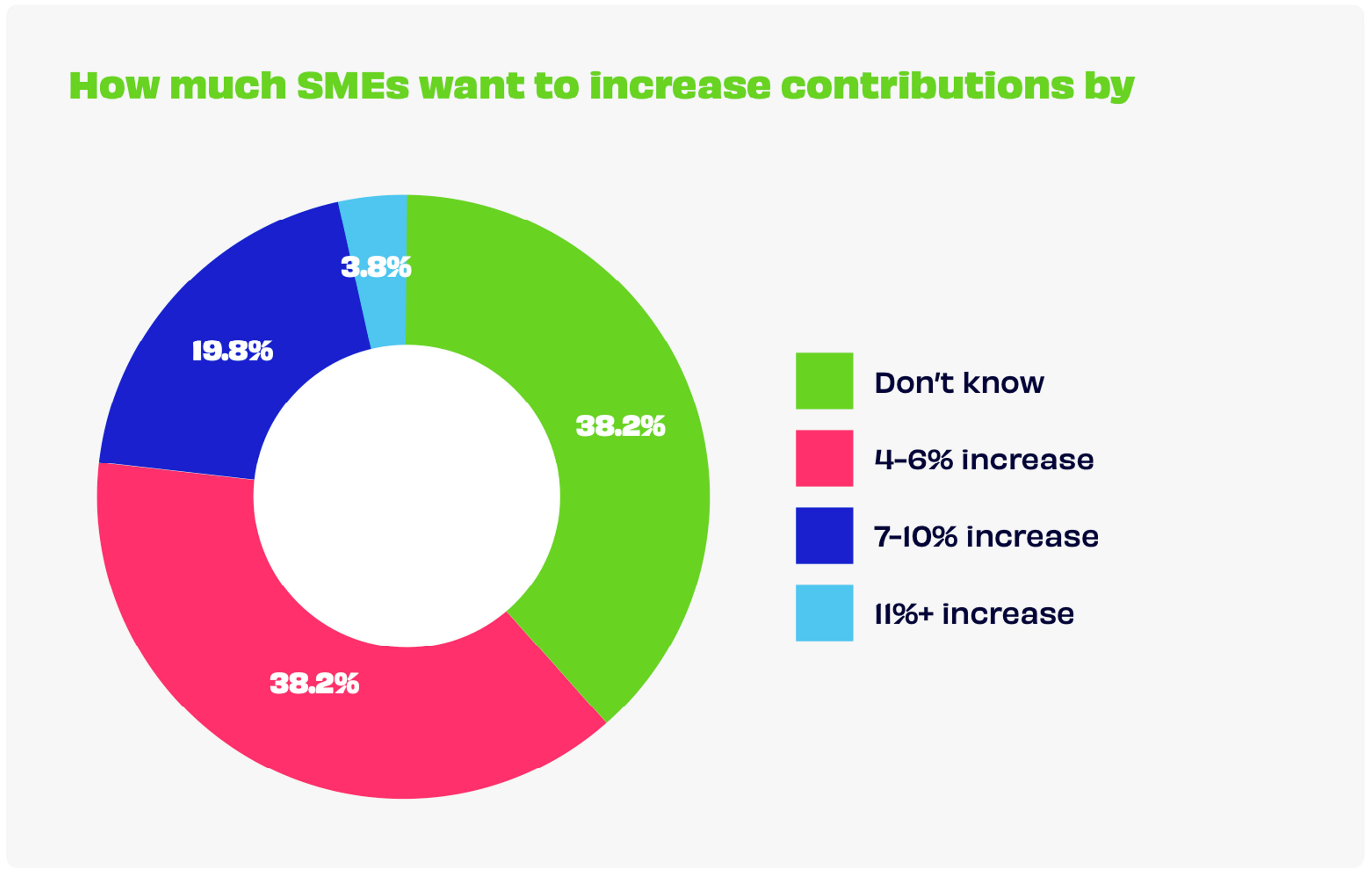

It is overwhelmingly clear that employers do want the best for their staff. Asked for the reasons for the level of their pension contribution, almost a quarter of SMEs said they wanted to do as much as possible to help employees – the second most common answer.

It was also the most common reason (27%) for increasing contributions, with another quarter planning to do so as part of financial well-being initiatives.

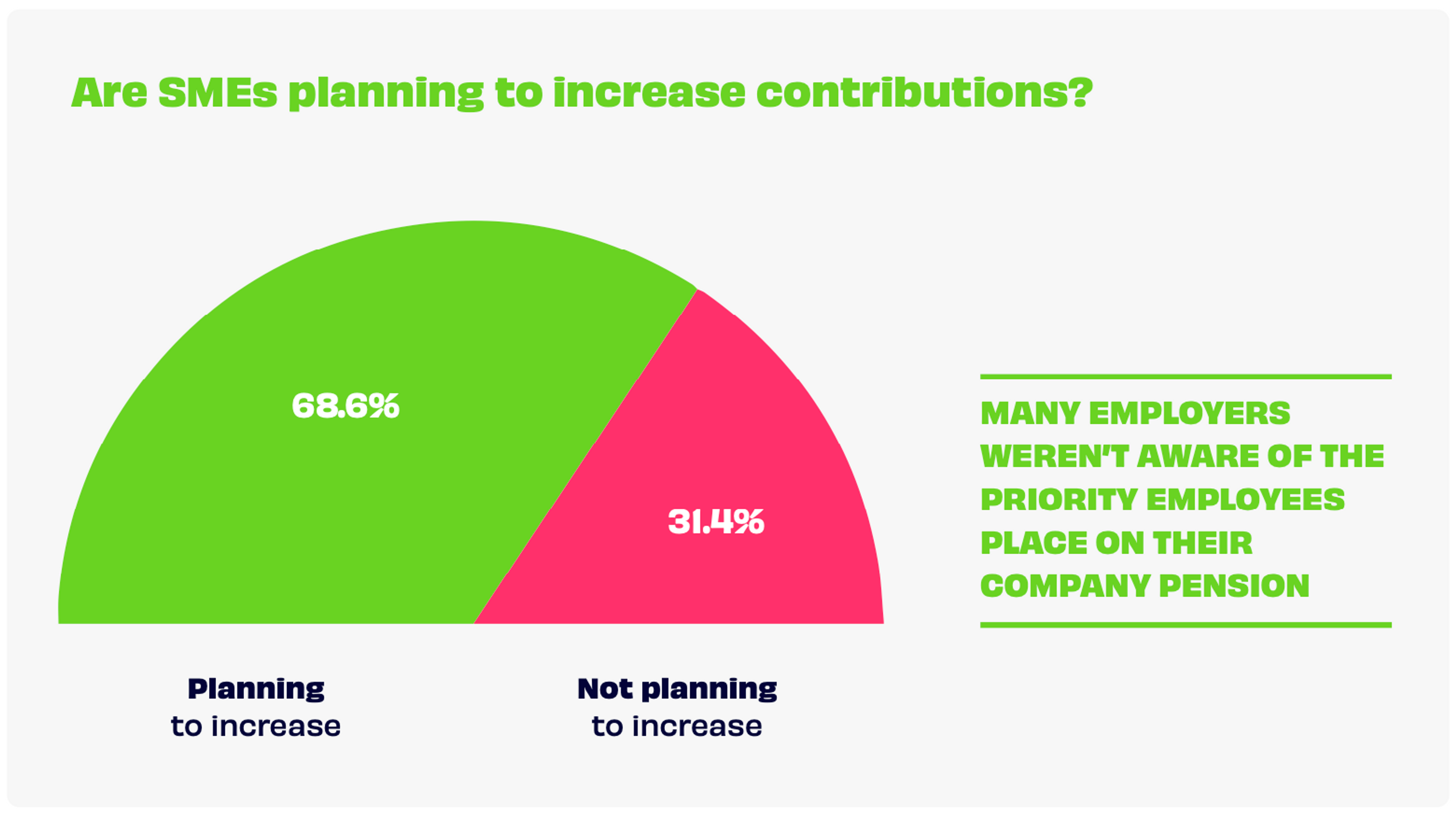

Our research also seems to confirm that many employers weren’t aware of the priority employees place on their company pension when it comes to reviewing their roles. A better pension scheme means better retention and engagement.

Without a clear business case, pensions will not get the time, effort and investment they need. That doesn’t just prevent more effective pensions; it also limits the value both workers and employers draw from the existing offering.

Recommendations

The situation, then, is clear. Employees want more from their pensions and businesses are uniquely positioned to support them.

But where do we go from here? What steps can we take to ensure that:

- Employers are offering a competitive pension scheme

- Employees understand and engage with their pension

Based on our research, Penfold have created a data-backed ranking system for workplace pension schemes in the UK - rating each scheme from Gold to Silver and Bronze.

Highlighting exactly what makes a best-in-class pension scheme offers employers a framework for how they can improve their own offering - helping to attract and retain the best talent for their business.

We also hope that this ranking system will help to bridge the gap between what employees want from a pension and what employers can feasibly provide, helping raise pension engagement across the board.

How they can improve their own offering - helping to attract and retain the best talent for their business.

Ranking a pension scheme

Every workplace pension scheme is different - tailored to the size, scale and priorities of the business that runs it.

Creating a universal ranking system for different pension schemes is then difficult. How can you easily compare the pensions of a 15 person start-up to a 500 employee financial institution?

Our methodology takes a closer look across the scheme as a whole, rather than relying purely on the size of contributions. What do employees really want from their pension scheme and what are SMEs actually offering today?

Broadly, it comes down to three main areas:

- Contributions: What level of contribution does your organisation offer? Do you match employee contributions? Is there a cap?

- Features & Flexibility: How does your pension work for each employee’s needs? Is it suitable for every stage of life? Does it offer ethical investing?

- Management & Engagement: Is your pension easy to understand and use? How do you support your employees to get the most out of their pension and plan for their future?

To help businesses understand what makes an attractive pension scheme, here’s our established three ranks:

- Gold

- Silver

- Bronze

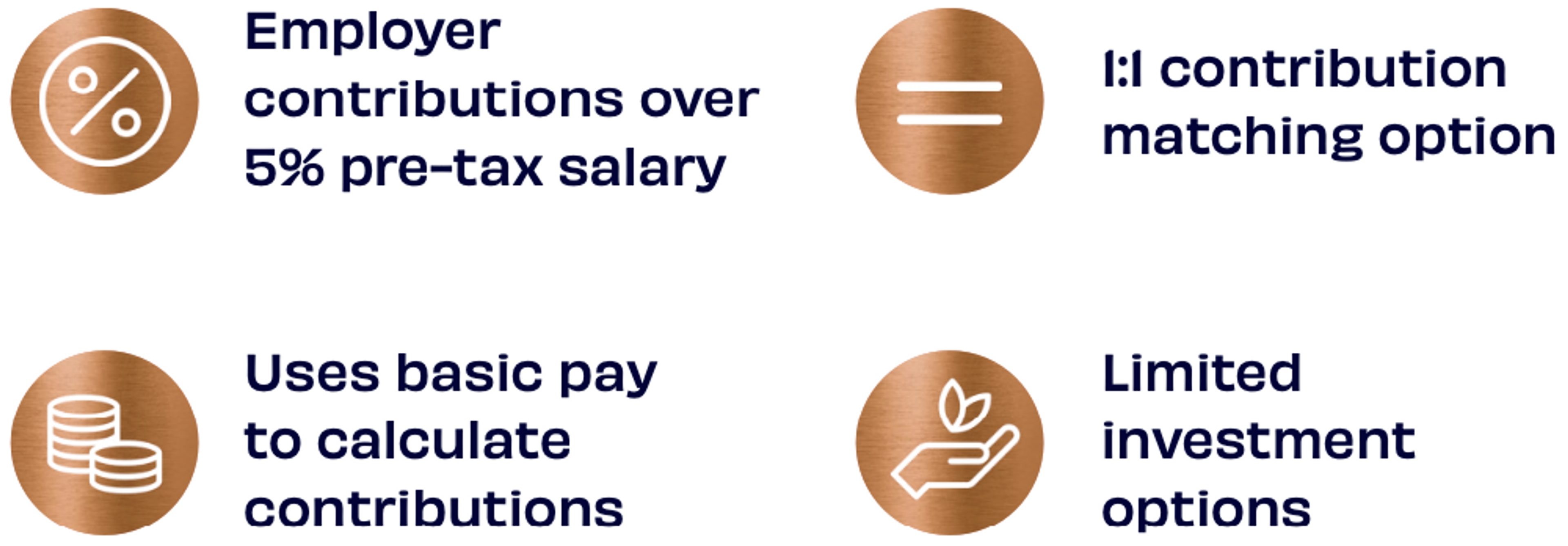

Bronze pension scheme

Bronze means your pension scheme is better than 40% of SMEs and can be used to attract and retain staff. It’s important to note that a Bronze scheme is far above the legal minimum requirement for auto-enrolment. A typical Bronze level scheme might look like this:

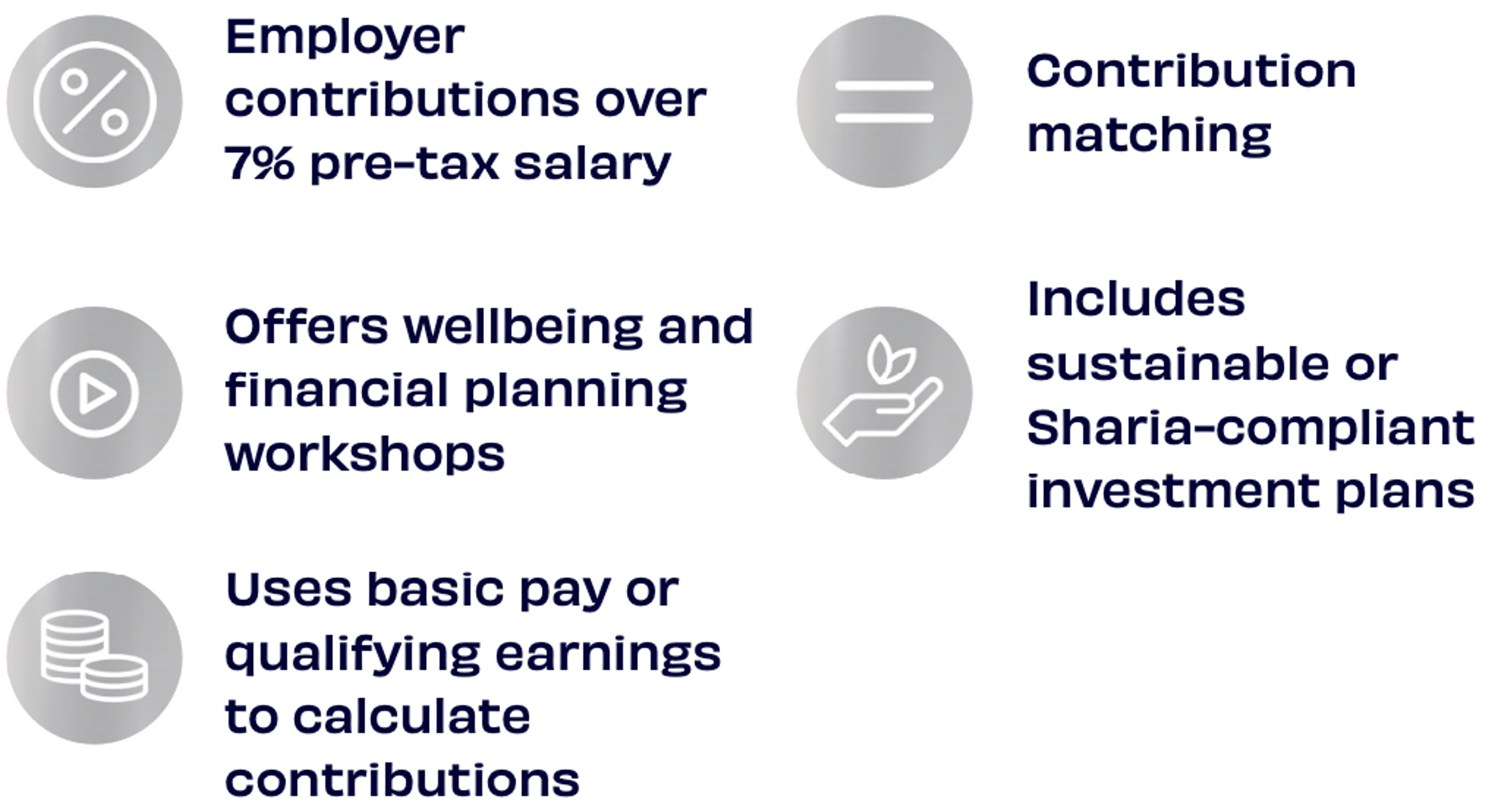

Silver pension scheme

Silver is a very good pension scheme, above 65% of UK SMEs. A typical Silver level scheme might look like this:

Gold pension scheme

Gold is an industry-leading pension scheme that should enable you to attract and retain the very best staff on the market. Your pension scheme will be better than 85% of the pension schemes offered by UK SMEs. A typical Gold level scheme might look like this:

Claim your free pension MOT

Want to know how your pension scheme measures up? Penfold is here to help. Get access to our benchmarked data and unlock bespoke recommendations on how you can build an engaging, cost-effective pension scheme that will help your company stand out from the competition. Request more information now.

Conclusion

While a lot of work has been done to improve the efficacy of workplace pensions over the last decade, it’s clear that there’s still work to be done to tackle the retirement savings shortfall.

It’s also clear pensions are an area employees want to engage with but often don’t know how. It may also be the case that employers have been making some wrong assumptions about the benefits that really drive engagement and retention.

It’s vital that employers don’t wait for government legislation to fix the remaining issues facing pensions and take the initiative - communicating with employees to build an attractive, transparent scheme for their team.

About Penfold

Penfold is the award-winning workplace pension provider for forward-thinking businesses who want an unbeatable employee experience.

We’ve rebuilt the workplace pension experience from scratch - creating an engaging and efficient pension scheme that will help make your business a great place to work.