Penfold's pension explained

- By

- Murray Humphrey

Trying to work out what Penfold is all about? Here's everything you need to know about Penfold pensions.

If you're ready to take control of your financial future, check out our private pension, self-employed pension or workplace pension today. Alternatively, if there's something else you wanted to check, don't hesitate to get in touch using the Live Chat icon in the bottom right of your screen.

What is Penfold?

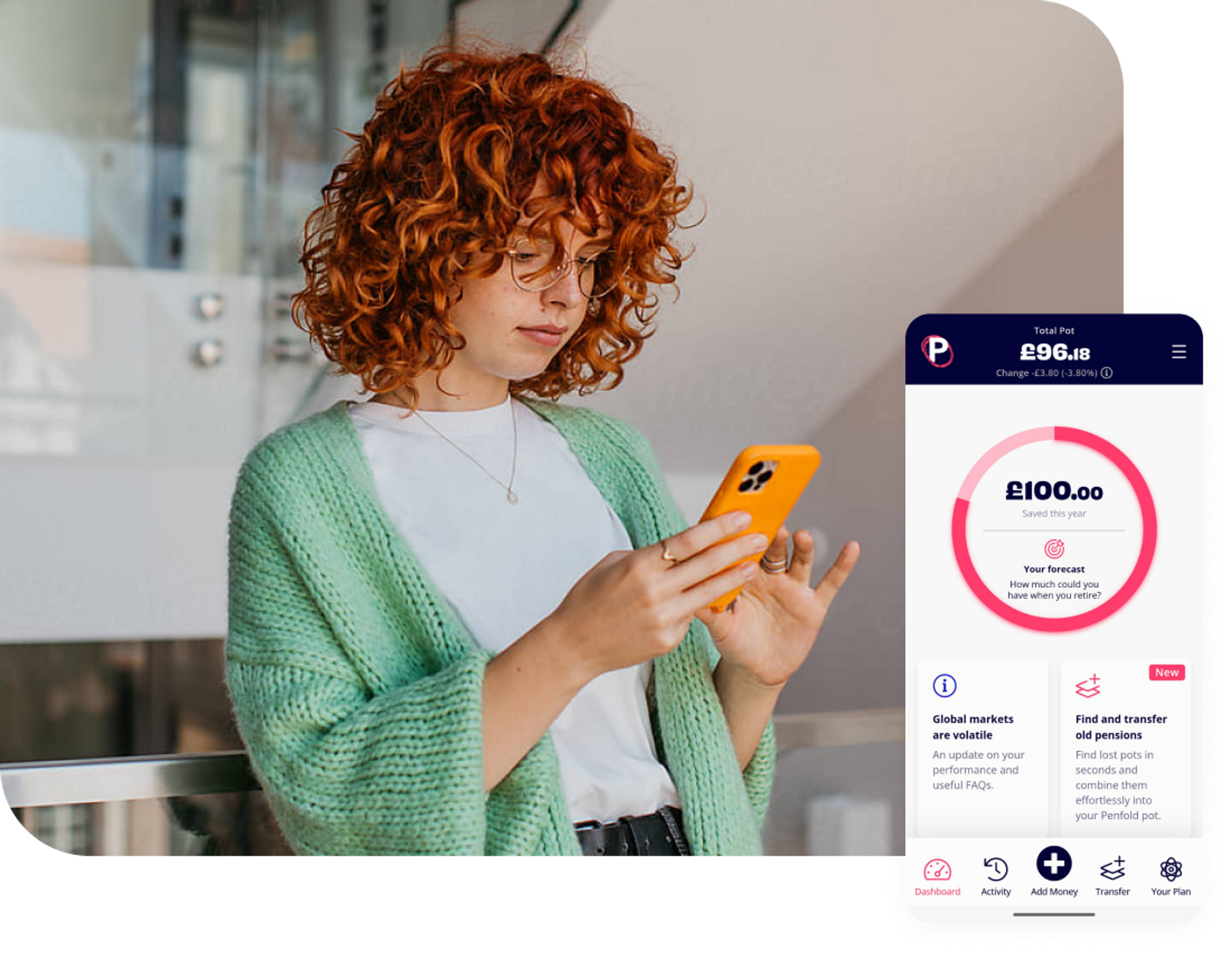

Penfold is the award-winning digital pension designed to help you take control of your savings and grow your wealth. With Penfold, you can effortlessly find and combine all your old pensions into one smart plan, accessible anytime online or in our app.

How old is Penfold?

Penfold was set up in May 2018, and became regulated by the Financial Conduct Authority in May 2019. The Penfold beta launched in June 2019.

What can Penfold do?

We've built a powerful, easy to use pension packed full of features to give you complete control of your savings.

Find old or lost pensions: Lost track of old pensions? Track down any lost pots from previous jobs, even if you don't know all the details with our simple, step-by-step tool.

Flexible contributions: We know that no month is quite the same as the rest. With Penfold, you can top-up, adjust or even pause your contributions at any time. All it takes is a couple of clicks or taps.

Complete visibility: See exactly how you much saved, and how your pension is performing at a glance.

Set your savings goals: Reach your retirement goals with our goal-setting tool. We'll calculate exactly how much you need to save into your pension for you.

Auto-save: Take the legwork out of your pension payments. Link your bank account to Penfold and process your contributions instantly. We can even automatically increase your contribution if you have a good month! Of course, we'll never take anything without confirming with you first.

Is Penfold safe?

Penfold is a UK registered pension scheme, regulated by FCA and part of the Financial Services Compensation scheme (FSCS). For more on how Penfold is regulated, we talk all about our pension safety here. We employ the latest in security technology to keep your savings secure.

Getting started with Penfold

How do I set up a Penfold account? Getting started with Penfold is a doddle. We wanted to make pensions incredibly easy and simple to set up, so sorting out your pension with Penfold should take less than 10 minutes and can be done in one go, online. We will need to verify your identity, so you’ll need a national insurance number and UK bank account as well as a UK address, and UK tax-payer status.

Is there a minimum amount I need to pay in? We think pensions are inaccessible enough as it is, and high minimum contributions only put people off saving. You can open a Penfold pension with just £1 a month.

How much does Penfold cost? Yes, each Penfold customer pays a single fee of either 0.75% (for BlackRock’s funds), or 0.88% (for HSBC’s Sharia-compliant fund) per year based on the average value of their pension that year. We don’t charge our customers to pause, stop, increase, decrease, top-up or consolidate pension pots. Read more about Penfold's single fee and what it covers.

Can I change contributions without a penalty fee? Yes, you can top up, pause or stop at any time, and increase or decrease your monthly contributions. All of these actions are free of charge.

Can I combine my existing pensions with Penfold? Absolutely. We help customers transfer and combine previous pensions. We know it can be hard to remember past employers’ pension providers, so all we ask is that you give us as much information as you have. If this doesn’t prove to be enough to go on, we’ll get in touch and work through the details together. There is no cost for customers using this service.

Saving with Penfold

What pension plans does Penfold offer? Penfold offer 4 hand-picked pension plans to help you save your way - Lifetime plan, Standard plan (with 4 risk options), Sustainable plan, Sharia plan. Read more about our investment strategy and the Penfold pension plans.

What are the tax benefits? The Penfold pension is like any other pension scheme, in that your contributions are eligible for tax relief. Tax relief is the money the government gives you as a reward for paying into your pension. and can be beneficial for both individuals and limited companies to receive. Penfold organises your tax relief for you with HMRC and add it to your pension pot automatically.

Can I pay into Penfold from my limited company? You can indeed – all you need to do when setting up your Penfold account on behalf of your company is enter the company’s bank details, rather than your own personal details, and add the company number. Contributions into your pension will come from the company’s account instead of your own, and you will be able to save on your corporate tax.

Can my employer make contributions to my Penfold pension? Yes! Penfold also offer auto-enrolment and workplace pensions to employers. You can find out more about our Workplace pension here.

Should I use Penfold if I already have a workplace pension?

If you have a workplace pension at your current job, your employer will likely contribute to your pension as well, and if you stop paying in, they might stop contributing as well – so you would lose that free money.

Some workplace providers charge high fees for making extra contributions beyond the minimum required under auto-enrolment legislation. If you want to pay more than the minimum, you should check the fees to understand if it might be better to pay into a separate, private pension, like Penfold.

If you have old pension pots from old jobs, but your employer is no longer paying into them, Penfold is absolutely for you. You can have a Penfold pension and still keep these old pension pots, or you can ask us to combine them into one place.

Does Penfold give advice?

We are not an advisory body so we can’t provide personalised advice about your pension. However, we can help you calculate how much to save into your pension, based on three generally accepted rules of thumb:

- the rate of economic growth

- the likelihood of inflation over time

- comfortable living costs for retirees

We want to make pensions accessible and easy to understand, empowering our savers to make the best financial decisions for themselves. If you think you would benefit from financial advice, you should seek out an independent financial adviser.

How can I get help with my Penfold pension?

Our friendly customer service team is available online via Live Chat every weekday from 9am to 6pm. You can also email us anytime at hello@getpenfold.com.

Learn more about every aspect of pensions with our Pension Guides knowledge base, and refer to our pensions glossary for any unfamiliar terms.

Ready to get started? Start your journey to a better financial future with Penfold today.

With pensions, as with all investments, your capital is at risk and the value of your pension with Penfold may go up as well as down. You may get back less than you put in.

Murray Humphrey

Penfold