Success story

Supporting Glint in setting up a salary sacrifice pension

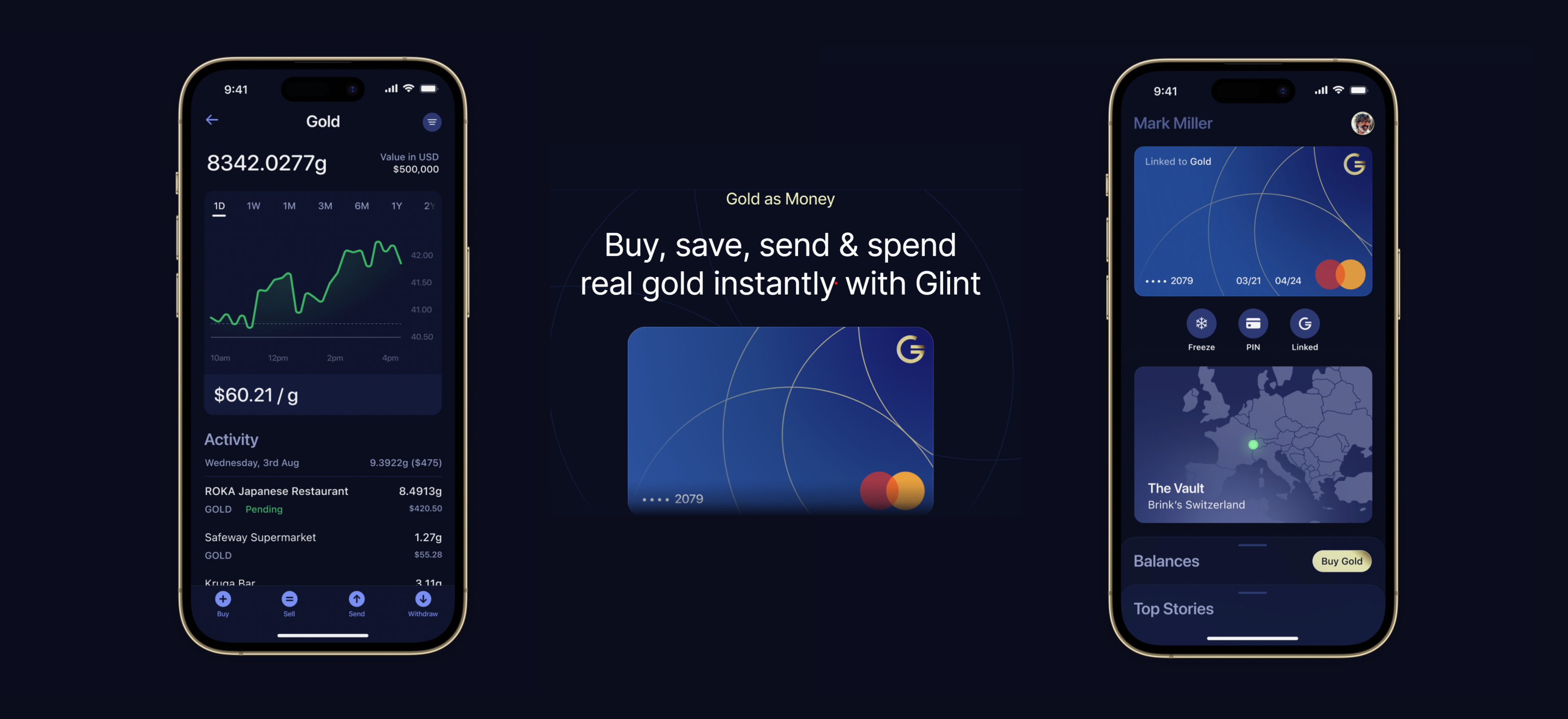

Glint believes in financial fairness for all. Glint was invented to liberate everyone from our current monetary system.

For millennia, gold has been the trusted store of wealth. In today’s world, it’s a secure hedge against inflation and a stable currency when stock markets fluctuate.

Glint offers an alternative to fiat currencies enabling our clients to buy, save, send and spend allocated gold with the flexibility of Mastercard.

Glint's challenge

Keen to bolster the financial wellbeing of the Glint team, Director of People & Culture Michelle Kangellaris was looking at ways company benefits could better support staff during the cost of living crisis.

The solution

Penfold’s easy to use app, which offers instant and clear access to pension information, proved tempting. Michelle also appreciated the way Penfold communicated information, simplifying pension jargon to help users better understand their pensions.

Glint already had a workplace pension, but what tipped her into going with Penfold was the seamless changeover and support to implement Salary Sacrifice, a tax hack that can result in employees increasing their take home pay.

Penfold offers pension workshops and webinars to hand hold teams through the process of this. For Salary Sacrifice to be implemented, HR teams have responsibilities to fulfil too and Penfold aims to make this integration as pain free as possible, a process which Michelle describes as “seamless”.

“Having Penfold onboard as our new pension provider has allowed us to improve financial wellbeing within the business. We have seen an increase in staff wanting to save extra towards their pensions since having Penfold on board, due to it being a salary sacrifice scheme and how simple Penfold make it for our teams to do so.”

Pension Set Up:

- 5% Employee, 3% Employer contributions

- Contributions calculated on Qualifying Earnings

- Salary Sacrifice default for everyone (employees can opt out)

The Results

In a recent survey, Glint’s staff have let Michelle know the Penfold pension is one of their most sought after benefits.

- 76% of Glint's team have logged into the Penfold app.

- 80% of Glint's team have requested a pension transfer to Penfold.

Michelle has seen an increase in staff wanting to save extra towards their pension since having Penfold on board, due to it being a salary sacrifice scheme. She praised Penfold for make it simpler for her teams to do this.