Wealth’s not just for the people in pinstripe suits

Our plans make investing easier for your employees, offering the potential to grow their wealth over time. They’re composed of a broad range of diversified investments so all your eggs aren't put in one basket.

How we manage your money

At Penfold, we think about four principles of investment when it comes to growing our members’ assets.

Active risk management

To manage risk, the core funds behind our plans use technology to respond to what’s happening in the markets and the world as a whole.

They do this by actively changing the investment allocation across different asset classes depending on the level of volatility in the market, providing an added layer of protection compared to more rigid investment portfolios.

Passive investments

Our plans use funds that provide exposure across whole markets as opposed to actively managed funds which involve humans picking individual investments.

These passive style strategies have been proven to generally outperform active strategies over the long term.

Low cost

We believe in low cost investments because fees eat into an employee’s pot as they accumulate over many years.

Our portfolios invest across a wide range of low cost investments called exchange-traded funds (ETFs) to keep the cost as low as possible for our customers.

Diversification

Diversification sounds complex, but it simply means not having all your eggs in one basket. Our plans hold a wide range of investment types across different regions and asset classes to reduce the risk that multiple markets could fall at the same time.

This helps to smooth out volatility of market peaks and troughs. Our plans invest across equities, bonds, commodities, and other alternative assets.

Introducing our plans

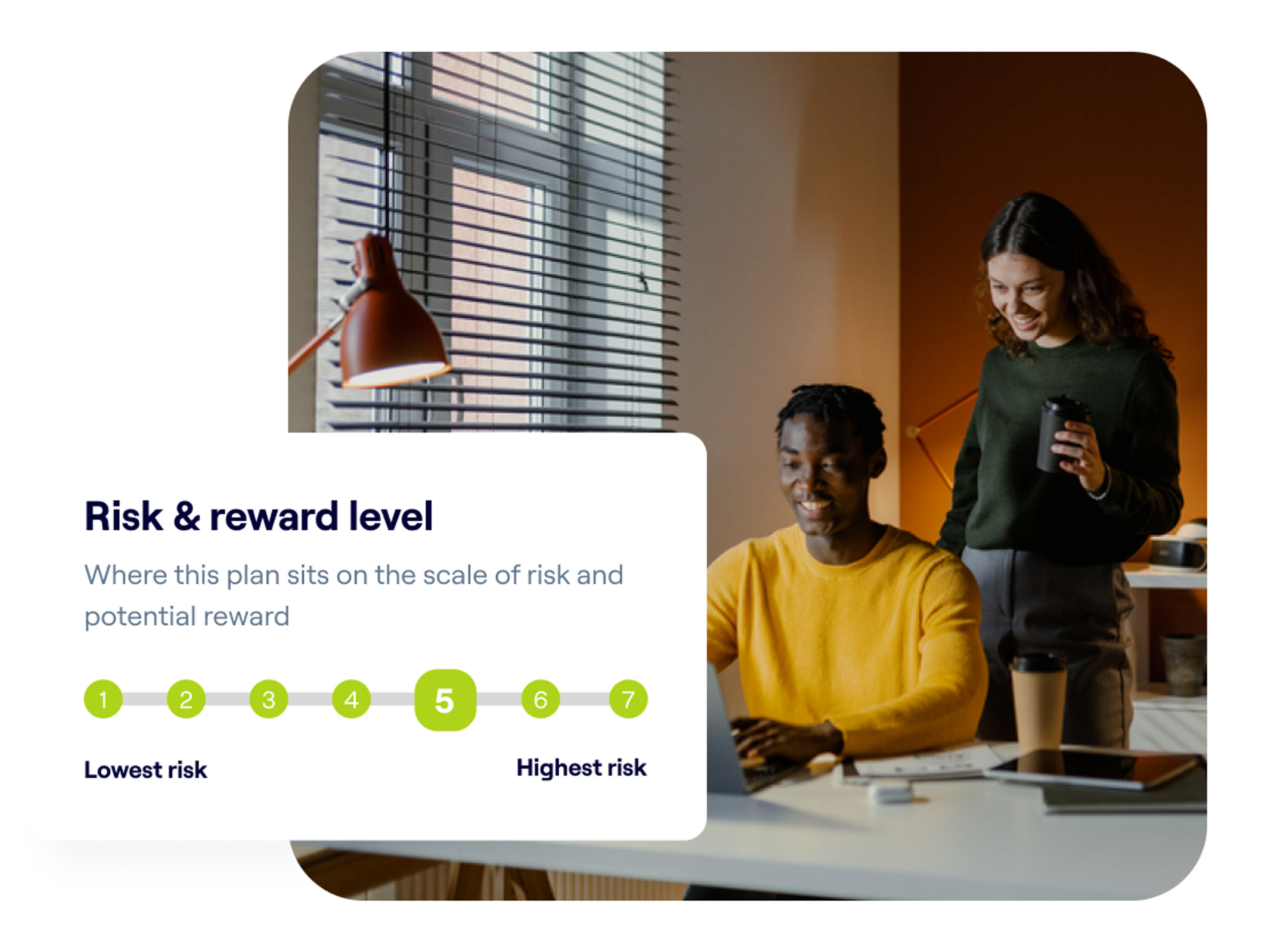

Penfold uses a series of innovative new funds from BlackRock, called the MyMap series. These funds invest your money across different markets around the world, offering a range of risk and return profiles to match your goals.

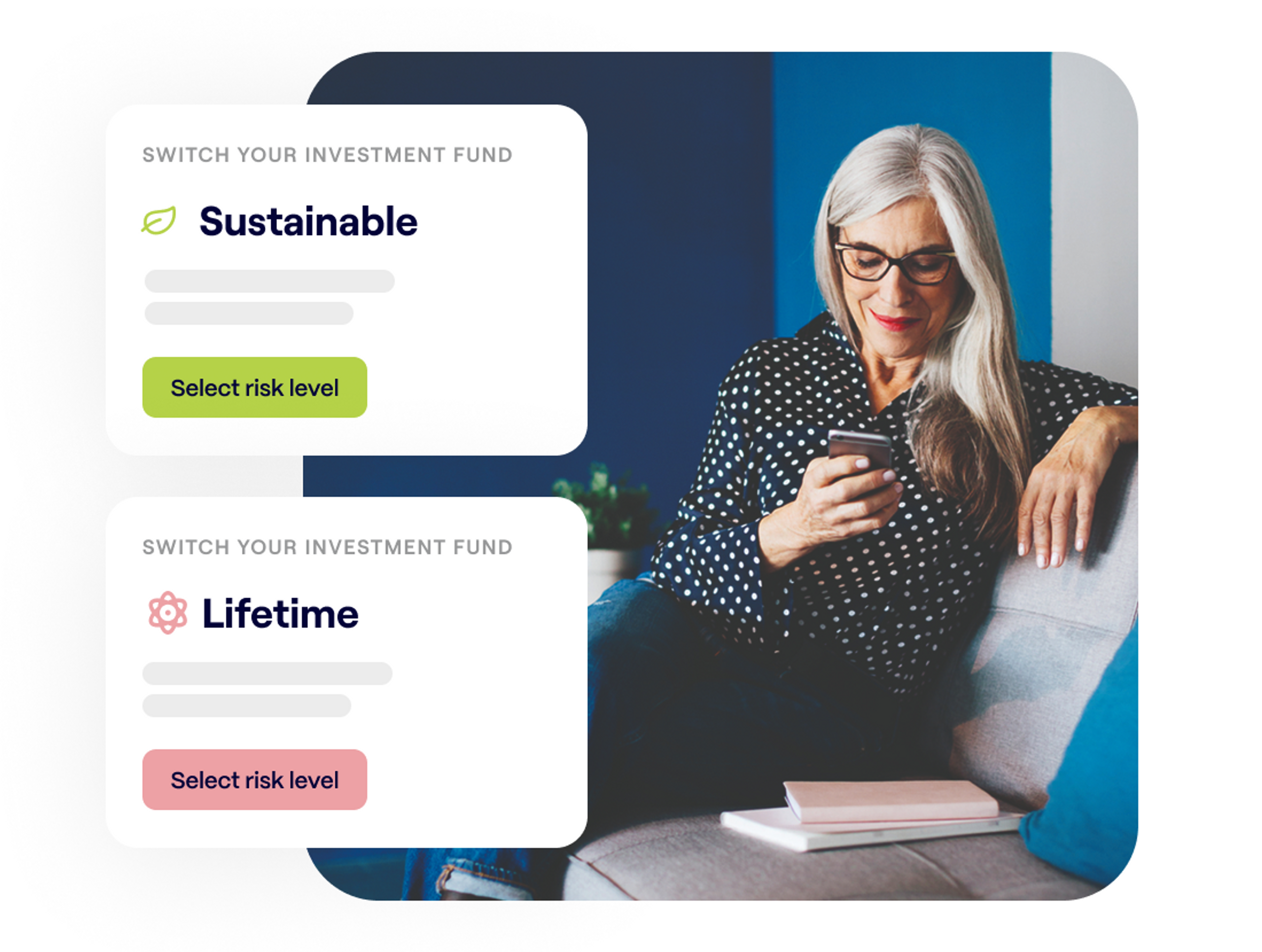

Lifetime

Sustainable

Standard

Sharia

Annualised fund performance

Standard lifetime plan, Ages 18-59

+X% since inception, 28/05/2019

Sustainable lifetime plan, Ages 18-52

+X% since inception, 03/03/2022

Sharia plan

+X% since inception, 01/03/2004