At Amplifi Capital we’re committed to investing in our colleagues and supporting their financial well-being.

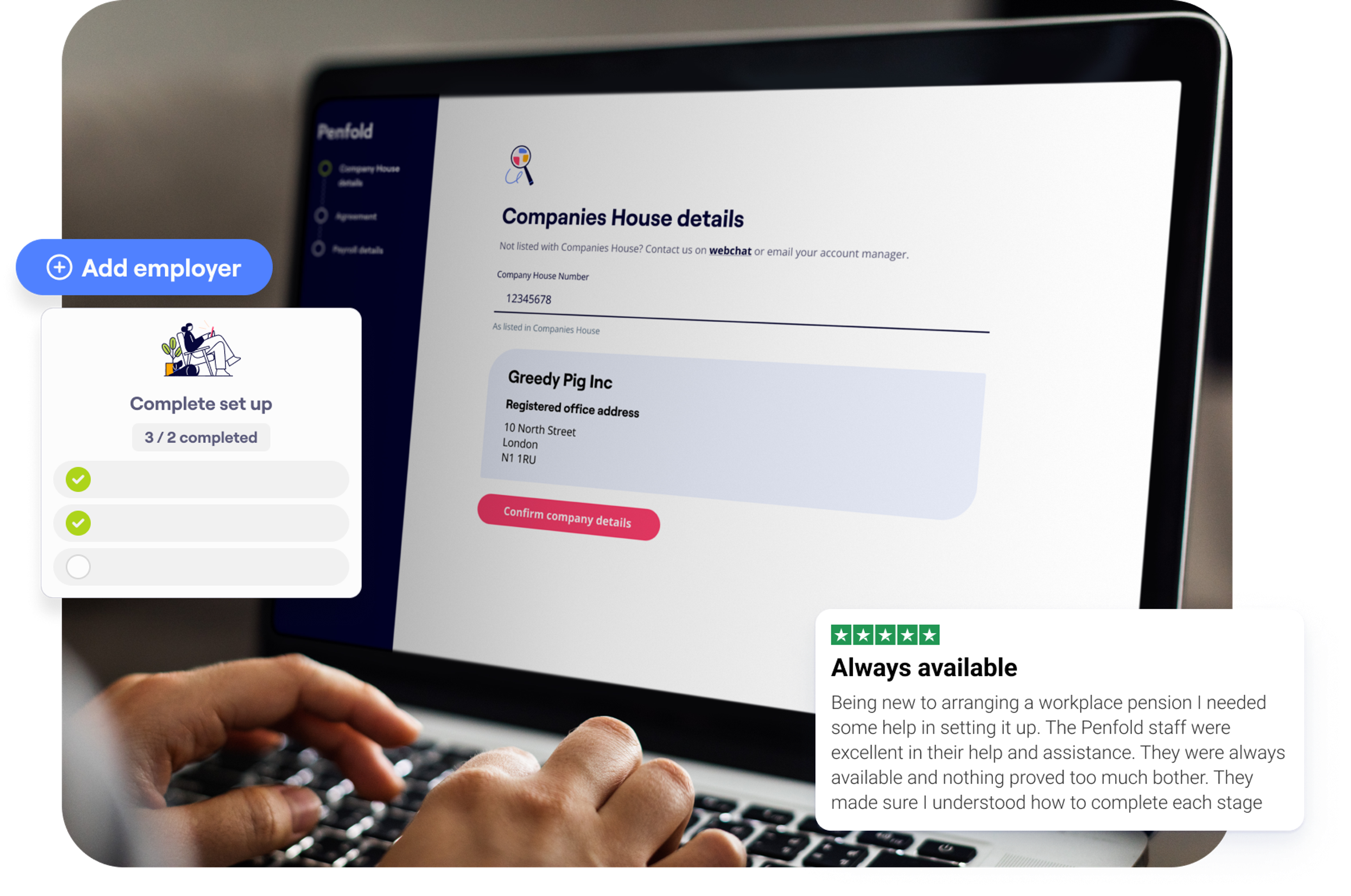

As part of a review of our workplace benefits, one of the steps we’ve taken is switching to Penfold’s salary sacrifice pension scheme.

With rising employment costs due to the upcoming increase in employer National Insurance contributions, it’s more important than ever to find ways to manage our budgets effectively.

Moving to Penfold helps us to continue to invest in our people whilst reducing employer NICs.

Lisia

CFO at Amplifi Capital