What is pension drawdown?

Discover what pension drawdown is, how it works, how to withdraw in a tax efficient way and a few of the pros and cons.

Pension drawdown is a flexible way to withdraw savings from your pension when you retire. In this article, we'll look at what pension drawdown is, how it works and a few of the pros and cons.

Pension income drawdown rules

Pension drawdown, put simply, is a tax efficient way of accessing your pension savings. Pension drawdown lets you withdraw 25% of your pot tax-free, leaving the rest of your savings invested - ready to withdraw at a later date. This can be an effective way to access some money now while ensuring a large chunk of your pension continues to grow and work hard for you.

Drawdown provides you with an income from your pension once you reach retirement age, currently set at 55, but rising to 57 in 2028. You can use drawdown for your workplace pension, private pension, or a combination of both. Your State pension will pay you an income separately once you reach State pension age - if you're eligible.

You may also see drawdown referred to as "flexible (or flexi) drawdown". It's the same thing, simply referring to how with drawdown, you get more flexibility with how you access your money.

With pension drawdown, you withdraw 25% of your pot tax-free.

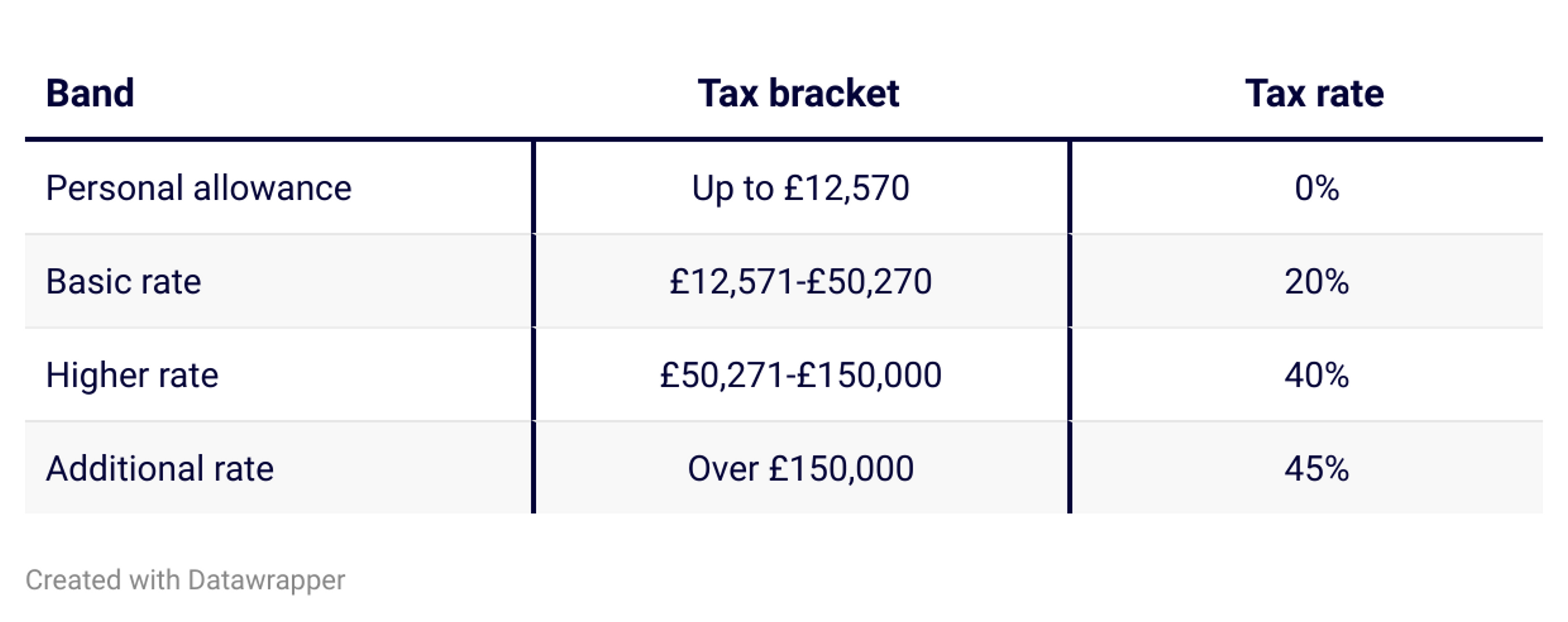

Pension drawdown tax

With income drawdown, it's important that you're clear on how your withdrawals will be taxed. As we've already covered, drawdown lets you withdraw 25% of your pot tax-free. What's left will be taxed as income. This means you'll need to pay tax at your marginal rate on anything you withdraw beyond that 25% tax-free lump sum. Here's a quick reminder of what that looks like.

If you withdraw £20,000 over the tax year (April 6th to April 5th), £12,570 of your withdrawals are tax-free. The remaining £7,430 will be taxed at 20%. You'll owe £1,486.

Take out £60,000 in a year and you'll owe £11,486 - as the portion of your withdrawal above £50,000 will be taxed at 40%.

Any tax deductions will be made by your pension provider BEFORE your withdrawal comes to you, just like being paid a salary. You won't have to complete a tax return yourself.

Remember, you'll owe income tax on your total earnings for the year, not just your pension withdrawals. So if you work part-time, or have started taking your State pension, this income will also affect how much income you'll need to pay.

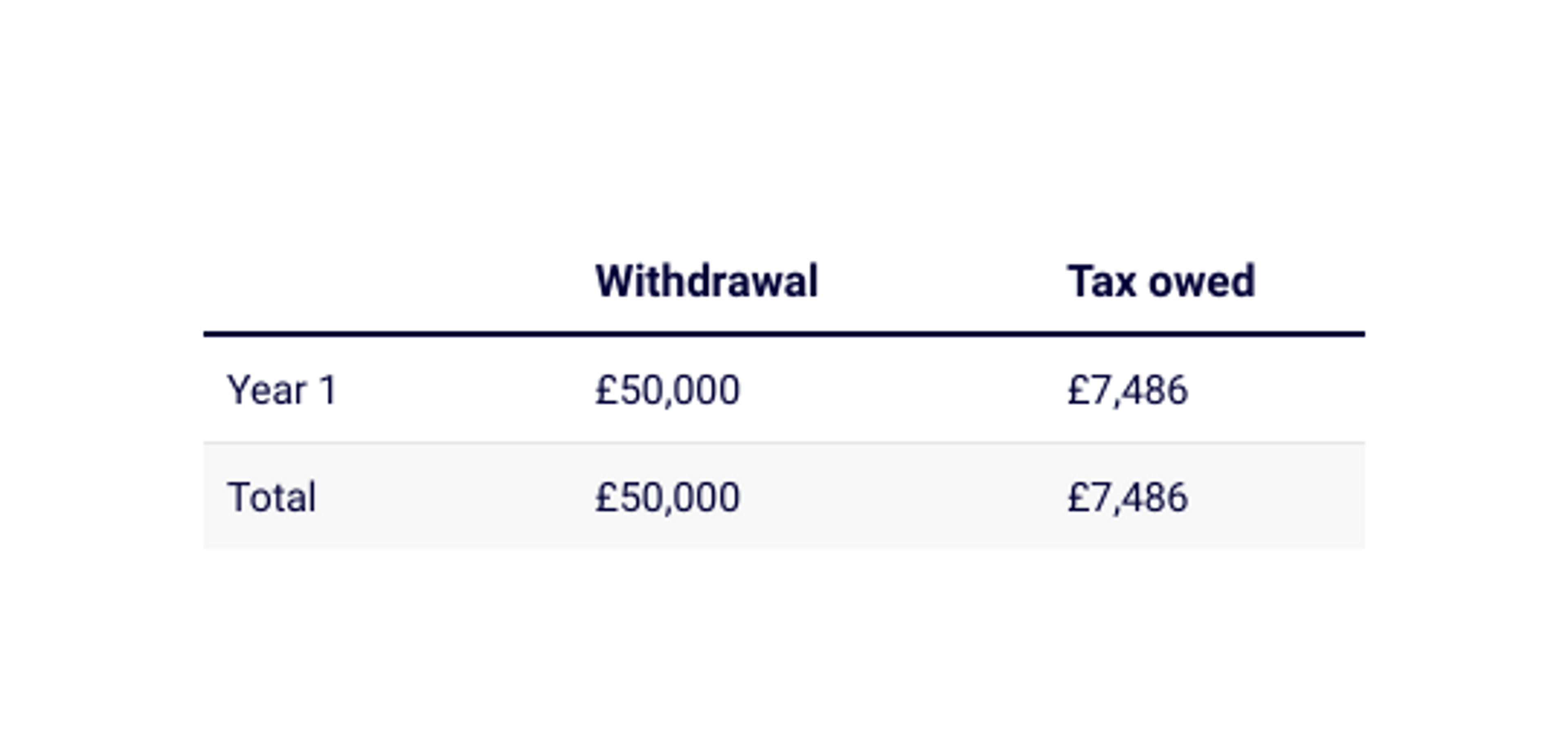

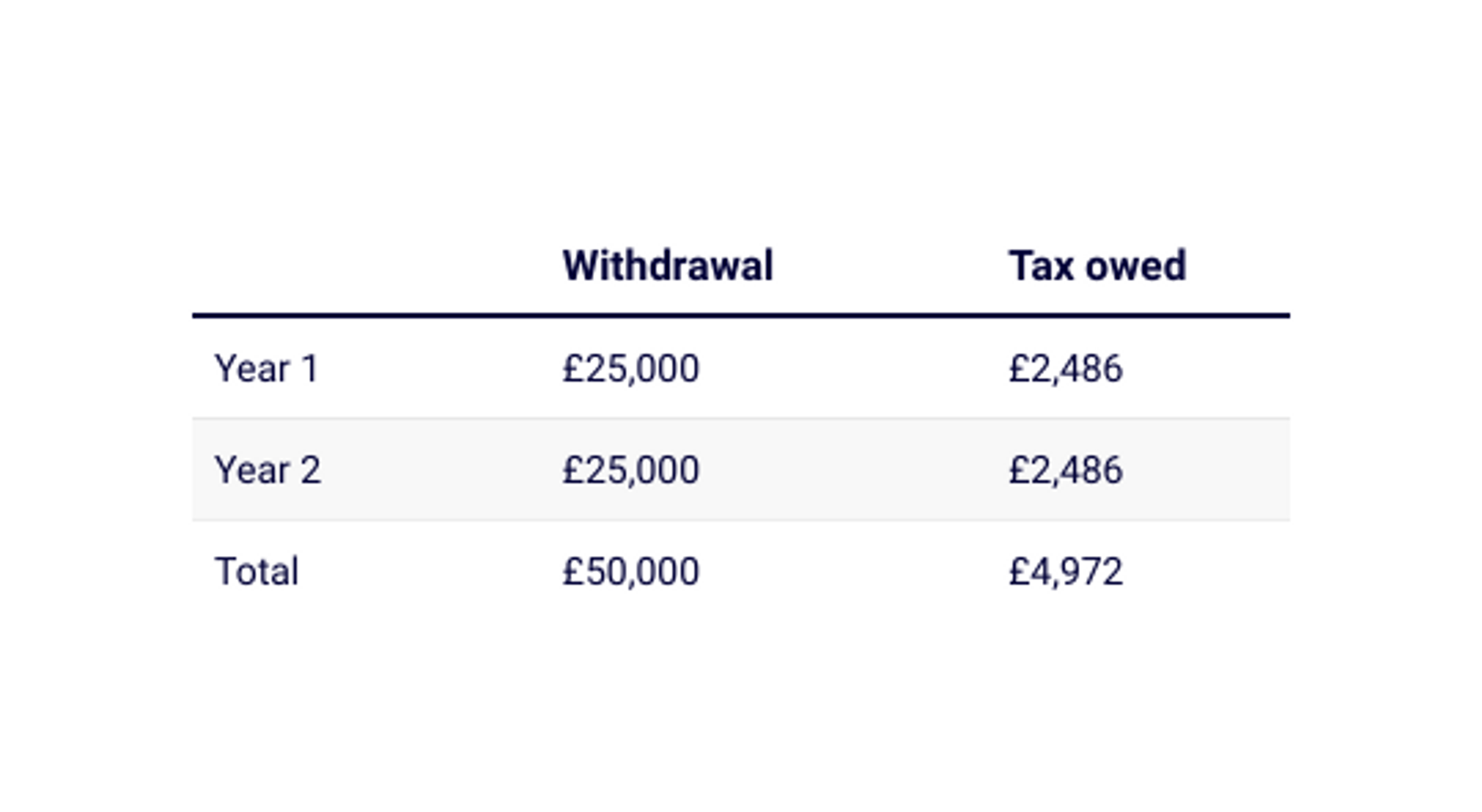

To stay tax-efficient, it's vital you only withdraw as much as you need each year so you don't end up paying more income tax than you need to. By planning how much you'll need each year, you can save yourself a good amount of money than if you just took all your savings out at once. Here's a quick example.

As you can see, just by staggering your withdrawals over 2 years, you've saved yourself £2,514 in income tax.

Income drawdown tax on death

Another important consideration to keep on mind is income drawdown tax on death. If you pass away before the age of 75 having opted for pension drawdown, any savings that are left in your pot can be passed onto your named beneficiary tax-free.

If you die after the age of 75, your beneficiary will need to pay income tax at their marginal rate on anything they receive from your pot. They can opt to take what remains as a lump sum, or as withdrawals over time.

Contributing to a pension after drawdown

You can still contribute into your pension even if you started to take money out via drawdown. However, the amount of pension tax relief you can claim is limited. This is due to the Money Purchase Annual Allowance (MPAA).

Once you've started to withdraw, you can only add £3,200 into your pension each year - collecting a £800 tax relief bonus from HMRC for a total contribution of £4,000. Anything above this will be subject to a hefty tax charge.

You'll also need to be wary of trying to add your tax-free lump sum back into your pension. If HMRC believes you're trying to re-invest your tax relief (known as 'pension recycling') you may have to pay more tax back.

Pension drawdown lets you keep part of your savings invested - helping to protect the real value of your money against inflation.

Why choose drawdown?

As with each pension withdrawal option, pension income drawdown has its pros and cons. Here's a quick summary of the strengths and weaknesses of opting for pension drawdown.

Pros

- Offers 25% lump sum tax-free right away

- Access the rest of your pot flexibly

- Leaving your pot invested protects your pension against inflation

Cons

- Income tax owed on any withdrawal above after tax-free lump sum

- No guarantee of returns on the portion of your pension that remains invested

- Income needs may change in the future

As always, we recommend speaking with an independent financial advisor before making a final decision about how to access your pension.

Summary

There are many ways to withdraw your pension, depending on your unique circumstances. Pension income drawdown is a great way of accessing some of your savings right away while ensuring that the bulk of your pension is still invested for the future.

Penfold is the award-winning digital pension that lets you combine and access your pension the easy way. Set up in minutes and get complete visibility into your savings in one, easy-to-manage app.