Is the UK Headed Towards a Retirement Crisis?

A deep dive into the affordability of retirement

Balancing the household budget has been a lot tougher in the last year. Global economic flux has eroded the disposable income of half the world's consumers. Coupled with surging expenses and inflation, this downward trend has severely limited the ability of many to keep paying what they were into their pension.

For the average person, balancing the scales between immediate needs and long-term savings has turned into the most challenging of juggling acts, especially for younger generations wrestling with student debts, entry-level wages, and high living costs. The reality is that, for the vast majority, the capacity to reserve a substantial portion of their income for retirement is dwindling rapidly. So are we heading for a pensions saving crisis?

According to the Pensions and Lifetime Savings Association’s latest Retirement Living Standards research, to maintain a ‘moderate’ living standard post-retirement, couples need an income of about £43,100 before tax, while singles require around £31,300. With the cost of living on the rise and the financial uncertainties of the future, are we saving enough to afford our desired lifestyle in retirement?

To match today's living standards, the pension pot for every individual should be significantly higher. But due to decreasing disposable incomes and rising cost of living, it's just not feasible. According to The Retirement Shortfall Report, the average worker will have a shortfall of £115,768 should they base their retirement income entirely on pension pots.

So, what does this mean for our future pensioners? Unless drastic changes are made, we may be heading towards a retirement crisis where many pensioners of the future could face poverty.

How spending habits and retirement savings are connected

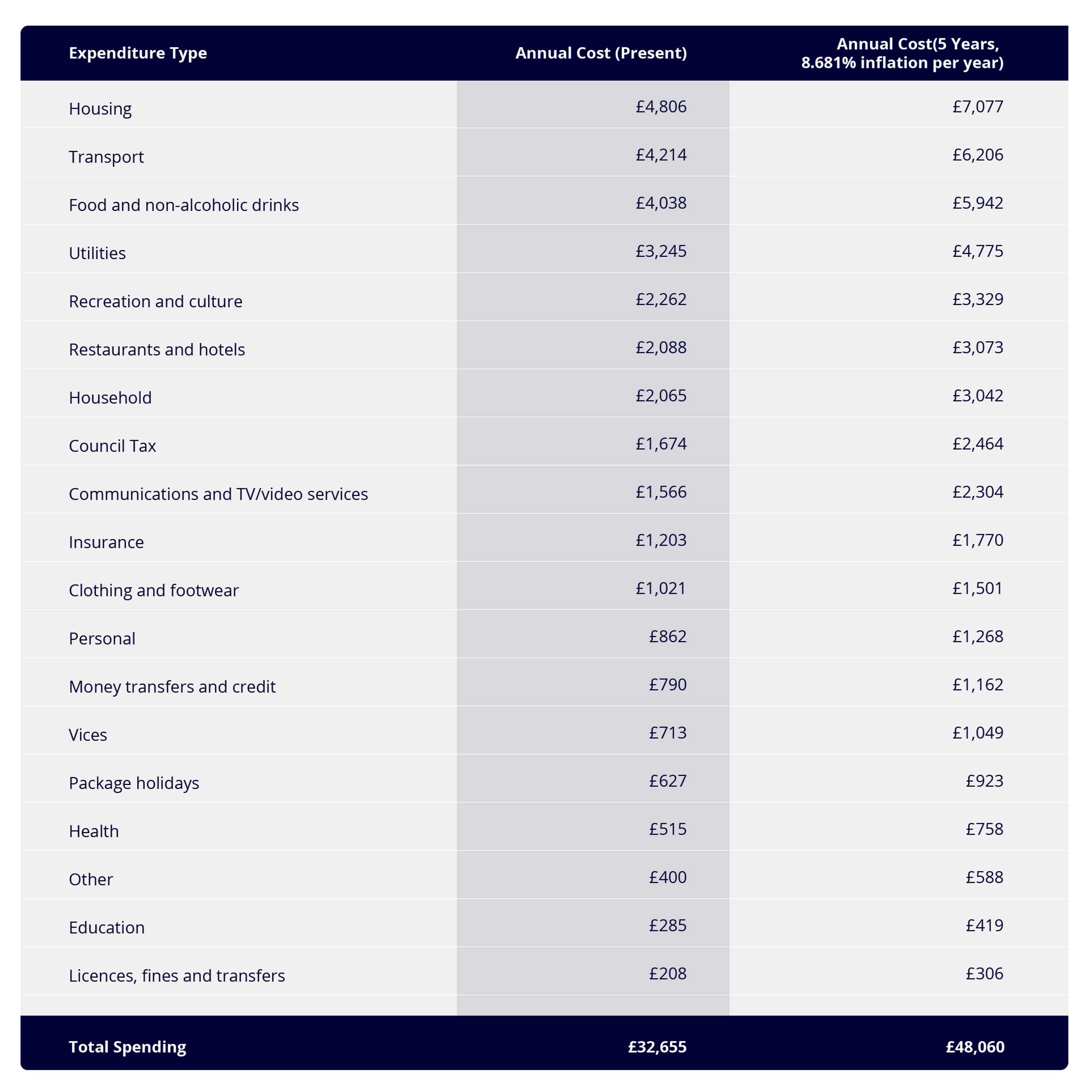

According to the analysis of ONS Family Spending data, the average UK household budget in 2023 is approximately £2,700 a month (£32,655 a year). However, this figure can vary significantly based on factors such as location, household size, and lifestyle choices. While spending is necessary for daily living, unchecked habits could significantly reduce the potential for retirement savings.

If we consider inflation only as the driving force behind future cost changes, we can apply an average inflation rate to estimate future costs. Inflation rates can vary year by year and by country, but the UK currently faces an 8.6% inflation rate.

By applying 8.6% annual inflation rate to each of the categories, in five years the annual costs for a household could jump by over £16,000.

*These estimates are based on the assumption that the inflation rate stays constant at 8.681% for the next 5 years, which might not be the case as it can vary. Moreover, as mentioned before, these calculations assume that the distribution of spending across these categories remains the same, which could change due to numerous factors.

It is important to remember that predicting future costs is challenging and depends on various factors beyond inflation, including changes in technology, consumer behaviour, market dynamics, and economic policies.

As costs continue to rise the amount of disposable income available continues to drop and it makes it harder for individuals to save towards important things such as a pension. According to the FMCG & Retail 2023 Whitepaper, disposable income in the UK has decreased by 65% in the last 12 months due to high inflation.

Are we saving enough for retirement?

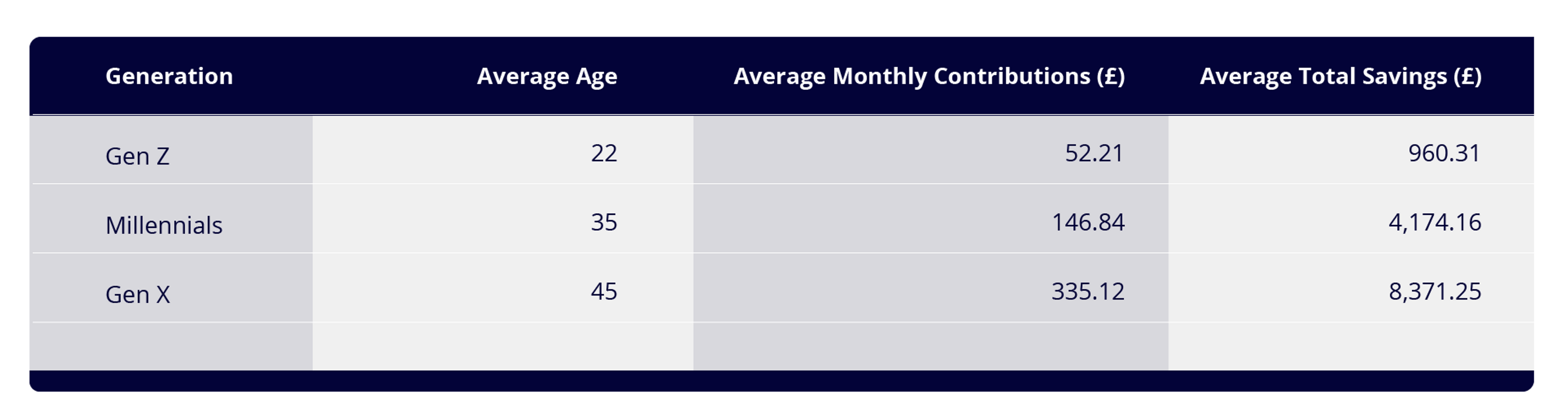

Financial habits and wealth accumulation vary significantly across different age groups, reflecting the various life stages, income levels, and personal financial strategies. Our latest data analysis shines a spotlight on these disparities, revealing some striking patterns in the saving behaviours of different demographics in the UK.

According to our data, an average 22-year-old is currently saving £52.21 per month on average towards their pension with a total savings of £960.31. The average salary for this age group is £26,096. If we take that in mind, according to calculations from Penfold's pension savings calculator, they should be contributing around £169 per month. This shows that Gen Z is saving £116.79 below what they should be to hit their retirement goals.

An average 35-year-old is currently contributing £146.84 per month on average towards their pension with a total savings of £4,174.16. The average salary for this age group is £32,965. However, according to the calculations from Penfold's pension savings calculator, they should be saving approximately £431 per month. This shows that Millennials are saving £285 below what they should be to hit their retirement goals.

An average 45-year-old is currently setting aside £335.12 each month on average for their pension with a total savings of £8,371.25. The average salary for this age group is £35,904. However, Penfold's pension savings calculator suggests that they should be contributing approximately £814 per month. This shows that Gen X are saving £479 below what they should be to hit their retirement goals

These scenarios underscore the importance of reviewing and adjusting pension contributions regularly, but also the affordability of it. Furthermore, they illustrate how less disposable income impacts every age group, making it that much more difficult to retire.

Realistic Retirement Goals

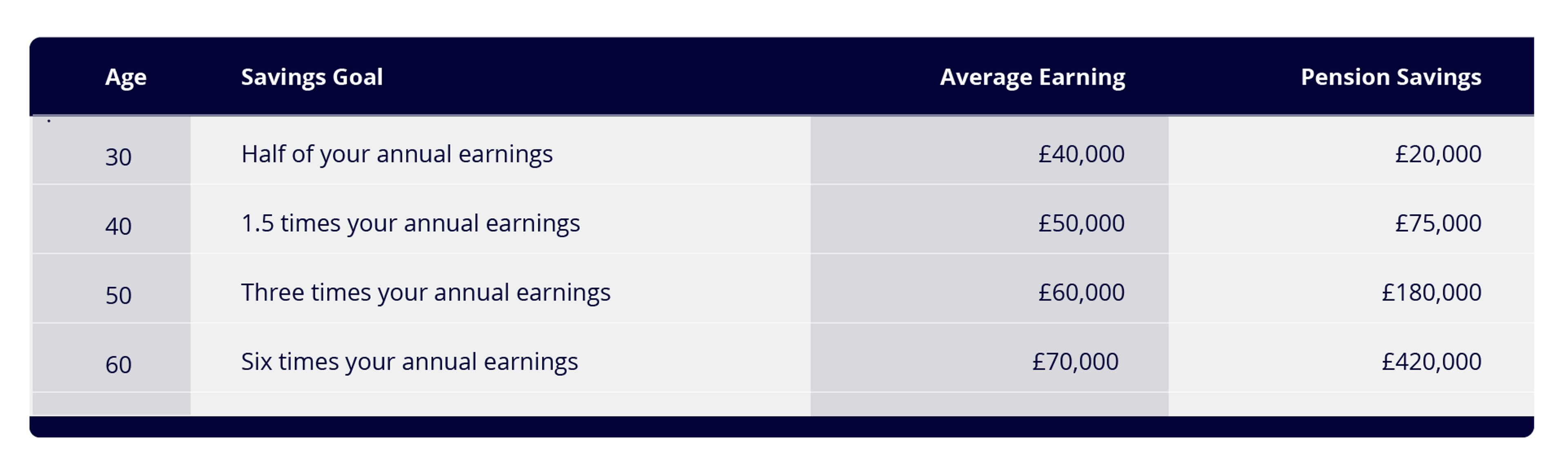

Achieving a comfortable retirement involves setting realistic saving goals throughout your working years.

This table, while a good starting point, should be tailored to your circumstances. These figures are approximate and may vary depending on factors like income, lifestyle, lifespan, and healthcare needs.

Whilst achieving these savings goals can be challenging (due to various factors such as financial commitments, compound interest expenditures, debts, and the rising cost of living) putting in place a combination of strategic saving, investing wisely, and controlling expenditures can make these goals attainable.

Striking the Right Balance: Retirement Savings and Quality of Life

A 'comfortable' retirement could mean different things to different people. Generally, it implies having sufficient income to meet basic needs, with some extra for hobbies, travel, and leisure activities. According to estimates, an individual would need £19,000 per annum, or £26,000 for a couple, to lead a 'comfortable' lifestyle. A more luxurious lifestyle, with provisions for long-haul trips and high-end purchases, would require an annual income of £31,000 for an individual or £41,000 for a couple.

However, achieving these income levels in retirement requires substantial savings. For instance, to secure an annual income of £41,000, one would need a pension pot worth £757,000. An alternative approach would be an income drawdown, which would require savings of £442,020 to maintain the same lifestyle. However, this approach involves greater risk due to the lack of a guaranteed income.

Pete Hykin, CEO and Co-Founder at Penfold, a workplace pension provider comments,

“I can tell you we're staring down the barrel of a potential retirement crisis in the UK. The struggle to balance immediate necessities with future financial stability has never been more challenging. The hurdles of student debt, entry-level wages, and high living costs weigh heavily on the young, while everyone, young and old, grapples with the rapidly diminishing ability to set aside substantial funds for retirement.

The scale of the disparity between necessary retirement savings and what people can actually put away is alarming. To sustain current living standards into retirement, the average UK individual should be tucking away a far larger nest egg. However, as disposable incomes shrink and the cost of living soars, such saving goals are drifting from challenging towards near impossible."