The true cost of accepting card payments

- By

- Murray Humphrey

With the pandemic over it seems impossible to find anywhere that still accepts cash payments. We’ve gone almost fully digital, living in a tap-and-go culture. While the shift away from cash was already well underway, it’s fair to say that Covid accelerated things!

And while it’s certainly convenient for consumers, going cashless, however, isn’t necessarily great for business owners. What’s the catch? - you may ask.

The cons of accepting card payments

Sure, card payments are incredibly convenient but does that convenience have a price? Absolutely.

When accepting card payments you pay transaction fees to a card payment processor (also known as a payment service provider). It means that for every payment you take, you’ll be charged money. Put simply, you’ll be paying to receive your own sales.

The amount of each transaction fee will depend on:

- The value of the payments (the larger the amount, the larger the fee);

- The card issuer (companies can charge different fees);

- The type of card (either credit or debit card);

- And how this payment is made (contactless, PIN, etc).

And finally, card payments are also notoriously prone to fraud and chargebacks.

But what is a card payment processor?

Card payment processors are the mediators between the banks and the merchant (i.e. the business owner). They manage the card transaction process, authorising and facilitating the transfer of funds to the merchant. As intermediaries, card payment processors handle the funds themselves, charging and deducting their transaction fees from the merchant - this is how they generate their own revenue.

In addition to the transaction fees, there are also delayed settlement times. Instead of receiving their money instantly, merchants typically need to wait 2-3 days, sometimes more, before the money arrives in their bank account. The reason for this is that with multiple stakeholders involved in the payment process, things take time.

The most common payment methods supported by card payment processors are in-person payments via card readers (these are the physical machines you see inside shops) and online payments via a payment gateway (the website checkout pages).

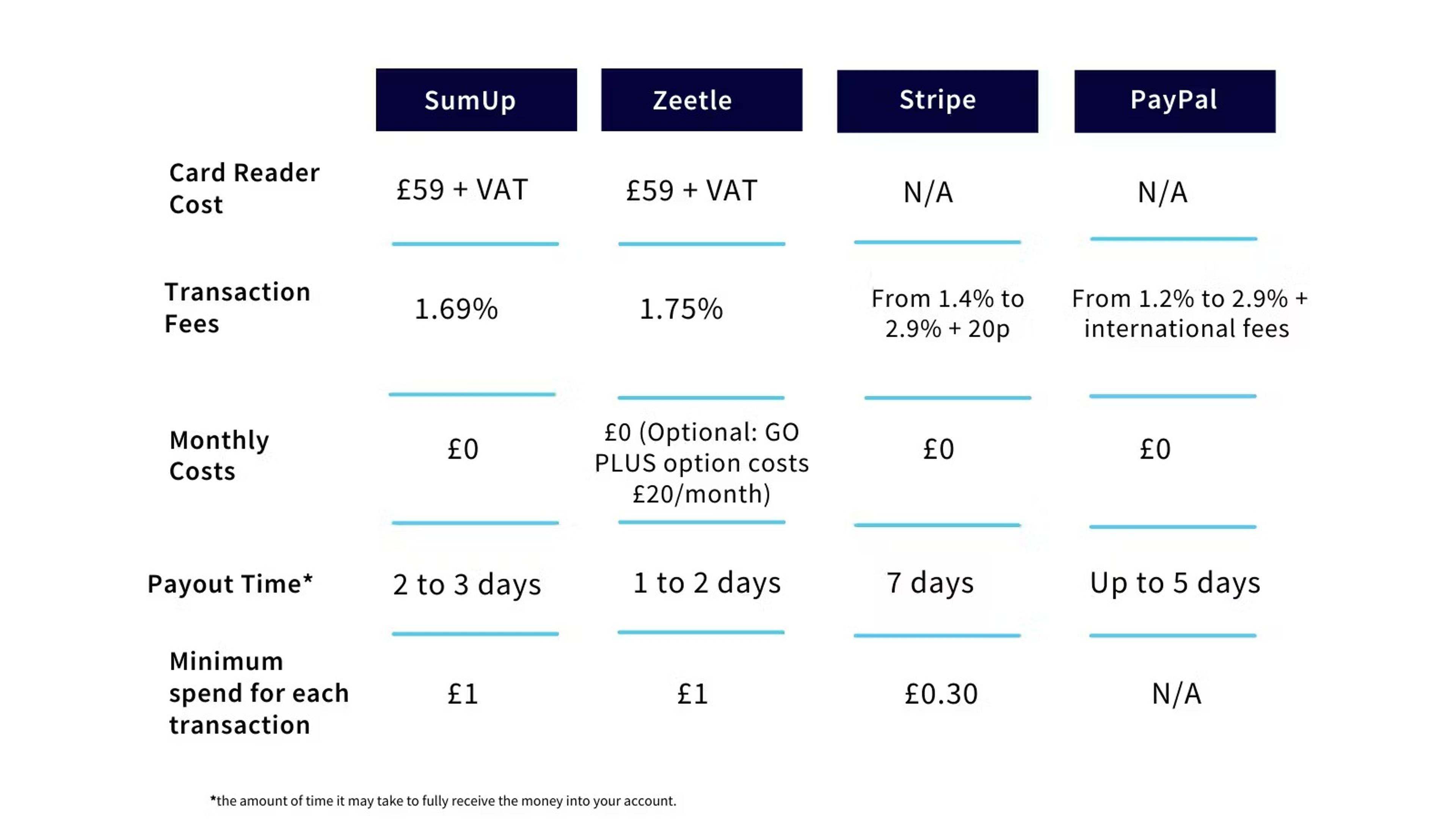

Let’s now take a look at a few card payment processor companies and what exactly you’re being charged for.

Although these fees may not seem much on a per transaction level, on an annual basis 1.5%-3% in transaction fees can add up to £1,000s. And every saving on these fees goes straight to a business’s profit line.

What’s the solution then? Open Banking payments.

Open Banking Payments

What are open banking payments?

Open banking payments, in short, are account-to-account direct payments. Consumers pay by authenticating and confirming payments directly with their own bank, without exposing any sensitive information to any third party. This virtually eliminates fraud.

For businesses, open banking payments:

- Are free, or at least very low cost because there's no card processing cost and intermediaries each taking a cut

- Settle instantly as payments use the bank-to-bank Faster Payments infrastructure, not the old card payment rails

- Have greater security - after all, funds flow direct from account to account with no intermediary touching the money along the way

How do I know if open banking payments are the right choice for my business?

Let’s be honest, open banking payments should be appealing for all businesses. You can get paid instantly, with zero fees, and it’s much safer for consumers. Once you hear about open banking, it seems almost illogical to continue accepting card payments.

Though, unfortunately, open banking payments are not yet suitable for all business models. If you own a retail business and rely on tens or even hundreds of point-of-sale transactions per hour, you’re likely to still opt for a card reader. Consumers want to quickly tap and go, whereas Open Banking payments still require a couple of extra clicks

Top fact: Points of sale retail businesses also benefit from card readers because it prompts impulsive buying as customers are not confronted with how much money they have in their bank account.

However, if you operate your business mostly or totally online or you’re a B2C service provider (e.g. therapist, driving instructor, mobile beautician, tradesperson, personal trainer, graphic designer, photographer and so on) then there’s no reason for continuing paying costly transaction fees when you have a more cost-effective offer on the market.

How can you opt-in to open banking payments?

There are various ways to accept payments through Open Banking. Many are aimed at large businesses, while others require fairly comprehensive tech skills to set up. If you’re a small business owner, it may be wise to select one that is specifically tailored to your needs. One that jumps to our attention, and that we’ve partnered with is Osu.

Osu is a modern, powerful and easy-to-use Open Banking payment collection and business management app built exclusively for sole traders and micro-limited companies. It means individuals can accept instant account-to-account payments. And on top of payments, the Osu app automates and simplifies the admin around booking and scheduling, customer management, invoicing, expense tracking and many other time-consuming tasks.

Osu actually helps you increase your profits!

- You don’t pay any transaction fees to accept Open Banking payments with Osu

- The Osu system automatically chases late payers and non-payers - meaning you get paid more and faster.

- By spending less time on administrative tasks, you fully concentrate on your craft and making more sales;

- As you use and pay for less business management software, you cash in a few more at the end of the month;

Osu is loved by sole traders and self-employed professionals, in fact it’s used by more than 10,000 people across the UK! Crazy, right?!

The app offers amazing features that are not only convenient for small business owners but also cost- and time-effective.

Here are some of the things you can do with the Osu app:

- Request payments via text message and/or email - it takes less than 20 seconds to create a request, plus an invoice can be generated for you automatically if you want!

- Take payments with 0% transaction fees and instant settlement;

- Automate the invoicing and late-payer chasing (a dream for the freelancers!);

- Share a booking website with your clients so that they can find a slot and book based on your availability (no more endless back and forth for scheduling);

Accept upfront payments or deposit fees for each booking slot or service (say goodbye to no-shows!); - Customer management functionality (that can be connected to your phone contacts list) where you keep record of your clients and take notes

- Easily photo receipts and invoices by simply taking a photo, giving you full overview of your weekly, monthly and annual expenses;

- Connect to directly to an accountant to sort out your taxes;

- Get the Osu team to register your business on HMRC and set up your business plan and logo;

- And many more powerful features are coming!

More than features, Osu has an incredibly supportive customer service team. We can guarantee you that you'll always chat to real people rather than robots and chatbots.

Other facts: Using the Osu app you can even generate QR codes that allow consumers to pay. Consumers simply scan the QR code and it takes them straight to the payment page where they just need to pick their bank, authenticate, and confirm the payment.

Murray Humphrey

Penfold