Top 6 Basic Tax Tips

- By

- Murray Humphrey

We all dread sorting out those taxes, whether you’re a freelancer, sole-trader or director. But keeping on top of the tax basics can reduce stress rather than leaving it to the last minute. We’ve partnered with TaxScouts to provide you with our top tax tips on how to stay on top of everything tax related. Like pensions, tax returns should be painless!

1. How tax works

Once you understand the basic structure of being taxed in the UK, everything else will click into place.

The tax year runs from 6th April to 5th April over any given two year period. What you earn each year between these dates is the income you’ll be taxed on. For example, in the 2020/21 tax year, you’ll need to calculate tax on your earnings between 6th April 2020 - 5th April 2021.

2. Understanding how much you owe

When you’re self-employed, there are two types of tax that you might have to pay: Income Tax and National Insurance.

Income Tax

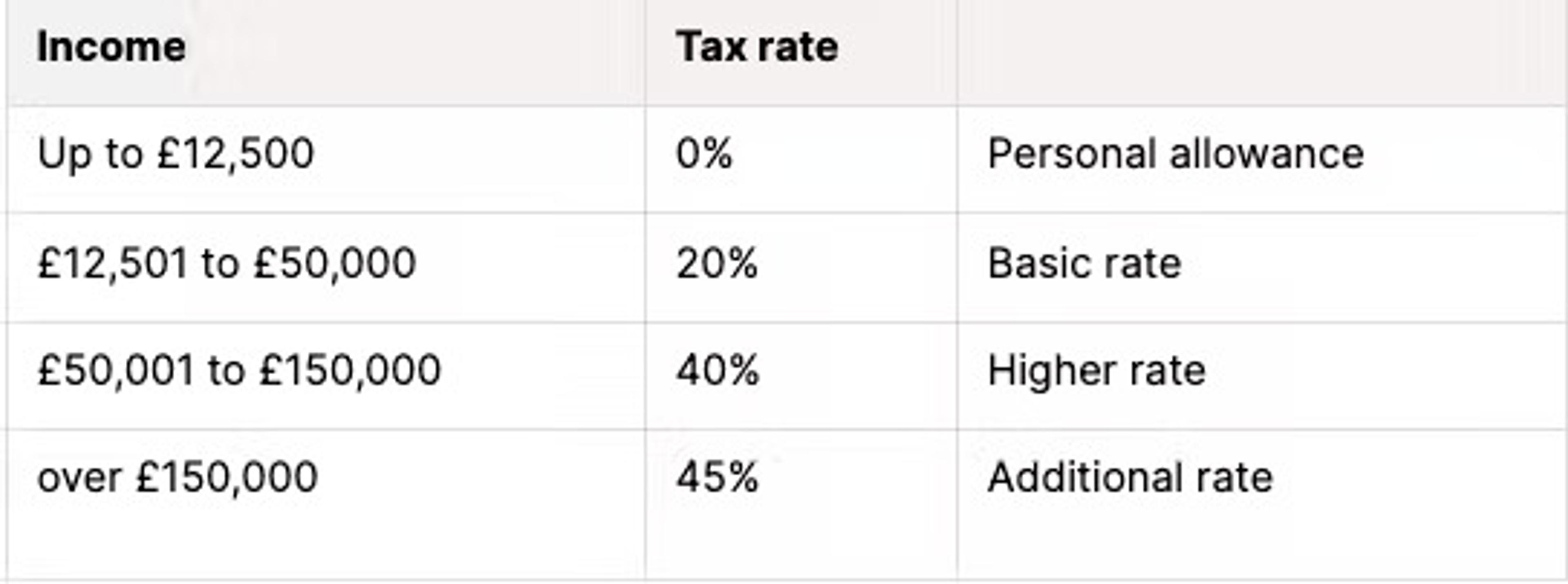

Everyone has to pay Income Tax, both employed and self-employed. However, how much we pay is based on how much we earn. The table below outlines how much you owe based on your earnings:

National Insurance

National Insurance is a little different. Even if you earn less than the tax-free personal allowance (up to £12,500), you still have to pay National Insurance contributions. This is because paying this tax makes you entitled to state-provided benefits, such as the state pension or disability allowance. If you earn over £6,515 you’ll pay Class 2 National Insurance or, if you earn over £9,568 you pay Class 4 National Insurance.

3. Remember the deadlines!

When you’re self-employed, you need to imprint these important dates in your brain!

- Register for Self Assessment - 5th October

- Tax return deadline - 31st January

- Payment on Account deadline (when you pay the second half of your tax bill) - 31st July

If you don’t meet the deadlines, HMRC will penalise you with a fine. Remember, the more transparent you are with HMRC the more lenient they’ll be!

4. Stay organised

Spreadsheets are your friend when it comes to keeping track of your finances. We recommend:

- Open a business account to keep your personal and business spending separate

- Create a spreadsheet at the start of your tax year:

- Track as you go

- Split your spreadsheets into monthly tabs

- Record your income and expenses

- If you do leave your taxes to the last minute (we’re all human, ey?), go through your bank statement with a highlighter to make sure to record everything

5. Know what an 'expense' really is!

The term expenses can be quite ambiguous. When you’re self-employed and you pay your own taxes, HMRC allows you to deduct any business expenses/ spending from your overall income. This means you’re only taxed on your profits. What classifies as a business expense is anything that you spend that is exclusively necessary for your business needs - a client char, to a coffee with a client. You just have to keep the evidence of spending.

Read more about what you can and can’t expense here.

6. Make use of good old tax relief!

Did you know that over £20 billion worth of tax refunds and reliefs are left unclaimed?

Understanding what tax reliefs are available can help you become more tax efficient by reducing what you’re liable to pay in tax. Here are a few examples:

- Gift Aid relief

- Maternity Allowance

- Mileage Allowance

- And more!

Want to learn more about tax?

Sign up to TaxScouts today and they’ll not only do your tax return fast, online and at super-low cost, but they’ll help you every step of the way, making your tax return as chilled as the celebratory drink you’ll have once it’s been filed.

Murray Humphrey

Penfold