Understanding the Spring Budget 2024

- By

- Murray Humphrey

In a key moment for personal finance, Chancellor Jeremy Hunt aims to set a new course for savers, investors, and families with the 2024 Spring Budget.

Unveiled on March 6th amidst the anticipation of the upcoming general election, this Budget – the last before the election – introduces significant changes aimed at generating economic growth while providing essential tax relief.

We’re going to dig into the details of the Budget, highlighting its impact on pensions and savings, and how Penfold can help you navigate these changes effectively.

Highlights of the 2024 Spring Budget

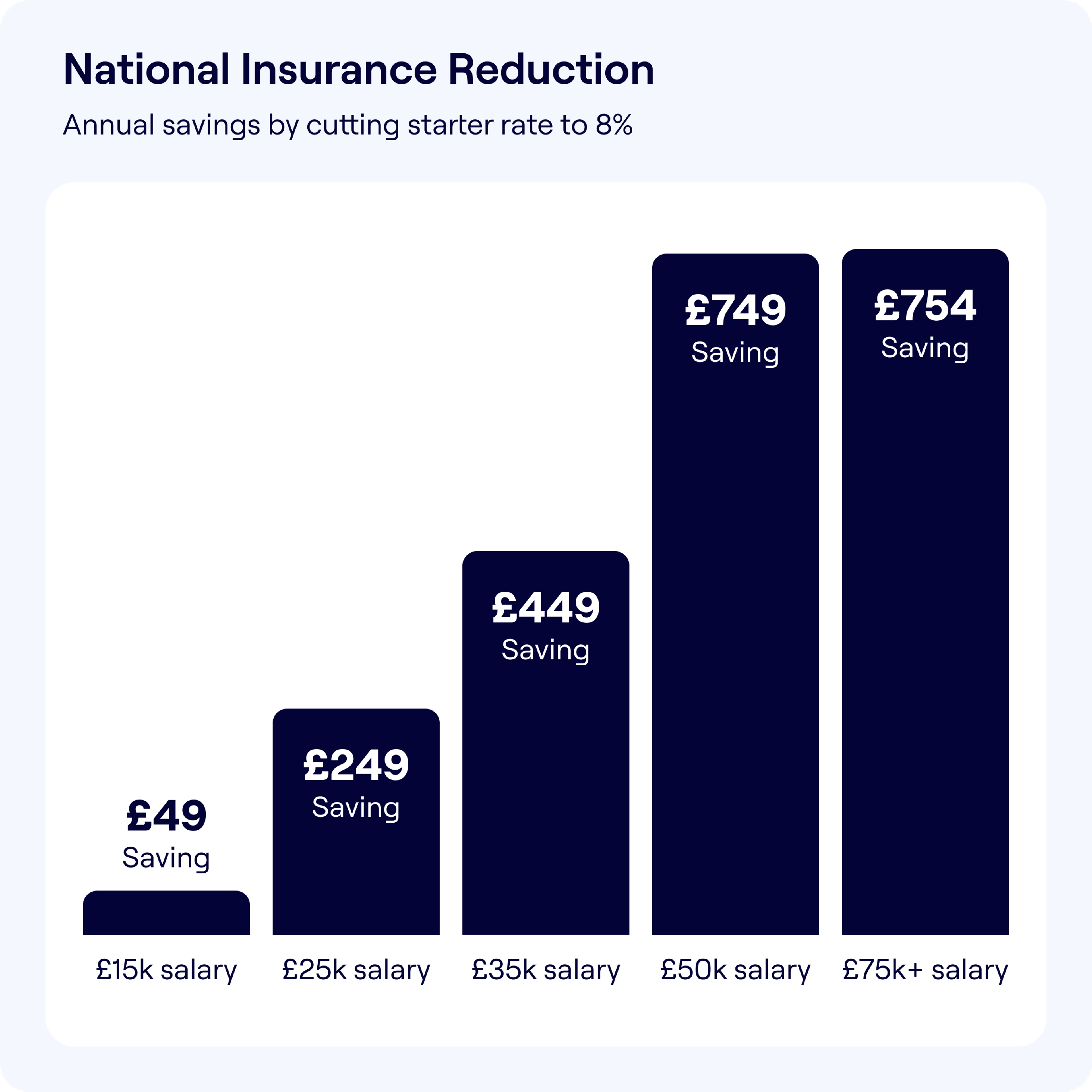

- National Insurance Reduction: For employees, down from 10% to 8%; for the self-employed, from 9% to 6%.

- Child Benefit Earnings Threshold Increase: Potentially boosting household incomes significantly.

- Introduction of a ‘UK ISA’: With an additional £5,000 allowance for investments in UK-listed companies.

- Capital Gains Tax on Property Reduction: The top rate drops from 28% to 24%, with specific changes for holiday let investments.

- VAT Threshold Increase: From £85,000 to £90,000, easing the tax burden on small businesses.

- Non-Dom Status Abolition: Moving to a residence-based tax regime.

National Insurance and Pension Planning

The Chancellor’s flagship announcement heralds significant savings for both employed and self-employed individuals, effective from April 6, 2024. It presents a prime opportunity for re-evaluating pension contributions to secure long-term financial well-being.

- For the Employed: The reduction in National Insurance contributions from 10% to 8% will lead to a direct increase in take-home pay for many workers. Specifically, those earning the average UK salary of £35,400 stand to save around £450 annually. When combined with the 12% to 10% reduction in the 2023 Autumn Statement the government says the average worker will be £900 a year better off.

- For the Self-Employed: The reduction in National Insurance for self-employed workers from 9% to 6% marks a significant saving of approximately £650 annually for the average self-employed person earning £28,000. This adjustment acknowledges the unique challenges faced by the self-employed sector and provides them with additional financial support.

However, even with these reductions, it’s worth bearing in mind that the threshold at which you start paying income tax remains frozen at £12,571 which means more people will end up paying income tax.

Child Benefit and Family Finances

The increase in the Child Benefit earnings threshold from £50,000 to £60,000 is a boon for families, potentially making them £2,200 better off annually. Child Benefit will now be lost once one parent earns above £80,000 – up from the previous £60,000. Child Benefit is worth about £111 a month for the first child from 6 April 2024, and £73 a month for a second child.

Contributions into a pension can reduce taxable income, potentially keeping it below the Child Benefit threshold and maximising the benefit received. For example if you earn £65,000, you could pay £5,000 into a pension and still receive the full Child Benefit (as long as there isn’t another earner in your household with earnings above the threshold).

Introduction of a “UK ISA”

The introduction of a “UK ISA” with an additional £5,000 ISA allowance for investments in UK-listed companies presents a new opportunity to save tax-free. The governments’ aim of introducing the “UK ISA” is to encourage investment into UK companies – they plan to consult on the details, and there’s currently no launch date.

Implications for Property Investors

Two changes announced at the Spring Budget will have implications for property investors.

First up, the top capital gains tax rate on second homes or investment property is dropping from 28% to 24%.

However, taxes are increasing for holiday let investors. The abolition of the furnished holiday lettings (FHL) tax regime in April 2025 means that owners of holiday homes will no longer be able to deduct full mortgage interest. The government’s aim is to incentivise more landlords to let property for the long-term amid a current shortage of rental properties.

VAT Threshold Increase and Non-Dom Status Changes

The increase in the VAT threshold from £85,000 to £90,000 will help more self-employed workers and small business owners avoid this tax.

Those who stay in the UK for more than four years will pay the same tax on their foreign income and gains as all other UK residents under plans to abolish non-UK domiciled individual status (“non-doms”).

Future Pension Changes

- Pensions Industry Reform: There’s a notable push towards transparency in the pensions industry. The government plans to require Defined Contribution pension funds to publicly disclose their asset allocations, including investments in UK equities. With Penfold, this is already a reality – we make it easy to see which companies, industries and locations your savings are invested in.

- Value for Money (VFM) Framework: In partnership with the FCA and The Pensions Regulator (TPR), the government is working on a VFM framework. This initiative aims to identify pension schemes that may focus too much on short-term cost savings at the expense of long-term investment outcomes, or whose current scale might hinder value to savers. Regulatory actions could be taken against schemes offering poor outcomes.

- Pensions Lifetime Provider: The government remains committed to exploring a lifetime provider model for Defined Contribution (DC) pension schemes in the long term. Continued analysis and engagement will be undertaken to ensure this benefits pension savers.

Conclusion

The 2024 Spring Statement presents several opportunities and considerations for individuals looking to optimise their financial planning and savings strategies.

We encourage savers to consider how these changes can be used to enhance their financial well-being. Whether it’s through adjusting pension contributions, exploring new saving avenues like the “UK ISA,” or understanding the tax implications of the latest announcements, we’re here to support you, ensuring you’re on track to meet your saving goals and enjoy a secure financial future.

As with all investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.

Murray Humphrey

Penfold