Reduce Employer NICs: Salary Sacrifice Pensions

Is Salary Sacrifice Worth It?

- By

- Frankie Dewar

Thinking about setting up salary sacrifice for your company? Wait!

Salary sacrifice can help your employees keep more of what they earn by lowering their taxes. Plus, as an employer, you’ll save by trimming your National Insurance contributions (NIC).

Is salary sacrifice worth it for UK businesses? We’ll explore the pros and cons as well as the different ways both you and your employees can take advantage.

What is salary sacrifice?

In a nutshell, salary sacrifice is where an employee agrees to swap part of their salary for a non-cash benefit. This lowers their annual pre tax salary, the ‘sacrificed’ earnings are then used to fund another benefit provided by the company. One of the most popular ways of using this scheme is with a salary sacrifice pension scheme.

Traditionally employees pays into their pension from their pre-tax earnings. With salary sacrifice, employees reduce their salary - instead contributions come entirely from the employer.

The result is that employees take-home pay is lower 'on paper'. This means the amount of salary National Insurance applies to is also lower. They also benefit from tax relief on their pension contribution.

As the employer, you'll also make savings on the National Insurance owed for your employees.

Other uses of salary sacrifice

The most popular use of a salary sacrifice scheme involves workplace pensions. However, employers can offer a range of other non-cash employee benefits. Here are a few examples:

- Childcare vouchers

- Cycle-to-work schemes

- Company gym membership

- Company car

- Life cover

- Professional development courses

The pros of salary sacrifice

The primary advantages of a salary sacrifice scheme are:

- employees can reduce their National Insurance contributions

- employees get tax relief on the money they add to their pension

- employers can reduce their National Insurance bill

Employees benefit from keeping hold of more of their earnings and trimming their tax bill.

Salary sacrifice example

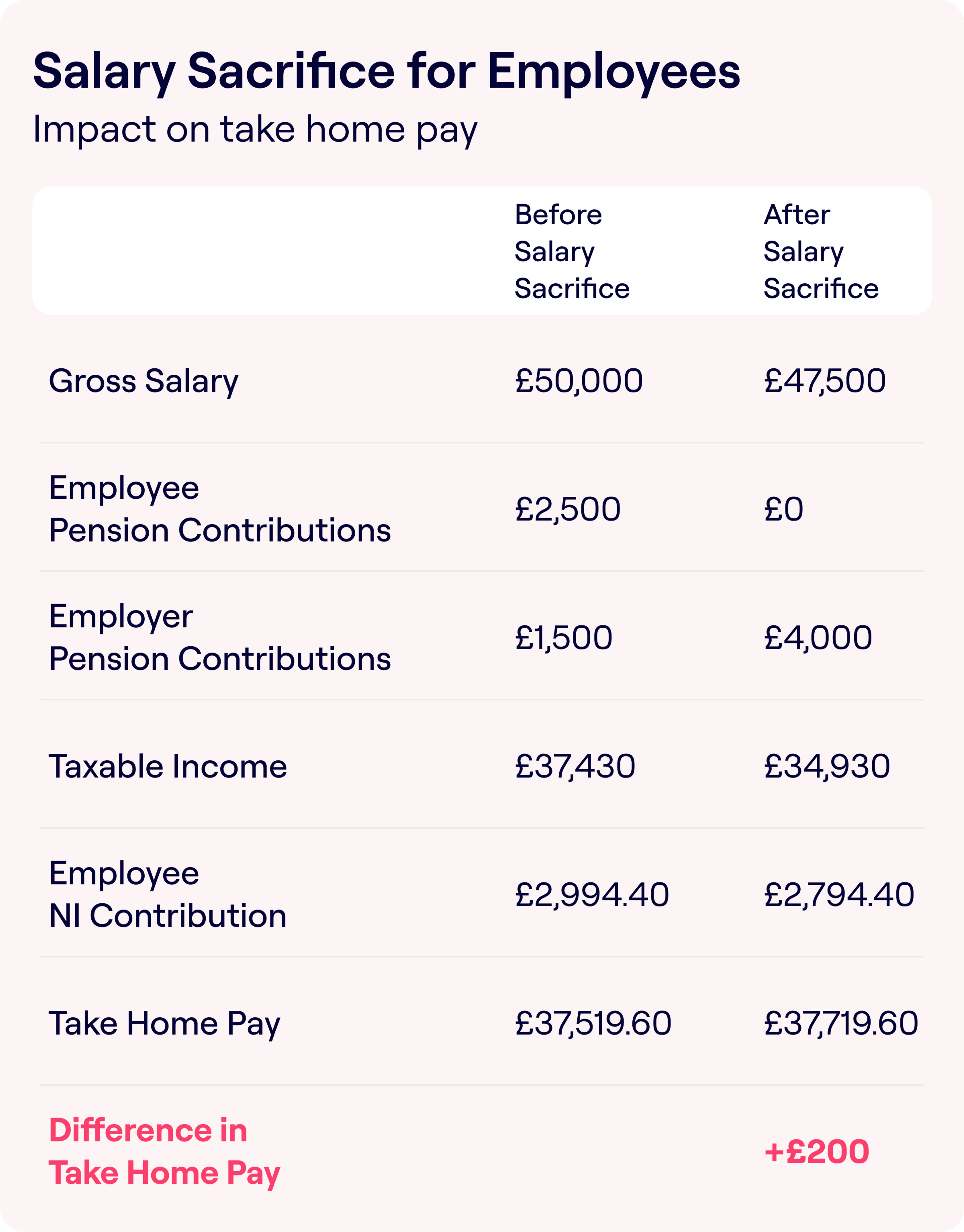

This example shows the difference salary sacrifice makes for an employee with an annual salary of £50,000.

Before salary sacrifice:

- The employee makes the minimum pension contribution of 5% (or £2,500 a year).

- The employee's net pay after tax and pension would be £37,519.60.

After salary sacrifice:

- The employee's earnings drop to £47,500, meaning they are being taxed on £47,500 rather than £50,000.

- The employee is still contributing the same 5% (or £2,500 a year) into their pension. However, this contribution is no longer included in their total salary.

- Net pay increases to £37,719.60 with no impact on total contributions into the employees workplace pension scheme.

The table below shows how much an employee earning £50,000 a year would save by switching to a salary sacrifice pension.

In some cases, employers add their National Insurance savings from salary sacrifice into the employee’s workplace pension as well. This increases their overall contribution and gives their employees a boost on the way to retirement.

The table below shows the employer impact of switching to a to a salary sacrifice pension. Of course, the more employees a business has, the larger the savings will be.

Non-cash benefits such as pension contributions and cycle-to-work schemes are exempt. This is because employers pay National Insurance on gross salaries.

See how much your business and employees could save by using our salary sacrifice calculator.

Further benefits depend on the benefit but include:

- Better employee engagement and retention

- A more attractive benefits package for new hires

- Improved mental and physical well-being of your employees from corporate gym memberships

- Higher levels of morale and productivity due to better care of your employee’s children

Employers can switch to salary sacrifice by updating their employment contracts. Any changes will need to be agreed by their employees first.

The cons of salary sacrifice

While there are several benefits, salary sacrifice can also have a few negative consequences. Here are some key factors to keep in mind that could affect your final decision.

As an employer, you could encounter increased administration costs when you implement a salary sacrifice scheme. These typically include:

- cost of amending employment contracts

- updating your payroll

- submitting another compliance check

Of course, the savings you make from switching to salary sacrifice could help to cover this initial cost. Penfold can also take care of this for you, making the entire process effortless.

It's also worth noting that any employees on a low income may not be eligible to join. This is the case if salary sacrifice results in their income falling below the national minimum wage.

Additionally, there can be an impact on an employee's salary based benefits and ability to borrow money. Again this is because salary sacrifice leads to a lower overall income. In particular, it could have a knock-on affect on:

- life insurance

- mortgage borrowing

- statutory maternity pay

- credit card borrowing limits

- unemployment benefits

- disability benefits

It’s important to note that salary sacrifice contributions are considered solely employer contributions.

Contributions via salary sacrifice are unlikely to be refunded if an employee wants to opt out of auto enrolment. This is the case whether they are part of a defined benefit or defined contribution pension scheme.

Is salary sacrifice worth it for your business?

For an employee, salary sacrifice is almost certainly worth it. Especially as the pension contributions can help grow their retirement savings, while helping them pay less tax.

As an employer, you should check whether your workplace pension provider accepts salary sacrifice contributions and get their advice.

Looking to trim your business' National Insurance bill with salary sacrifice?

- See how Penfold can help you save money with salary sacrifice.

- Request more information about salary sacrifice.

Frankie Dewar

Join Penfold and bring financial wellbeing to your team

Give your team a top pension and boost their financial wellbeing

Boost your benefits package to keep and tempt the best talent

Get industry-beating account management at no extra charge