7 minutes

Property v Pension: which is a better investment?

- By

- Elizabeth Anderson

You could pour thousands of pounds into both of them during your life. But which one is the winner?

Owning a property and putting money into a pension are the two biggest investments people will make in life.

As most people pay a 25 year mortgage (or longer) on their home and you can’t access the funds in your private pension until you are 55 (rising to 57 in 2028), both are long-term investments that have the potential to provide financial security in later life when you stop working. Because no one wants to work forever, right?

And at the time of writing, the value of both of those investments amounts to hundreds of thousands of pounds. The average UK house price is £286,000 according to the Office of National Statistics. The average pension pot size for those nearing retirement is £107,300.

However, the Pensions and Lifetime Savings Association (PLSA) think the value of that pot should be much more. Assuming 20 years of retirement and using their Retirement Living Standards as a guide means you’ll need around £450,000 for a moderate standard of living.

Don’t panic! We realise this is a huge sum of money. However, it is achievable with the help of tax breaks that everyone is entitled to, something called compound growth and, maybe most important of all: time. At least the same amount of time it takes to pay off the average mortgage.

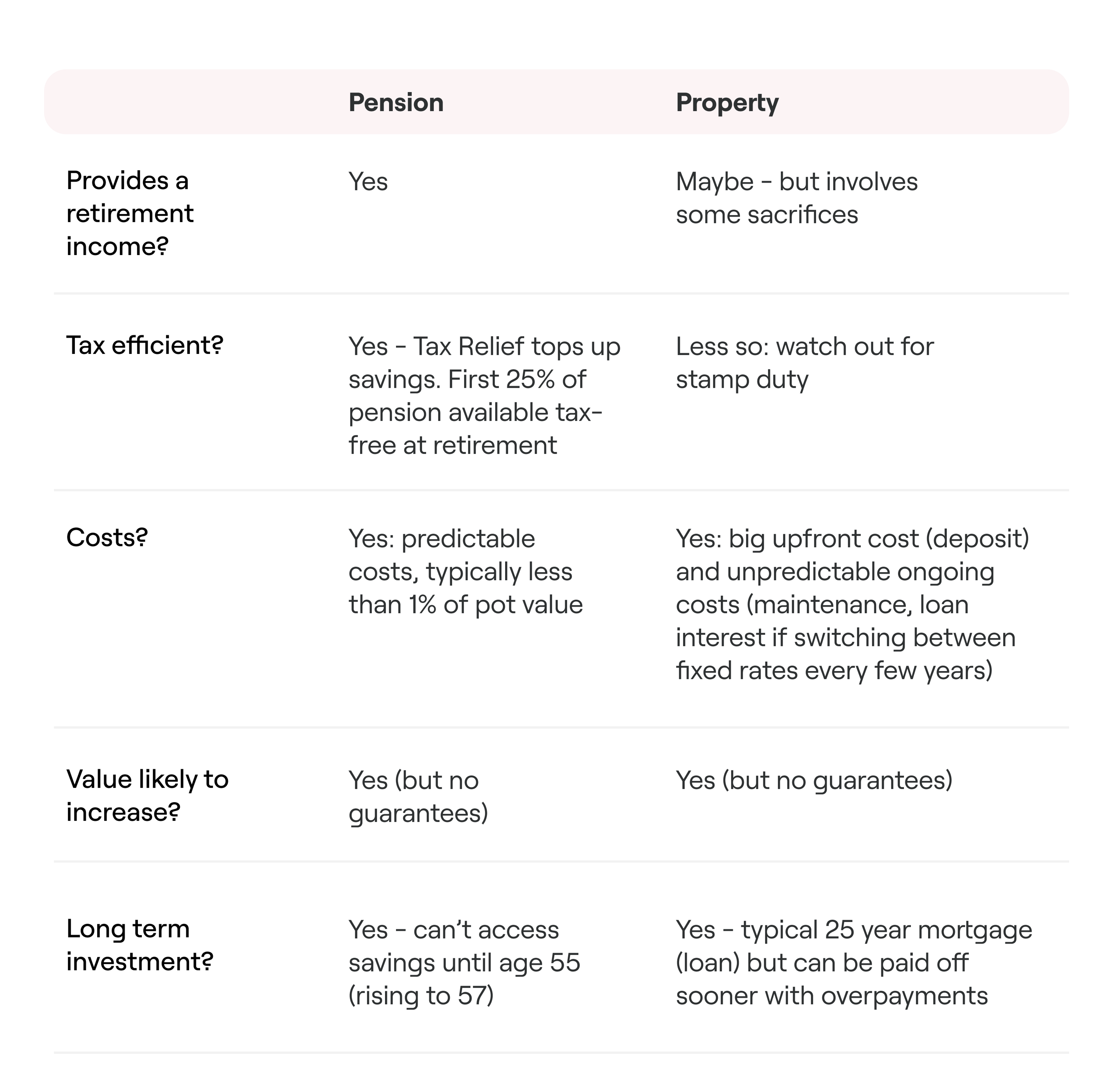

So if you had to choose, where should you put your money? We’ve put together a few pointers to help you consider which option – property or pension – is best when thinking about your future.

Pensions: the ultimate flexible savings account?

Investing in a pension means saving money over the span of your working life to provide a replacement income when you finish working – and we’re focusing on private pensions here.

There is of course the state pension. It’s currently worth £10,600 per year, an amount that would be very difficult to live on. It’s why auto-enrolment was introduced in 2012, to encourage people to save into a supplementary private pension.

Pensions can be an extremely tax-efficient way to save for retirement. As long as the money you put into pensions doesn’t exceed your annual salary or £60,000 (whichever is lower) you won’t be taxed on it. As well as the money that is automatically deducted from your salary when you are enrolled in a workplace pension, you can also make ad-hoc lump sum payments.

And you can have several pensions. Indeed, it’s likely you already will have a few if you’ve worked for different employers. You can choose to save with a range of providers if you are looking for variety as each provider will offer different funds and plans.

Alternatively, you may prefer to have all your savings in one place so you can keep track of them. It’s easy to combine all your pensions in one place, as we explain here.

Home sweet home

So how does putting your money into bricks and mortar compare? Here are some of the plusses.

The most obvious thing to say is that it will provide you with a secure place to live. If you keep up mortgage repayments, you’re investing in your own home and if you have chosen a fixed rate mortgage, your monthly payments will stay the same for an agreed period of time.

On the other hand, if you’re paying a landlord to rent a property, they can raise the rent whenever they like or choose to end your tenancy, meaning you’ll have to look for somewhere else to live.

Once you’ve paid off the mortgage, you’ll no longer be tied into monthly property payments – which is important for a comfortable lifestyle when you retire.

Indeed, the Retirement Living Standards we mentioned above don’t take into account that you will be paying monthly mortgage repayments or rent. If you are doing so by the time you retire, your outgoings will obviously be more.

Just like a pension, a property is likely to increase in value over time. From the early 1990s through to 2021, there was substantial growth in the UK housing market, though the rate of increase varied from year to year and region to region.

According to the UK House Price Index, prices on average more than tripled in this period (allowing for inflation). The average house price in the UK in the early 1990s was around £50,000, and by 2021, the average house price was approaching £250,000. As ever, past performance is no indication of what might happen in the future.

Property: considerable costs

First and foremost, buying a property requires a substantial upfront payment. According to Zoopla, it’s 15% of the cost of the house, with the average deposit required for a 3-bedroom house currently being £34,500. That’s quite a bit more money than you need to start a pension.

There are also costs involved with owning a home as they do tend to need maintenance! Paint will peel (or get marked by the kids dashing around) and appliances will fail and need to be replaced. If roofs or windows need replacing, they’ll leave a much bigger hole in your pocket.

The second is there’s no guarantee the property will rise in value. The area may change over time or a recession may drag house prices down at a time you are looking to sell.

Then there are the taxes you have to pay. When buying a property, you’ll pay stamp duty land tax (SDLT), the rates for which are here. For example, if you are buying a home for £320,000 you’ll pay £3,500 (although first-time buyers in England and Northern Ireland do not pay stamp duty on the first £425,000 of any property).

The tax advantages of pensions

In contrast, pensions are much more tax-efficient. When saving into a pension you’ll benefit from tax relief. Essentially this means any money paid into your pot is boosted by an extra 25% from HMRC, and higher rate taxpayers can claim back a further 20% or 25%.

If you are employed, your employer will also pay into your pension each month – free money that will give your savings a further boost. Contributions are also automatically deducted from your salary, enforcing good saving habits.

When it comes to drawing your pension, 25% can also be withdrawn tax-free in retirement. The remaining amount may be subject to income tax if you take money out regularly.

Last, there is the magic ingredient of pensions: compound growth.

Pension drawbacks

Pensions are designed to give you an income in retirement. As such, they are a long-term savings scheme and you won’t be able to withdraw money from a pension until the age of 55 (rising to 57 in 2028).

There is also the chance you could lose money if your investments don’t perform as well as hoped. The value of your investments can go down as well as up.

When you withdraw money from your pension, you’ll pay income tax on withdrawals above £12,570 a year (the personal allowance). However, the first 25% of your pension is tax-free.

Finally, there is a maximum on how much you can pay into a pension a year while receiving tax relief. This is £60,000, which is more than most people would pay into a pension but can be an issue for high earners who would like to contribute more.

Paying for retirement

The most obvious advantage to pensions is that they will give you an income in retirement. A pension is a pool of money from which you either can draw funds or buy an annuity, which generates an income for life. You’ll have to use some of this to pay rent if you don't already own a house outright, plus your pension has to cover all your other living expenses, such as the weekly shop, household bills, travel etc.

If you own the house you live in when you retire, there’s no rent to pay, but how do you pay all your other living expenses? If you’re banking on the value of your property to help pay for retirement, there are a couple of ways to do it but both involve some sacrifice. If you have a family home you could downsize to a flat and live off the excess proceeds – if the profit will cover however many years you live for.

Another option is equity release (gradually re-mortgaging) where you're being loaned money to pay for your living expenses and essentially giving the house back to the bank when the last borrower dies or moves into long-term care.

Property v Pension: which is the winner?

Pensions offer a lot of plusses. Tax relief and employer contributions are essentially free money, adding to the amounts you put in, and growth is tax-free until you withdraw money in retirement. At this point, you may pay income tax depending on your annual earnings but you get a generous tax-free allowance. Most importantly, you’ll have a pot of savings with which to supplement the limited state pension.

But we’ve also got a lot of time for property. Given the upfront investment required, it’s not as easy to get started with property as it is with a pension, but investing in a home to call your own can provide a valuable sense of security. Plus, if you can pay the mortgage debt before you stop working, it’s going to make for a more comfortable retirement.

Pensions and property have both enjoyed significant growth over the long term. In the last 50 years, the value of housing has risen by an incredible 464% (averaging 9% per year). Pension savings are mostly invested in stocks; for comparison the FTSE100 was launched in 1984 and in that time has risen by 645% (averaging 7% annually).

Both investments come with risks, but there is also a lot to be gained. You might not be surprised to hear us conclude that, because of the tax advantages, the slow but steady growth they offer and the predictable costs, we think pensions just edge it.

With investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice and past performance is not a reliable indicator of future performance.

Elizabeth Anderson