Unveiling the Hidden Costs of Home Ownership in the UK

- By

- Murray Humphrey

The cost of living crisis has impacted UK homeowners greatly over the past 2 years - as rising costs affect our ability to save as energy costs, maintenance and day-to-day charges continue to eat into our disposable income. Whilst ever-growing interest fees increase, mortgage rates and rising energy costs increase our monthly bill payments, there is also a realm of hidden costs within our home that go relatively unnoticed. When combined can actually make a big difference.

With this in mind, Penfold has investigated the hidden cost of home ownership and what small things could make a big difference in our savings.

Energy Vampires: The Silent Saboteurs Draining Your Wallet

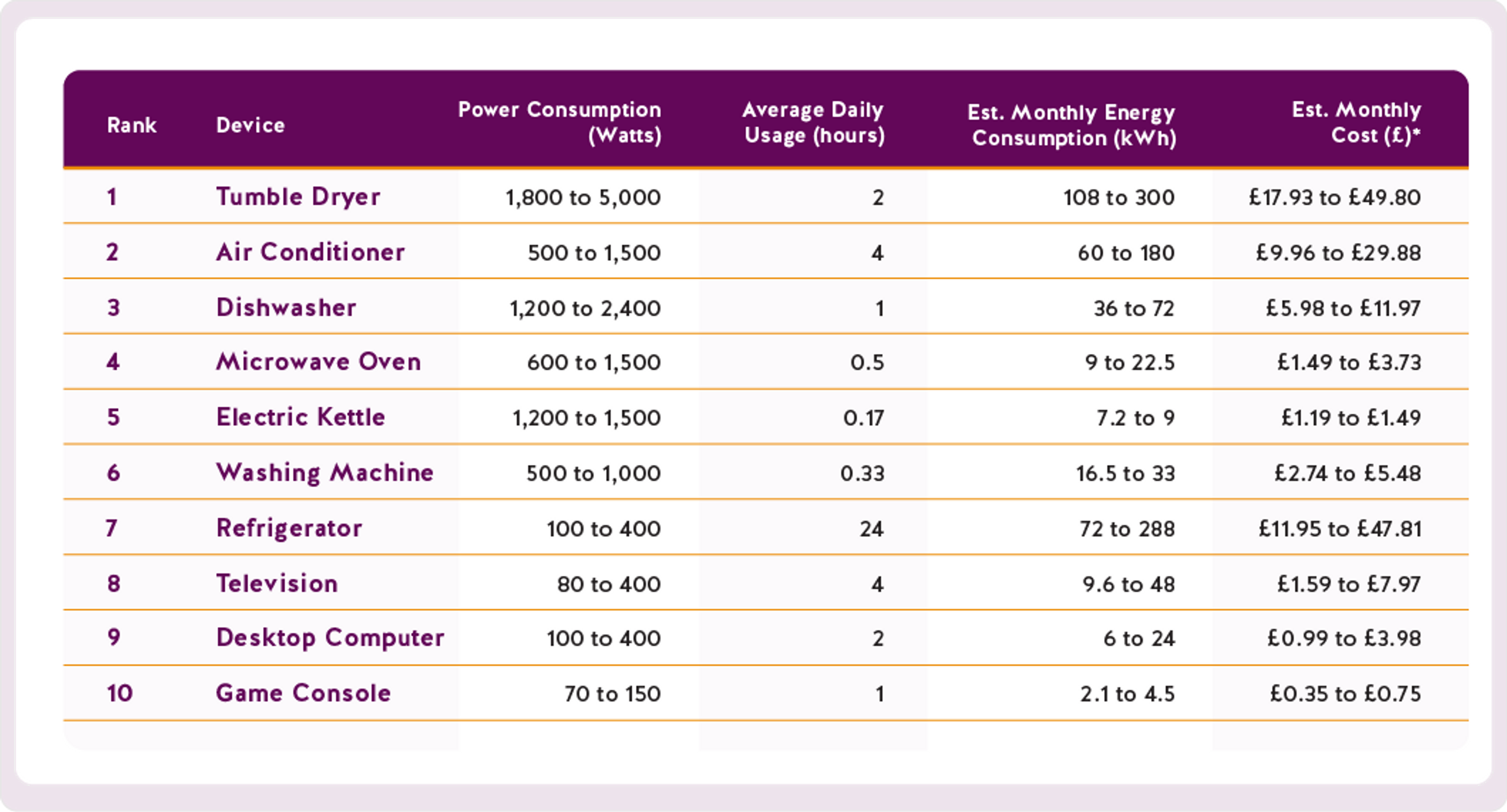

Did you know that even when your electronic devices are turned off, they can still consume electricity? These stealthy energy vampires lurk in your home, secretly draining power and increasing your energy bill. According to a study conducted by the Energy Saving Trust, energy vampires can account for up to 16% of a household's electricity usage in the UK, costing the average UK household around £147 per year.

The implications of these hidden costs are significant, both for individual households and for the environment.

Common energy vampires include devices such as televisions, gaming consoles, set-top boxes, computers, printers, and even seemingly harmless items like phone chargers. These devices often feature standby lights, digital displays, or remote control sensors that necessitate a constant power supply, leading to continuous energy consumption.

Please note that the estimated monthly energy consumption and costs are based on the assumed average daily usage and the average cost of electricity in the UK at 16.6p per kWh. Actual costs may vary depending on individual usage patterns and electricity tariffs.

*Estimated monthly costs are rounded to the nearest penny (£).

These findings have unveiled the energy-guzzling culprits in our homes, with tumble dryers and air conditioners claiming the lead.

Findings also show that major appliances like dishwashers, washing machines, and refrigerators are significant contributors to energy consumption. While smaller devices such as microwaves, electric kettles, and televisions may seem innocent, they still add to the overall electricity costs.

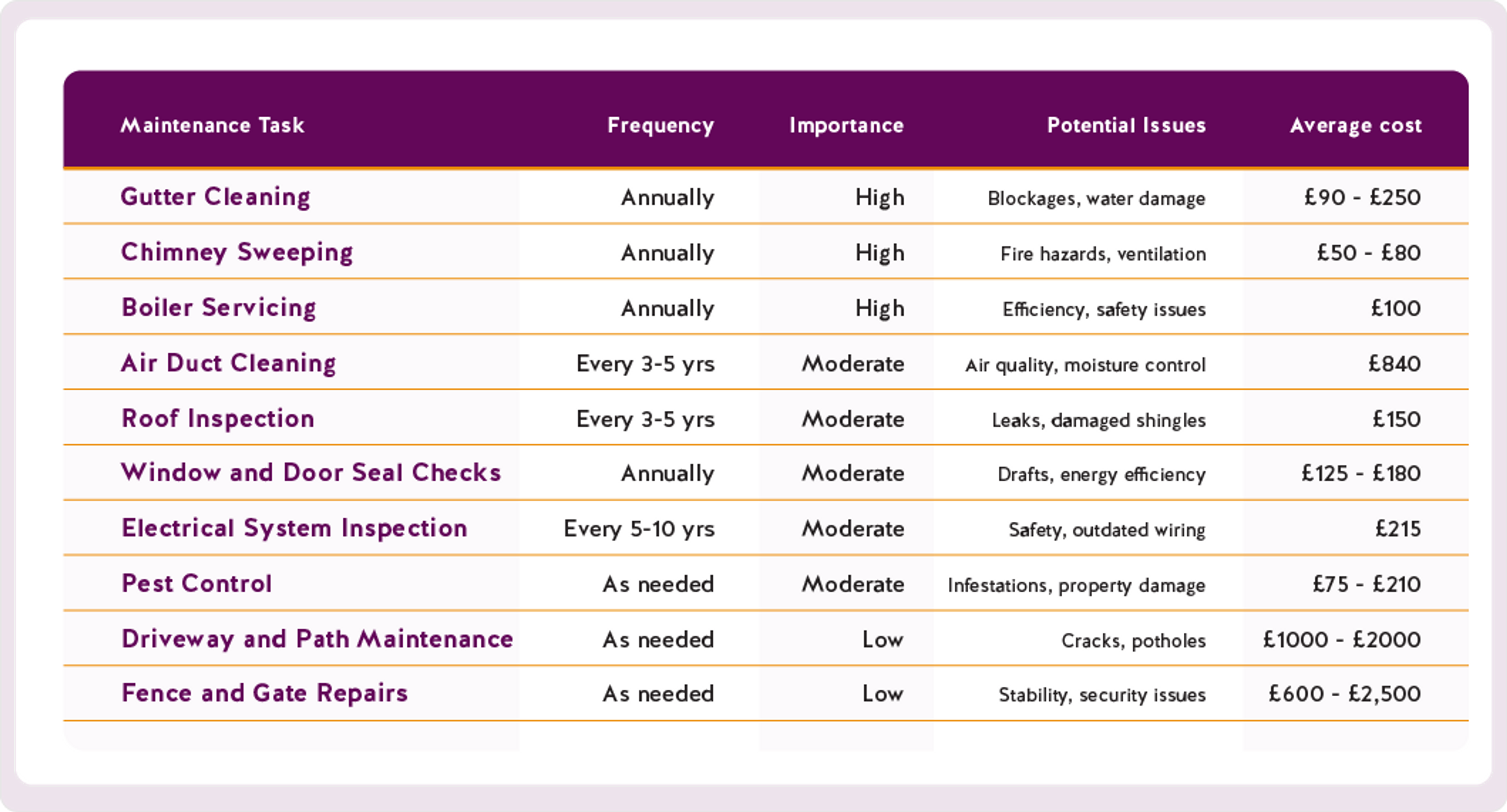

Sneaky Maintenance Tasks

Maintaining a home in the UK is a never-ending task, and it's the hidden maintenance costs that can catch us off guard. According to Rated People, 51% of homeowners will do less home improvement work because the cost of work has increased.

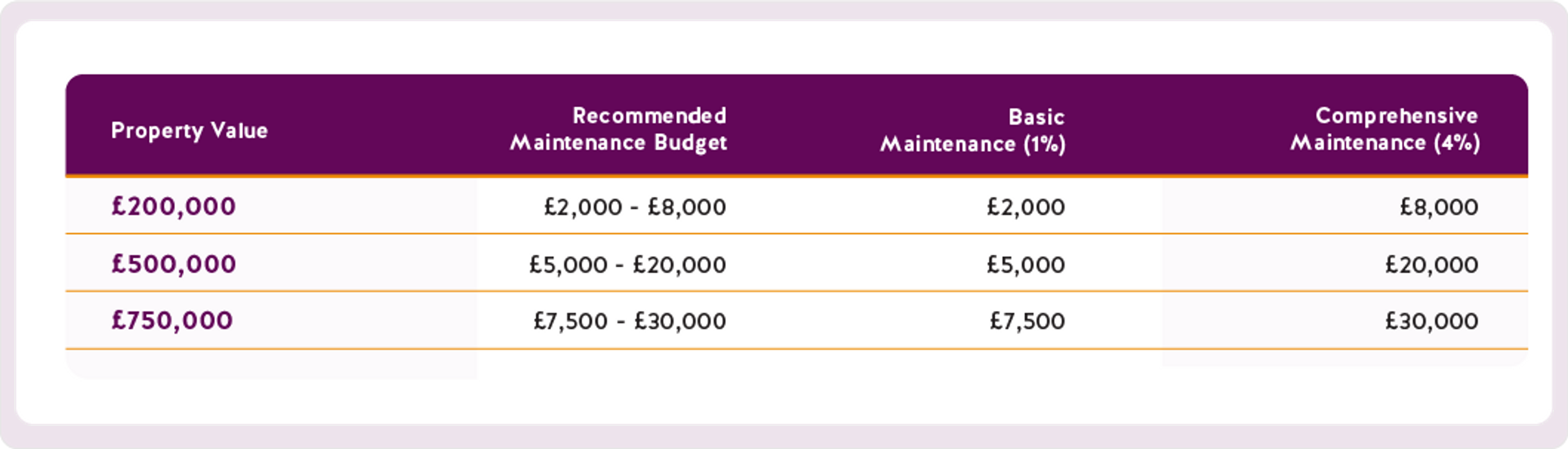

According to a report by Southwark Council, UK homeowners should spend between 1% and 4% of the value of their property per year on home maintenance and repairs.

For instance:

However, many homeowners underestimate the ongoing costs involved in keeping their homes in top shape.

Neglecting essential maintenance tasks in the UK, such as boiler servicing, gutter cleaning, and roof inspections, can have detrimental consequences that extend beyond immediate inconvenience. These tasks may seem minor or easily overlooked, but failing to address them can lead to more significant repairs and higher expenses down the line. Let's explore why these maintenance tasks are crucial and the potential risks associated with neglecting them.

The Most Expensive Room in the Home

The kitchen is often considered the most expensive room in an average house in terms of electricity consumption due to the presence of multiple energy-intensive appliances.

Refrigerators are essential appliances that run continuously, consuming a significant amount of electricity. According to Uswitch.com, a typical fridge in the UK consumes around 166 kWh of electricity per year which costs around £53 a year. However, this figure can vary depending on factors such as the size, age, and energy efficiency rating of the refrigerator. You may be able to reduce the running cost of your fridge by setting it to a temperature around 2 or 3 degrees celsius - this is sufficiently low to prevent bacteria growth but not so low that it unnecessarily increases energy consumption.

Electric ovens are known to be energy-intensive appliances, especially when operated at high temperatures. According to the UK government's data on average domestic electricity consumption, electric cookers (ovens and hobs) account for approximately 4% of the total household electricity usage. The exact energy usage can vary based on factors such as cooking time, temperature, and cooking method, but the predicted cost of usage is around £50.

Microwaves are generally more energy-efficient compared to ovens. According to the Energy Saving Trust, a microwave typically consumes around 0.17 kWh per use which is 8p per day. Based on these numbers, if we used a microwave every single day for a year, it’d cost us around £30. However, the energy consumption can vary depending on the wattage and duration of operation.

Modern dishwashers have become more energy-efficient, but their energy usage can still be significant. According to the Energy Saving Trust's data, dishwashers can cost us up to £72 to run per year. The exact energy consumption can vary depending on the dishwasher model, program selected, and load size.

The cumulative cost of running kitchen appliances can have a notable impact on a homeowner's annual expenses. When considering the costs of refrigerators, electric ovens, microwaves, and dishwashers, the total annual expenditure can amount to approximately £205. These figures emphasise the significance of managing energy consumption in the kitchen to maintain financial stability and create room for savings.

By choosing energy-efficient appliances, homeowners can reduce electricity usage and subsequently lower their utility bills. Simple habits like using appliances efficiently, such as running the dishwasher only when it's full or utilising the microwave for smaller cooking tasks, can contribute to overall energy savings.

By actively managing kitchen energy consumption and considering energy-efficient choices, homeowners can not only control their annual expenditure on electricity but also contribute to environmental sustainability. These conscious efforts enable individuals to allocate their resources towards other financial goals, such as retirement savings or education expenses.

Pete Hykin, CEO and Co-Founder at Penfold, a workplace pension provider, comments:

“It's not enough to diligently manage our mortgage payments and utility bills. We must delve deeper and uncover the silent financial culprits that quietly chip away at our budgets, leaving us wondering where our hard-earned money went.

The implications of these hidden costs are significant, both for individual households and for the environment. Take energy vampires, for example. These culprits consume electricity even when our devices are turned off, accounting for up to 16% of a household's electricity usage in the UK. By addressing this issue, we not only reduce our energy bills but also contribute to a more sustainable future by lowering unnecessary strain on power grids and decreasing carbon emissions.

Similarly, neglecting essential maintenance tasks can have detrimental consequences, leading to more significant repairs and higher expenses down the line. It's important to allocate a portion of our budget for home maintenance and repairs, following the recommended range of 1% to 4% of the property's value per year. By staying on top of these tasks, we can prevent minor issues from turning into major headaches and ultimately save money in the long run.”

Murray Humphrey

Penfold