What does capital at risk mean?

- By

- Murray Humphrey

As you look around for the best place to save your money, it's likely you'll run into the warning "your capital is at risk". But what does that actually mean? In today's blog, we'll explain what capital at risk is and how this affects your pension.

Capital at risk meaning

Put simply, capital at risk means there's a chance you could lose money from an investment.

Whereas some methods of saving (like a bank account, or a cash ISA) offer a fixed, steady interest rate, others invest your money into a financial market, seeking higher returns.

A financial market here just means a place where the value of something varies by how much someone is willing to pay for it. Good examples include buying stocks and shares, commodities like gold, or even buying a house. With these kinds of investments, there is no guaranteed return on your money - you could make a nice profit, or you could end up with less than you originally had.

The word capital simply refers to the money you have available to invest - hence the term, capital at risk.

In an ideal world, any investment opportunity you come across would be accompanied by an in-depth, balanced explanation of the pros and cons.

Of course, in reality, there often isn't enough time or space on things like ads or social media posts. For these, the Financial Conduct Authority (FCA) recommends including “capital at risk” as a short-hand compromise.

Here's the main takeaway. Whenever you see the phrase your capital is at risk, just think: there's a chance I could end up with less money than I have right now.

Capital at risk means you could lose money from the investment.

What does capital at risk mean for pensions?

Now we've defined the concept, let's look at an example - what does capital at risk mean for your pension?

Everything you pay into your pension is invested into a pension fund - a bundle of different investments curated by a fund manager to help your pension pot grow over time.

Pension funds work by combining the pension contributions of different savers into one giant pot, which is then invested into a range of financial assets, including equities (company shares), bonds and gilts, property, and even cash. Your money isn’t held in a savings account, it’s used to buy a small part of these investments.

Over time, the value of your savings may grow from stock price increases, interest earned on fixed-interest investments, or dividends paid out from shares. However, because these investments are susceptible to market forces, the value of your pot can go down as well as up. This is why you'll see the message "your capital is at risk".

Why pick investment options with capital at risk?

Ok, if certain investments include a risk of losing money - why on earth would anyone use them? It’s all about returns.

Generally speaking, investments that include a level of risk allow for higher potential returns. Rather than settling for a lower, fixed growth, you’ll have the chance for your money to grow far more significantly.

A regular savings account with a fixed interest rate of 0.5% (if you’re lucky) sounds all well and good - until you realise you’re actually losing real money to the rising costs of living.

Inflation means that every year the price of things like fuel, milk and bread go up - £10 last year won’t go as far this year.

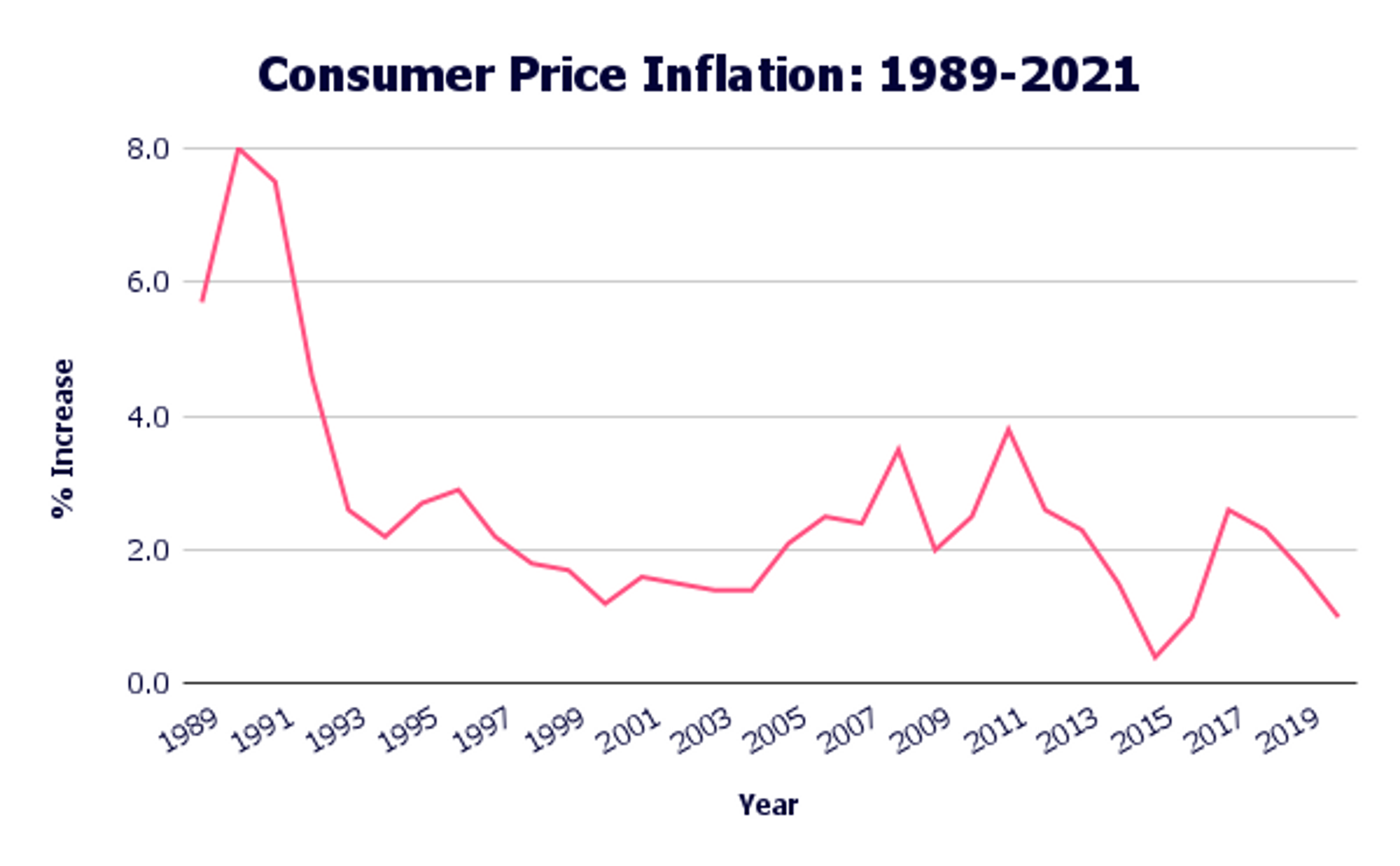

Source: Office for National Statistics

The chart above shows how much the cost of living has risen each year. As you can see, the price of everyday items goes up by around 2.5% on average. That means any money you have in a savings account with an interest rate of less than 2.5% has actually gone down in value.

In order to actually grow your savings and end up with more in the long run, it’s strongly recommended to take some level of risk to make sure you beat the rate of inflation.

The other factor at play here is time. When we talk about risk, we often also talk about volatility - the size and frequency of ups and downs in the value of your investments.

- the more time your pot has to recover from any dips

- the longer compound interest has to work its magic

Here’s the thing to remember: While it’s important to be aware of the risk that comes with investing, it’s equally crucial to know that, in the long term, you are far more likely to end up with more money in your pension than if you hadn’t invested.

Murray Humphrey

Penfold