Autumn Statement 2023: Impact on Your Financial Future

You’ve probably heard quite a buzz about the UK Government’s Autumn Statement 2023, haven’t you? Well, it’s not just hot air – this statement could be a game-changer, especially if you’re keeping a keen eye on pensions and personal finance. Let’s unpack this together, shall we? We promise to keep it light and insightful.

Simplifying and Strengthening Pensions

Lifetime Provider Model and Small Pots: Imagine a world where managing your pension is as simple as managing your favourite playlist. The government is proposing a ’one pension pot for life’ approach, reducing the complexity of having multiple pots. Practically, this means that when changing jobs you’ll be able to pay into your previous workplace pension scheme rather than having to set up a new account. It’s a major step towards simplifying pension management.

Saver Choices at Retirement: With new proposals, retirees will have better guidance and options when accessing their pensions. This means more informed decisions and potentially more stable financial retirement plans.

Focus on Long-term Investment Over Low Fees: The Government wants pension funds to shift focus to long-term investment performance rather than just low fees. This approach might increase your pension value over time, a positive move for your future.

Ensuring Trust and Value in Pensions

Master Trust Review: The review of the Master Trusts market is like a regular health check for pension schemes with the aim of maintaining high standards in their management. The goal? To ensure pension savings are in safe hands, managed by schemes that meet rigorous criteria.

Value for Money Framework: The government wants to make sure that every penny put into your pension is working its hardest for you. The implementation of this framework will help ensure that every pound in your pension is working effectively towards your retirement goals.

Fueling Growth Through Pension Investment Initiatives

Investment Initiatives: By introducing funds like the Growth Fund and supporting technology and science businesses, the government is aiming to create robust investment opportunities for pension schemes. This could lead to more dynamic and profitable pension portfolios, offering potential for higher returns. It’s about choosing investments that not only grow your pension but also contribute to the broader economic landscape.

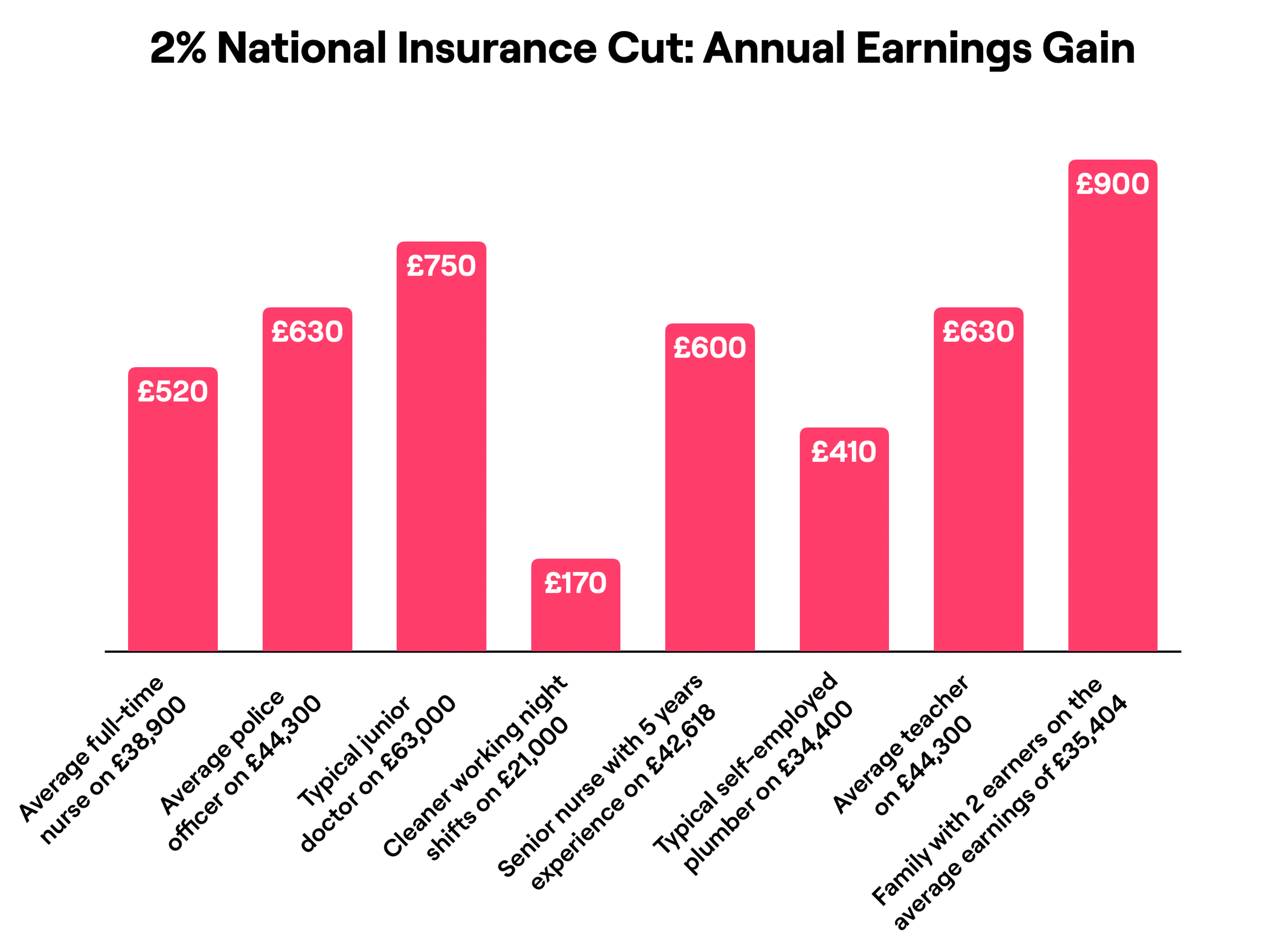

National Insurance Savings

The reduction in National Insurance contributions means more take-home pay for millions of workers and self-employed individuals. It’s a financial boost that directly benefits your pocket, enhancing your ability to save or spend.

The State Pension and the Triple Lock

The Triple Lock is like a sturdy umbrella against the storm of economic change. The government’s decision to uphold the Triple Lock guarantees that the State Pension will increase in line with average earnings. This is crucial for protecting pensioner incomes against inflation and economic shifts, ensuring that pensioners are not left out in the cold.

Navigating Financial Change with Confidence

From pension reforms that seek to make your retirement smoother and more rewarding, to adjustments in National Insurance that put a little extra back in your pocket, these measures are about crafting a financial environment where more people can thrive.

At Penfold, we see these changes as positive moves, aligning with our commitment to simplifying pensions and finance for everyone.