1. What is this Document?

We hate hidden fees at Penfold. That’s why we’ve written this summary of all fees and charges for the Penfold Pension to hopefully make everything crystal clear. Although you should read this alongside the Penfold Terms and Conditions, you won’t find any other hidden fees buried elsewhere. Please do contact us with any questions.

2. Annual Fee

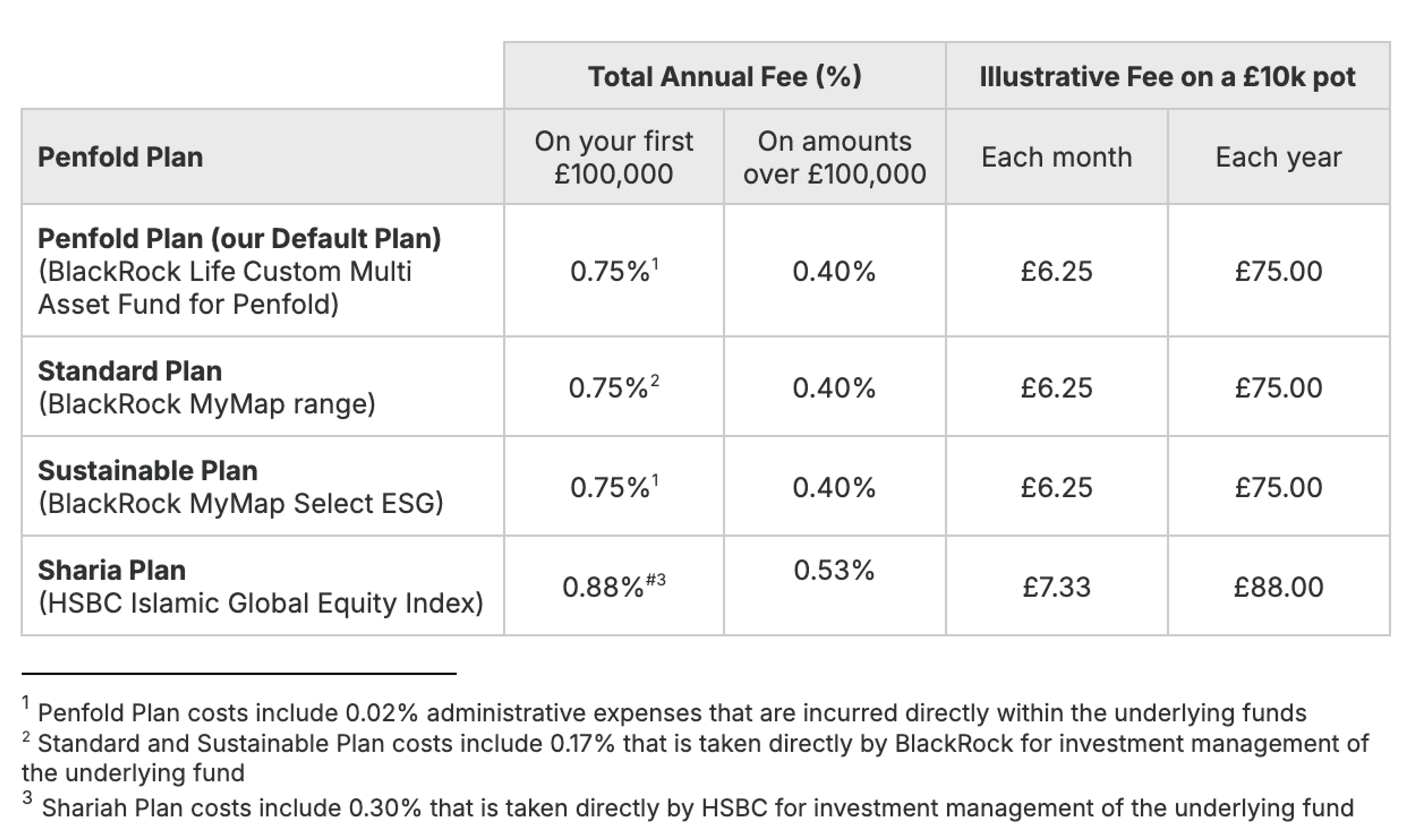

Your Penfold Pension has one simple Annual Fee, which is calculated as a small fixed percentage of the amount you have saved up in your Penfold Pension. It is calculated based on the daily value of your chosen pension plan, and the appropriate monthly proportion of the Annual Fees is deducted each month from your pension portfolio.

This fee covers absolutely everything for your Penfold Pension, even the underlying costs of managing your investments that are paid to the providers of the Permitted Investments held within your Plan. Please note however that you may have to pay other costs and charges (see section 5 below).

The table below shows a breakdown of our Annual Fees across our various Plans and an illustrative example of what you may pay, unless otherwise agreed, in which case we will inform you about your fee structure directly.

For customers invested in the Default Plan, Penfold will deduct 0.73% in Annual Fees from your Plan, with a small amount (0.02%) being incurred within the fund as administrative expenses, for a total 0.75% in Annual Fees.

For customers invested in the other Plans, we will take a smaller percentage of the Annual Fee directly from your Plan to pay for the pension services provided by us, and the manager of the Permitted Investments held within that Plan will take the rest directly from the Plan for the management services that they provide. But the overall fee you pay, and its daily calculation process, is the same as for our Default Plan.

3. Benefits Withdrawal Fees

After you reach retirement age, some pension providers charge further administrative fees when you decide to take out your pension money, which are different depending on how you choose to draw the money. These are called Benefits Withdrawal Fees.

We do not currently charge any Benefits Withdrawal Fees to existing or new customers. We will however let you know if we ever intend to change this policy.

4. What’s Included

The Annual Fee includes everything from setting up your Penfold Pension with us, making any type of contribution, transferring in or moving money between Penfold Plans, drawing money after you turn 55 or even if you decide to leave us before then.

If you then decide that you want to transfer all your pension pots to one place we will transfer those into your Penfold Pension all for free too. However, there may be some rare circumstances where we are unable to offer this service to you, which we will discuss and explain at the time of the transfer request.

The following Penfold services are provided at no additional cost to you:

- Setting up your Penfold account;

- Locating your previous pensions;

- Consolidating your pensions;

- Withdrawals;

- 30 day cancellation;

- Free transfers out at any point;

- Changing your Pension Plans;

- Pension splitting on divorce;

- Payment of Pension death benefits;

- Payment of Pension ill/serious-health benefits;

- Provision of contract Notes.

5. Other Costs and Charges That May Apply

Post

All documentation and communications in relation to your Penfold Pension will be provided electronically through our website. If you want us to provide you any paper documents through the post, additional postal fees may be applied. If you ask for this, we will tell you the fee we charge for sending by post.

Transaction Costs

All investments include transaction costs which occur when they are bought and sold – including when we or you buy and sell investments within your Penfold Pension. These include taxes such as stamp duty or levies charged by the regulatory or tax authorities. These fees are not earned by Penfold. The effect of these fees is to marginally reduce the growth of your investments. These transaction fees vary by each of the investments you might be invested in and continually change over time.

Over 2024, the average transaction cost for each BlackRock fund was:

- Standard Plan - Risk Level 4 ( MyMap 6): 0.06% transaction cost

- Standard Plan - Risk Level 3 ( MyMap 5): 0.06% transaction cost

- Standard Plan - Risk Level 2 ( MyMap 4): 0.07% transaction cost

- Standard Plan - Risk Level 1 ( MyMap 3): 0.06% transaction cost

- Sustainable Plan - Risk Level 5 (MyMap 8 Select ESG): 0.11% transaction cost

- Sustainable Plan - Risk Level 3 (MyMap 5 Select ESG): 0.17% transaction cost

- Sustainable Plan - Risk Level 1 (MyMap 3 Select ESG): 0.09% transaction cost

Switching risk levels within the Penfold Plan:

When you switch between risk levels within the Penfold Plan, your investments may need to be rebalanced to reflect the new target asset allocation. This rebalancing involves buying and selling investments and therefore incurs transaction costs. Based on estimates provided by BlackRock, this is expected to result in a one-off transaction cost of approximately 0.08% of the value of your pension at the time of the switch. This cost is not charged by Penfold and is incurred within the fund as a result of the underlying transactions.

The transaction cost for our HSBC fund is:

- Sharia Plan (HSBC Islamic Global Equity Index Fund): 0.013% transaction cost

The money manager separately discloses these costs and as BlackRock and HSBC are two of the largest money managers in the world they are able to keep these costs as low as possible.

Small amounts left in account

We may also charge a small administrative fee for closing your Penfold Pension in circumstances where there is a small amount of money left on your account which you do not wish to have transferred to another provider or withdraw. In such cases we will donate the fee to a charity of our choosing.

Fee Reviews

The fees described in this Charges Schedule may be varied from time to time in response to inflation, regulatory changes or other good reasons. Where possible we will give you advance notice via email of any changes to these fees.

Interest on Cash in your Penfold Pension

For customers in our non-Sharia Plans, interest is paid on the cash temporarily held, on your behalf, through your Penfold Pension. We calculate the interest due on your account each month based on the interest received from their partner bank.

The interest rate varies.

The investment principles for our Sharia Fund do not permit the collection and payment of interest on temporary cash balances. We will collect the interest in relation to these accounts and donate it to a charity of our choosing.

We periodically review our policy on interest payments. If there are any changes, such as stopping interest payments or charging a future administration fee, we’ll notify you in advance.

Non Payment of Annual Fee

The Penfold Pension is designed to have your money invested promptly. This means that there is usually no cash from which to take the Annual Fee. The Annual Fee is therefore deducted from your investments directly. If we are unable to be paid our fees directly by selling down investments because there is insufficient value in the investments within your Penfold Plan, we may sell whatever Assets are in your Penfold Pension to partially settle your fees and then close your account.