Pensions with the highest complaint rating

- By

- Murray Humphrey

In the last year, searches in the UK for “opt out of my pension” have increased 614%. Private and workplace pensions alike are seeing more applicants exiting their pension schemes than ever before.

In a recent survey, 2,086 UK adults were queried on their key concerns for the general population. The number one concern was the rising cost of living at 58%, closely followed by rising inflation at 42%.

The third biggest concern people wish to address is that they will not be able to save enough for retirement, at 29%.

Across the whole economy, there is a general downward trend in workplace pension participation, with the proportion of employees contributing at least 6.5% of their earnings decreasing from 46.7% to 45.4% between 2021 to 2022.

Private vs. workplace pensions

Workplace pensions and private pensions differ in regard to who sets them up. As the name suggests, workplace pensions are set up by an employer, with little input from the individual receiving it.

Private pensions, or personal pensions, are set up by the saver with no involvement from an employer.

While both pebsion types allow for the saver to put aside money for retirement, the amount you are able to save will differ.

Workplace pensions allow for a minimum individual contribution of 5% of your salary, automatically deducted from your monthly salary.

Additionally, contributions will also be made by the employer, with a legal obligation to pay an added 3%, resulting in a combined total of 8% monthly payments towards your retirement savings.

Those who choose to opt out of a workplace pension won’t be entitled to the additional contribution from their employer, so why are so many people opting out of their pension schemes?

Why are people opting out of pensions?

The alarming rate in which people are opting out of pensions is due to have a major impact on the collective ability to save for retirement, with 17% of 18 to 24 years olds opting out of pension contributions. Millennials aren’t far off, with an opt out rate of 15%, and Gen X, at 10%.

32% of savers in Generation Z say their primary focus is savings for a home, 31% are saving for material goods, while 28% say their main objective is affording a holiday abroad.

However, there was evidence of some younger people taking an interest in pension saving, with 23% of savers in Generation Z making additional contributions compared to 17% of Millennials and 25% of Generation Xers.

The upwards trend in the number of individuals opting out of their pensions is not only due to the period of financial instability we are experiencing but also because of the negative interactions with the pension providers themselves.

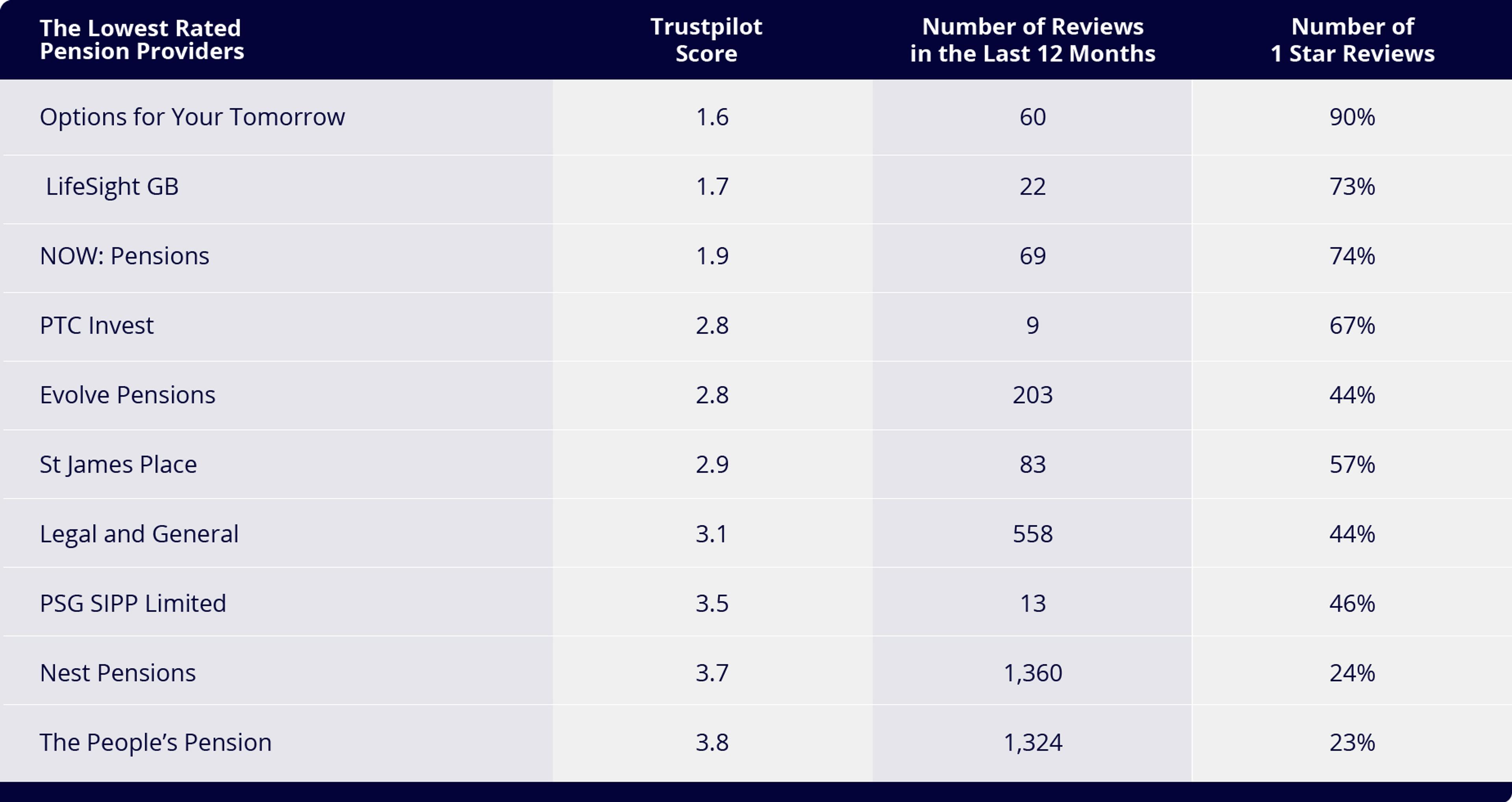

Based on Trustpilot reviews, Options for Your Tomorrow is the nation’s least favourite pension provider. 90% of their reviews in the last 12 months were 1 star out of 5, landing them with a total rating of 1.6 out of 5.

Additionally, while The People’s Pension have an overall score of 3.8, they have had the highest number of 1 star reviews in the last 12 months, with a total of 305. In contrast, Penfold has an overall rating of 4.6 out of 5, with 82% of reviews being 5 stars in last year alone.

The most common pension provider complaints

The reasons for certain pension providers not meeting customer expectations differs from provider to provider.

Many savers have reported the same recurring issues that have resulted in an unpleasant, dissatisfactory experience when attempting to add to or access their pension pots.

According to the Financial Ombudsman Service, there was a 91% increase in complaints about investments and pensions in the 2020/21 financial year. 20,854 complaints were received, compared with 10,920 in the previous year.

The number of complaints so far in 2021/22 is 16,276, as of 1st September 2022. This included 6,340 administration or customer service complaints and 2,662 new complaints about personal pensions.

There is a wide range of factors associated with the reduced number of people choosing to save for a pension.

Often it is due to the interactions savers experience with their pension provider, resulting in a level of distrust towards them.

1. Poor customer service

Poor customer service is amongst the most common complaints, with all of the lowest-rated pension providers including reviews detailing poor customer service practices.

All reviews for the lowest-rated providers commented on bad service, often flagging issues such as automated calls, appointments not being kept and avoidance of contact via email and telephone alike.

2. Lack of transparency

Misleading or unclear terms and conditions are one of the most common and troubling issues savers have dealt with when trying to access their pension pots.

Often savers are faced with excess charges that have not been clearly stated, leaving them in a financially precarious position.

Trustpilot reviews have revealed that the lack of clarity has left those savings for a pension in a financially precarious position.

Issues such as £500 costs for withdrawal and fixed fees up to £3,500 have been reported for some of the worst rated providers, with VAT costs having to be paid.

3. Unreliable handling of data and finances

Surprisingly, many reviewers of the lowest-rated pensions complained about the undependable nature of their providers.

Some found that their pension pots were not available or difficult to access when they reached retirement age.

If any of the money was available, some reviewers stated that the full amount initially promised was not paid out in full.

Funds were not the only thing that savers have claimed to have been mismanaged, but also personal data.

Customers have reported issues such as receiving information regarding other savers, rather than their own, or a complete loss of their own personal details by the provider.

Tips for choosing a pension provider

Choosing the best pension requires you to assess a variety of factors, including the associated features and fees each company provides. Key things to consider when choosing a pension include:

1. Understanding your pension type

The pension type you opt for should be considered, evaluating factors such as the investment options available.

Here you should assess whether you would prefer an app or web-based product while deciding whether you would like to be able to access other saving accounts such as ISAs, notice accounts, fixed-rate bonds and regular savings accounts to name a few.

2. Choosing a trustworthy provider

Pension providers who can provide educational and informative advice can help with your decision-making process.

This will include elements such as being able to speak to customer service promptly when required, as well as clear options surrounding when you would like to start taking money out of your account.

3. Knowing where your money is going

It is important to understand whether your pension provider is authorised and regulated by the Financial Conduct Authority and whether or not you will be able to make a claim to the Financial Services Compensation Scheme if they were to become insolvent.

4. Understanding pension fees

Customer service is a key part of knowing your money is safe with a pension provider, but knowing when you can start taking money out of your account, and the fees involved, are just as important.

Customer service is a key part of knowing your money is safe with a pension provider, but understanding how your savings might be charged is key to making a healthy investment for retirement.

The various fees you should understand before choosing a provider include:

- Account charges

- Foreign exchange fees

- Ongoing charges

- Exit charges

- Drawdown fees

Why choose Penfold?

While there is a steady decrease in the number of individuals who are opting into pension schemes, Penfold’s services are still highly sought after.

Penfold’s customer base has grown by 64% in the year to 31st August 2022 with 87% of Trustpilot reviews in the same period receiving a 5-star rating.

Penfold’s funds have also performed well - for example in the 36 months since it launched in May 2019, the Standard Plan risk level 4, Penfold’s most popular plan, saw investments grow by 32.5%.

The most comparable Vanguard LifeStrategy 80% fund has grown by 26.2% in the same period. It is important to note that past performance is no guarantee of future results.

Confusing fees and charges often cause issues for those saving in a pension. Penfold’s single, all-encompassing fee, reduces the uncertainty savers may face while saving for their retirement. Penfold’s annual fee is easy to understand, any type of contribution, transferring in or moving money between investment plans, drawing money after you turn 55 or even if you decide to leave us before then is completely free.

Concerns reported by savers using other pension providers are in contrast to the way that Penfold operates.

Customer service, client communication and issues surrounding security are handled promptly by Penfold’s team of experts, allowing you to reach out at any time with ease on chat, by phone, or by email.

Penfold can help you save for a pension with resources such as our Pension Calculator, helping you to figure out how much you may need to save for retirement.

Our Pension Guides can also help you to assess what type of pension may be best for your needs. Whether it’s a self-employed pension, a workplace pension or a private pension, easily find a pension or transfer your previous pension with Penfold’s extensive range of solutions, helping you to find the right option.

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest.

This information should not be regarded as financial advice.

Sources:

Murray Humphrey

Penfold