Penfold Partner With Just Eat

- By

- Murray Humphrey

Freelancing. Side-hustles. The gig economy. The way we work and earn has changed drastically over the last few years. Here at Penfold, we think it’s about time our pensions caught up.

Our mission is to make saving for tomorrow easier today. To offer a flexible pension that anyone can set up and manage effortlessly. No matter what their career looks like.

And it seems we aren’t alone. Just Eat, the nation’s favourite takeaway courier, have become our latest partner in the fight to make pensions painless. Read all about how we're working together and our courier pension below!

JustEat Deliver A Better Pension

When you’re a courier, it’s easy for your pension to fall to the bottom of your to-do list. Enter JustEat.

They wanted to make it easier for their couriers to start a pension. Now, we’re working together to give their 32,000+ strong delivery team access to our digital pension - with an exclusive bonus to get them started on their saving journey.

Just Eat are one of the pioneers of food delivery and are passionate about making their couriers' experience the best it can be. One of the ways they do this is by helping them prepare for the future. That’s why they’ve partnered with Penfold - to help their dedicated delivery team stop worrying about the financial future and focus on today.

The Simple Pension for Couriers

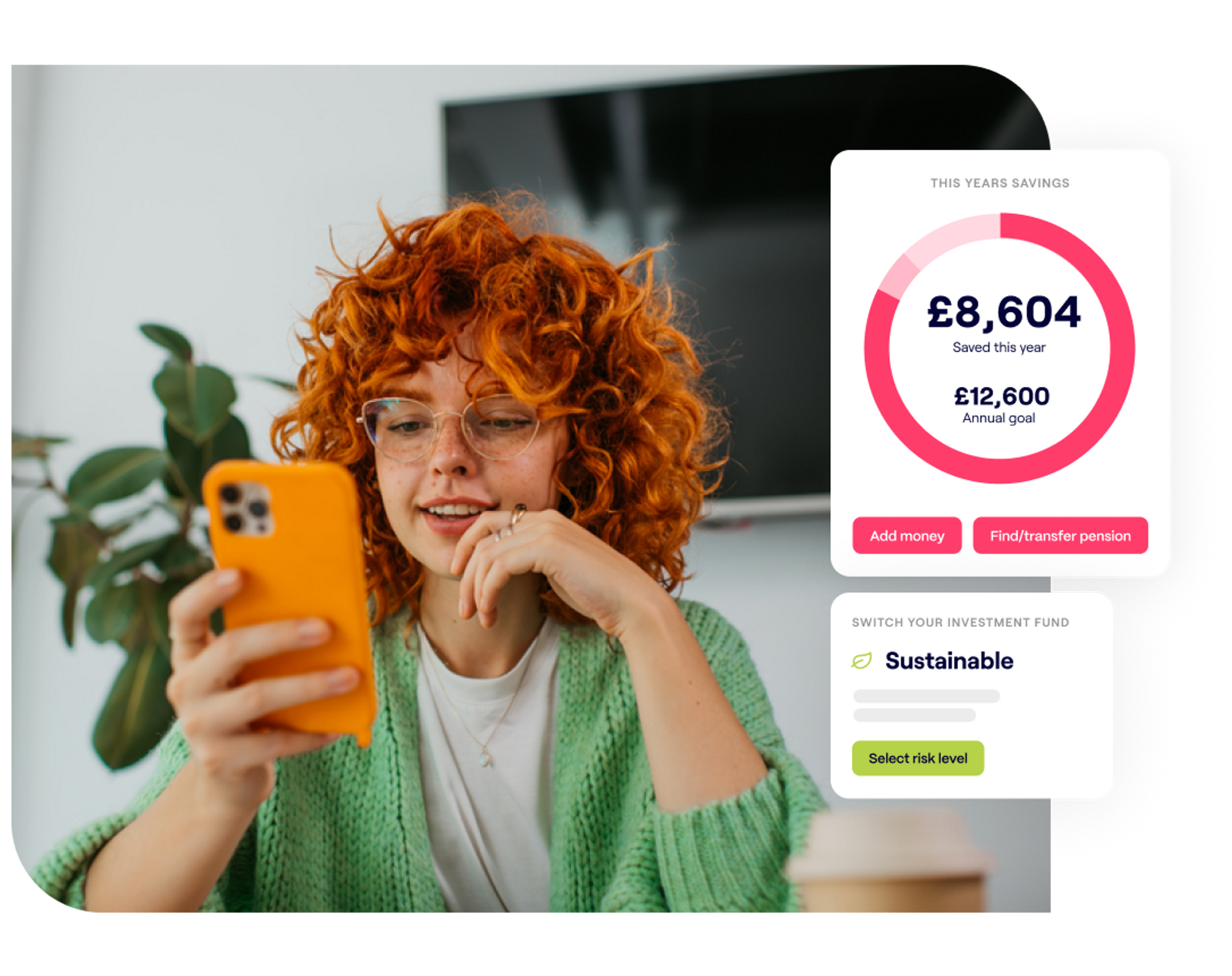

Couriers are often on the move and manage their work schedule via their phones - just one of the reasons Penfold and JustEat are such a great match. Our pension can be managed exclusively on your phone: couriers can top-up their pension, track down old pots and understand their retirement goals all from our app. The perfect fit for their busy schedule. Plus, it takes just 5 minutes to set up - less time than it'll take for your next takeaway 💪

We understand that a courier's income can vary throughout the year. That’s why Penfold’s pension has been built to be as flexible as possible. There’s no minimum contributions and couriers can pause contributions or make one-off payments whenever suits them.

The Just Eat Pension

Contributing to a pension, even a small amount, is a fantastic way for couriers to save for their retirement and make sure they take advantage of the tax benefits and compound interest that come with a pension.

Traditionally, pensions have not kept up with the rise of flexible work and we’re excited to partner with a thoughtful business in Just Eat to enable all their couriers to have access to a better pension.

For more information on setting up a pension for yourself, check out our guide to pensions for the self-employed.

Murray Humphrey

Penfold