The key principles behind our Sharia Fund

- By

- Chris Eastwood

Muslims represent a quarter of the world's population, yet less than 1% of global financial assets are Sharia-compliant. Penfold, the pension for everyone, is on a mission to turn this misrepresentation around!

As you know, we built Penfold to break down the traditional pension myths and complications, and make pensions accessible and simple for everyone. To put into practice our principles of inclusion, we’ve launched a Sharia compliant pension option to for the muslim community. We’re delighted to work with HSBC to launch our new Sharia Plan, for customers looking to invest their savings in line with Islamic principles on finance.

How is the fund Sharia-compliant?

If you select the Sharia Plan, this means that your pension contributions are invested in a wide range of different companies that operate in a Sharia-compliant way. Let’s break down what Sharia compliant really means:

Sharia Board

Each Sharia fund has its own elected Sharia board of people who monitor the fund, it’s investments and the managing directors to make sure that it’s being Sharia compliant the whole time. All major decisions have to be OK’d by the board. The board creates an annual Sharia certificate to evaluate how the fund has adhered with Sharia principles, to prove that it is fit as a Sharia compliant fund.

Ethical investing

Islamic philosophy prioritises ethical investment, which means that Sharia compliant funds don’t generate an income from unethical or non-halal means. The Sharia board makes sure it restricts or excludes investment in industries such as alcohol, tobacco, pork, finance sector, weapons & adult entertainment. The Sharia plan allows for up to 5% of income to come from non-compliant means, which is ‘purified’ and donated to community charities that support positive social change which is chosen by the Sharia board.

Interest

Islamic finance says that financially benefiting from lending, receiving or exchanging money is unfair and can create inequality. This is why no interest is earned or paid within a Sharia compliant fund. Instead, wealth is made by profits from trade and investment, rather than interest. This means that the assets in the Sharia fund are placed in a checking account which restricts earning interest on the money in the account.

Less uncertainty

Islamic finance rejects uncertainty because a risky investment could potentially involve selling goods & assets of uncertain quality, which goes against the Islamic principle of certainty and openness in business dealings. This means a Sharia fund doesn’t use complex investment methods and instruments that could involve greater uncertainty, risk and speculation such as derivatives. The fund instead just invests in listed company stock, to make sure all transactions are clear and identifiable.

Where is the Sharia fund invested?

The Sharia Plan invests 100% of your money in company stocks and so it carries a higher level of risk than some of our other plans, which invest a higher percentage of your money in bonds that are less risky. This means that there is a higher growth potential over the long term, however you may also see larger ups & downs along the way. Please bear in mind that these short term ups & downs are to be expected when it comes to investing in the stock market, and are in fact necessary when trying to grow your money over the long term.

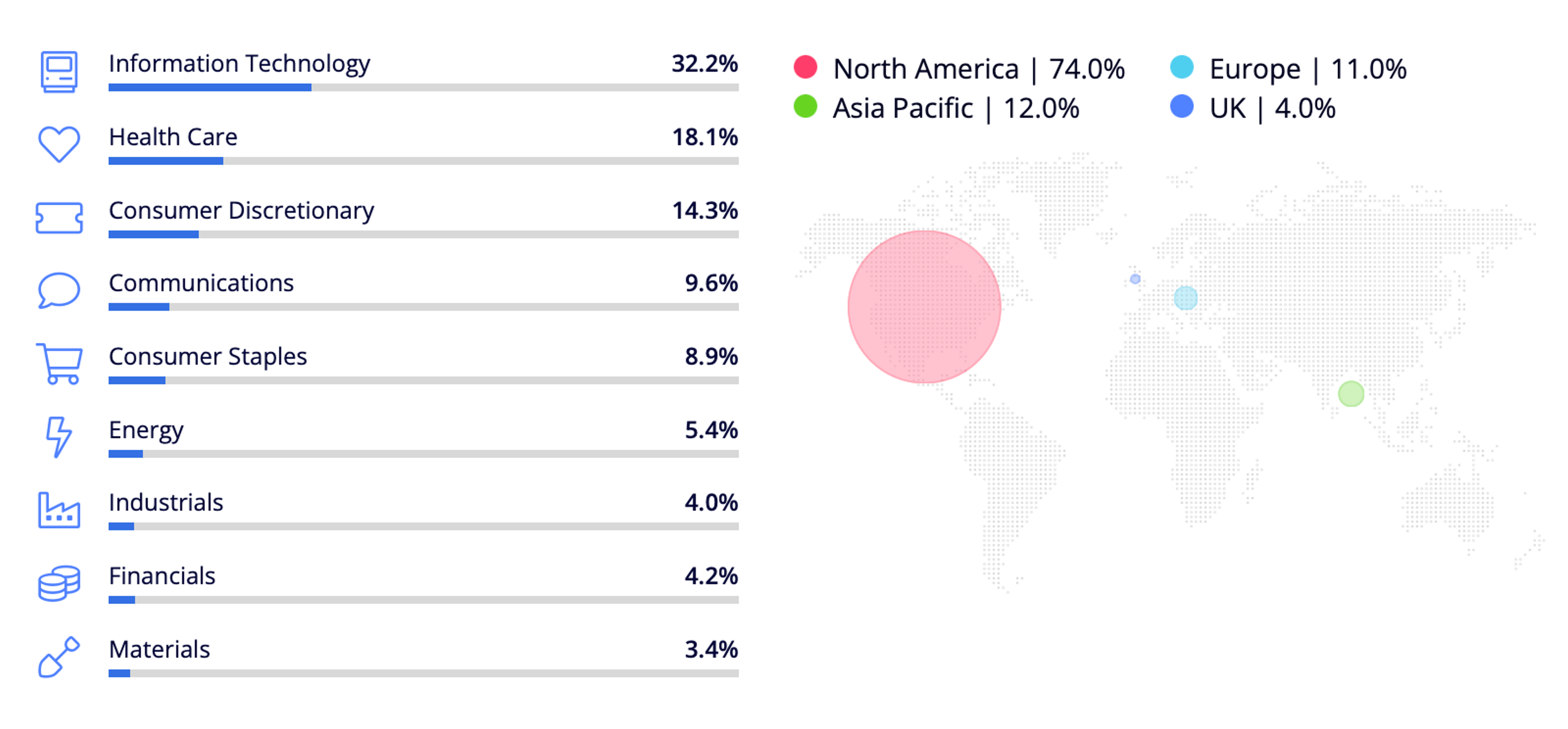

The companies this plan invests in are spread around the world with the majority (75%) based in North America, followed by 14% in Europe, 4% in Greater Asia, as of November 2022. The plan invests across a wide range of industries, with 31% in Technology companies, followed by 19% of the fund invested in Healthcare. Under 6% of the fund is invested in materials, energy and less than 1% in finance. You can see the full breakdown of the fund and what industries and countries it’s invested in below.

Who is the Sharia fund for?

This is a great option for those that are looking for a socially responsible way to invest their money under Sharia law. Because of the higher risk level, it means that the fund is a great option for those who are a long way from retirement, looking for strong, long-term growth and don’t mind ups and downs in value each year. If you’re close to retiring within the next few years, you may want to choose an investment option from our Standard plan, with a lower risk rating.

If you’re investing in our Sharia Plan, the all-in annual management fee is 0.88%. 0.3% of the annual fee goes to HSBC for investing your money. The remaining 0.58% (0.23% on amounts over £100k) is split between Penfold and its partners who help keep your money safe, in line with pension regulation, and claim back your tax relief.

Penfold’s Sharia Plan invests your money in the HSBC Islamic Global Equity Index Fund. More information about this fund can be found here:

HSBC Islamic Global Equity Index Fund - Overview

HSBC Islamic Global Equity Index Fund - Fund Information

As with all investments, capital is at risk so your pot value may go down as well as up.

If you have any questions, please get in touch with us on our online chat or through email here.

Chris Eastwood

Penfold Co-CEO and Co-Founder