Should Gen Z Be Doing More to Save for Their Retirement?

- By

- Murray Humphrey

As the UK’s Gen Z population begin to start their careers and enter the workforce, securing a pension pot for their retirement may seem like a distant concern. However, it’s more important than you think. With the state pension age seeing a gradual rise to 68 between 2044 and 2046 for those born on or after April 5, 1977, relying solely on a state pension won’t guarantee you a comfortable retirement. UK savers will need to start saving for retirement as early as possible to ensure a comfortable and secure future - and that includes Gen Z.

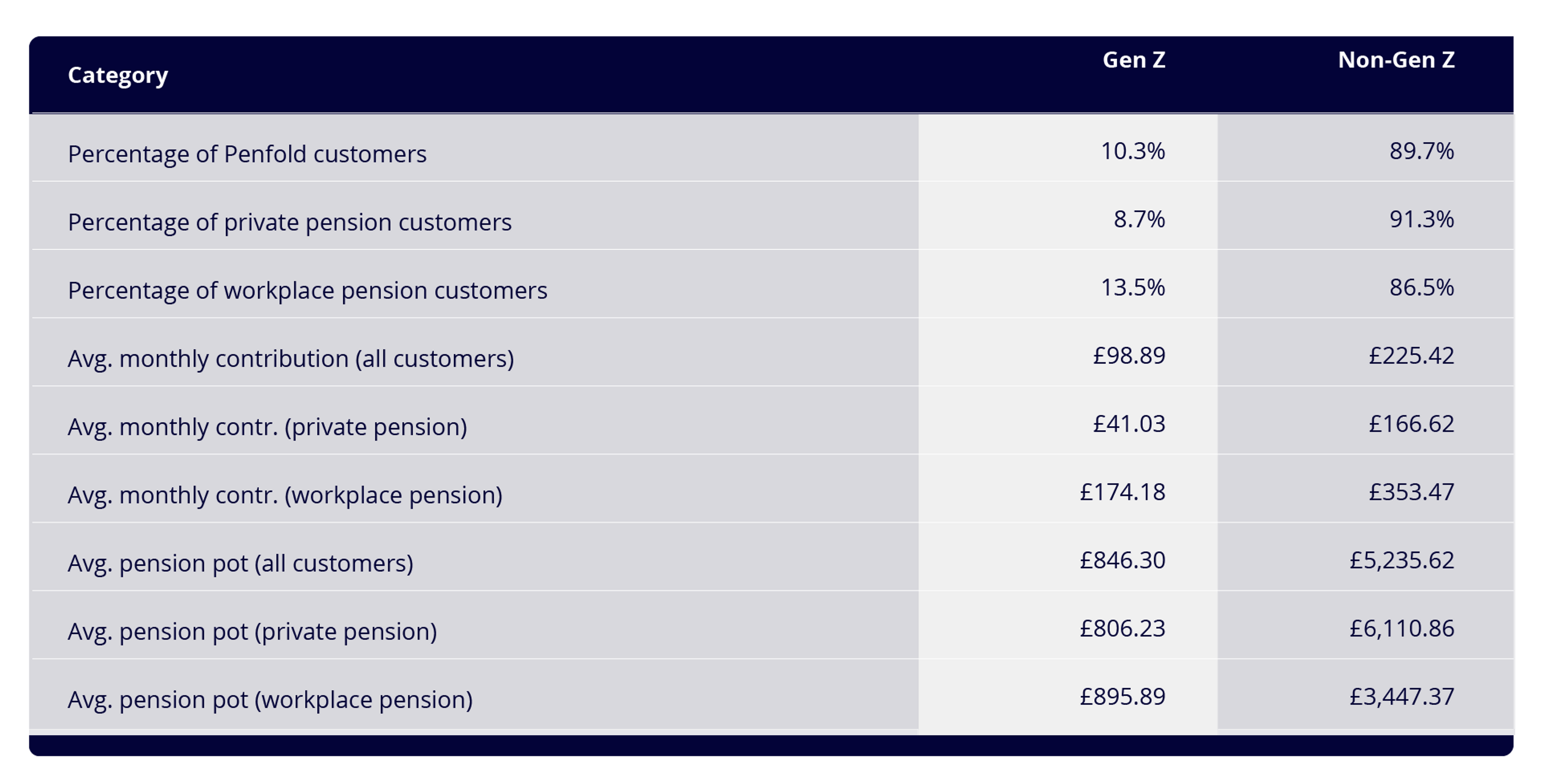

Penfold has analysed their database of savers and discovered that the average monthly contributions of Non-Gen Z savers are more than double those of Gen Z savers across all of Penfold’s customer types. This disparity highlights the potential challenges younger generations face in saving for retirement and the possible lack of financial education that’s needed to understand the importance of saving for your pension from an early age.

Whilst Gen Z is actively participating toward their financial future by contributing to their pension pots, their contributions are averaging only £98.89 per month. It would require 59 years of saving for a comfortable retirement which would mean they couldn’t retire until they were between the ages of 77 and 85.

According to a survey of UK adults by YouGov, 18-24 year olds believe they should be able to afford to retire by the age of 65. This is three years below the state pension age and 12 years below what they could afford with their current average contributions! It’s clear that at current contribution rates, Gen Zs will need to adjust their savings strategies or redefine their retirement expectations to retire before their state pension age.

How does Gen Z Saving Differ from Other Generations

As we delve into the financial habits of Generation Z, recent data from Penfold has unveiled some compelling trends and challenges that set them apart from their predecessors.

Focusing on retirement savings, the data reveals the following:

Gen Z prioritises workplace pensions over private pensions

The data shows that a higher percentage of Gen Z individuals participate in workplace pensions (13.5%) compared to private pensions (8.7%). The fact that Gen Z is opting for workplace pensions may indicate a lack of understanding about the importance of saving for retirement, and that retirement planning is not a priority for them. Not only this but according to a study by YouGov, 41% of 18-24 year olds are only making their employers' minimum contribution, which may leave them short when it comes to retirement.

Significant contribution gap between Gen Z and Non-Gen Z savers

The average monthly contributions of Non-Gen Z savers are more than double those of Gen Z savers across all customer types. Whilst this will be influenced by salary differences and career stages, the average monthly contribution for Gen Z is still below what that should be saving for their age group and average salary. This suggests Gen Z’s prioritisation of pensions is less than other key life savings events such as home ownership or holidays.

In a survey conducted by YouGov, when asked if you were able to withdraw money from your pension pot (either state or workplace), what, if any would you spend it on, 58% of 18-24 year olds said they would withdraw their money before retirement to spend on a large purchase they were saving for such as a house deposit or a holiday.

Workplace pensions are more effective for Gen Z's retirement savings

The data indicates that Gen Z savers have a larger average pension pot in workplace pensions (£895.89) than in private pensions (£806.23). There’s a lack of engagement and transparency around pensions for this age group which shows the importance that employers should have good pension schemes in place to support Gen Z and educate them about this topic.

But why is Gen Z so different to their predecessors and how will this impact saving for their retirement?

Alternative Career Paths for a New Generation

Gen Zs are forging a new path when it comes to careers and retirement savings. Many are turning to the gig economy, which offers flexible work arrangements and a way to earn income on their terms. However, this shift in career paths means that Gen Z must also take on the responsibility of setting up a private pension to ensure their financial security in retirement.

The gig economy refers to freelance work and short-term contracts, often facilitated by online platforms. According to a recent survey conducted by Fiverr, 70% of Gen Z consider freelancing a viable career option alongside a traditional 9-5. This approach allows them to continue working and earning an income well into their retirement years.

However, this shift to the gig economy also means that Gen Z must take on the responsibility of setting up their private pension. Unlike traditional employees who have employer-sponsored auto-enrolment retirement plans, gig workers must ensure they have enough savings to fund their retirement. Unfortunately, many are not taking this responsibility seriously.

This lack of pension savings could have serious consequences for Gen Z's financial security in retirement. Without a pension, they may be forced to continue working long past the traditional retirement age or live on a reduced income in retirement.

It's Getting Harder to Save for Retirement

Retirement savings have always been challenging, but it's become even more challenging in recent years. The retirement age is rising, and many traditional pension plans are struggling to keep up with the changing economic landscape. For Gen Z, it's essential to start saving now to ensure a comfortable retirement.

So, what can Gen Z do to ensure a comfortable retirement? Firstly, it's essential to start saving early. By taking advantage of compounding interest, even small contributions can add up over time. Employers often offer pension schemes, so it's worth checking what options are available and taking advantage of any matching contributions.

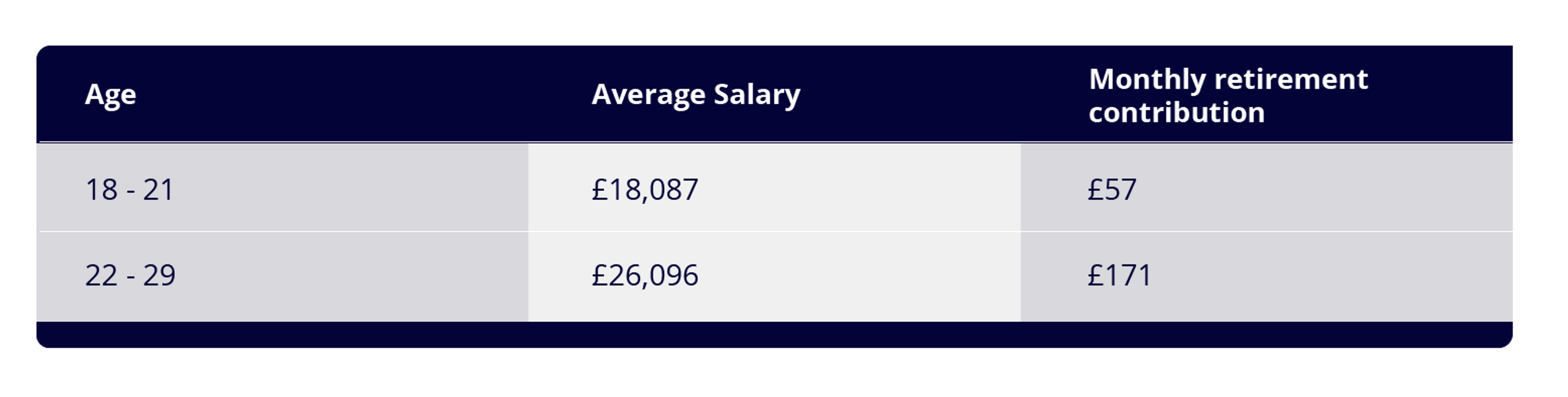

Based on Penfold’s pension calculator an 18-year-old, making £18,087 a year will have to save at least £57 per month until the current age of retirement to comfortably retire. This calculation takes into account several factors, such as the individual's current age, income, and retirement goals.

It's important to regularly reassess your retirement goals and adjust your contributions accordingly. As your salary increases, it can be a good idea to increase your retirement contributions to ensure that you are on track to meet your financial goals in retirement.

How Much Money Will I Need When I Retire?

A good rule of thumb is that you might need about two thirds of what you earned while working to be comfortable in retirement. It's impossible to know exactly what your life will look like when you want to stop working, so it can be helpful to use a rule like this just to give you a sense.

Either choose how much you earn at the moment, or how much you think you will be earning when you are settled in your career, then multiply that number by two thirds (or 67%).

Saving £109 per month may seem like a significant amount for someone just starting in their career, but it's essential to consider the long-term benefits of saving for retirement. By prioritising retirement savings and taking advantage of employer pension schemes, Gen Zers can ensure a comfortable retirement and avoid being forced to work well into their later years.

The consequences of not saving for retirement can be severe. Without sufficient savings, Gen Zers may have to continue working long past the traditional retirement age or live on a reduced income in retirement. This can be a significant burden and can impact their quality of life in later years.

Gen Z may face unrealistic expectations about their ability to achieve financial independence and retire early. While it's certainly possible to build a successful career and achieve financial freedom, it often takes years of hard work and disciplined savings.

How to Save for Retirement

Start Saving More: The beginning of 2023 saw an increase in searches by 200% for the term "how to save money" on Google, as consumers look for tips and tricks on how to keep saving despite rising costs.

- Start saving now: Begin contributing to your pension pot as soon as possible to benefit from compound interest and government and employer top-ups.

- Calculate How Much You Have and How Much You Need: It is also important to set realistic goals for retirement savings.By starting to save in their early twenties, Gen Z in the UK can take advantage of decades of compound interest and potentially grow their retirement savings significantly.

- Be consistent: Make regular pension contributions, even if they vary in size due to life events. Young adults should aim to save 5% of their income each month, even if it is a small amount.

- Take calculated risks: Consider investing in higher-risk assets for potentially higher rewards, depending on your risk tolerance. Gen Zers can also take advantage of online resources such as articles, blogs, and forums to learn more about retirement savings and investment strategies.

- Increase contributions: As your salary grows, put more money into your pension pot to accelerate your savings.

- Combine pension pots: Merge multiple pensions from previous jobs for better oversight and easier management.

- Avoid high fees: Research pension fees and choose a plan with lower charges to maximise returns. Financial professionals can provide advice on the best retirement savings options for individual circumstances and help individuals create a savings plan that works for them.

Pete Hykin, Co-Founder at Penfold comments:

“Saving for retirement may not be a top priority for many members of Gen Z in the UK, but it is important to start as soon as possible to secure a comfortable future. By taking advantage of employer-sponsored retirement plans, setting up a personal pension or ISA, cutting back on unnecessary expenses, seeking guidance from a financial professional, and utilising online resources, young adults can increase their retirement savings and ensure a more secure future.

It's important to remember that every little bit helps and that starting early is the best way to take advantage of compound interest. By implementing these tips, Gen Z in the UK can secure a future that is financially comfortable and allows them to enjoy their retirement years to the fullest.”

Murray Humphrey

Penfold