Women’s Financial Wellbeing During a Cost of Living Crisis

- By

- Murray Humphrey

Are you feeling the squeeze of the cost of living crisis and struggling to save for retirement? You're not alone. It's no secret that women are facing different hurdles during these economically challenging times and in many cases, it may be taking its toll on your financial wellbeing.

To help address these challenges, we partnered with Your Juno, the financial education app designed for women and non-binary individuals, to host a webinar focused on navigating the gender pay and pension gap. The webinar unpacked practical tips to maximise your pension and build better financial habits during these tough times.

Here's a summary of the key takeaways from the webinar, which should help you feel more confident about your finances today and in the future.

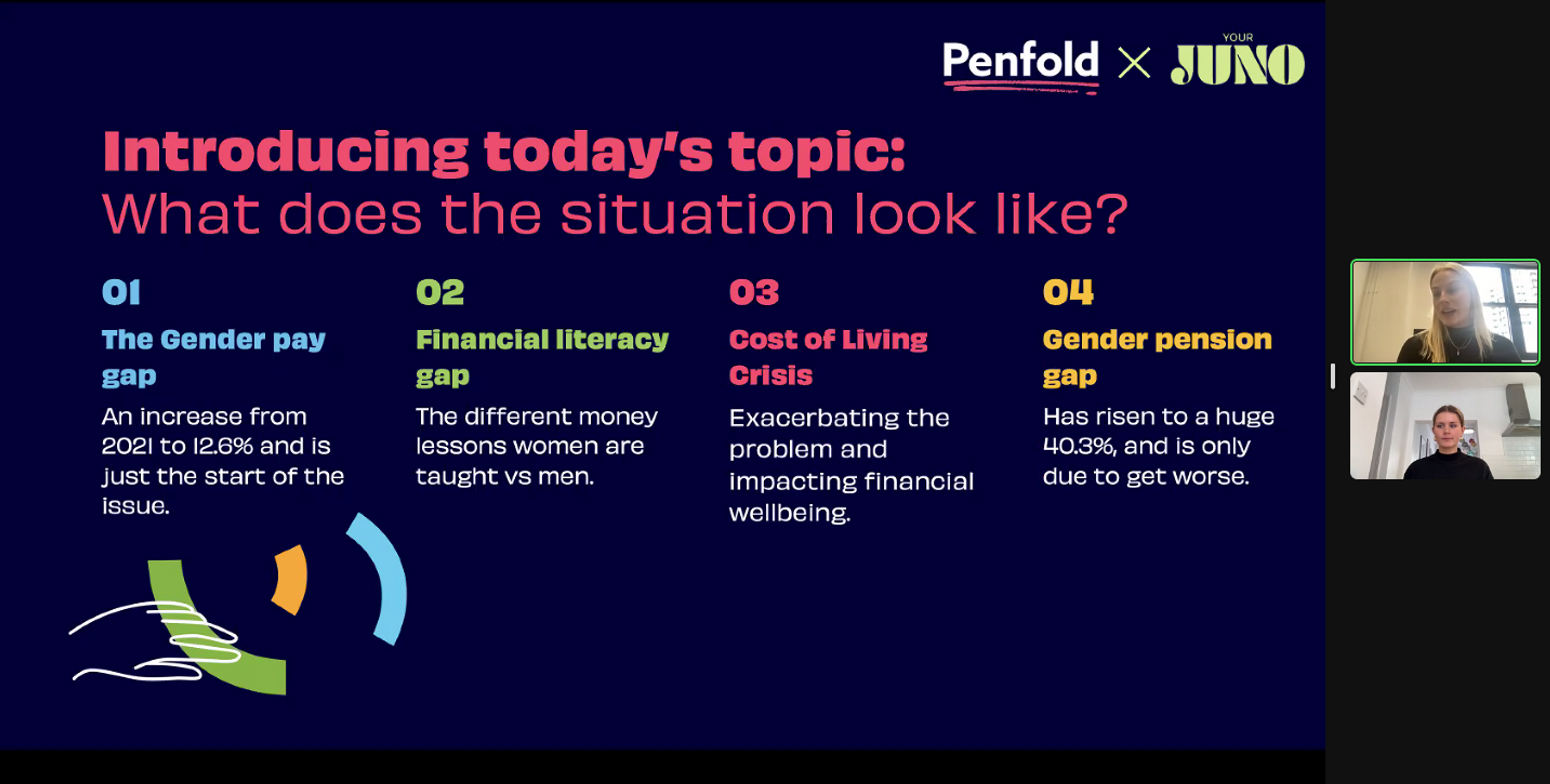

Reasons behind the gender pay & pension gap

The gender pay gap

Despite many efforts, the gender pay gap is actually increasing year on year in the UK. The pay gap has risen to 12.6% in 2022, a 3.8% increase from the previous year.

Alexia Brogile, CEO & Founder of Your Juno, says “the gender pay gap stems from a legacy of outdated gender norms”. For example, women are more likely to become the primary caregiver and have gaps in their employment history to look after their children. Women are more likely to work part-time or in lower-paid sectors, leading to lower pay and fewer opportunities for career progression. As a result, there are fewer female managers and fewer women in higher-paid jobs.

Coupled with the rising cost of basic goods and services, it’s no doubt that the crisis is disproportionately impacting women. As primary caregiver, women are often less able to increase their hours of paid work to support the increase in prices, making them the “shock absorbers of poverty”.

The financial literacy gap

Differing levels of financial literacy between men and women can also impact the gender pay gap. Unfortunately, studies have uncovered a financial literacy gap in the UK, with women having lower levels of financial literacy than men. According to the UK government’s Money and Pensions Service this is true by several metrics - awareness, confidence, feelings, experience and trust. Just 36% of women think they understand enough about pensions to make decisions about retirement, compared to 54% of men.

The reasons behind the gender financial literacy gap are complex. “For women, money is a taboo topic which is a primary cause of differing literacy levels”, Alexia mentioned. Women are less likely to talk about finance with their friends and "women are taught very different money lessons from a young age". Moreover, women have less exposure to financial matters than men, with traditional gender roles placing more emphasis on men as primary breadwinners and decision-makers.

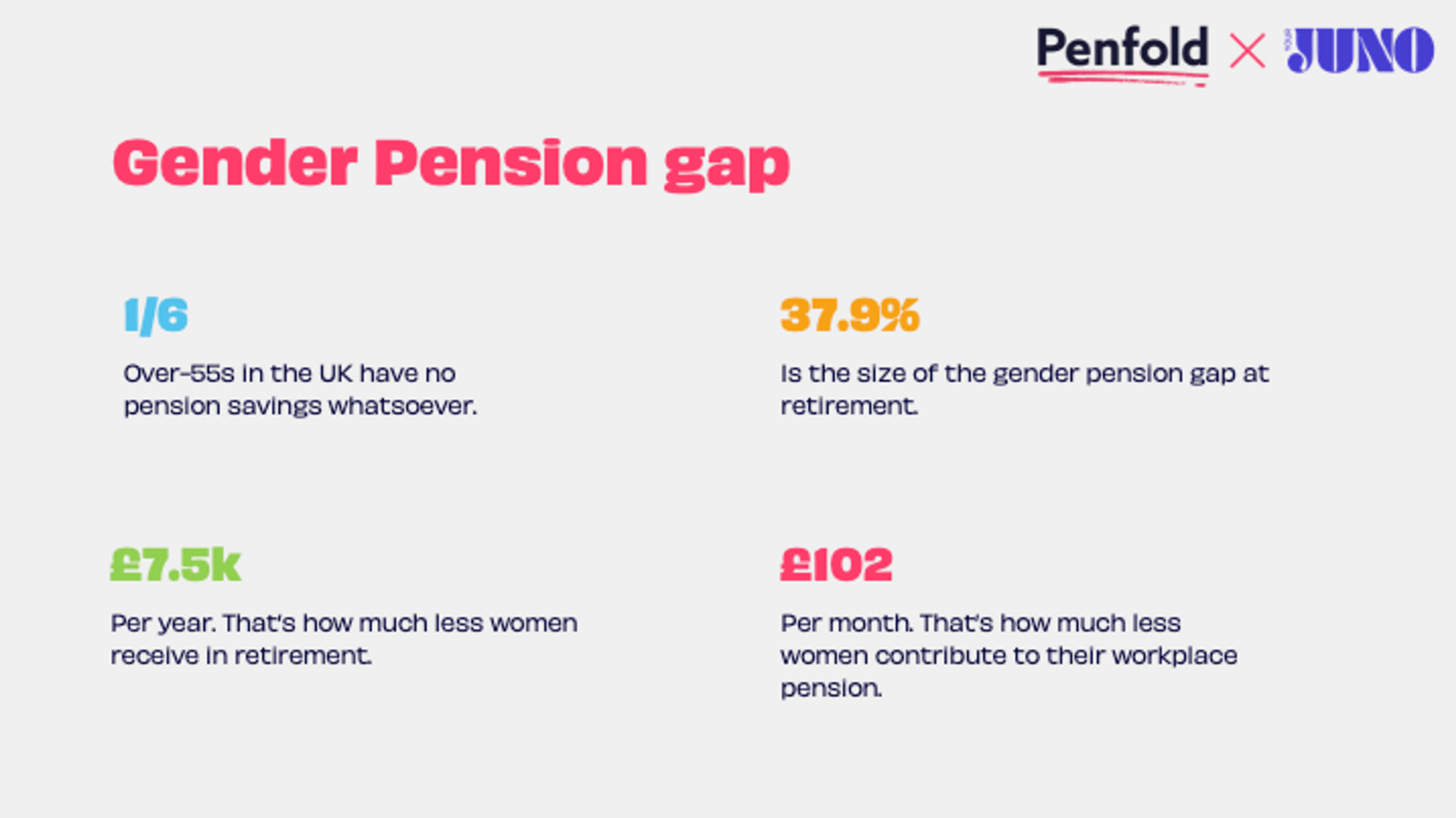

The gender pension gap

The pay and literacy gap has contributed to a widening gender pension gap. The average retirement value for women is 37.9% less than for men as reported in a 2022 House of Commons research brief. This is increasing year on year, and with the current economic state, things may only be getting worse.

We get that for many, a pension may not be your priority right now. However, our own data has shown that the cost of living crisis is making our customers more anxious than ever about their future, despite the increasing demand to cover the costs of today.

That’s why in this webinar we unpacked 4 important tips to help you leverage your pension without putting any further financial burden on your finances today.

Navigating your pension and building stronger financial habits

It’s good to talk

Millions of women are impacted by the Cost of Living crisis and for many, opening up about the topic can be the first step towards tackling it. Talking to friends and colleagues about your experiences – both negative and positive – can help to normalise conversations about money and bring solace.

Employers are also increasingly looking for opportunities to support their employees financially, with many willing to offer guidance and improved benefits to help out. If you're going through financial difficulties, don't hesitate to reach out to your employer.

Conversations about finances within relationships can be uncomfortable but some short-term pain might produce some long-term shared gain. If you have conversations with your partner about the gender pay gap and gender pension gap, you can ensure responsibilities are weighted fairly for saving for the future. And if you're single, make sure you have a clear financial plan and are taking steps to prepare.

Take advantage of tax relief and compound returns

When times are tough, the first thing people look at is cutting long-term saving habits. However, taking advantage of the tax opportunities from your employer and pension provider can help relieve financial anxiety about the future.

The sooner you can add money to your pension, the longer it has time to grow and increase in value - and the less you’ll need to add overall. Compound returns means your pension is exponentially growing year on year because you’re earning interest on the interest.

Additionally, pensions are one of the most tax-efficient savings vehicles, as the government adds 25% on top of your contributions. Employers often match additional contributions, therefore stopping your contributions altogether would mean you’re missing out on tax relief added by the government as well as your contribution from your employer. As well, if you do take career breaks in future, it’s particularly important to make sure you’re taking advantage of what your employer is offering today.

As well, your employer may offer salary sacrifice, which is the most cost-effective way to add money to your pension. Salary sacrifice reduces your national insurance contributions, meaning you owe less tax overall and get to keep more of what you earn.

Tax treatment does depend on your individual circumstances & may be subject to change in the future.

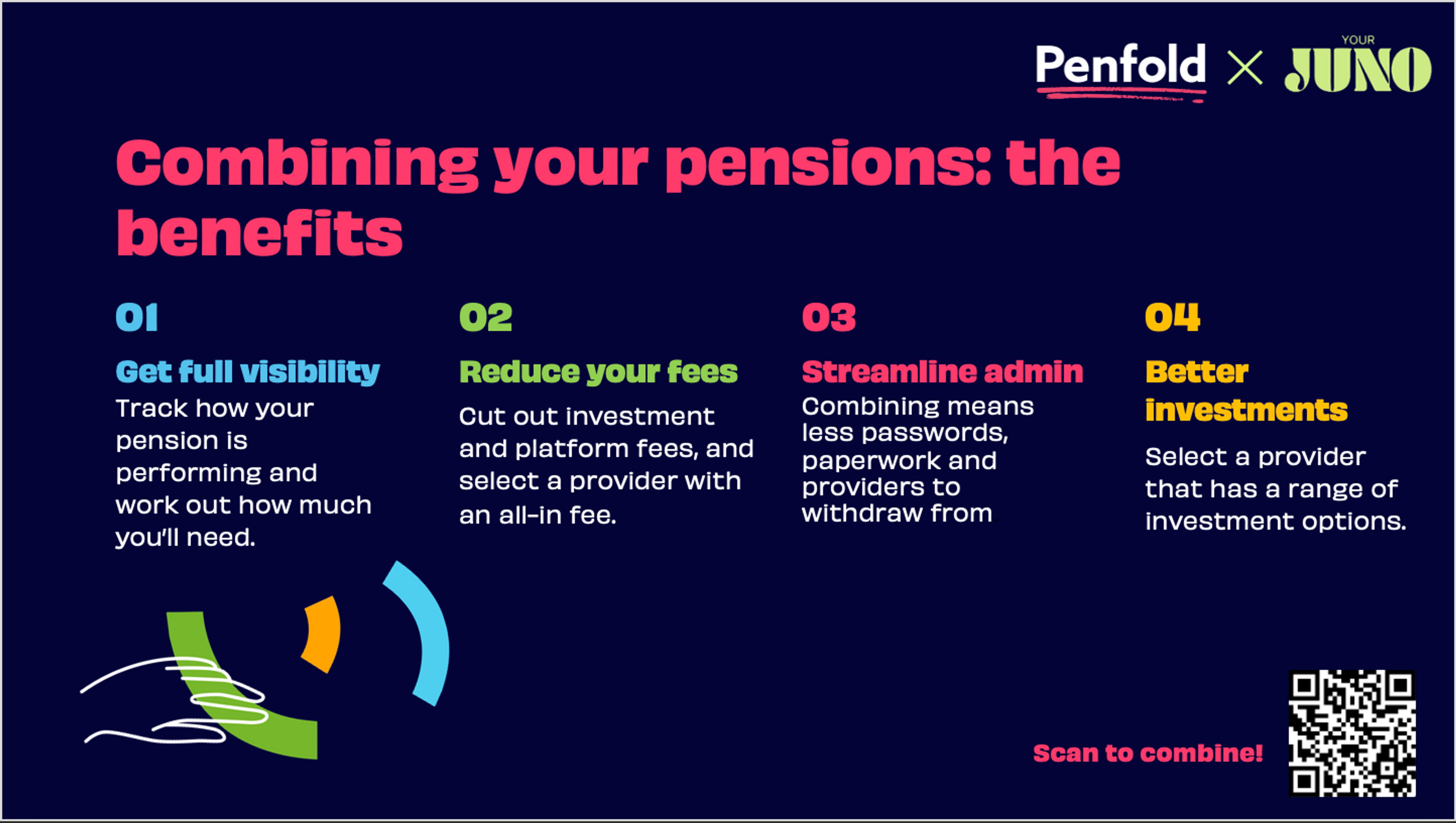

Get full visibility over your pension

For many women, it’s rare to have one job for the whole of your life, especially with parenthood. Changing jobs means you’ll be enrolled in several different pension schemes. With different salaries and contributions from different jobs, it’s difficult to know how much you have for your future. Combining all your pensions together can give you a clear picture of what’s ahead.

Bringing all of your pensions together means you're streamlining financial admin and you can potentially reduce your fees by cutting out investment and platform fees if you select a provider with an all-in fee.

You can combine all of your pensions into Penfold in just a few taps and use our Forecast tool to get a real picture of what your overall income could be at retirement. This will help you understand if you’re taking advantage of tax relief and compound returns, and when and how you need to increase your contributions to get on track.

Changing pension providers is an important decision. Before transferring pensions, please make sure it's the right decision for you by comparing providers' fees and any guaranteed benefits, and be sure that the investments available are suitable for you. We cannot accept defined benefit pension transfers.

If you decide to close your Penfold account and the value of your account has gone down, the amount returned to the provider may be less than your original transfer.

If you change your mind after transferring your pension, there is a 30 day cancellation period to transfer your pension back to your original provider.

If your employer is currently paying into your pension, transferring that account may mean you lose out on their contribution. For more information on the risks see here.

Murray Humphrey

Penfold