We're crowdfunding again!

We’re thrilled to announce that we’re once again giving our savers the chance to join in our mission to help everyone on their way to a comfortable retirement.

We are raising a top-up investment round to continue the expansion of our workplace pension and keep improving our product and service for all customers. Our shareholders have committed over £1m already, taking us to a total of £19m in funding since we started Penfold.

Now, we’re once again inviting our community to join in.

Investment is fully EIS eligible for 2023/24 tax year.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more

We're making great progress

And we aren't slowing down.

£375m+ assets under administration (+150% in 2023)

63,000+ active customers

1,250+ workplace pension clients

£19m investment raised

Join our mission to fix pensions

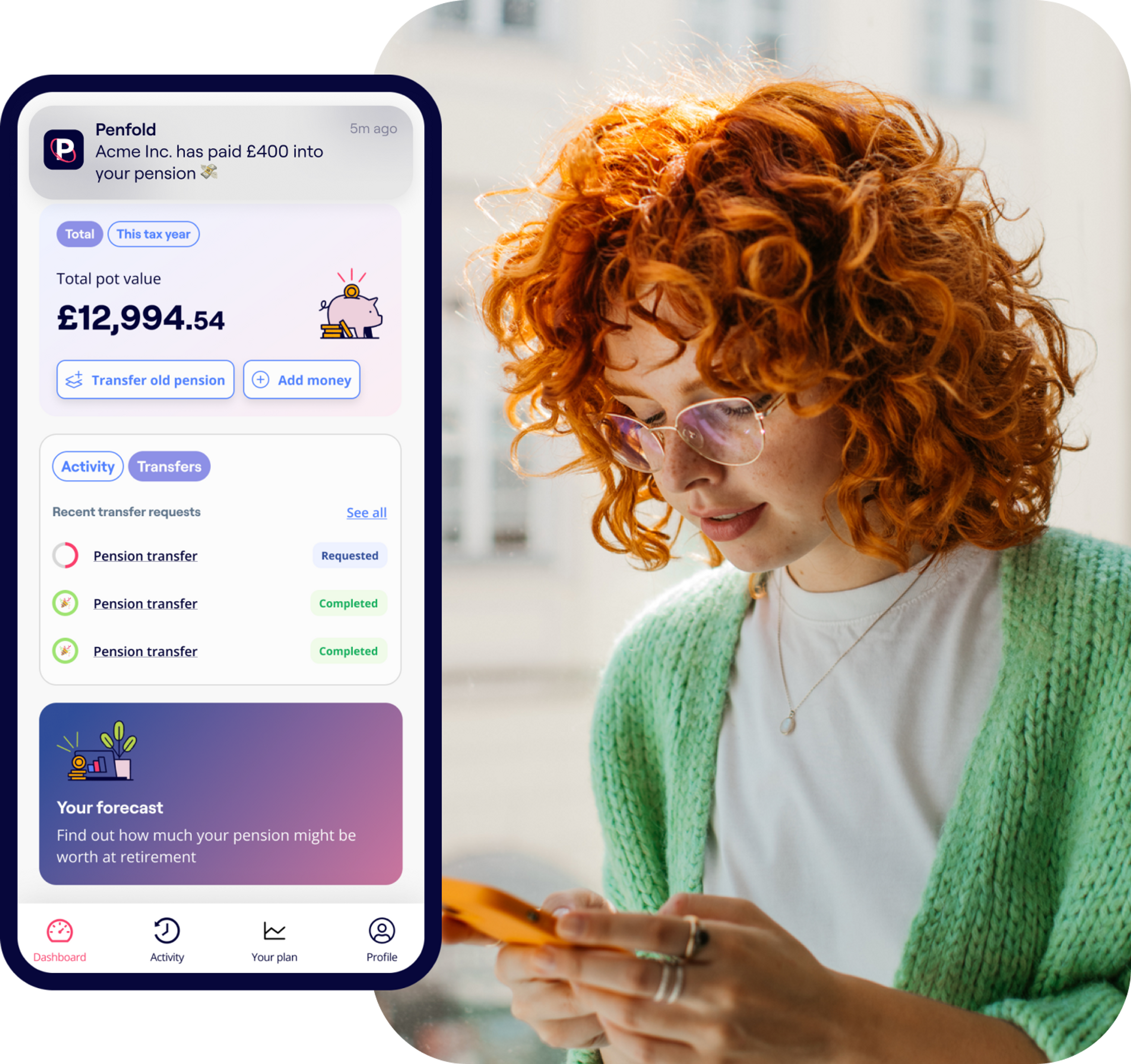

Traditional providers make saving for retirement too difficult. Outdated technology and endless jargon leaves people confused and disengaged.

So we built a modern, easy to use pension that has already helped over 63,000 customers save more than £375m for later life.

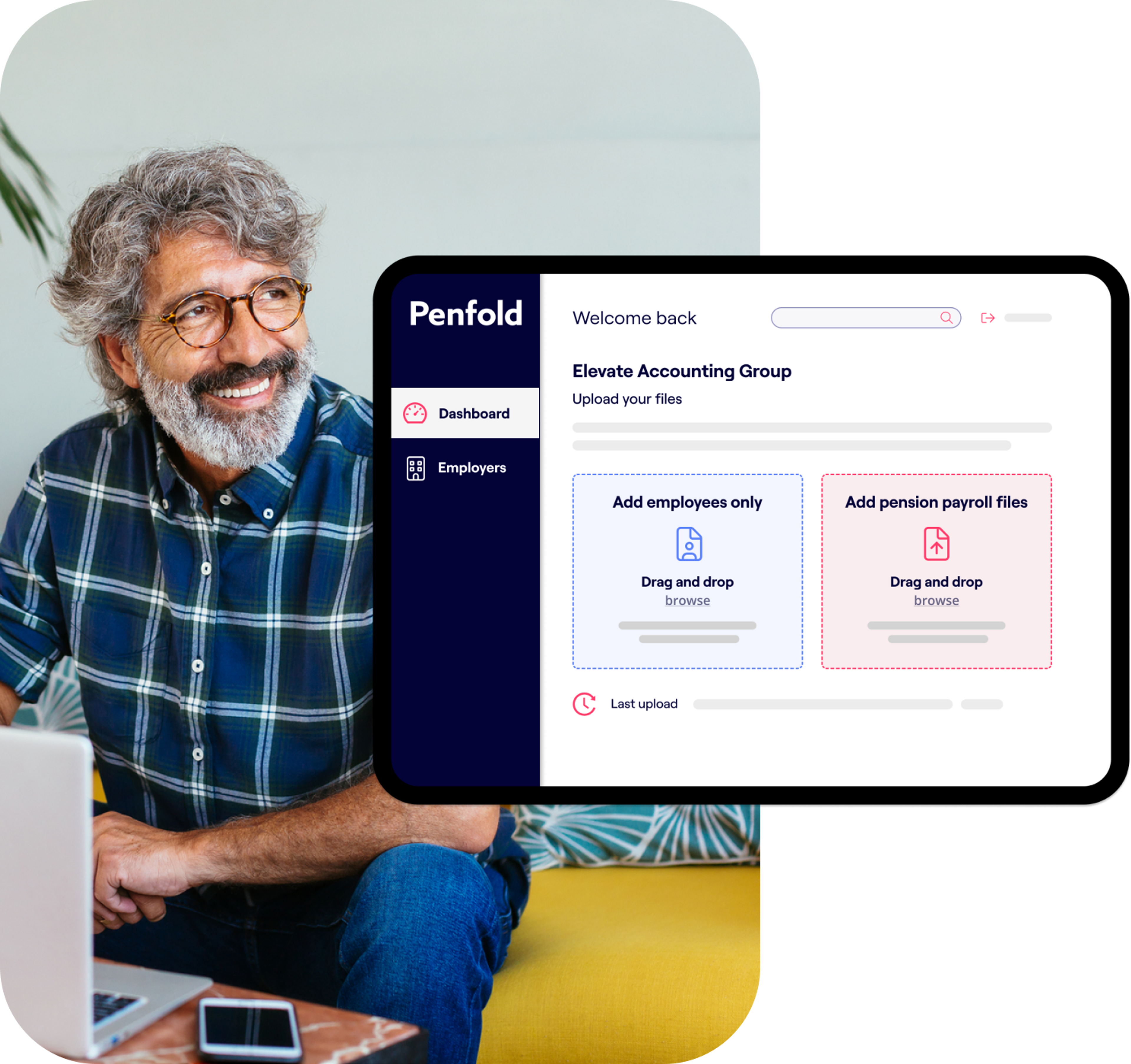

Since our last crowdfund, we have continued to scale up our popular workplace pension, now reaching over 1,250 clients, ranging in size from 2 employees to over 3,000!

But this is just the start. Our mission is to be the pension that stays with people throughout their life and gets millions more people saving enough for retirement.

Backed by the best

So far, we've raised £19m in funding from some of the most experienced fintech investors and entrepreneurs in Europe. Our investors include venture capital firms Plug & Play Ventures and Force Over Mass Capital, as well as early backers in some of technology's biggest names.

What’s next for Penfold

Since our last crowdfund in 2022, we've scaled up our workplace pension, taking it to over 1,250 businesses with over 36,000 staff, alongside our 27,000+ individual customers.

We're now raising a top-up investment round to continue the expansion of our workplace pension and keep improving our product and service for all customers.

This funding also allows us to aim for profitability as a business without the need for any more fundraises in future.

Investor rewards

Investors in Penfold can also qualify for:

£10+ Pilot

Everyone who invests receives an investor badge in the Penfold app and an invitation to the beta list for early access to new and premium features.

£750+ Captain

The same as Pilot plus 0.5% off your Penfold management fees from 1st April 2024 to 30th June 2024.

£1,500+ Astronaut

The same as Pilot and 0.5% off your Penfold management fees from 1st April 2024 to 30th September 2024.

Crowdfund FAQs

Crowdfunding has become a popular way for individuals to invest in private businesses. However, it's essential for first-time investors to be aware of the risks involved. Here, we break down some key statements and facts related to crowdfunding for a better understanding of this investment approach.

Most startup businesses fail, and profitability may take a long time and isn't guaranteed.

Startup businesses are statistically more likely to fail than publicly listed companies.

If a business you have invested in fails, you are likely to lose all of your money, with no chance of any initial investment being returned.

Assessing the likelihood of a return on investment is the responsibility of the individual investor.

Once invested, selling your shares is not guaranteed, and you cannot ask for your money back at any time. Any return will likely be long-term (5+ years) and you are unlikely to receive dividends.

Most companies that have crowdfunded will not be tradable on a public stock exchange and you will likely only see a return in a limited number of circumstances, such as if the company is acquired.

Investments in startup companies should be a small part of your portfolio, mixed with lower-risk investments. Diversifying your investment portfolio means spreading your investments to reduce risk.

The valuation of private shares is sometimes hard to estimate, meaning you will not always know the latest value of your investments.

The equity you own may decrease if a company issues further shares, and minority shareholders are unlikely to be asked before a company issues additional shares.

A company can issue shares at a lower share price in the future, and in the event that a company is acquired by another business, you may be forced to sell your shares at a loss.

Yes, every investor will receive shares in “Penfold Technology Limited” for which Penfold is our trading name. The number of shares you receive will be proportionate to the amount you invest. The final number of shares issued depends on the number of investors and amount of money raised.

We will notify anyone who registers their interest before the campaign goes live. Anyone that pre-registered will receive exclusive access to the campaign before it is made public.

The campaign will last up to 7 days, ending whenever we reach our investment target. If we reach our target early, we‘ll give notice 24 hours before the round closes. Please note, there is a limited amount of equity available in this round and we expect the round to fill quickly. We encourage you to invest as soon as the round opens.

Having raised £19m to date, including over £1m in this round, we’re seeking this top-up to accelerate the growth of our Workplace proposition, and continue introducing improvements to both our product and customer service. Please see our business plan on our Crowdcube page for more details.

If we are fortunate to raise more than our target, we’ll use the extra investment to grow the company even more quickly than we currently plan. Raising investment above our target simply means we will have more shareholders and be ‘giving away’ a larger percentage of our company.

Please note your payment is not taken upon investment.

Once a pitch has been funded and has closed to further investment, you will receive a cooling off email, which includes a copy of the company’s Articles of Association for you to review.

During this cooling off period, which is generally no shorter than 4 days (including weekends), you’ll have the opportunity to review your investment before it becomes final. Once the cooling off period has expired, we’ll send you an email confirming when your payment, which includes your investment and Crowdcube’s investment fee, will be collected.

We will issue shares to the Crowdcube Nominee to hold for you after the successful completion of the campaign, once your investment has been processed. Completing the round and necessary paperwork takes a few weeks, but typically you can expect to receive confirmation from the Nominee of your share ownership around 4 weeks after the campaign has ended.

Penfold is a private limited company which means, at present, there is no public forum for buying and selling our shares. Shares may be bought and sold by private arrangement, however, you must first offer them to other shareholders before transferring them to a single third party at your own expense.

It’s possible, although no such plans are currently in place. This would be an opportunity for you to sell your shares.

Yes, our business plan (and financial overview) will be available on our Crowdcube campaign page. If, after reading it, you have any further questions please don’t hesitate to contact us. You’ll find our contact details supplied in the pack - we’re happy to answer all questions or supply any additional information.

There are two ways you could make a return on your investment: (1) selling your share in the company for more than you paid for it, and (2) receiving dividends from the company.

Selling your shares

Ideally, the business you’ve invested in will grow to a point where it lists on the stock market (“going public”), is bought by a larger company, or the company management buys back equity from investors. At that point, you might be able to sell your shares and make a profit.

Receiving dividends

In addition, if the company you’ve invested in becomes profitable, it may be able to pay dividends. Read more, including some examples of the exits and dividends our investor community have realised, on Crowdcube’s investor returns page.

The Enterprise Investment Scheme (EIS) is designed so that your company can raise money to fund your company’s growth, by offering tax reliefs to individual investors who buy new shares in your company.

Under EIS, you can receive up to £5 million each year, and a maximum of £12 million in your company’s lifetime. This also includes amounts received from other venture capital schemes.

You can find the latest information on EIS from HMRC, here.

Remember your capital is at risk

This is not an investment commitment at this stage - once you have registered your interest, we’ll be in touch via email when our campaign is open for investment.

We believe investing should be for everyone, but it is important to remember your capital is at risk. Your investment could be locked up for a long time, as you don’t get a return until we exit (i.e. we’re bought or go to market in an IPO).

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

Approved as a financial promotion by Crowdcube Capital Ltd. authorised and regulated by the FCA (No. 650205).

Most countries in the world including the UK and the rest of Europe are embracing equity crowdfunding as a progressive way of allowing individuals to invest in the businesses they believe in and thus support innovative companies to grow. However equity crowdfunding is regulated quite differently in the USA, Canada and Japan so if you are from one of these countries please contact us on invest@getpenfold.com.