Self employed pension tax relief explained

See what pension tax relief is and how it works for the self-employed, business contributions, how much can be paid in and more.

One of the biggest advantages of paying into your pension is tax relief. But when you work for yourself, it can be difficult to see what this means for you in real money terms. Is paying into your pension really worthwhile? In this article, we’ll break down exactly how self employed pension tax relief works in the UK.

What is a self employed pension?

A self-employed pension is a personal pension designed for people who work for themselves and don’t have access to a workplace pension. This includes sole traders, freelancers, contractors, consultants and small business owners. Because there’s no employer automatically setting up or contributing to a pension on your behalf, the responsibility for saving for retirement sits entirely with you.

Most self-employed people use a personal pension or a Self-Invested Personal Pension (SIPP) to save for retirement. These pensions allow you to make contributions in your own name, benefit from government tax relief, and invest your money for long-term growth. They’re flexible by design, making them well suited to self-employed income, which can vary from month to month or year to year.

Unlike workplace pensions, self-employed pensions aren’t tied to a specific job or contract. This means you can keep contributing regardless of how your work changes, and you remain in control of how much you pay in, when you contribute, and how your pension is invested.

What is pension tax relief for self employed?

The best way to think about tax relief on pension contributions is like a savings bonus from HMRC. The government wants to encourage the self employed to put money aside for later life. So, every time you pay into your pension, you’ll get a ‘tax bonus’ on your contributions.

For most people, this works out as 25% on top of whatever you pay in. Contribute £100 into your pension, the government will automatically add £25 themselves via tax relief. If you're a higher earner, you may be able to claim even more back.

At its most basic, tax relief is essentially a reduction in your tax bill for the year - and your pension is one of the best ways to claim it. Let's take a look at how this actually works.

How self-employed pension contributions work

Self-employed pension contributions are designed to be flexible, reflecting the realities of running your own business. You can contribute regularly each month, make one-off lump-sum payments when you have surplus income, or combine both approaches. There’s no requirement to commit to fixed contributions, and you can pause or change payments at any time.

Contributions are usually made from income that’s already been taxed, with tax relief then added to your pension by the government. This means every eligible contribution you make is automatically boosted, helping your retirement savings grow faster than saving outside a pension.

With Penfold, you can make contributions via Direct Debit or debit card, giving you the freedom to align pension payments with your cash flow. Whether you prefer to contribute steadily or top up your pension after a strong trading month, your contributions remain fully flexible and easy to manage.

Importantly, you don’t need to wait until the end of the tax year to contribute. Pension contributions can be made at any point during the year, allowing you to plan around profits, tax bills and personal financial goals.

How does tax relief on pension contributions work for the self employed?

For most people, claiming this tax relief on your pension is fairly straightforward. If you’re a basic rate taxpayer, you pay 20% income tax on everything you earn above the personal allowance (£12,570). However, putting that money in your pension means you get refunded on the tax you already paid.

Here’s the best way to think about it. Whenever you pay into your pension, you'll get a 25% bonus on top of however much you paid in. We think it's a little clearer to refer to it as a "25% bonus" rather than "20% tax relief". It’s a little complicated, but here’s why.

Let’s use a £100 pension contribution as an example again. If you’re a basic rate taxpayer paying 20% income tax, £125 in your pocket becomes £100 after you pay tax. That’s because 20% of £125 is £25. £125-£25=£100. Easy.

When you come to put this money into your pension, you're getting the income tax you originally owed back. To make you whole, the government adds the difference back into your pension for you. Voila, a £100 pension contribution becomes £125 once again.

Penfold automatically claims this basic rate tax relief from HMRC on your behalf, so you don’t need to submit a separate claim or fill out additional paperwork. This ensures your pension contributions are topped up quickly and efficiently.

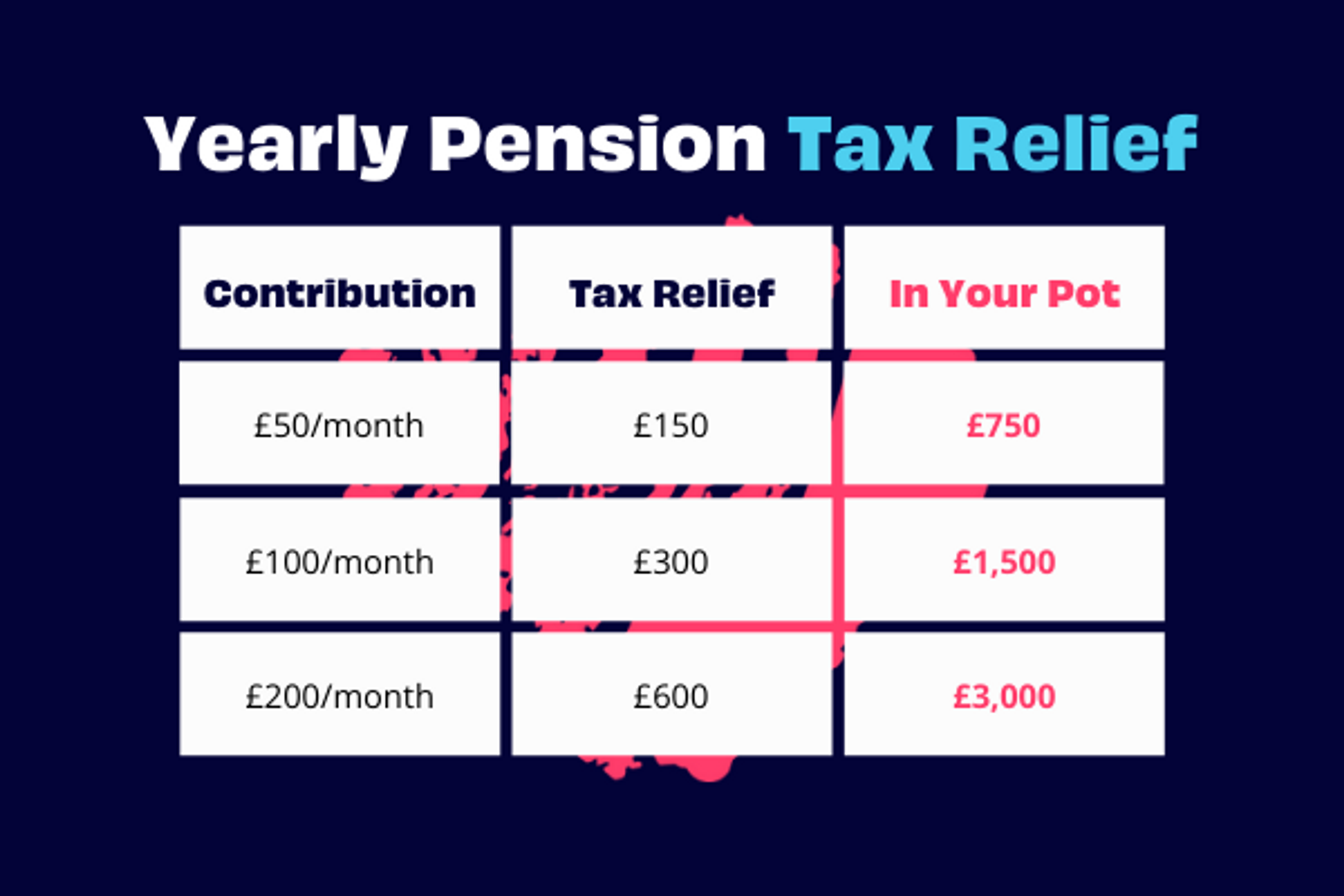

The more you contribute, the more tax you’ll save. Here’s what this can look like over a year.

Here’s a simple way to think about it: for every £50 a month you pay into your pension, you’ll get an extra £150 back in self employed pension tax relief over the year. And here’s the best part: if you’re a higher (or additional) rate taxpayer, you can enjoy even more back from tax relief. Read on for more on that.

Pension tax relief for high self employed earners

Higher and additional rate self employed taxpayers get extra tax relief on their pension contributions. You’ll have already received 25% extra on your pension contributions just by paying in.

However, you can claim back a further 20% (25% if you’re an additional rate taxpayer) yourself. The best part? This extra relief doesn’t even have to go into your pension.

There is a catch however. Unlike basic rate relief, your pension provider won’t automatically add this to your pension for you. You’ll need to claim it back by adding your pension contributions to a self-assessment tax return. You’ll also be limited by your annual pension allowance. Check out our guide on claiming higher rate tax relief for more.

For every £50 you add to your monthly pension contributions, you’ll get an extra £150 back in yearly tax relief.

What about business contributions?

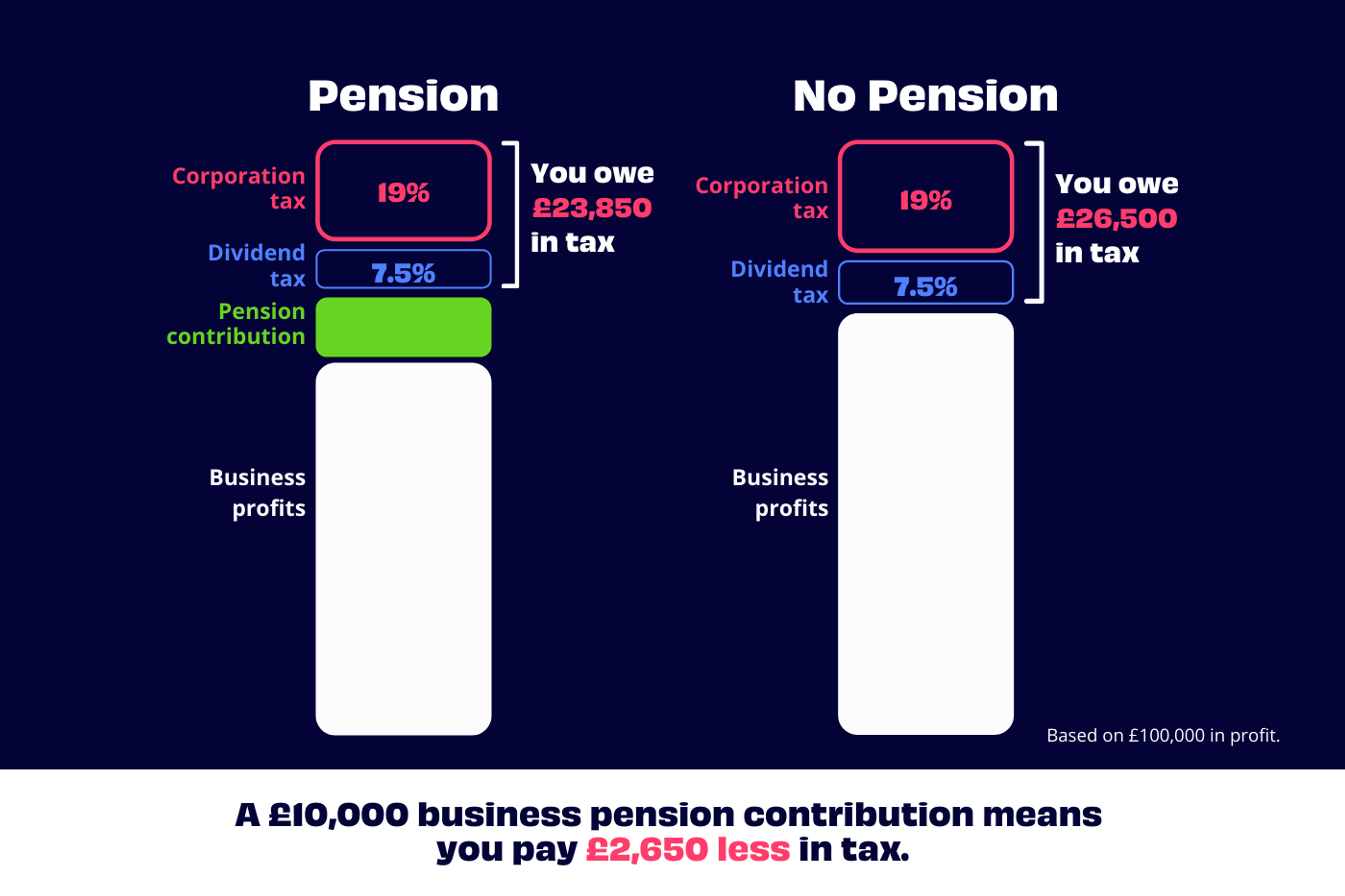

If you’re a limited company director paying into a directors pension from your business account, your tax relief will work a little differently. You’ll still receive tax relief at your marginal tax rate (depending on which tax band you fall in), but you’ll also save on corporation tax.

That’s because your pension contributions are a business expense - coming from your company rather than you as an individual. You can take your contributions off your total profits, therefore reducing the overall amount of profit you owe tax on.

Similarly, as your contributions come from your pre-tax income, you’ll also reduce your National Insurance contributions, helping you to keep more of what you earn.

How much can I pay in?

There is a limit on how much you can contribute each year and still benefit from self employed pension tax relief. Currently £60,000 (or 100% of your yearly income, whichever is lower). This allowance includes your own contributions plus any tax relief added by HMRC. This applies whether you’re contributing as an individual or via your company.

If your earnings are lower, your maximum tax-relievable contribution is based on your taxable profits for that tax year. However, even if you earn little or no income, you can still contribute up to £2,880 per year, which is increased to £3,600 once basic rate tax relief is added. This makes pension saving possible even during quieter years or when starting out as self-employed.

There are a few other situations that could change how much you can pay in - go read our guides to pension limits and carrying forward previous years allowances for more.

How to set up your self employed pension

Ready to take control of your financial future? Penfold is the perfect pension for the self employed and limited company directors. Here’s why.

- Set up in five minutes

- Top up, pause or adjust your contributions anytime

- Automatic 25% tax relief bonus

- Choose from four diversified plans from the biggest money manager on the planet

A Penfold pension helps you keep more of what you earn and secure your financial future. Learn more about our award-winning pension today.