Salary Sacrifice enabled our team to save more of what they earn. This has been extremely important recently with the ever increasing cost of living.

The business being able to benefit from employer savings is also a win. Savings can be used elsewhere or passed back to the team to further enhance staff benefits,

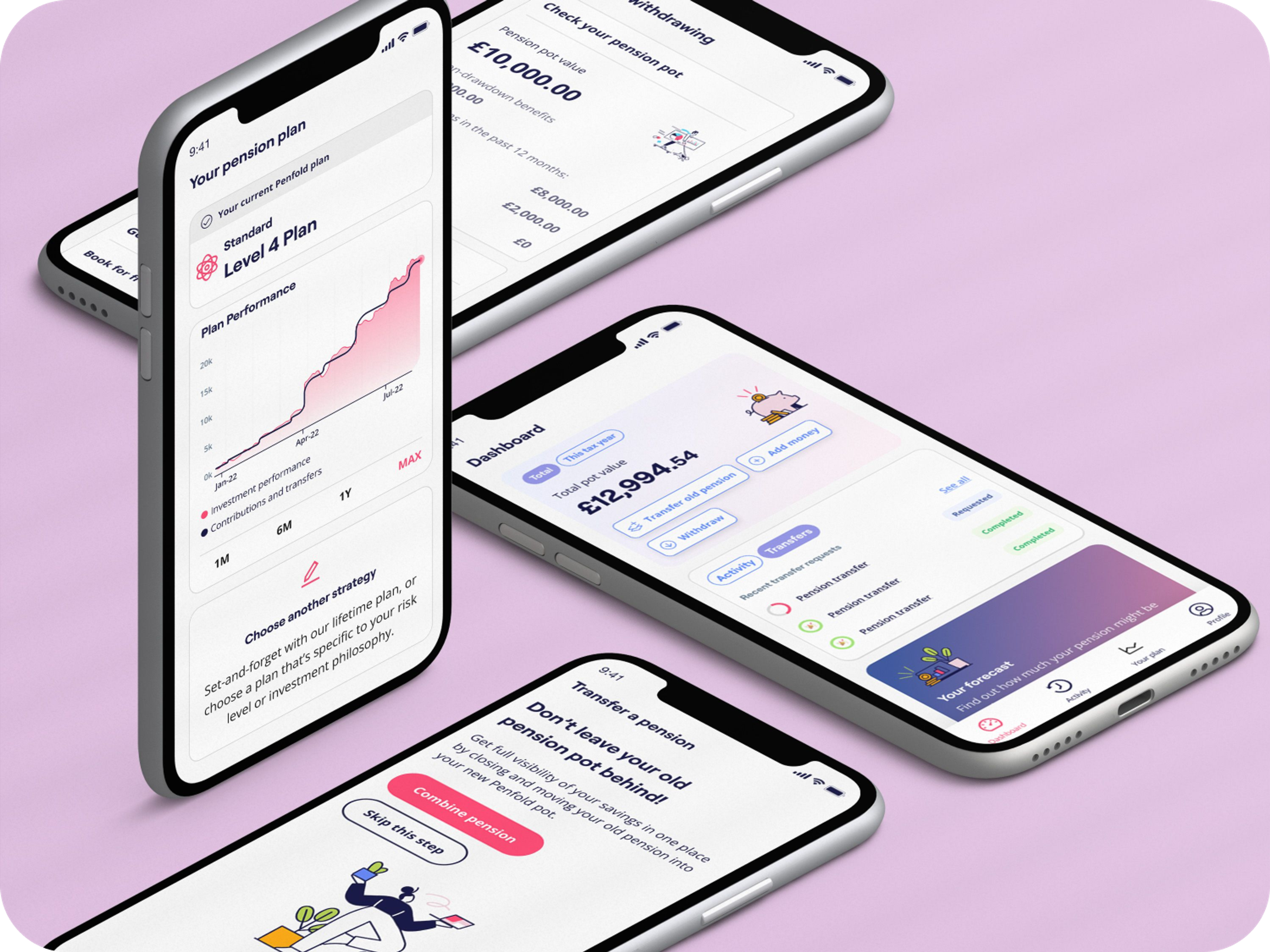

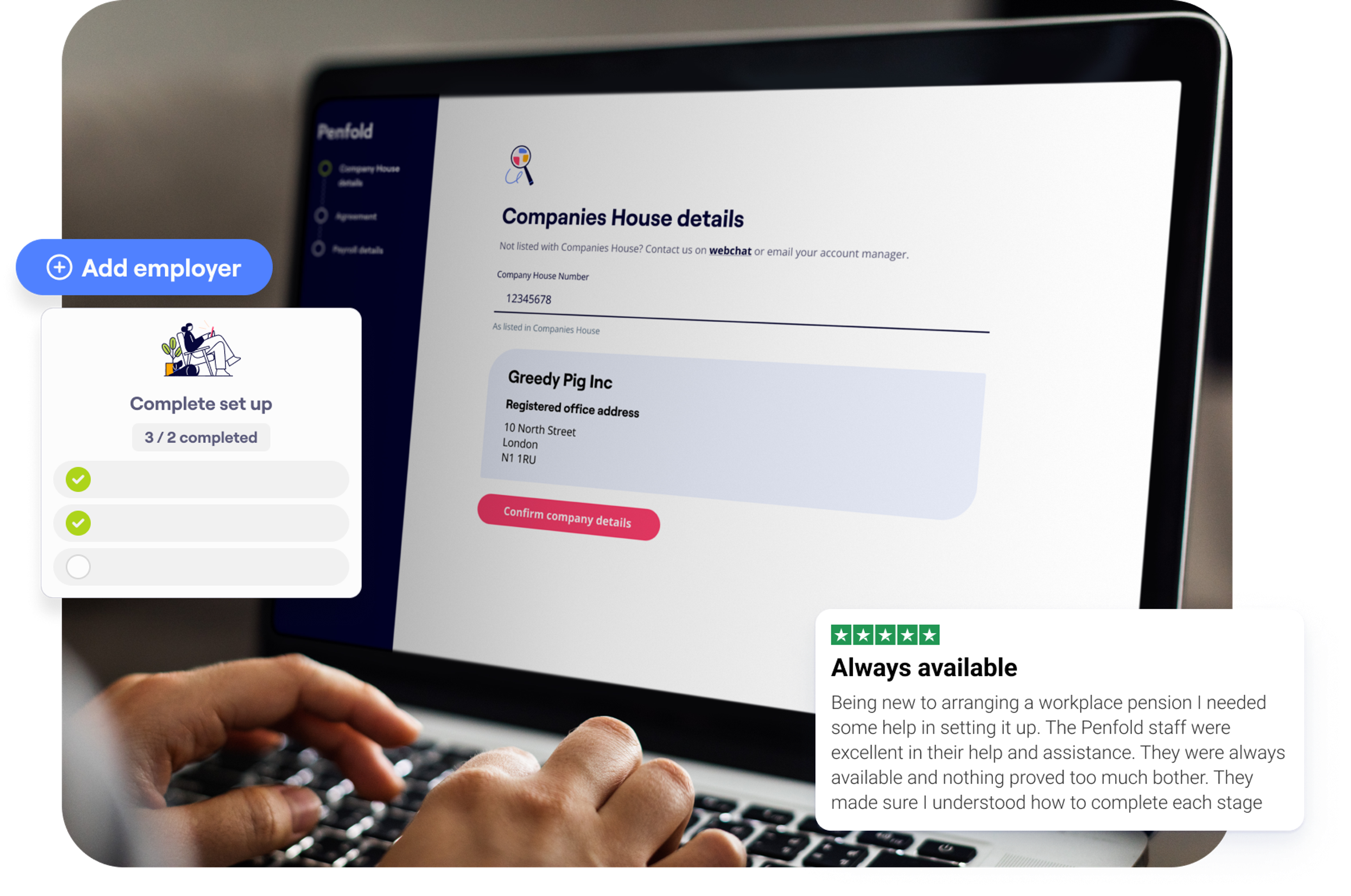

The transition process is very straightforward and the team at Penfold do a super job at explaining each step.

Michelle Kangellaris

Director of People & Culture at Glint