Penfold helped us to understand salary sacrifice really well.

We had an overview meeting, were sent FAQs and Penfold also hosted a Pension Workshop to take our teams through the platform & salary sacrifice which was really helpful.

The transition process is very straightforward and the team at Penfold do a super job at explaining each step.

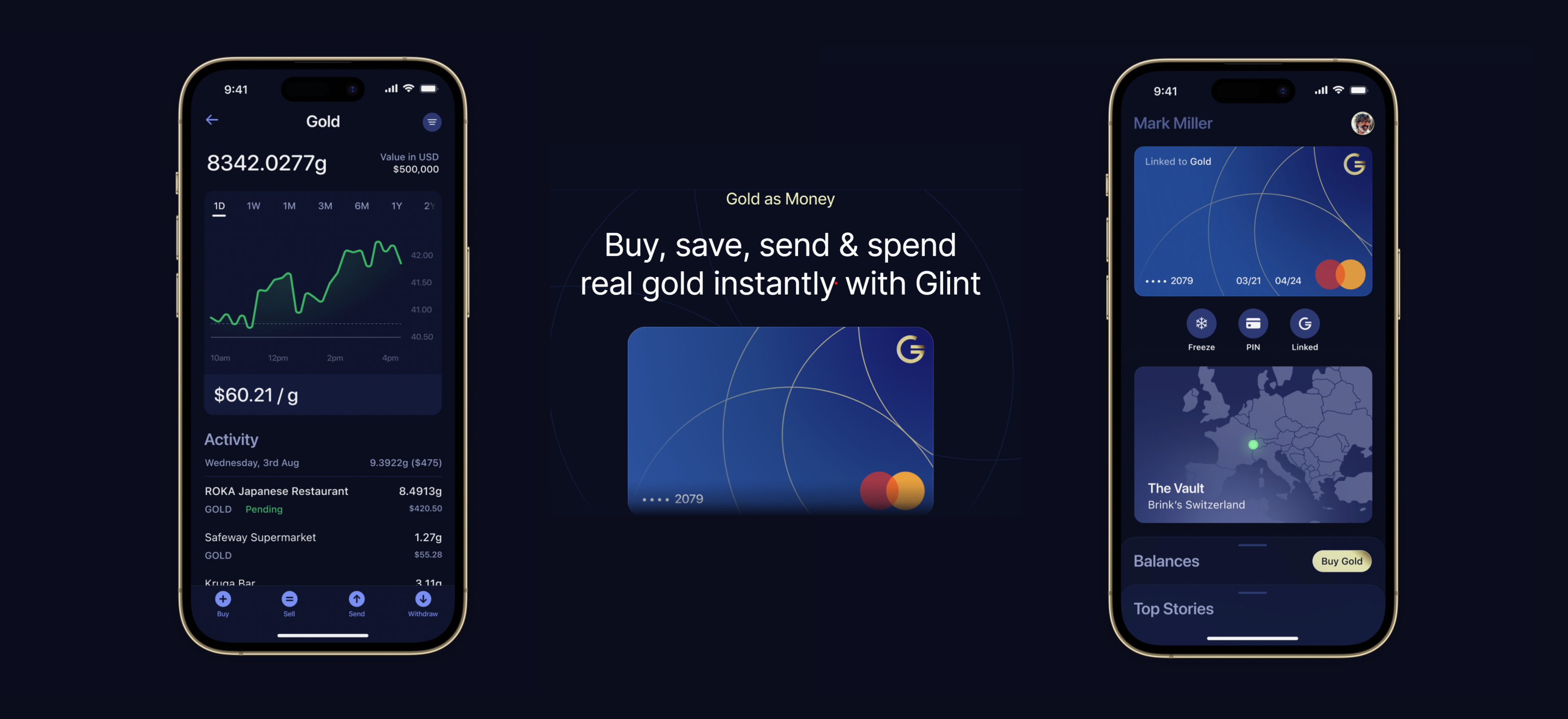

Michelle Kangellaris

Director of People & Culture at Glint